Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

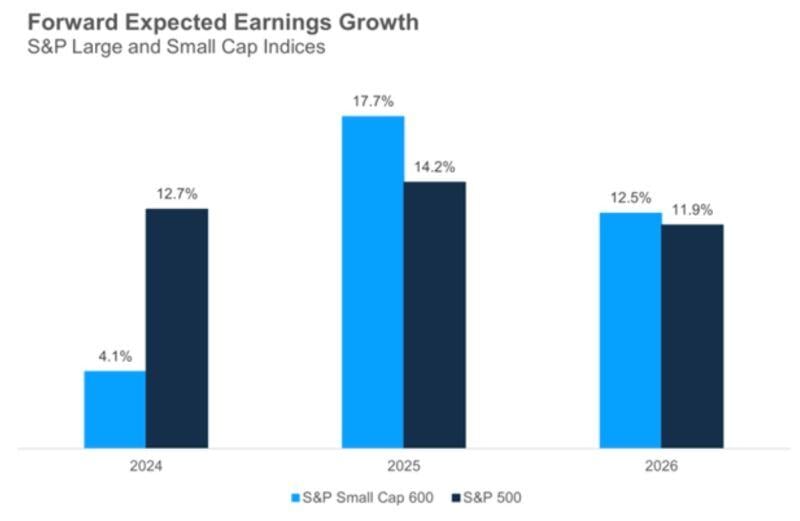

2025 and 2026 look much better for US small caps earnings, relative to large caps

Source: JPM, RBC

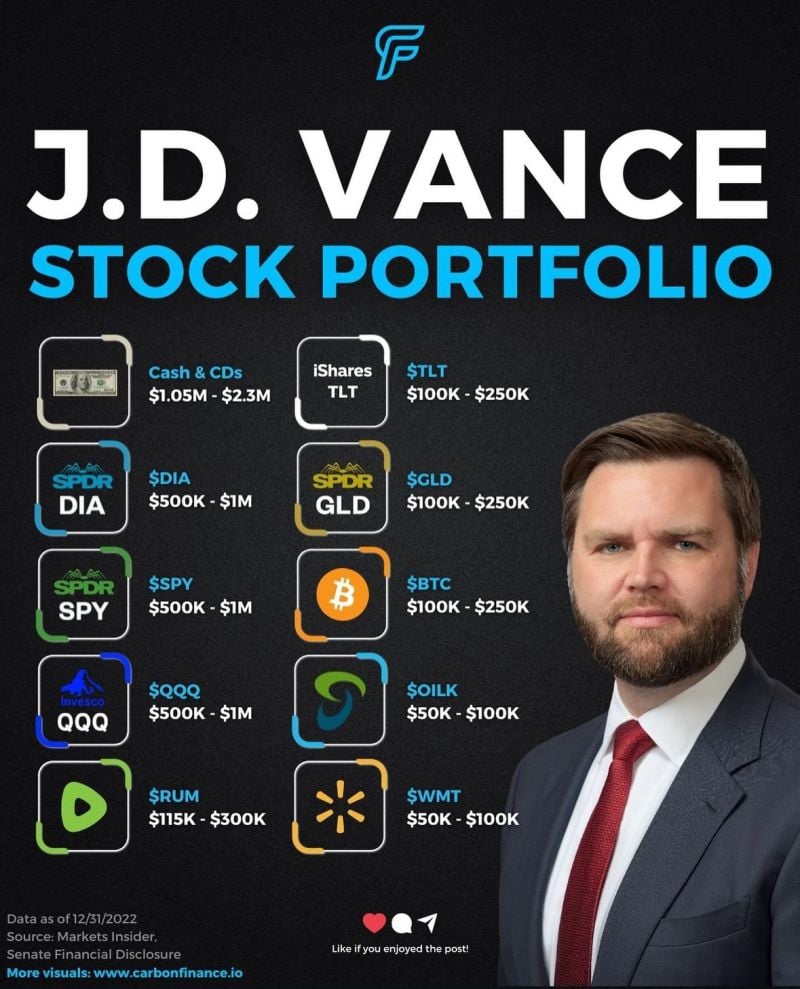

Here’s what JD Vance’s portfolio looks like

Source: Savvy Trader

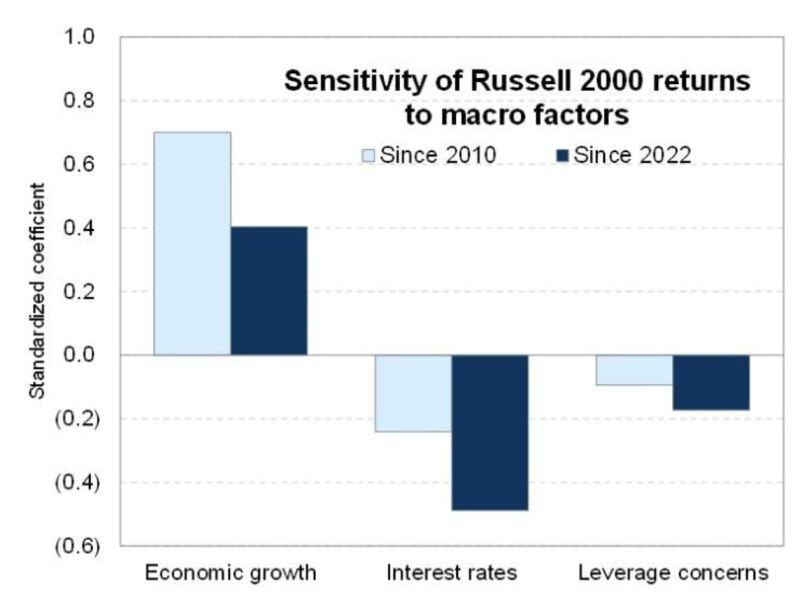

For US small caps, rates just as important as growth since 2022.

And as we know, March of 2022 is when the hiking cycle began... Source: GS, RBC

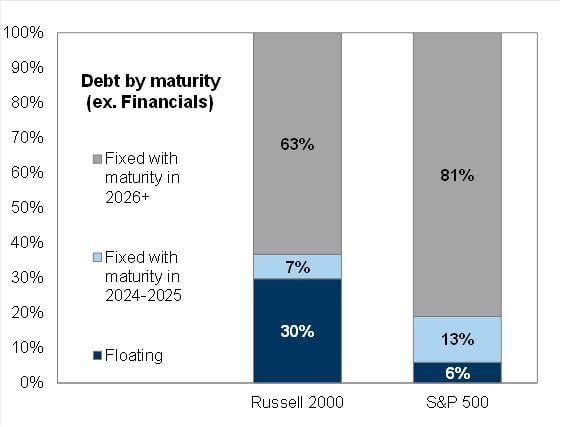

A large portion of Russell 2000 debt load is floating

It thus makes a lot of sense that small-caps were the most hot by monetary policy tightening / higher interest rates. Now the Street is anticipating rate cuts, small-caps underperformance might be coming to an end... Source: GS

Sox plunged 6.8% in semi conductor sector's worst selloff since March 2020

on the prospect of increased export restrictions on advanced semiconductor technology, and by Donald Trump's latest comments on Taiwan. Taiwan "did take about 100% of our chip business" and "should pay us for defense," Trump said in a Bloomberg Businessweek interview. Intel and GlobalFoundries bucked the trend as potential US domestic semi 'winners.' Source: Bloomberg, HolgerZ

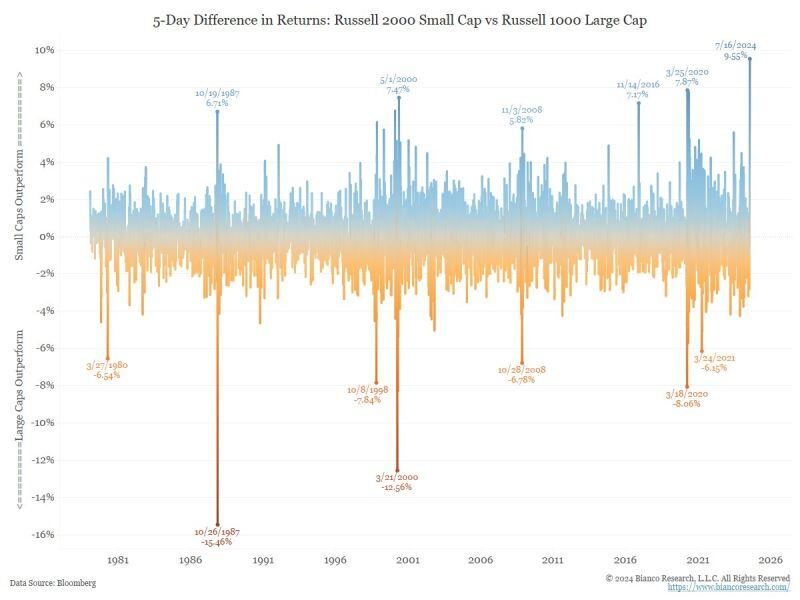

The biggest outperformance of small-cap stocks over large-cap stocks, over a 5-day period, in history.

Data starts in 1978 Source: Jim Bianco

Investing with intelligence

Our latest research, commentary and market outlooks