Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

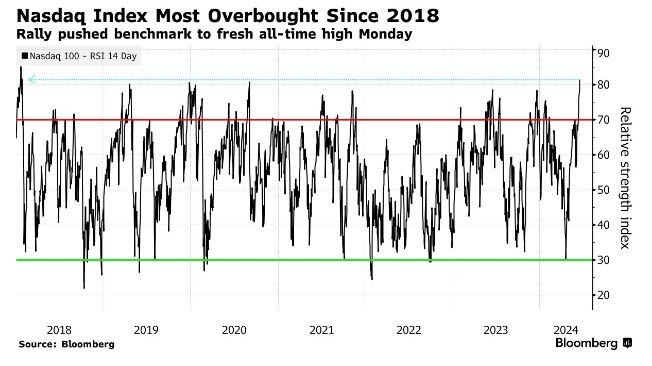

Mega Cap Tech Stocks hit their most overbought level in more than 6 years last week

Source: Barchart, Bloomberg

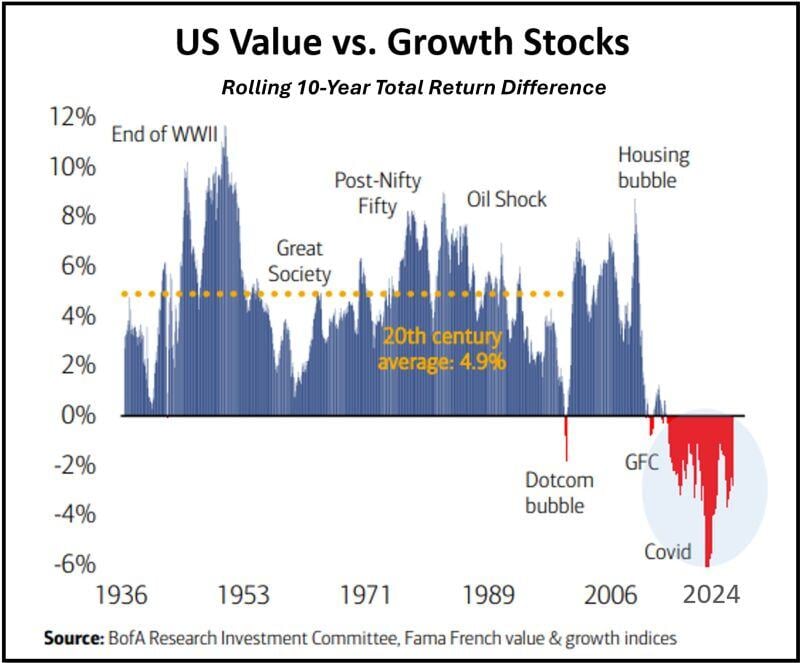

Was the recent trend of growth stocks outperforming value stocks an anomaly, driven mainly by lower capital costs that favored growth over profitability?

As shown below, history shows that US value outperformed US growth most of the time (using rolling 10-year Total Return) Source: Tavi Costa, BofA

Moscow to Mumbai.💥

The INSTC corridor is making progress every day. The International North–South Transport Corridor (INSTC) is a 7,200-km (4500 mile) long multi-mode network of ship, rail, and road route for moving freight between India, Iran, Azerbaijan, Russia, Central Asia and Europe. The objective of the corridor is to increase trade connectivity between major cities such as Mumbai, Moscow, Tehran, Baku, Bandar Abbas, Astrakhan, Bandar Anzali, etc. Russia-Iran-India corridor is a game-changer that involves many countries and different modes of transportation. And quite a logistical and geopolitical accomplishment! Source: S.L Khantan

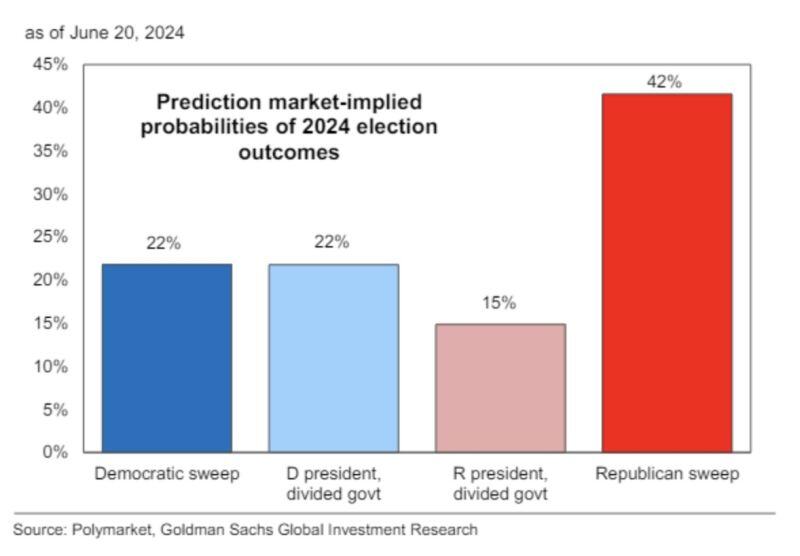

Prediction markets imply markedly higher odds of a Trump presidency than a Biden presidency ahead of next week's first presidential debate

w/the probability of a Republication sweep (42%) almost twice the odds of a Democratic sweep (22%). Source: GS thru HolgerZ

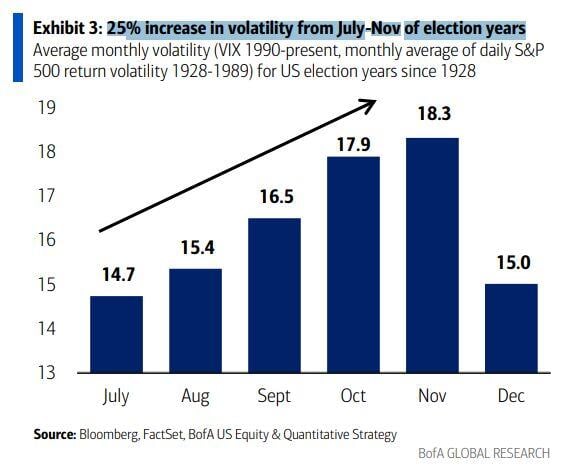

History shows an average 25% increase in volatility from July-Nov of election years...

Mike Zaccardi, CFA, CMT, BofA

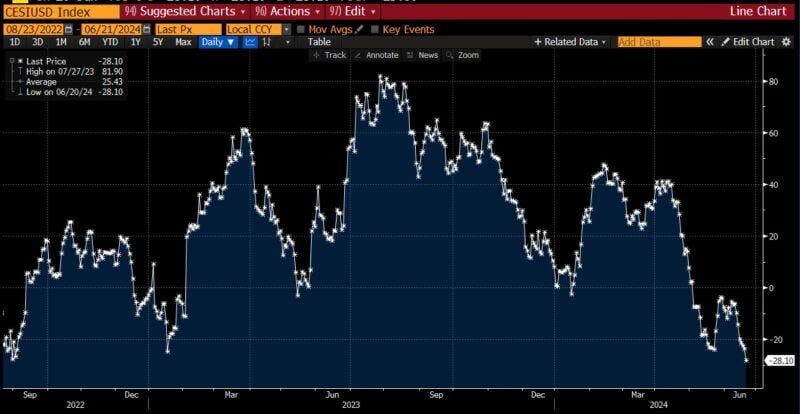

The Citi US economic surprise index has fallen to about the most negative since 2022

h/t @daniburgz, Liz Abramowitz, Bloomberg

Large tech stocks just keep getting bigger: The S&P 500 Equal Weight index relative to the S&P 500 is now at its lowest level since the 2008 Financial Crisis

This ratio has accelerated as the S&P 500 has rallied by 14% year-to-date while the equal-weight by just 5%. The disconnect has been driven by the 5 largest stocks which have seen a 32% gain combined this year. Since January 2023, the S&P 500 is up a massive 41% while the equal-weight index is up just 16%. At the same time, Russell 2000 Equal Weight is nearly flat, up just ~3%. Source: The Kobeissi Letter, The Daily Shot

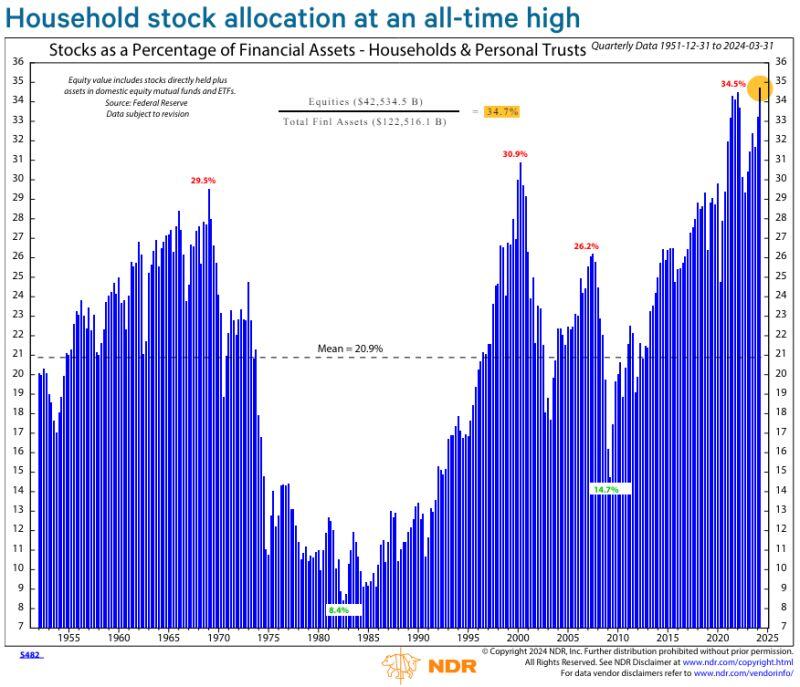

U.S. household stock allocation has reached an all-time high

Source: NDR_Research

Investing with intelligence

Our latest research, commentary and market outlooks