Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

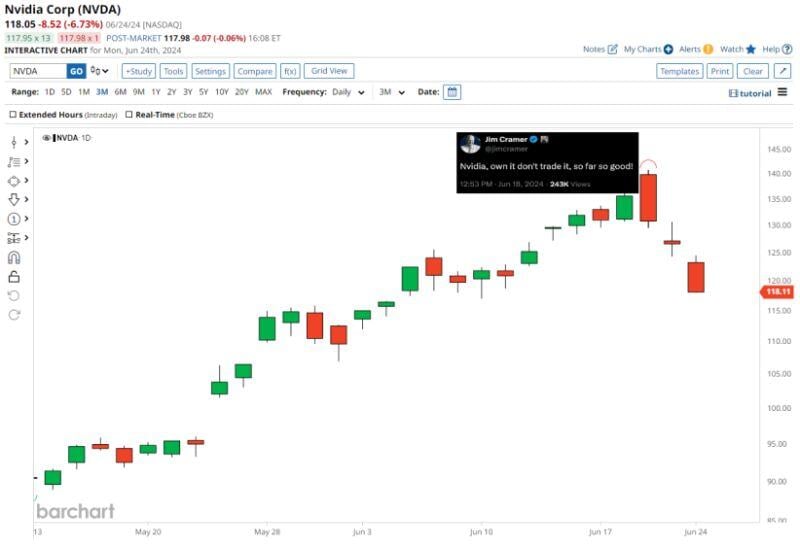

$NVDA is now down 13% since Jim Cramer said "Nvidia, so far, so good"

Source: The Kobeissi Letter

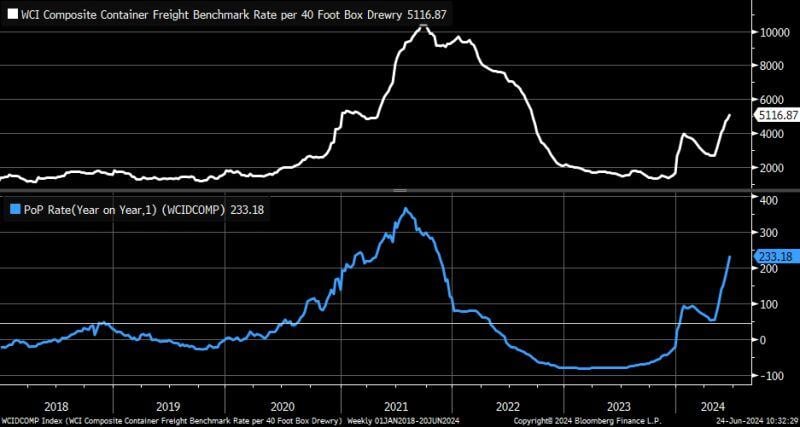

Global freight container rates still moving higher and year/year increase is now up to +233%

Source: Bloomberg, Kevin Gordon on X

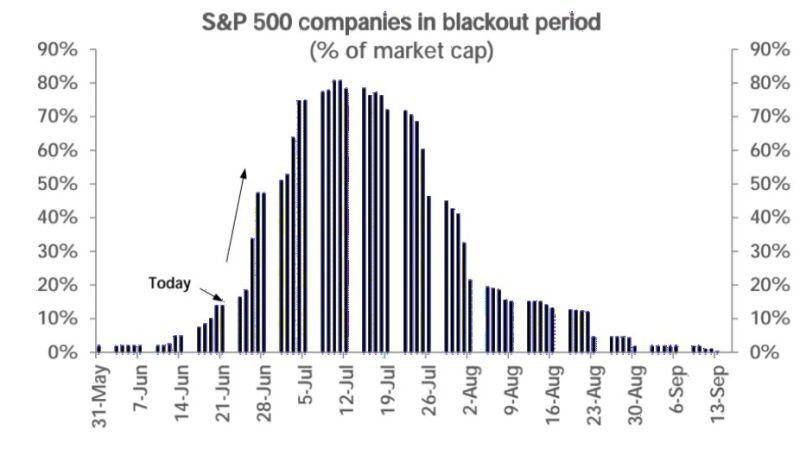

And so begins the S&P 500 buyback blackout period . . .

Source: Markets & Mayhem

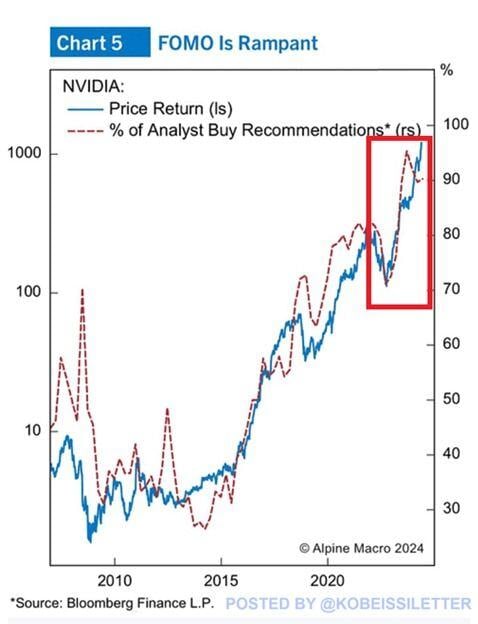

Nvidia FOMO ? This is interesting:

~90% of Wall Street analysts have now a buy rating on NVIDIA, up from ~30% a decade ago. This comes after the chipmaker's share prices have skyrocketed 27,989% over the last 10 years. As the stock rally intensified, the number of buy ratings rapidly increased. Wall Street has never been more bullish of $NVDA. While fundamentals are strong, there is indeed a risk of short-term pullback. A buying opportunity? Or just the start of something more severe? Source chart: Alpine Macro

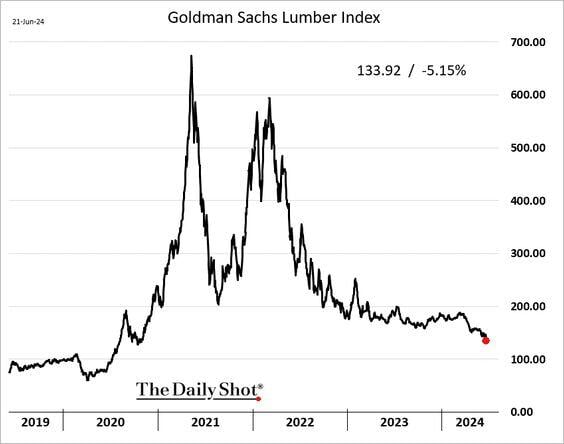

Lumber prices continue to sink amid a soft US housing market

Source: The Daily Shot

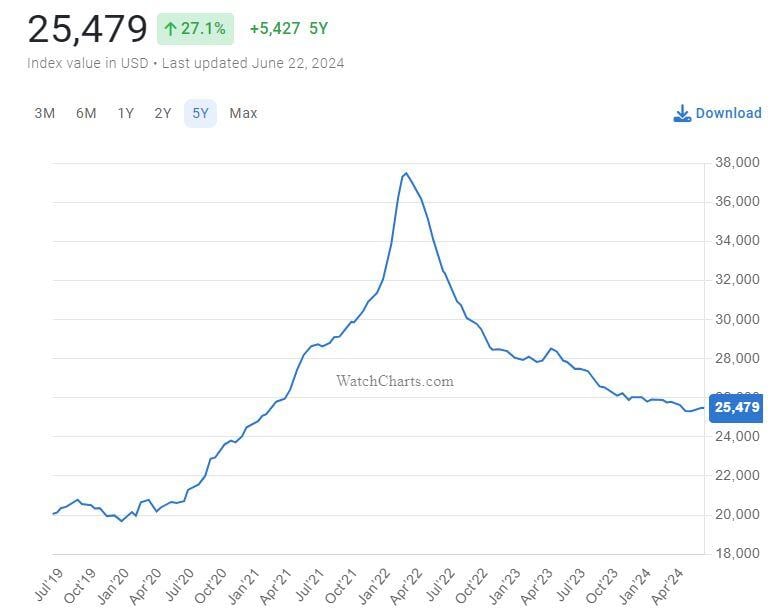

Rolex prices are down almost 40% from highs

Source: Michael Burry Stock Tracker ♟

Investing with intelligence

Our latest research, commentary and market outlooks