Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

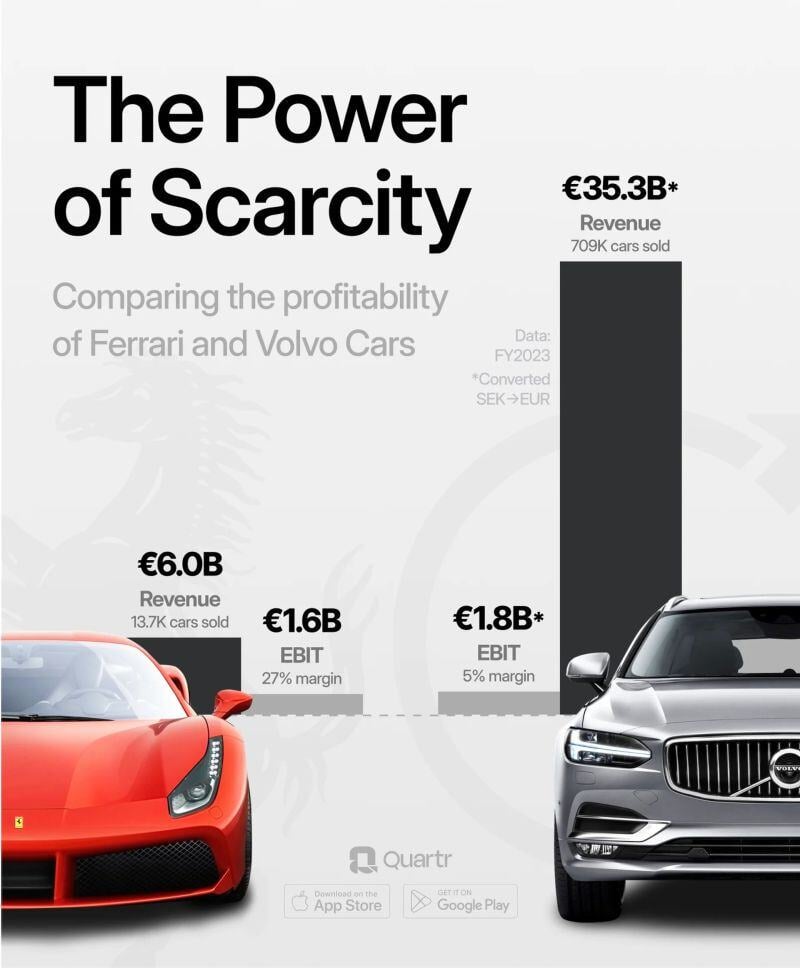

The power of scarcity. Comparing the profitability of Ferrari $RACE and Volvo $VOLCA

Source: Quartr

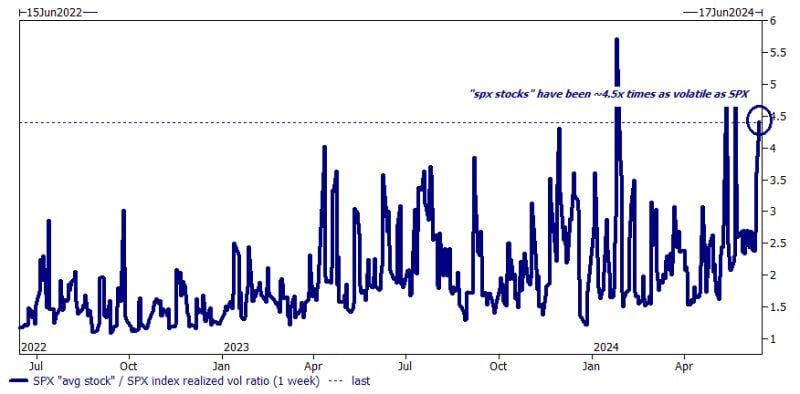

Wow. The average S&P500 stock has been on average 4.5x as volatile as the broader index!

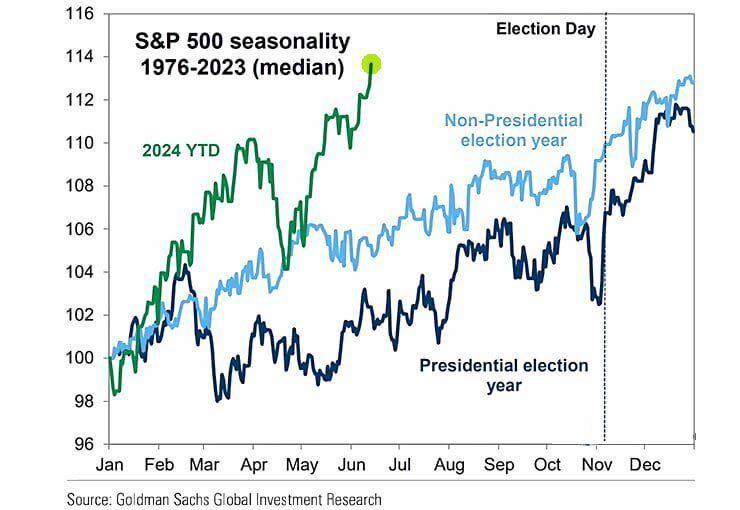

Chart: Goldman Sachs Source: Markets & Mayhem

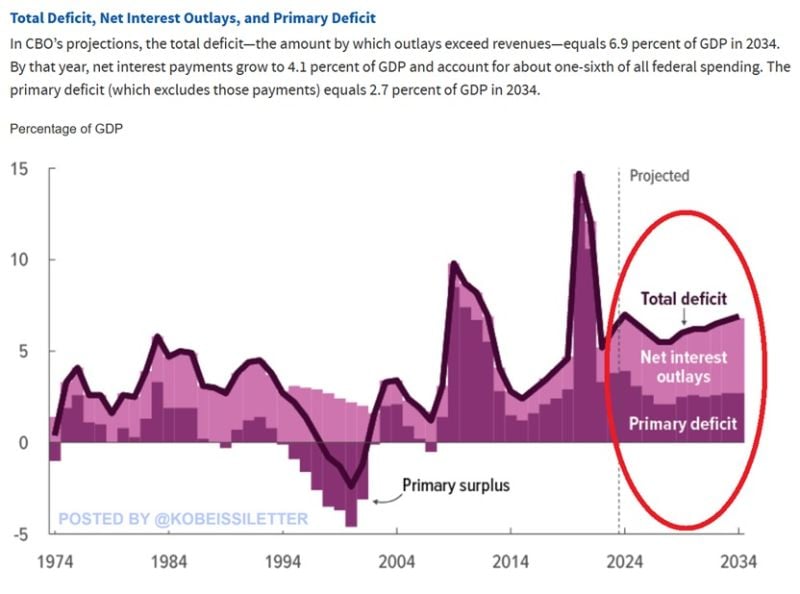

BREAKING: The CBO has raised the US government's deficit forecast for Fiscal Year 2024 from $1.5 trillion to $1.9 trillion, or 6.7% of GDP.

This would be the highest deficit since 2021 when the deficit hit $2.8 trillion in response to pandemic lockdowns. By 2034, the deficit is expected to reach $2.9 trillion or 6.9% of GDP, totaling a whopping $22.1 trillion over the 2025-2034 period. The CBO projection also assumes that net interest will reflect over 50% of the budget deficit over the next decade. These numbers all assume no recessions and lower interest rates. What happens if rate cuts are delayed and a recession hits? Source: The Kobeissi Letter, CBO

Investing with intelligence

Our latest research, commentary and market outlooks