Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Almost 23 years ago, Standard & Poor's selected Nvidia to replace the departing Enron in the S&P 500 stock index...

Source: Michel A.Arouet

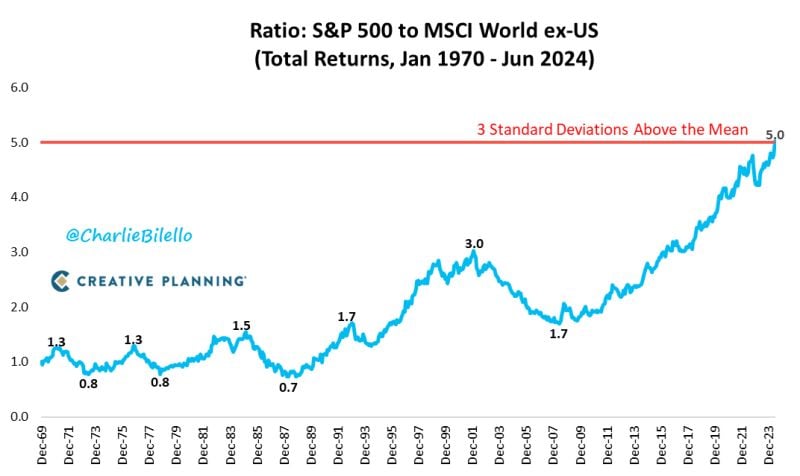

US vs. International stocks... 3 standard deviations above the mean...

Source: Charlie Bilello

Momentum Trading is having the most success in history, even surpassing the Dot Com Bubble

Source: Barchart, Bloomberg

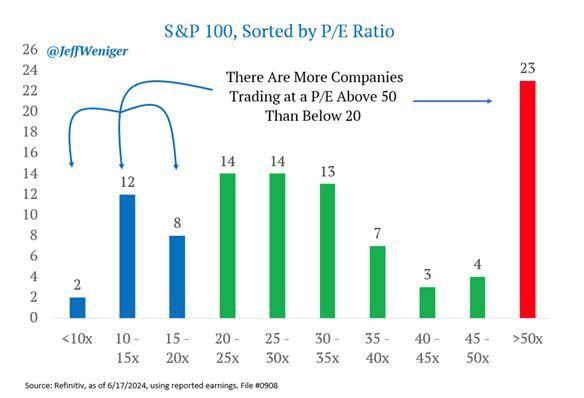

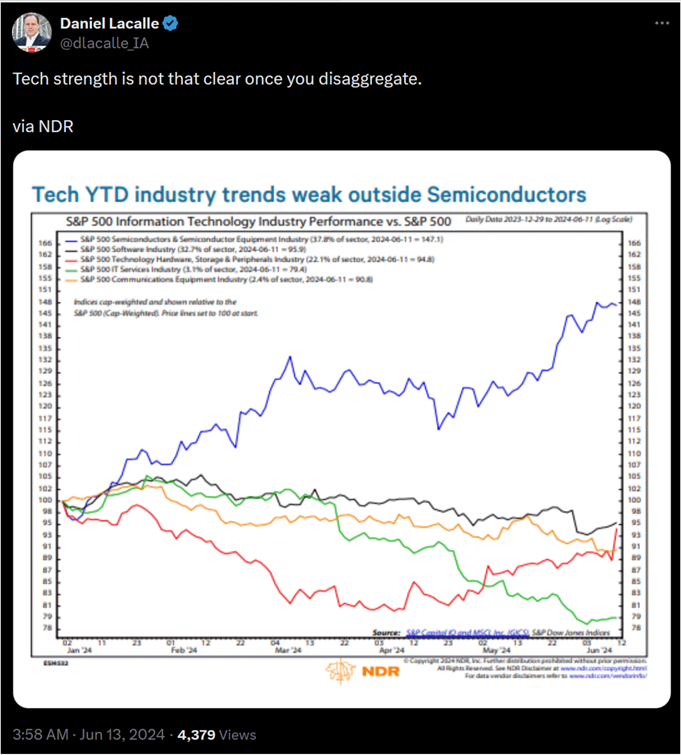

Tech strength is not that clear once you disaggregate

Source: Daniel Lacalle X via NDR

Investing with intelligence

Our latest research, commentary and market outlooks