Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

2024 looking a LOT different than previous election years.

Will we see a return to the mean? Source: Trend Spider

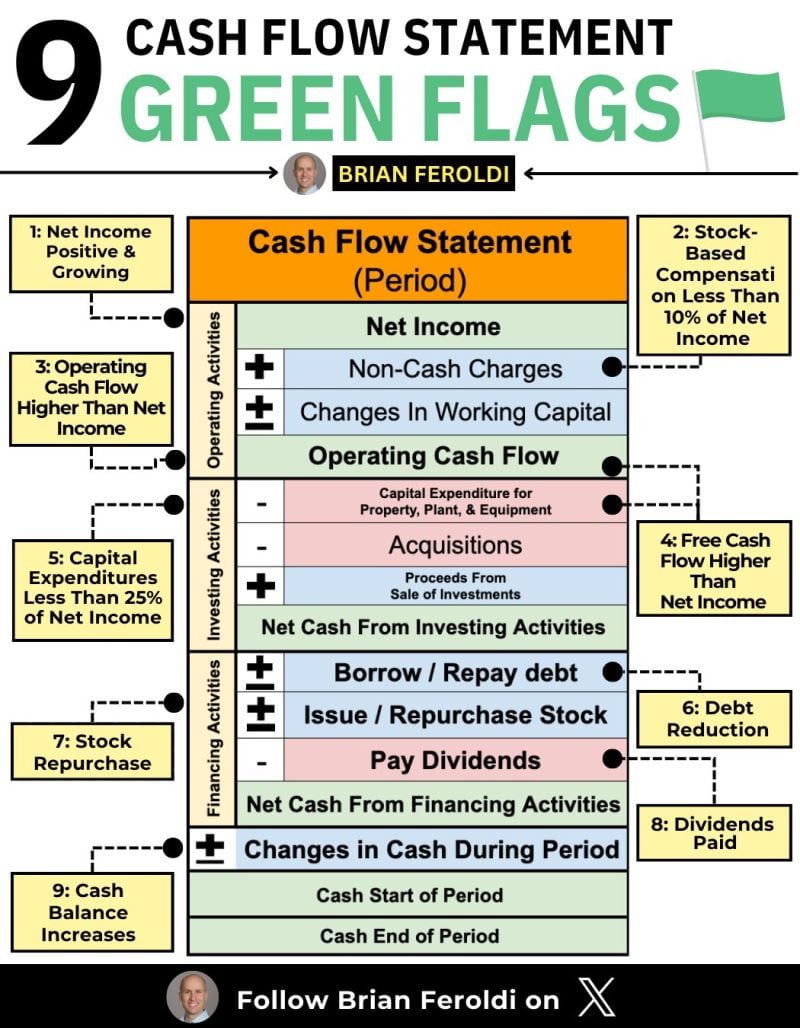

When evaluating a business idea, it's helpful to consider several key factors.

Source: agrassoblog.org

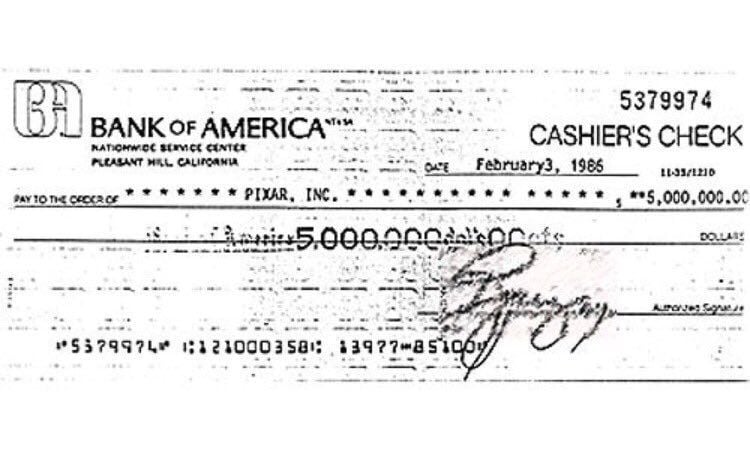

What a lengend... Steve Jobs bought Pixar in 1986. It was part of Lucasfilm. George Lucas wanted to sell.

Jobs had left Apple and was looking for a new adventure. He paid $5 million. He then invested another $5 million. 20 years later, Disney bought Pixar for $7.4 billion. Source: Jon Erlichman

In case you missed it...

Europe’s gas imports from russia overtook supplies from the US for the first time in almost two years in May, despite the region’s efforts to wean itself off Russian fossil fuels since the full scale invasion of Ukraine. While one-off factors drove the reversal, it highlights the difficulty of further reducing Europe’s dependence on gas from Russia, with several eastern European countries still relying on imports from their neighbour. The US overtook Russia as a supplier of gas to Europe in September 2022, and has since 2023 accounted for about a fifth of the region’s supply. But last month, Russian-piped gas and LNG shipments accounted for 15 per cent of total supply to the EU, UK, Switzerland, Serbia, Bosnia and Herzegovina and North Macedonia, according to data from ICIS. LNG from the US made up 14 per cent of supply to the region, its lowest level since August 2022, the ICIS data showed. Link to Article >>> https://lnkd.in/eJJjKBFi Source: FT

Interesting article by The Wall Street Journal ->

US dollar stable coin BOOST DEMAND for US government bonds and help the US keep up with China... Source: Radar, WSJ

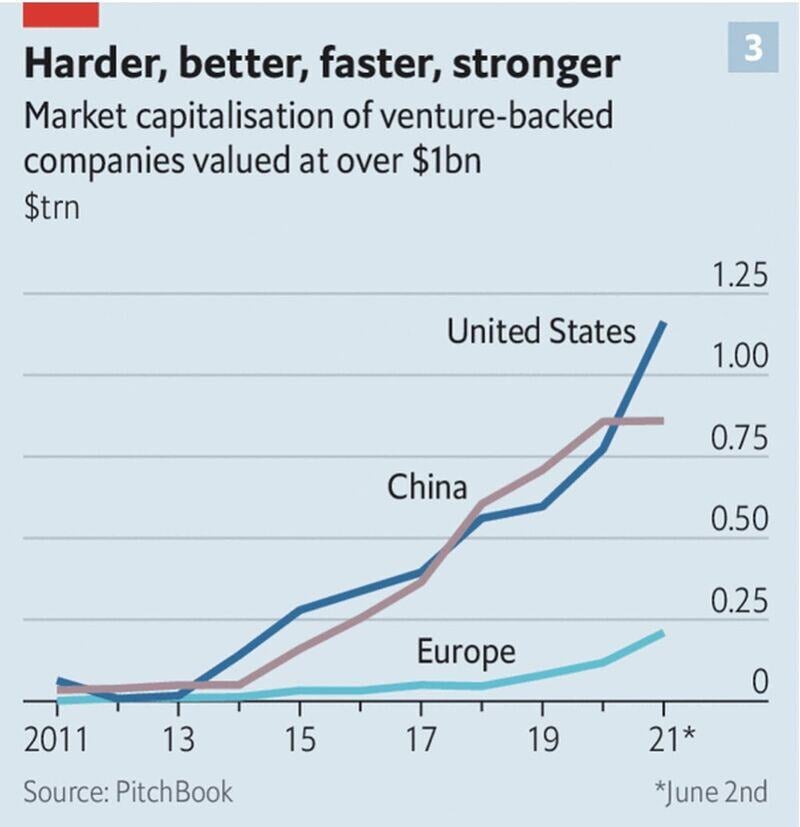

Europe is way behind in Tech 💻

Source: Science Is Strategic, The Economist, Pitchbook #venturecapital

Investing with intelligence

Our latest research, commentary and market outlooks