Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

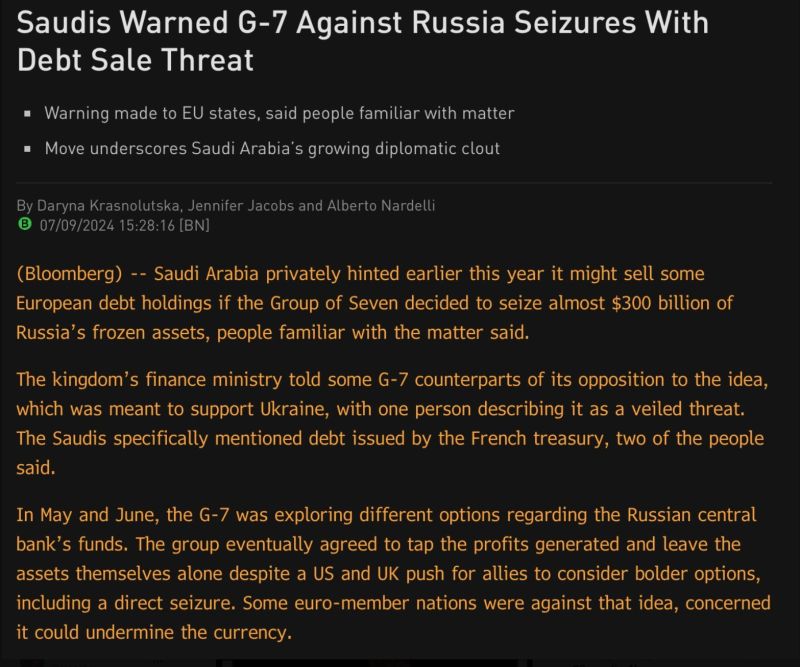

The East-West divide: some evidences of the Saudi/Russia/China emancipation vs. the West

Source: Bloomberg

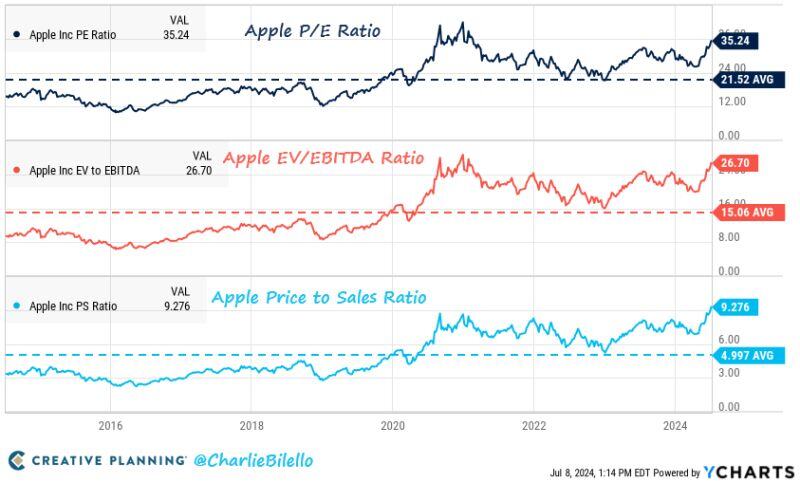

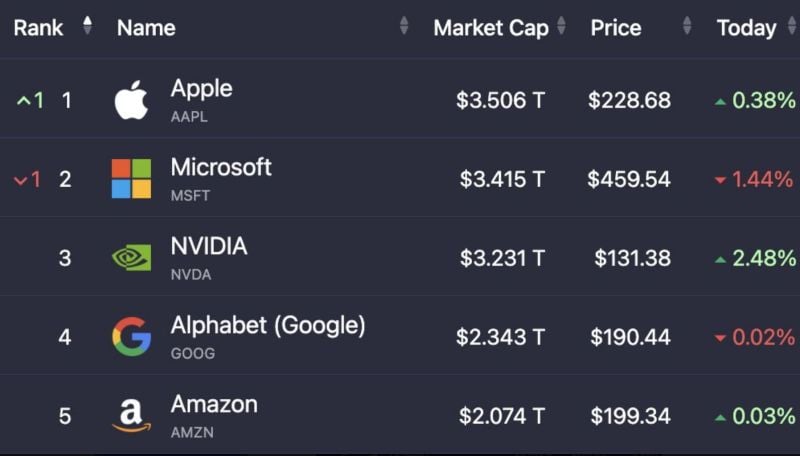

Apple's P/E Ratio: 35x

10-year average: 22x Apple's EV/EBITDA Ratio: 27x 10-year average: 15x Apple's Price to Sales Ratio: 9.3x 10-year average: 5.0x $AAPL Source: Charlie Bilello

The secret is there is no secret.

Consistency over intensity. Progress over perfection. Fundamentals over fads. Over and over again. Source: Investment Books (Dhaval)

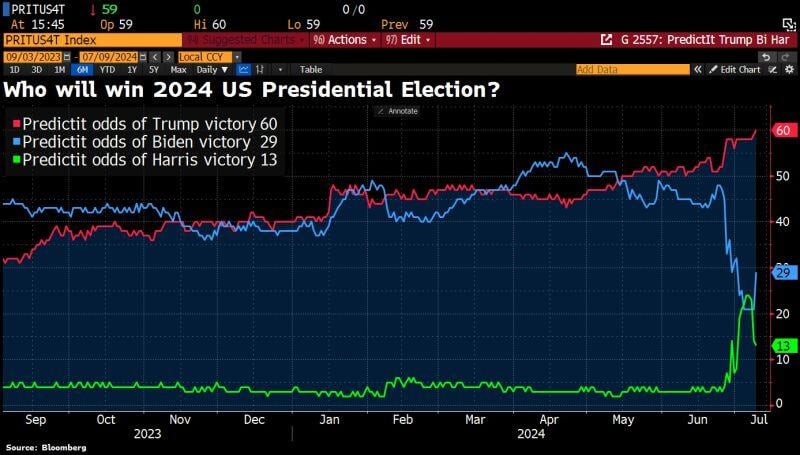

Looks like Biden keeps the lead on Democrats nomination and this means a high probability of Trump winning Presidential election

Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks