Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

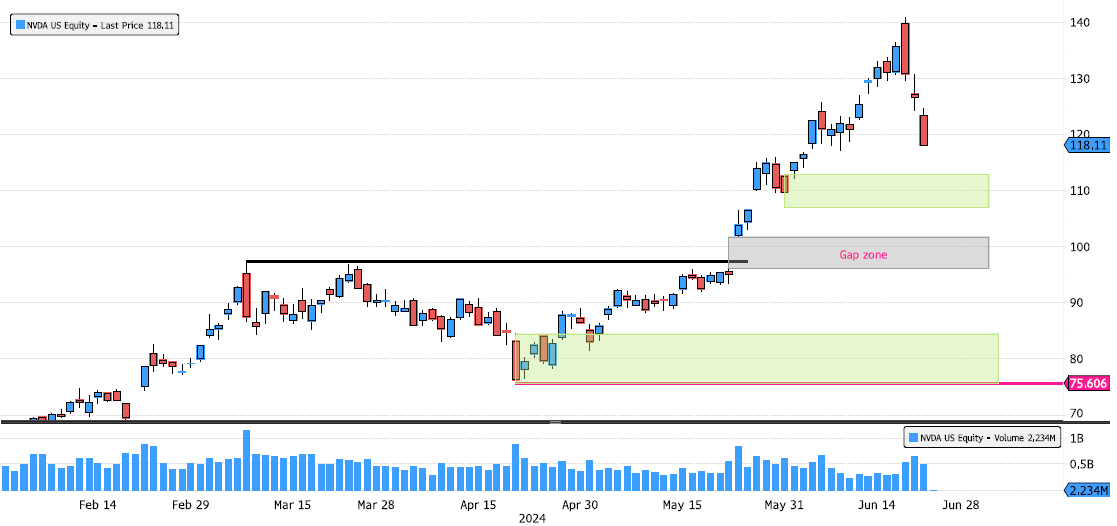

Nvidia Looking for Support

Nvidia (NVDA US) has started its consolidation. The first minor support is at 117. An interesting level to keep an eye on is the 107-112 zone, which also represents a 50% Fibonacci retracement. If all those levels break, there is the gap zone at 96-101.60 that could be filled and, of course, the major support zone at 75.60-84.35, but that seems so far away! Source: Bloomberg

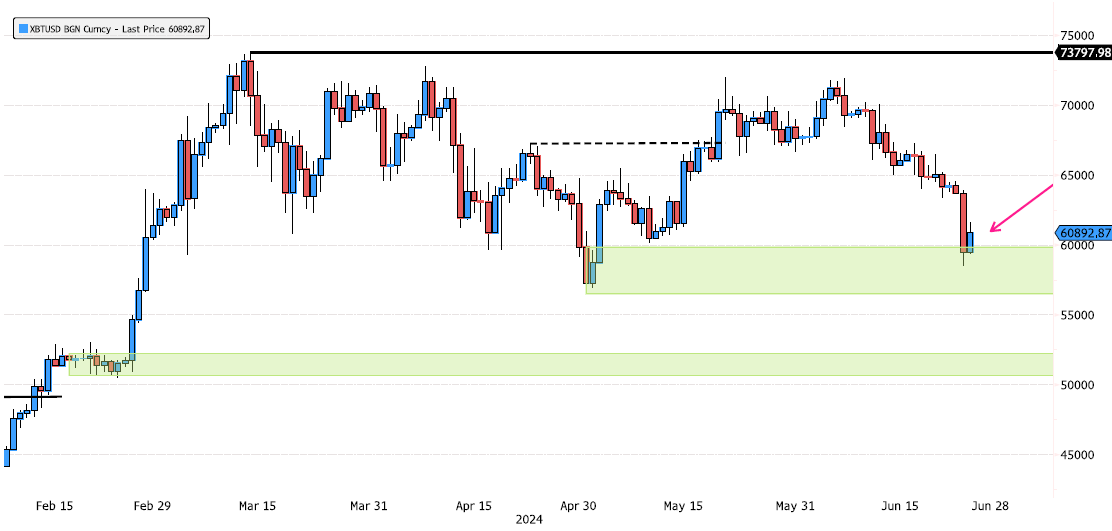

Bitcoin at demand zone

Bitcoin (XBTUSD) showed positive signs in May with a break above the last swing high, suggesting that the consolidation could be over. Yesterday's sell-off (-8%) reached a strong demand zone. Keep an eye on this level. Source: Bloomberg

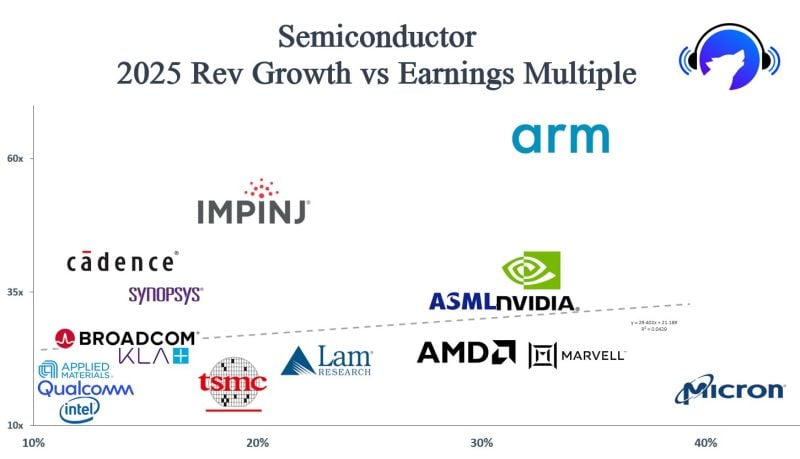

Semiconductors 2025 revenue growth (expected) vs. earnings multiple

Source: Shay Boloor

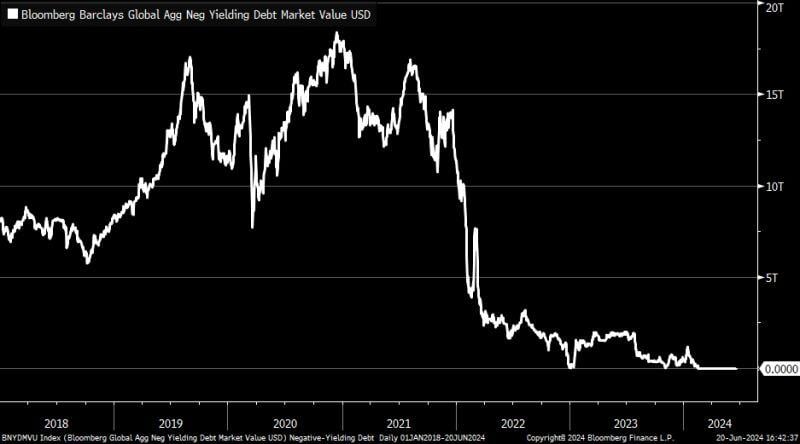

The end of ice age... Will we come back one day to a world of negative yielding debt???

Below chart shows the USD Market Value of negative yielding debt. It peaked above $18T after Covid... Source: Bloomberg

No reasons to worry at all... Just bros living in the moment...

More seriously remember what the East-West divide and the new world order (as defined by Zoltan) are all about: Wars are about alliances: the enemy of your enemy becomes your friend... After the BRICS, should we focus instead on Turkey, Russia, Iran, China, and North Korea playing “TRICKs” – an alliance of economies sanctioned by the U.S. getting ever closer economically and militarily?

If you want success, you need to out-fail everyone.

It’s not about being perfect. It’s about adapting quickly after failure. Source: Chris Donnelly

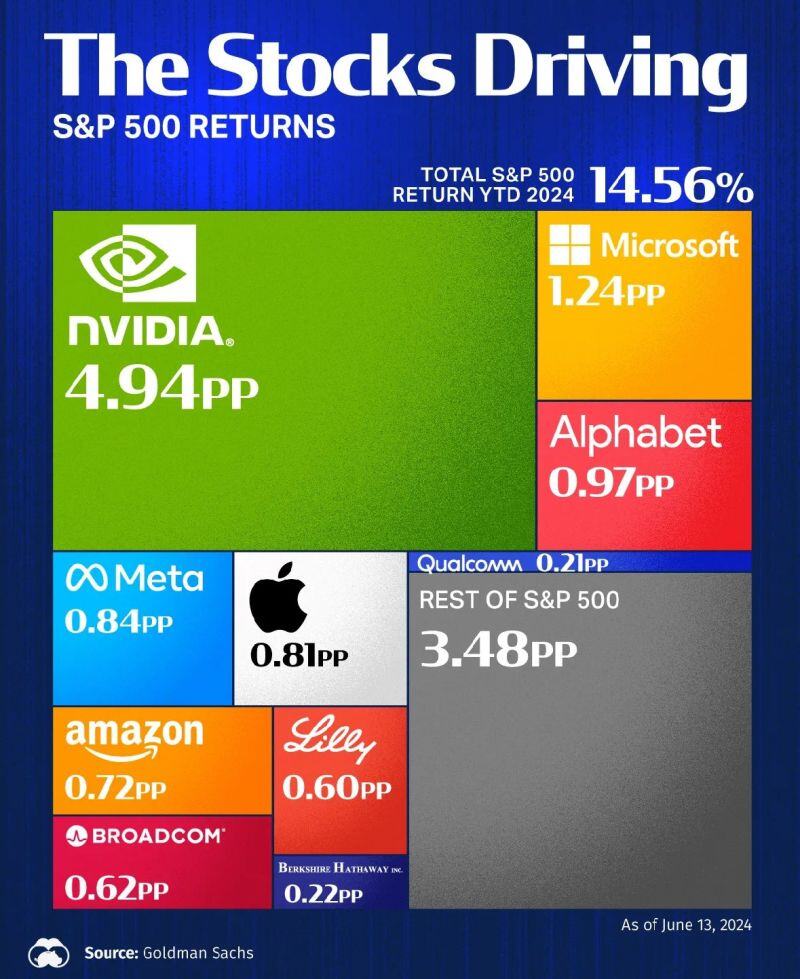

Here are the stocks driving the S&P500’s almost 15% return so far in 2024.

Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks