Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Netflix, $NFLX, officially kicks off big tech earnings season with a MASSIVE swing in price.

The stock just swung over 10% in a matter of minutes after reporting results. The company reported Q2 2024 EPS of $4.88, above expectations of $4.76. They also added 8.05 million subscribers, crushing expectations of 4.5 million. Big tech earnings season has officially begun. Source: The Kobeissi Letter

Meb Faber >>> Investing quote of the day via Jason Zweig

.

The US dollar index $DXY and the 10-year yield $TNX are both breaking down.

Source: Steven Strazza, All Star Charts

Over the last few months, week-ends have been full of surprise

Can we get a new one this week? Obama says President Biden "needs to seriously consider the viability of his candidacy." Top Democrats have said Biden may drop out of the 2024 election AS SOON AS THIS WEEK-END. Odds of Biden winning election are plummeting again (note that the fact he is COVID-positive doesn't help either) Source: The Kobeissi Letter

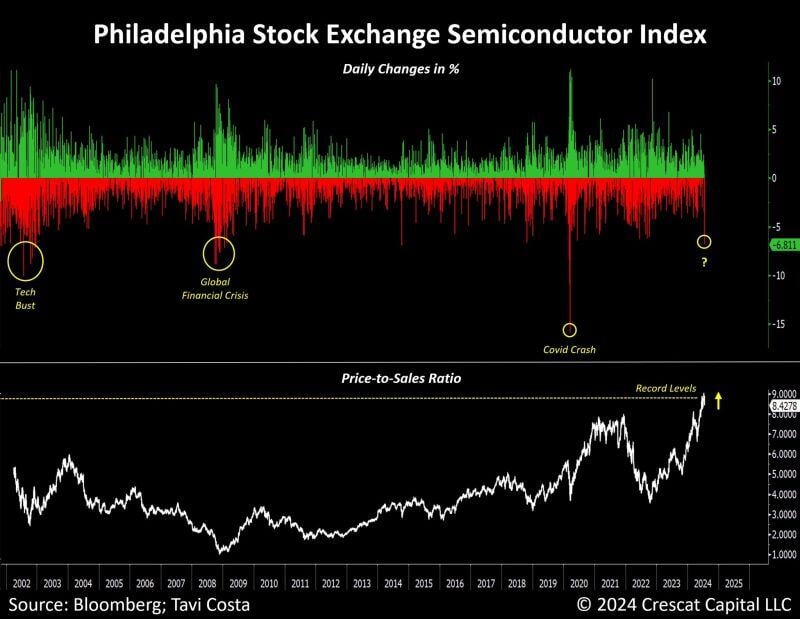

We just saw the largest selloff in the semi-conductors SOX index since the pandemic crash

It is taking place at the time valuations are at record high (see below price-to-sales in the chart underneath) Source: Bloomberg, Tavi Costa

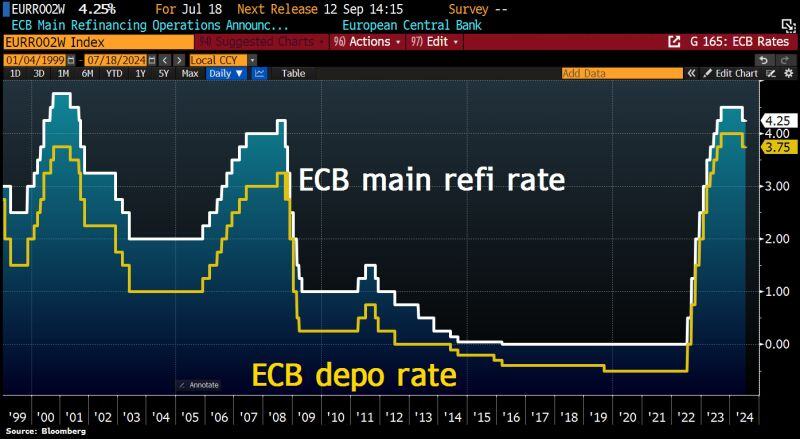

ECB leaves all rates unchanged as expected.

Main Refi at 4.25%, deposit rate at 3.75%. Guidance on interest rates also stays unchanged: Not pre-committing to particular path. ECB to follow data-dependent, meeting-by-meeting approach. Source: Bloomberg, HolgerZ

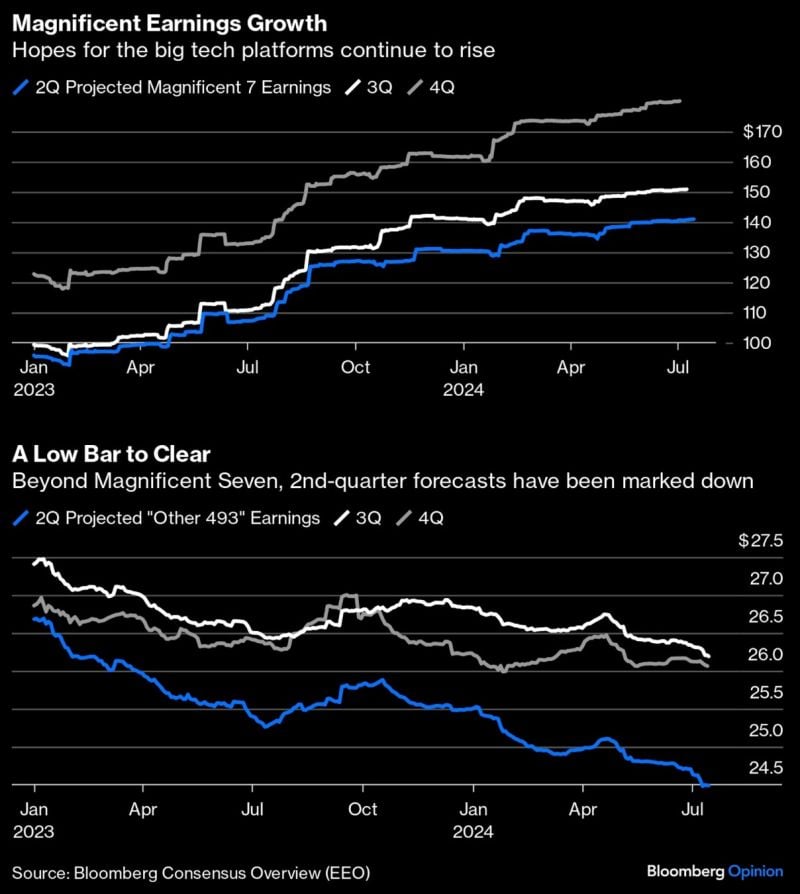

There are 2 ways to look at this chart:

1/ Mag7 outperformance is justified by positive earnings revision (vs. negative revision for the rest); 2/ The bar has been raised quite high for the Mag7 (so beware if they disappoint) while the bar is low for the other 493 stocks (there is room for positive surprise) Source: Bloomberg, RBC

Investing with intelligence

Our latest research, commentary and market outlooks