Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

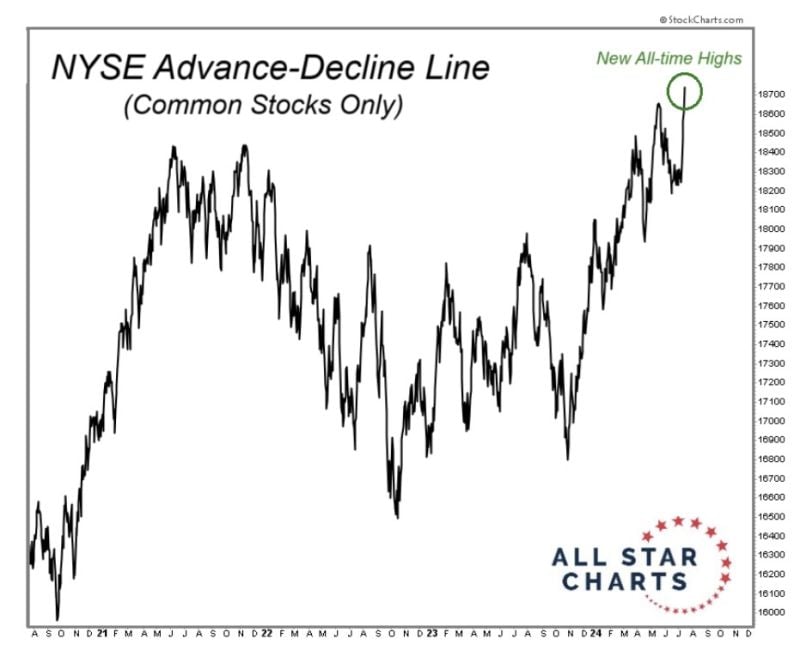

The NYSE A-D Line keeps making new highs. The US equity bull market is not just 7 stocks.

It's not just Tech. And it's not just large-caps. Yes some correction and rotation can take place from time to time. But it remains a bull market until proven otherwise. It's just a bull market... And it has been for over 2 years now. Source: J-C Parets

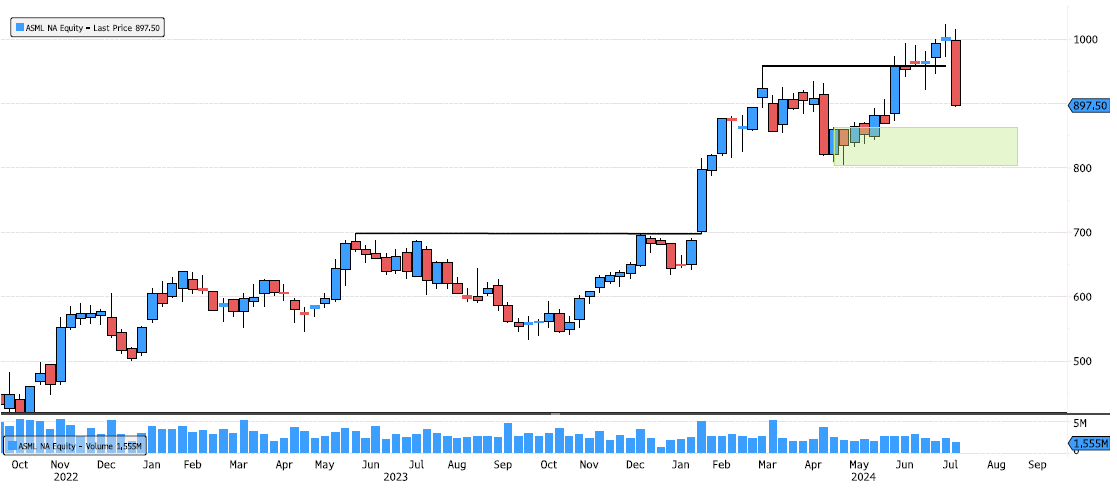

Global chip stocks from Nvidia to ASML fall on geopolitics, Trump comments.

Global chip stocks fell sharply, with ASML , Nvidia and TSMC posting declines amid reports of tighter export restrictions from the U.S. and a ramp-up of geopolitical tensions fueled by comments from former U.S. President Donald Trump. ASML’s Netherlands-listed shares were down 11%, while Tokyo Electron shares in Japan closed nearly 7.5% lower. The moves came after Bloomberg on Wednesday reported that the Biden administration is considering a wide-sweeping rule to clamp down on companies exporting their critical chipmaking equipment to China. Washington’s foreign direct product rule, or FDPR, allows the U.S. to put controls on foreign-made products even if they use the smallest amount of American technology. This can affect non-U.S. companies. Source: CNBC

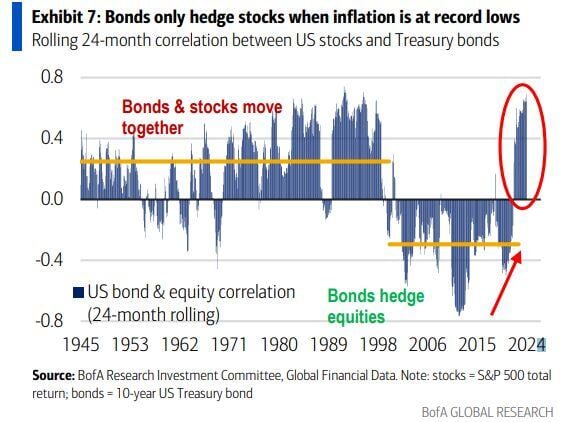

Historically, bonds acted as efficient portfolio hedges only when inflation is <2%.

Below is the rolling 24-month correlation between US stocks and Treasury bonds. Source: Mike Zaccardi

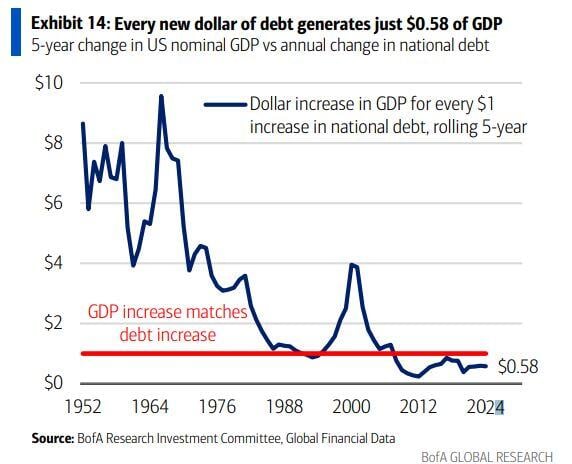

Unproductive debt...

Every new dollar of US debt generates just $0.58 of GDP Source: Mike Zaccardi, BofA

ASML Trying to Find Support

ASML is under pressure today, down 8% due to earnings. The next major support zone to keep an eye on is between 804-862. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks