Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

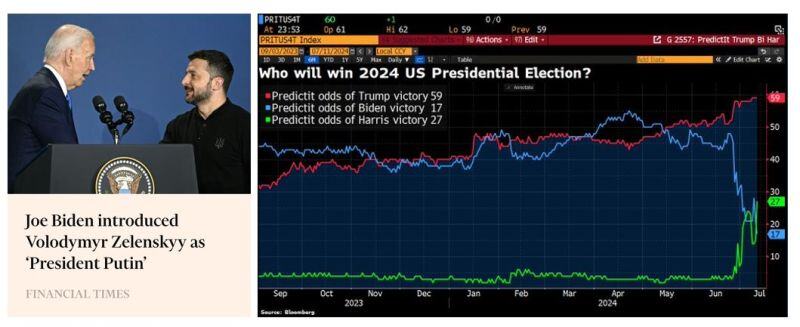

Biden betting odds (blue line) fall after US President calls Ukraine’s Zelensky ‘President Putin’ in latest brutal gaffe, but corrects himself.

Trump odds (in red) now stand at 59% while Harris odds (in green) increased to 27% Source: Bloomberg, HolgerZ, FT

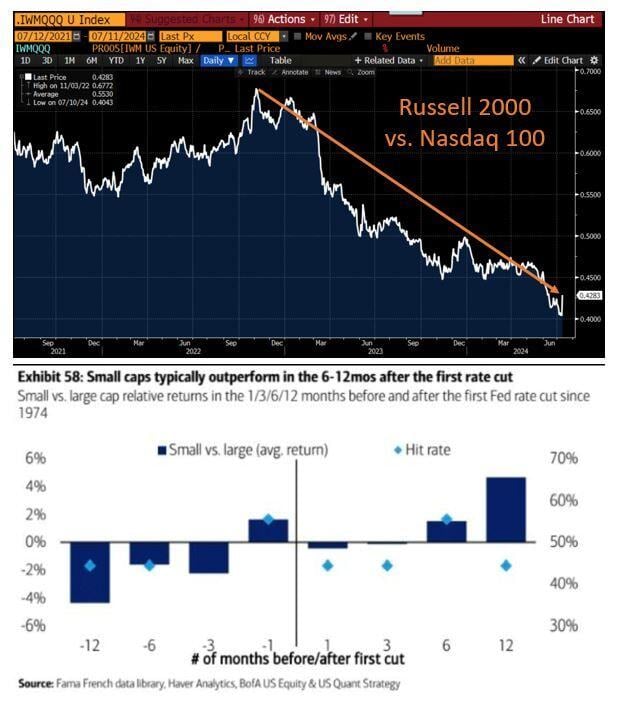

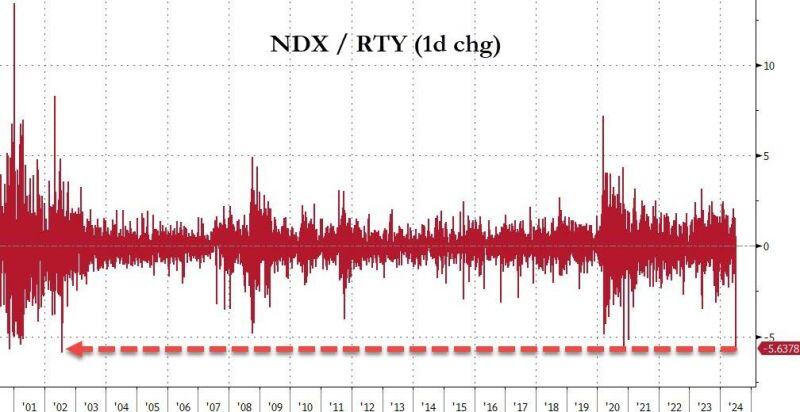

Yesterday was a big ROTATION day on US equities market with small-caps hugely outperforming large-caps

Indeed, small-cap Russell 2,000 gained 3%+ while the S&P 500 fell on the day. The only other day that happened was back on 10/10/2008... Investors probaby have these 2 charts in mind: 1) The HUGE underperformance of small caps vs large aps over the recent years; 2) History showing that Small caps outperform AFTER the first rate cut. The lower than expected US CPI iunflation number for June acted as a trigger for the rotation with hedge funds being forced to cover their long large / short small par trades. Source: Bloomberg, DB, RBC

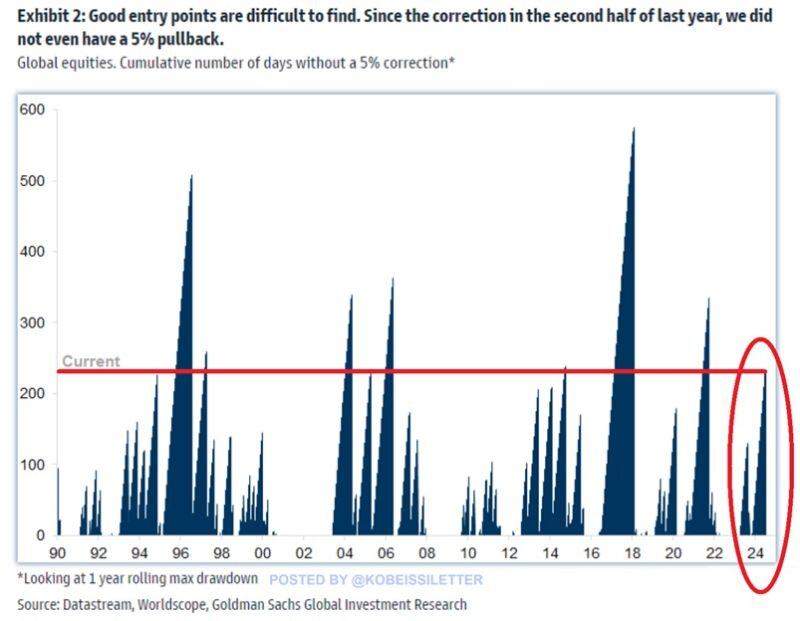

It has now been over 220 days without a 5% pullback in the S&P 500, the 3rd longest streak in the last 10 years.

The last time a 5% correction occurred was in the second half of 2023. Overall, over the last 34 years, the longest stretch lasted for ~550 days in 2016-2018. Meanwhile, the S&P 500 has skyrocketed by 33% since October and 15% year-to-date in one of its best rallies in years. Source: The Kobeissi Letter, Goldman Sachs

Is the Bank of Japan intervening again trying to prevent the Yen from falling further against the U.S. Dollar?

barchart

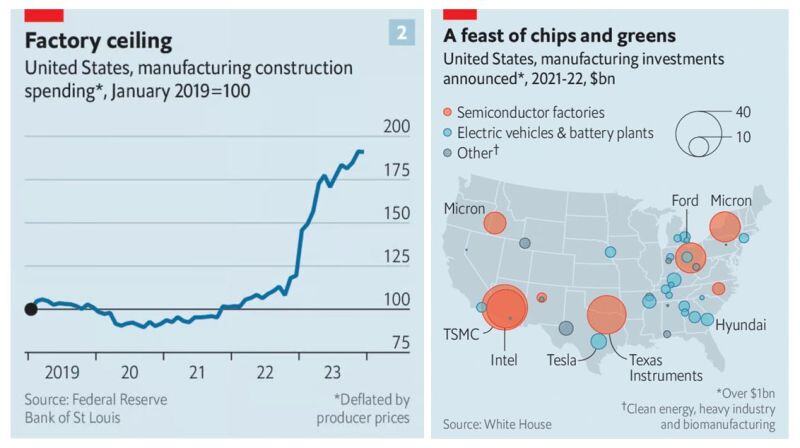

US manufacturing mega-boom in 2 images

Source: Science is Strategic, The Economist

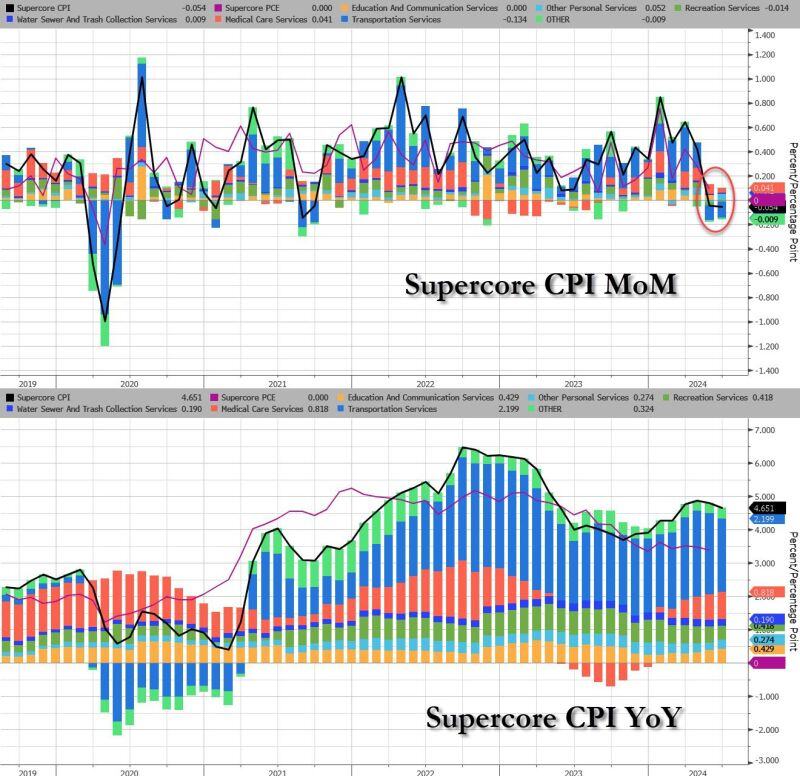

US supercore CPI is negative MoM for the 2nd month in a row

zerohedge.com, Bloomberg

Gold >2400 as markets believe lower than expected CPI report is opening the door to rate cuts by the FED starting in September.

Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks