Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

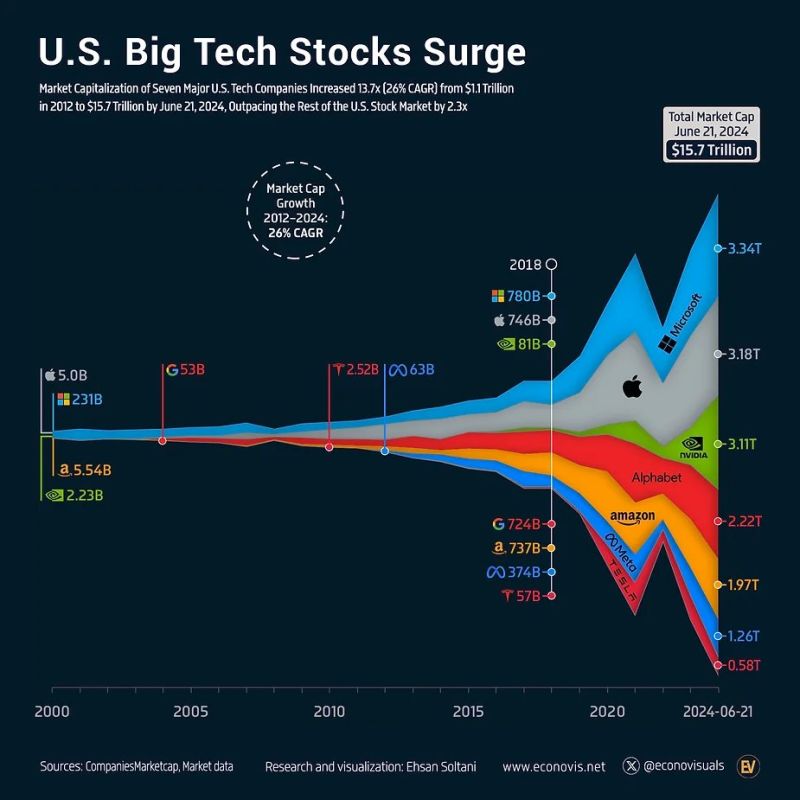

Amazon enters elite $2tn club as AI optimism fuels rally.

Amazon up ~27% this year, driven by improving growth trends as AI re-accelerates its cloud-computing business. The milestone puts Amazon into an exclusive club of comps worth $2tn or more: Alphabet crossed the level in April, while Nvidia, Microsoft, and Apple are all worth north of $3tn. (via BBG)

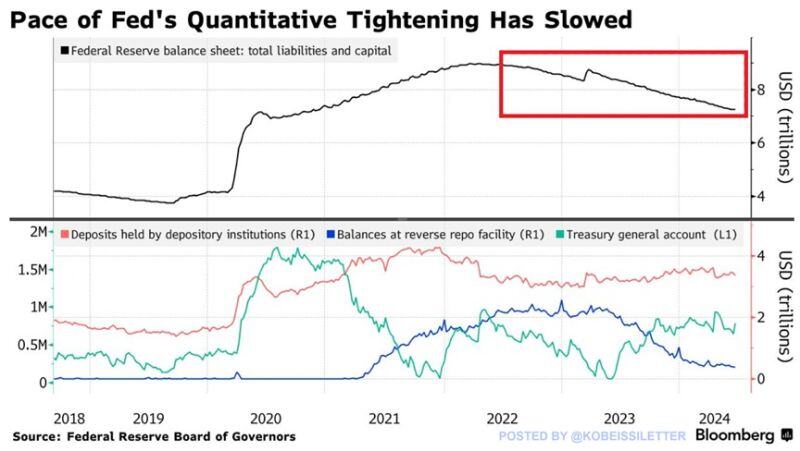

The Fed has been shrinking its balance sheet at the fastest pace ever:

Since April 2022, the Federal Reserve has reduced its balance sheet by $1.71 trillion to $7.25 trillion, a 19% decline. By comparison, from 2017 to 2019 the Fed’s balance sheet runoff amounted to 16%. However, the Fed's balance sheet still stands $3.1 TRILLION above pre-pandemic levels. Meanwhile, the Fed slowed the pace of runoff from $95 billion to $60 billion a month at the beginning of June. Will the Fed's balance sheet ever reach pre-pandemic levels?

Visualizing the incredible surge in tech stocks 📊

Markets & Mayhem 🤖

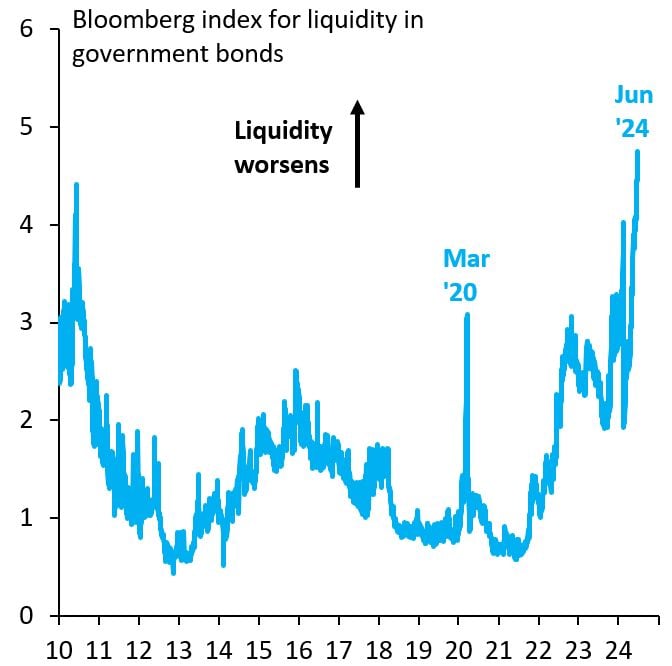

BREAKING 🚨: U.S. Treasury Market

Treasury liquidity is now at its worst point in AT LEAST the last 14 years, surpassing even the onset of Covid Source: Barchart, Robin Brooks

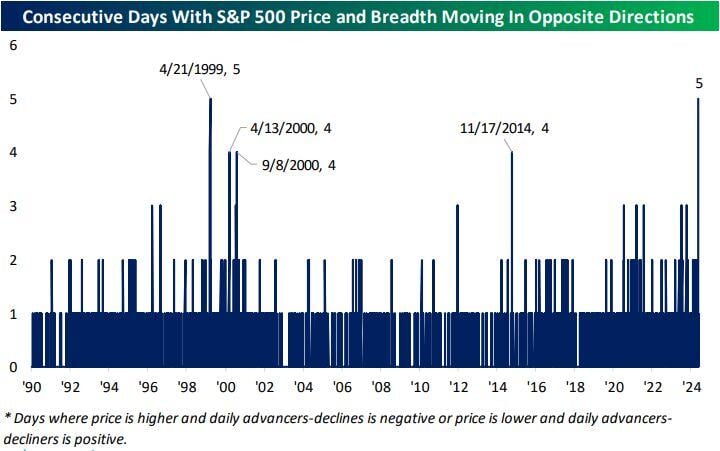

Yesterday the SP500 managed to rise on negative breadth.

It's now been five days in a row where price has gone in one direction and breadth has gone in the other. That ties the record streak from April 1999. Source: Bespoke

Energy Sector Retracement After Breakout

The Energy sector (XLE US) broke out of an ascending triangle in March! This was good news for confirming the bullish trend. As with many breakouts, they are usually followed by a retracement. The market has just reached the 50% Fibonacci retracement. This is a very interesting level to keep an eye on. Source: Bloomberg

If you ever get upset for selling too early just know it could have been worse.

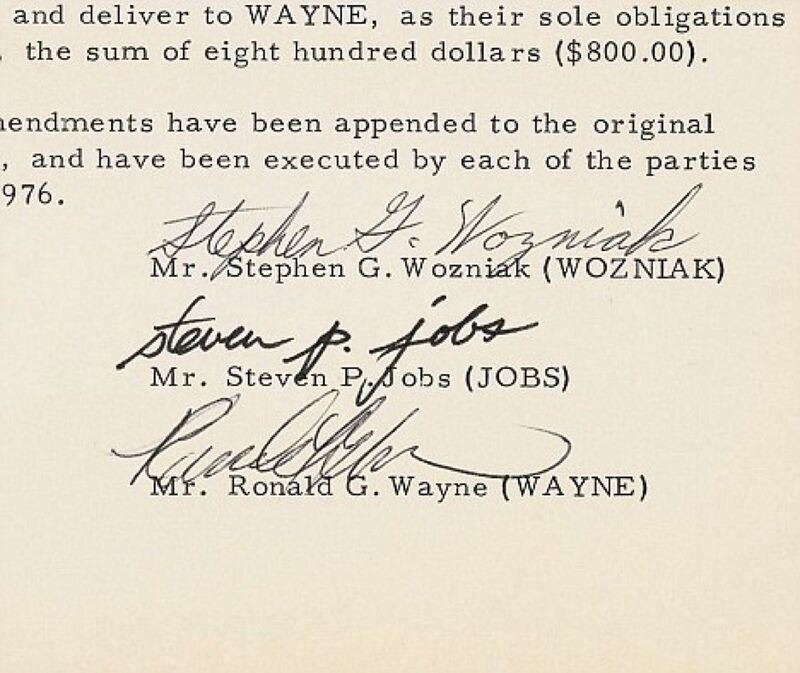

Meet Ronald Wayne Apple's 3rd co-founder who sold his entire 10% stake in the company for $800 back in 1976. 10% of Apple $AAPL is currently worth ~$328 Billion... Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks