Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

As per The Kobeisi Letter >>> The S&P 500 is now up 34% in under 8 MONTHS

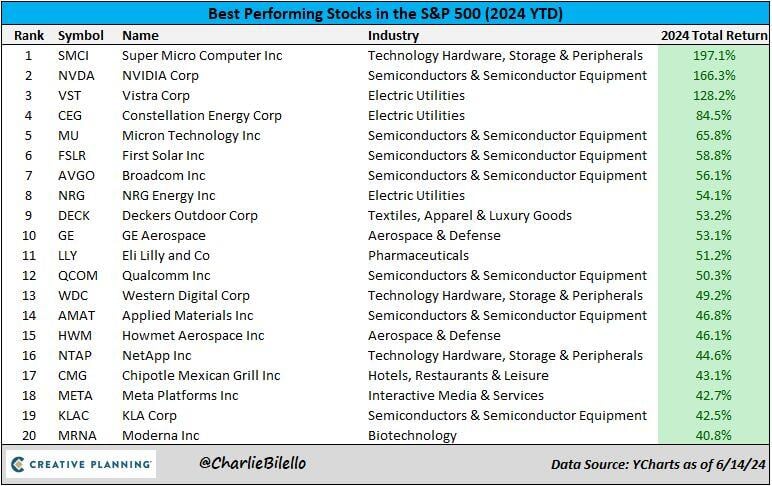

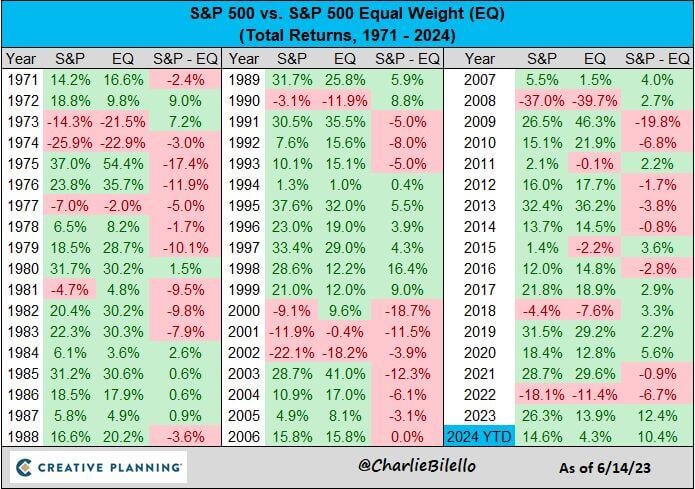

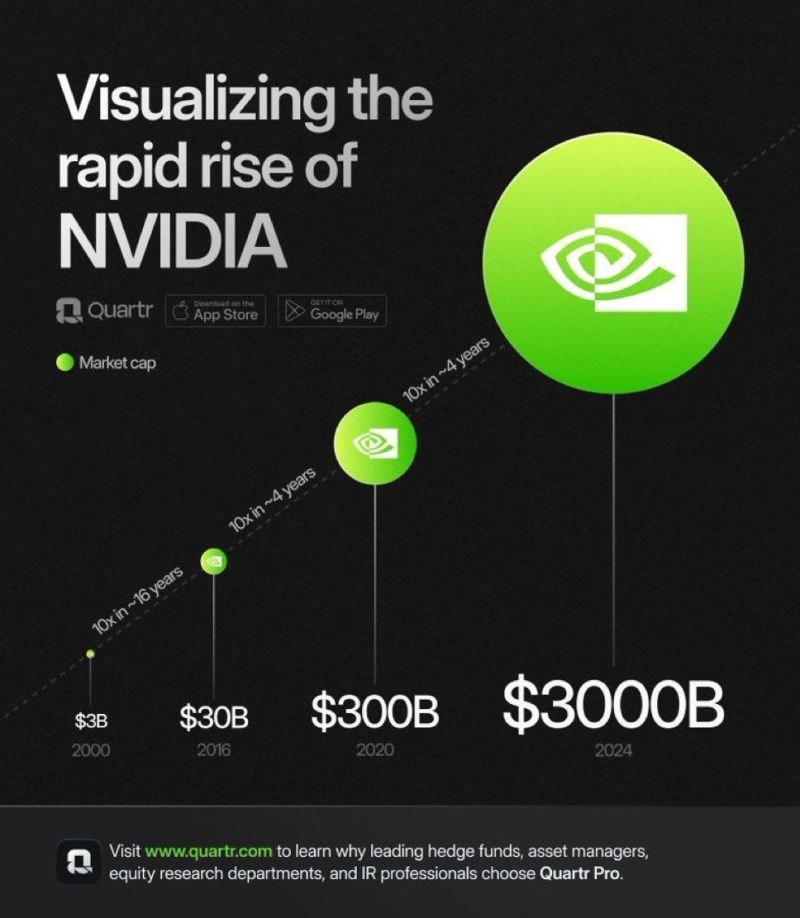

Since the October 2023 low, the S&P 500 has added 1,370 points or $11.5 TRILLION in market cap. In other words, the S&P 500 has added ~$1.4 trillion in market cap PER MONTH for the last 8 months in a row. This means that the S&P 500's return since October 2023 is now 3 times the average annual return. Nvidia stock alone, $NVDA, has added $2.2 trillion in market cap over this time period. That's ~20% of the S&P 500's market cap gains coming from just one stock...

Mag7 stocks have added $2.3 trillion in market cap in Q2 so far... while the 493 other stocks in the S&P 500 have lost $720 billion...

Source: www.zerohedge.com, Bloomberg

The US has captured one third of all global capital flows since 2020, compared to just 18% before the pandemic

Source: Barchart

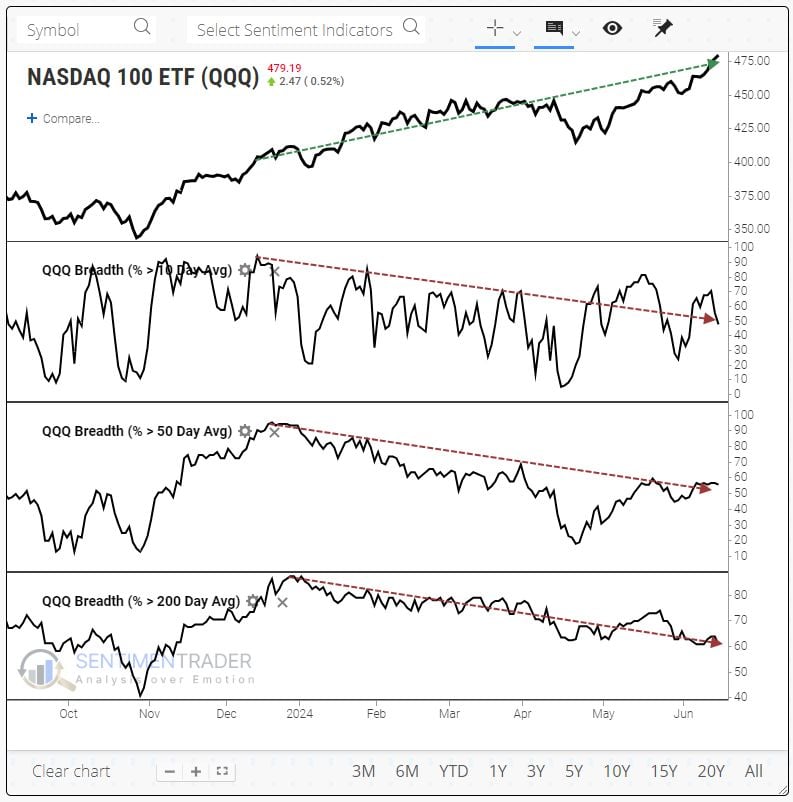

As highlighted by Sentiment Trader, market breadth for Nasdaq 100 QQQ is indeed a growing concern

The Nasdaq 100 continues to notch record high after record high. Many of its stocks are not only lagging, but they're falling to monthly, quarterly, or even yearly lows and below their 10-, 50-, and 200-day moving averages. This is not normal. In fact, it's never happened before to this degree. There is a possibility that the average stock will catch up to the index, that is not how things usually pan out. Almost never, in fact. Risk is high in that index.

Investing with intelligence

Our latest research, commentary and market outlooks