Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

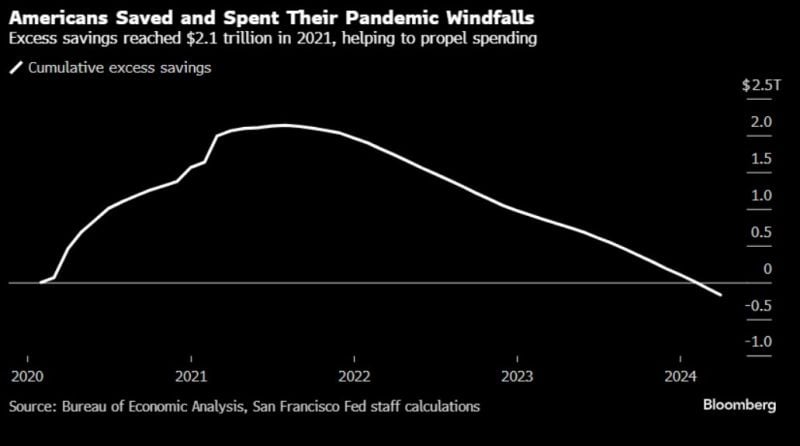

American excess savings reached $2.1 trillion in 2021, but they ran dry months ago.

The pandemic savings cushions that helped Americans weather high prices in recent years have worn through, contributing to a loss of consumer firepower that’s rippling through the economy. Delinquencies are rising. Executives are flagging caution among shoppers in recent earnings calls, and retail sales barely increased in May after falling the month prior. Economists forecast solid inflation-adjusted consumer spending in data out Friday, helped by lower gasoline prices, but that would follow an outright decline in April. Source: Bloomberg, Lisa Abramowitz

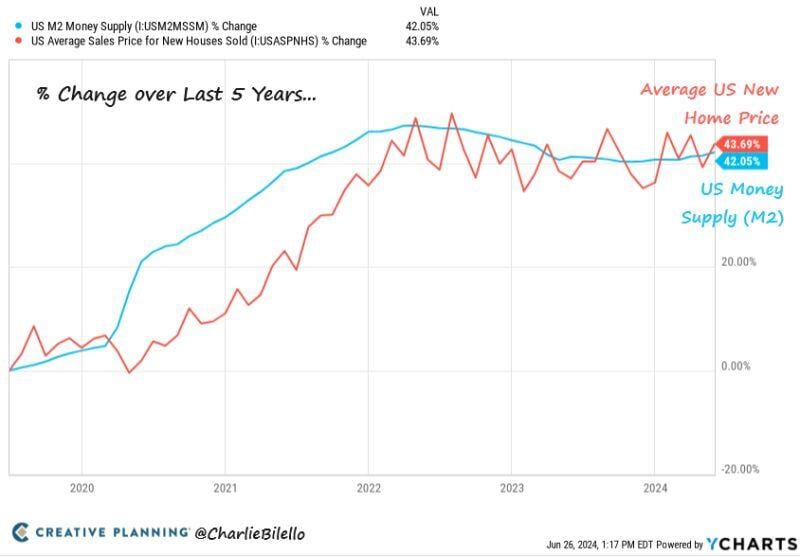

% Increase over the last 5 years...

US Money Supply (M2): +42% Average US New Home Price: +44% "Inflation is always and everywhere a monetary phenomenon." - Milton Friedman Source: Charlie Bilello

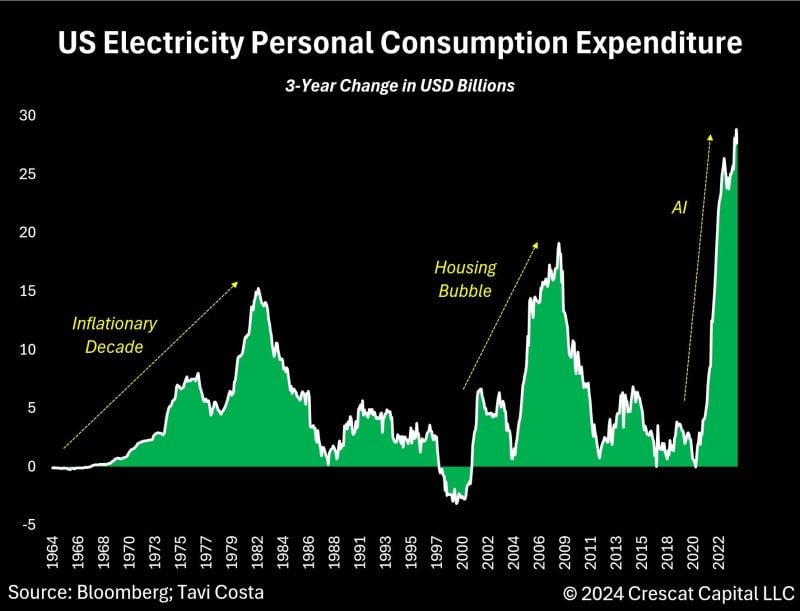

Electricity consumption has skyrocketed, and this is just the beginning.

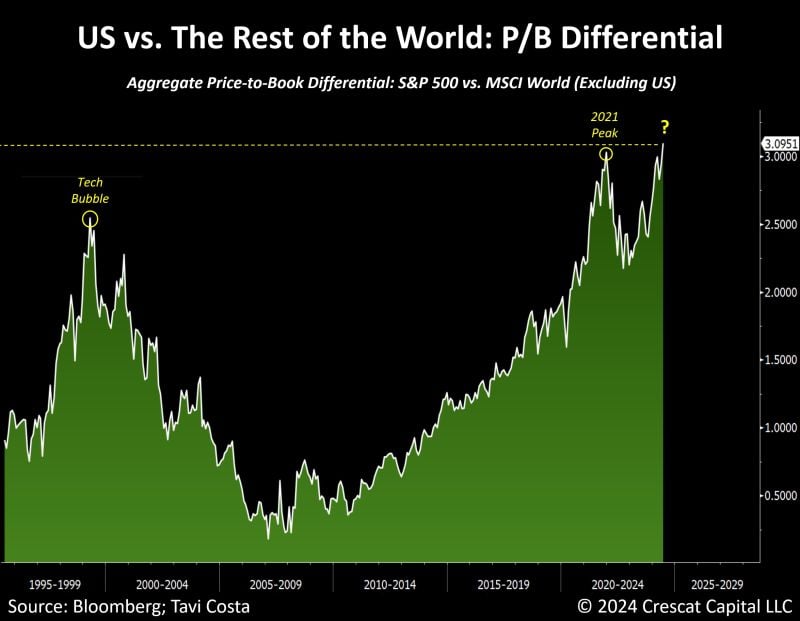

As highlighted by Otavio (Tavi) Costa, the surge in electric cars, electric heating, and new AI advancements is dramatically increasing our electricity needs. Among the questions raised? 1) Is the global economy prepared for these changes? 2) Could AI be inflationary in the short run and deflationary in the long run? The extensive infrastructure necessary to harness AI requires hardware expansion, while commodities (particularly metals) remain historically constrained. Source: Crescat Capital, Bloomberg

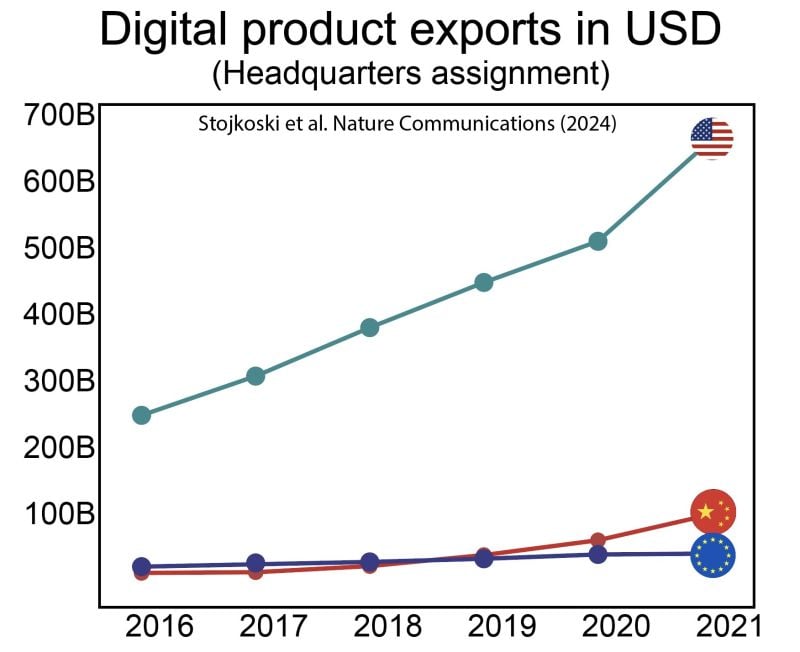

Wondering why the US stockmarket is eating the world?

Here's a visualisation of the digital trade divide... Markets & Mayhem

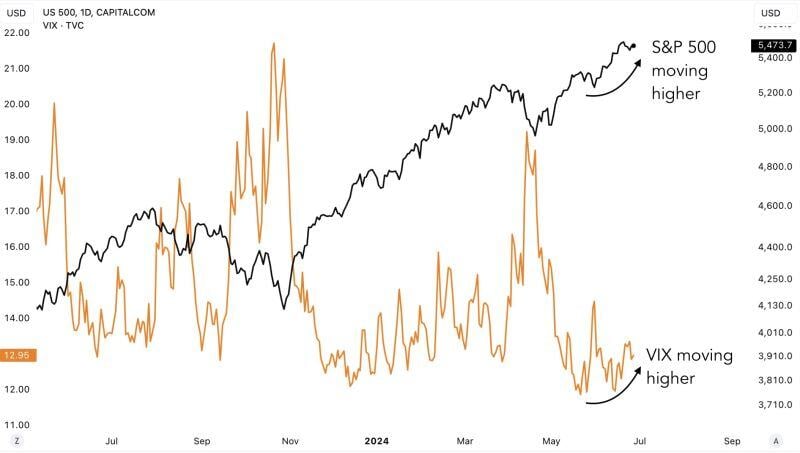

Major divergence spotted:

The VIX has been trending higher since mid-May. But even the SP500 has been moving higher. This is an anomaly. Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks