Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

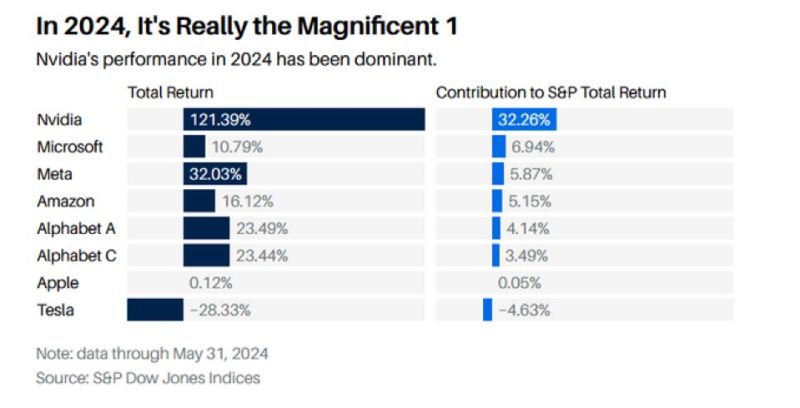

From Mag 7 to... Mag 1

$NVDA is up 122% ytd and contributed to toughly 33% of $SPX gains… Source: Rahul on X

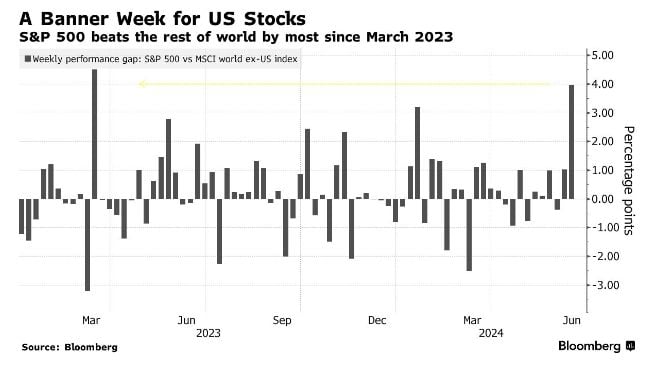

S&P 500 $SPX outperformed Global Stocks this week by the largest margin in 15 months...

Source: Barchart, Bloomberg

#china #macro: Retail sales beat expectations

The strong growth in retail spending is particularly notable given the continued pressure on the property sector, with negative spillovers to household sentiment. It’s probably a relief to a government looking to reset the economy over time. Source: CNBC. Bloomberg, Mohamed El Erian

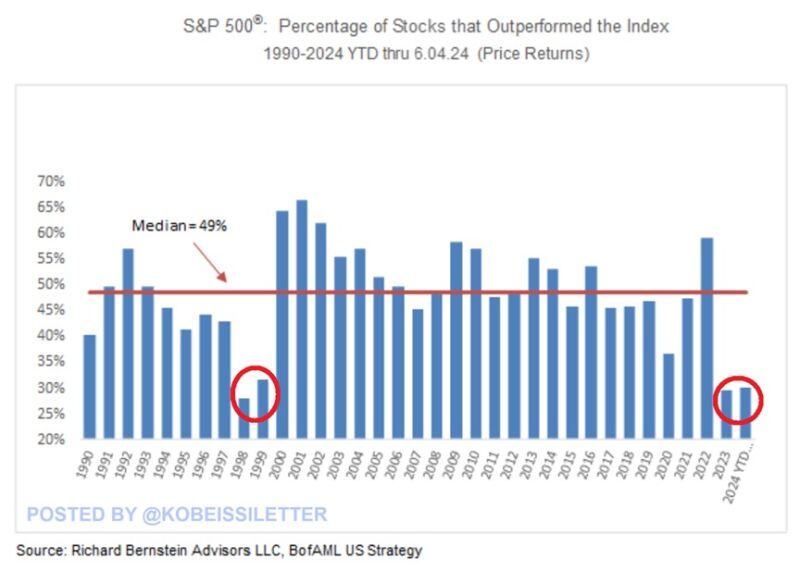

Only 30% of the SP500 stocks have outperformed the index year-to-date.

This is slightly higher than the 29% that occurred in 2023. Since 1990, a streak of 2 consecutive years with such a low percentage has happened only during the 2000 Dot-com bubble. By comparison, the historic median is 49% which typically implied healthy market breadth. The S&P 500 has rallied 12% year-to-date largely driven by just a few tech stocks. A few stocks are driving the entire market. Source: The Kobeissi Letter, Richard Bernstein Advisors

Probably a feeling shared by many households in developed economies and which (partly) explains the rise of populist parties

Source: Markets & Mayhem

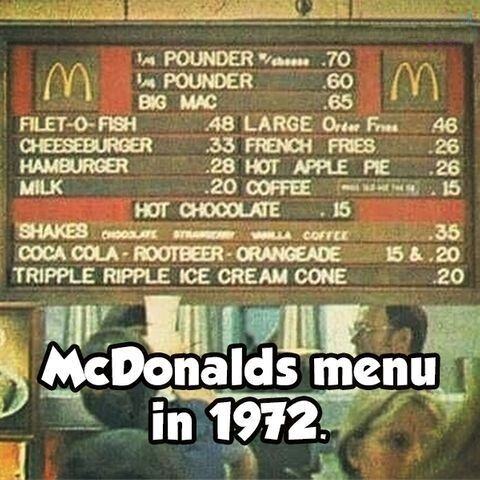

McDonald's menu in 1972

Source: Retro Toys and Cartoons

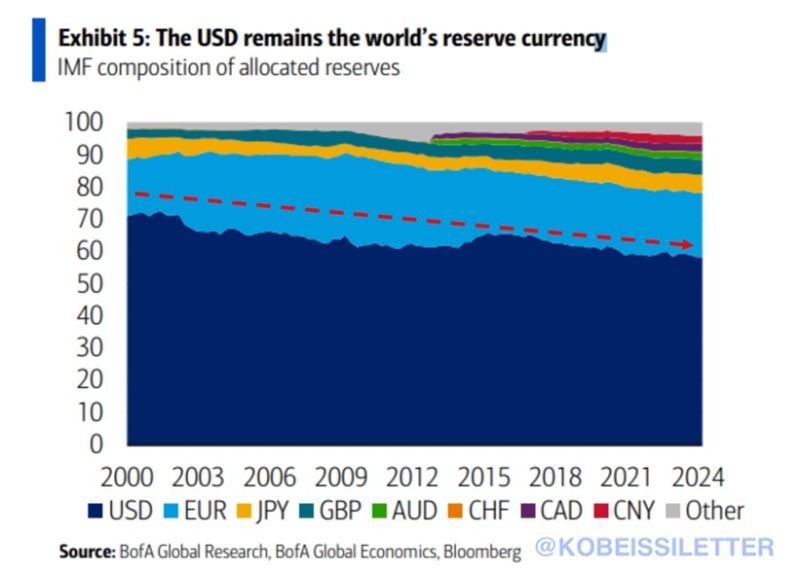

The US Dollar's reserve currency status remains in a downtrend:

The US Dollar share of the world's central banks reserves fell slightly to 58.4% in Q4 2023 from 59.2% in Q3 2023, according to the IMF. By comparison, the US Dollar accounted to 71% of reserves globally in 2000. However, it is worth noting that the US Dollar remains the most dominant currency and it's not even close. For example. the Chinese Yuan's share in Q4 2024 was just 2.3% and the Euro's share is ~20%. Is the US Dollar's reserve currency status safe? Source: The Kobeissi Letter, BofA

Investing with intelligence

Our latest research, commentary and market outlooks