Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

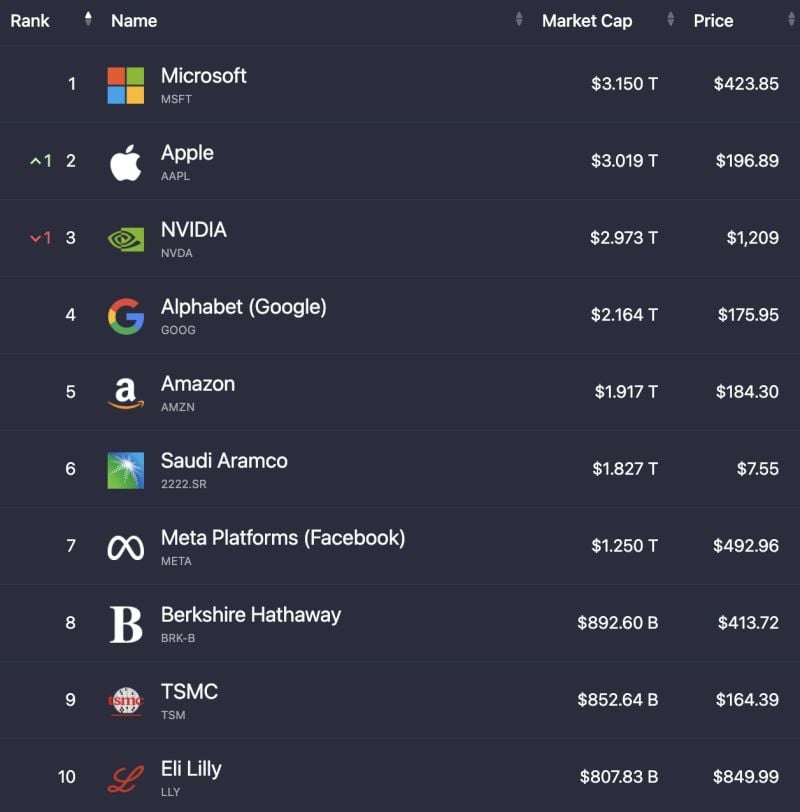

The top 10 largest stocks in the world are now worth a combined $18.85 Trillion up from $18.21T last week.

Source: Evan

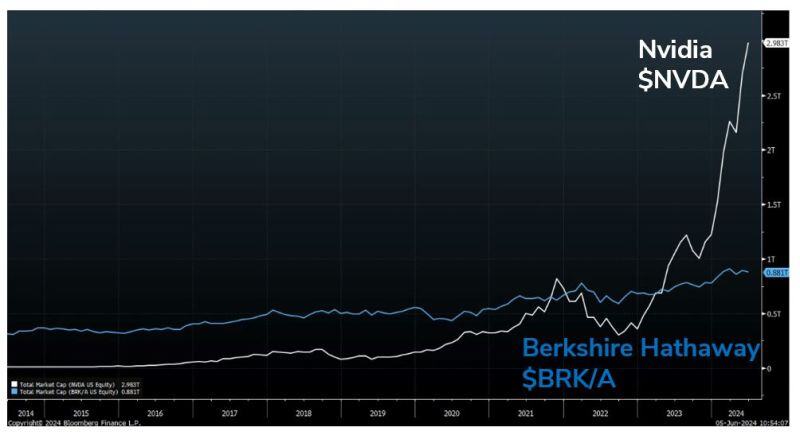

Over the past 32 trading days, Nvidia $NVDA has gained more than $1 trillion in market cap.

To put that into some sort of perspective, the 6-week gain is greater than the total market cap of Berkshire Hathaway $BRKA, which Warren Buffett has spent 6 decades in building... Source: Jesse Felder

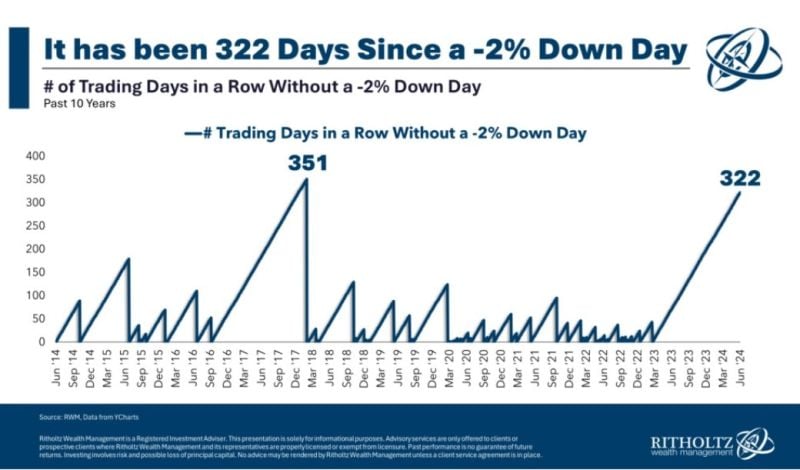

It has been a very quiet year so far for US equity markets...

No down day > 2% for the SP500 despite Middle East conflict, China doing military exercises around Taiwan, Fed interest rates cuts expectations moving from 6 to less than 2, etc. Source chart: Ritholtz

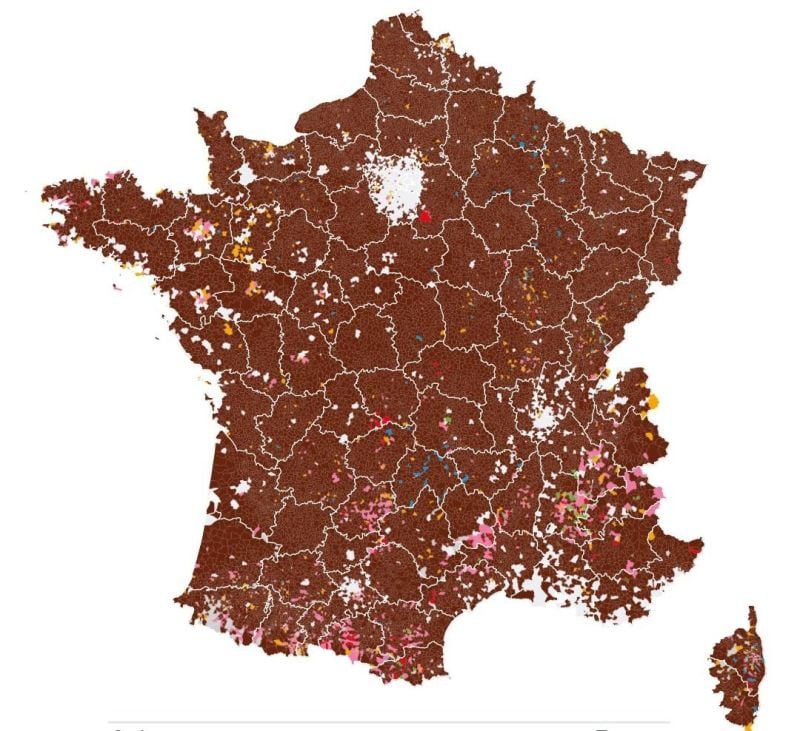

EU Parliamentary elections in France.

In brown where Far-right Le Pen party has won yesterday. Source: Xavier Ruiz

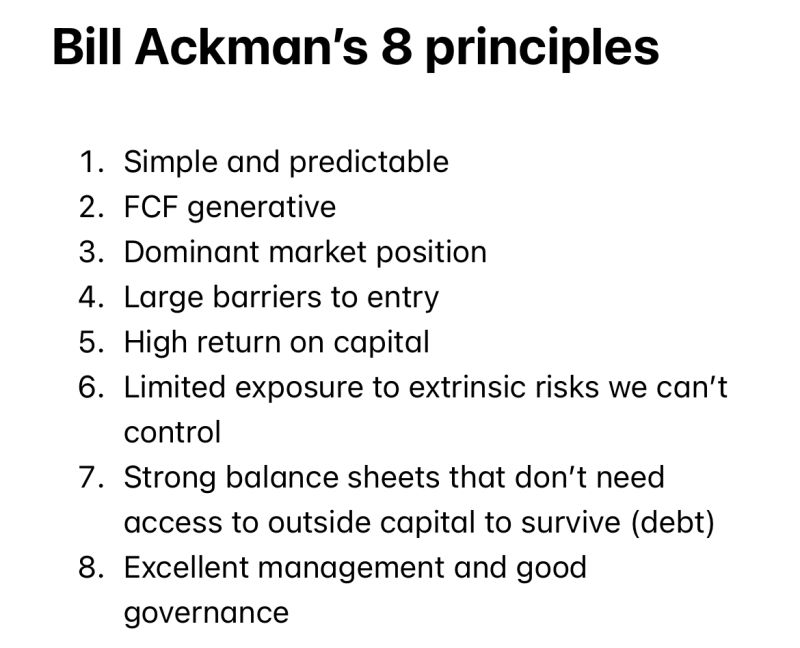

Notes from Bill Ackman 's fireside chat in Omaha - thru David Park on X:

People Underestimate the Power of Checklists - Pershing Square had the best 6 years of its history since they inscribed their checklist into a piece of "stone" - "If I ever veer [off this checklist] just hit me over the head with this thing" The checklist:

Investing with intelligence

Our latest research, commentary and market outlooks