Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

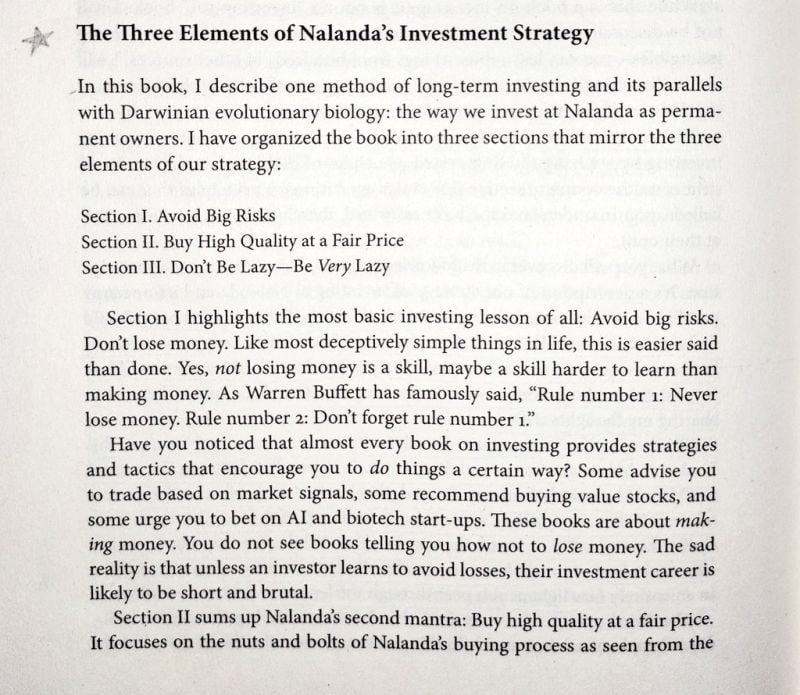

The 3 Elements of Nalanda's investment strategy

1. Avoid Big Risks 2. Buy High Quality at a Fair Price 3. Don't Be Lazy; Be Very Lazy Source: Investment Books (Dhaval)

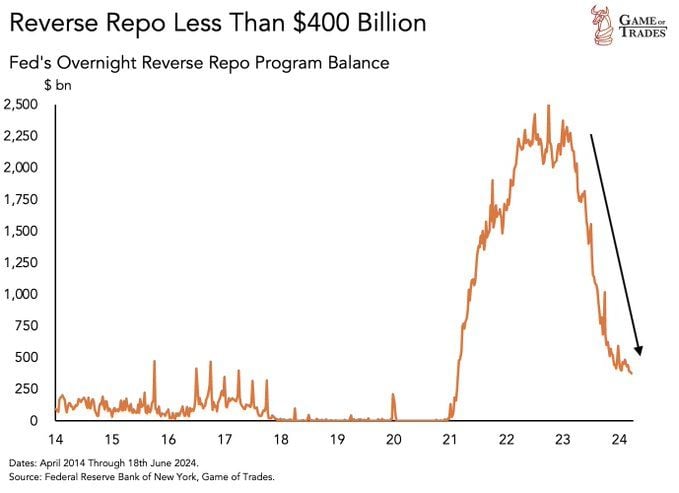

Reverse Repo has been falling off a cliff... Going from +$2300 billion to under $400 billion in just 1.5 years

Source: Game of Trades

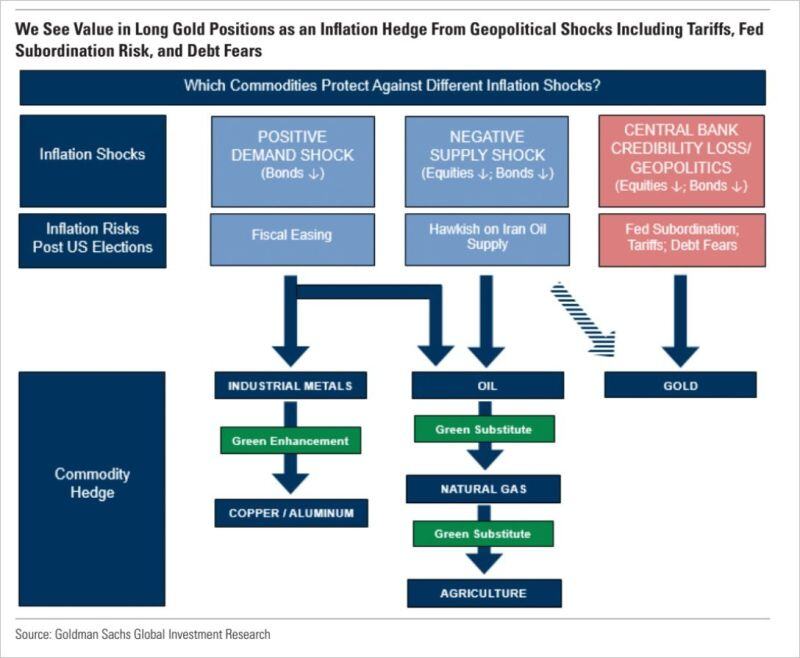

Which commodities protect against different inflation shocks? Goldman regards GOLD as a decent hedge

Source: Goldman Sachs, Ronnie Stoeferle

There was no support for the markets from the liquidity side this week

US liquidity shrank by $50bn as bank reserves saw the largest drop since April tax deadline. Source: Bloomberg, HolgerZ

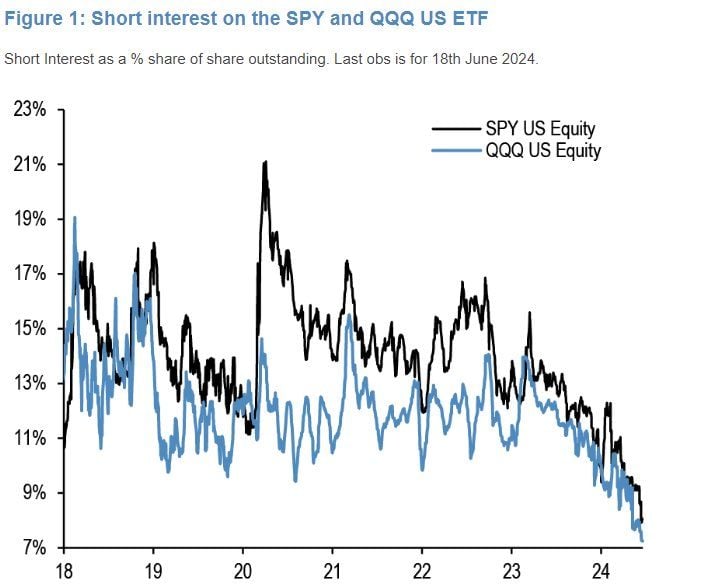

Short interest on the $SPY SPDR S&P 500 ETF and $QQQ Powershares Nasdaq 100 ETF as a % of shares outstanding is at record low levels

Source: JP Morgan

Gautam Adani is uber-bullish on indian equities "There has never been a better time to be Indian"

Source: Nikhil Oswal

Investing with intelligence

Our latest research, commentary and market outlooks