Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

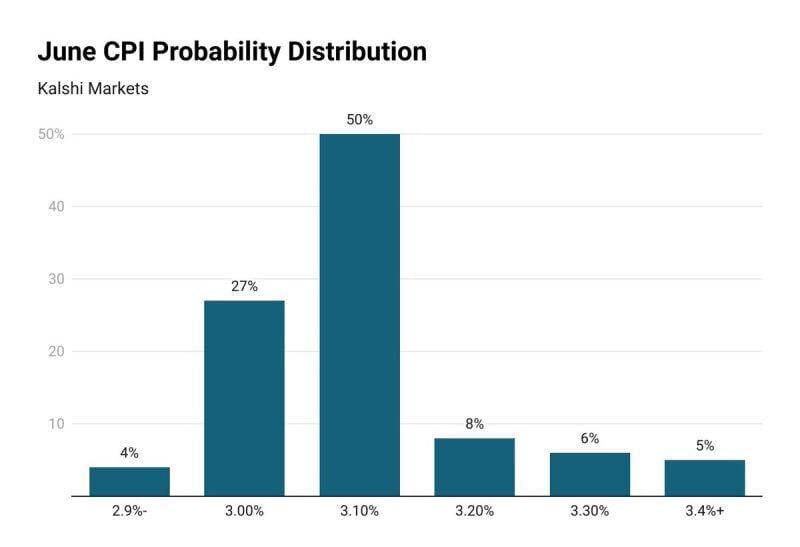

An important US macro data is expected today: the CPI inflation data for June. The median forecast for headline CPI inflation is 3.1%, but markets are showing a wide range.

Prediction markets currently show that there is a 19% chance of June CPI inflation coming in ABOVE 3.1%, according to Kalshi. On the other hand, there's a 31% chance of inflation coming in BELOW 3.1%. There's even a 5% chance of CPI coming in above 3.3%, which would put inflation back on the rise. If CPI inflation comes in as expected, it would mark the 3rd straight monthly decline in YoY inflation. Source: The Kobeissi Letter

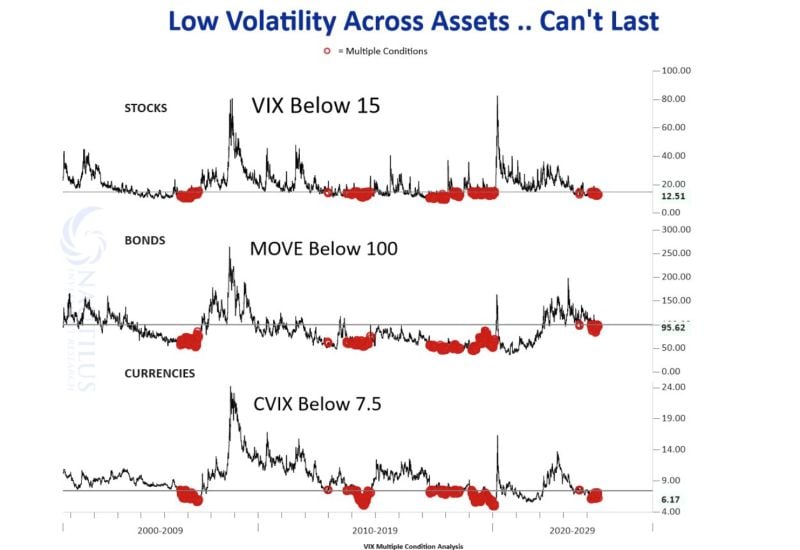

There is low volatility across asset classes.

Can it last? Source: Nautilus Research

🚨 JUST IN: China suspends its largest facilitator of short-selling in order to preserve market stability

Source: barchart

Big Tech is eating the world with Apple once again the undisputed Number 1.

Apple gained 2% after bullish Bloomberg report about the upcoming AI-enabled iPhone sales prospects. Apple is now worth almost $3.6tn in market cap, Microsoft is number 2 with $3.5tn ahead of Nvidia with $3.3tn. Source: HolgerZ, Bloomberg

🚨 JUST IN: A bipartisan group of Senators announce proposal that would prevent lawmakers from buying stocks and prevent spouses and dependent children from trading stocks beginning in March 2027.

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks