Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

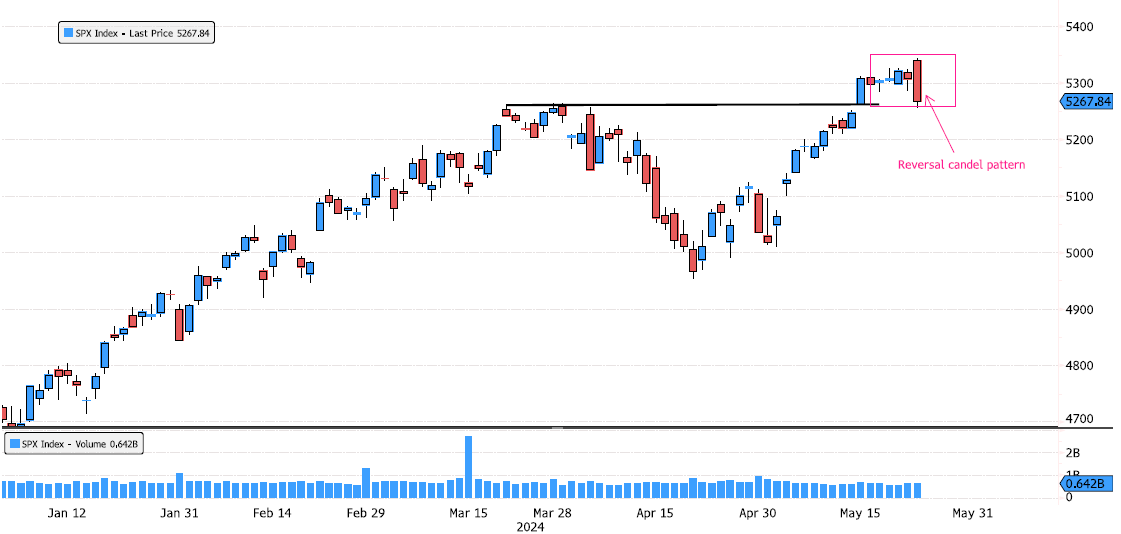

S&P 500 Index reversal candelstick pattern

Yesterday, the S&P 500 index posted a reversal candlestick pattern. The market opened at a new all-time high but closed at the day's lows, wiping out all of last week's gains! This pattern is typically a warning sign. While the trend remains bullish, a consolidation often follows after reaching a new high. Keep an eye on it. Source : Bloomberg

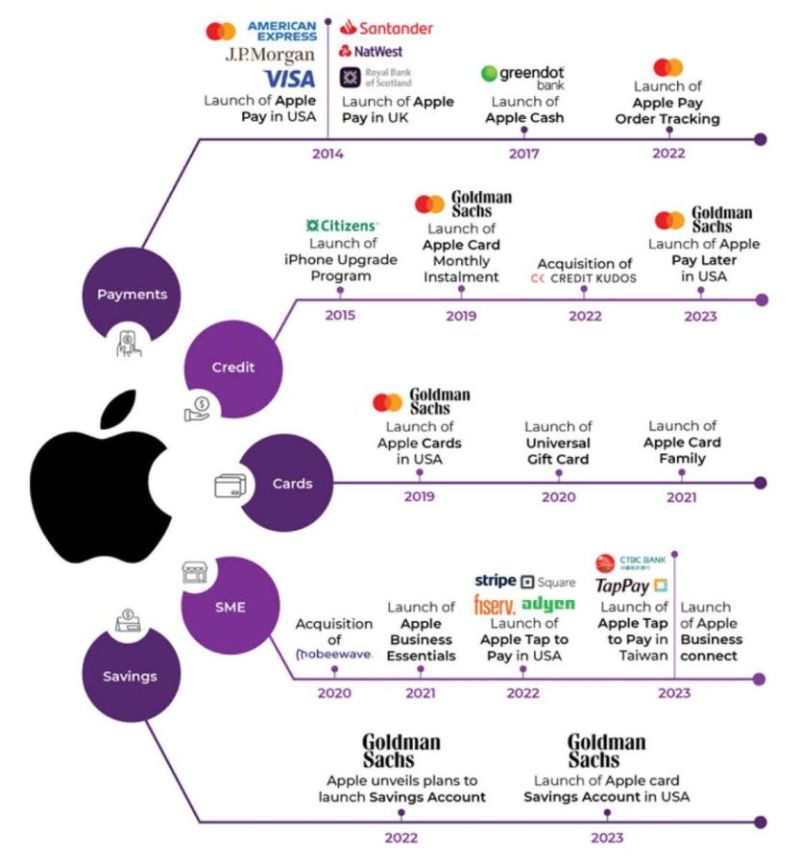

$AAPL is bigger into financial services than many realize:

- payments - savings - credit cards - BNPL Services now make up 22% of AAPL's revenues, with payments hitting all time revenue highs. Fun fact, in 2022, Apple Pay processed over $6T in payments, and is #1 mobile wallet Source: The Investing for Beginners Podcast @IFB_podcast

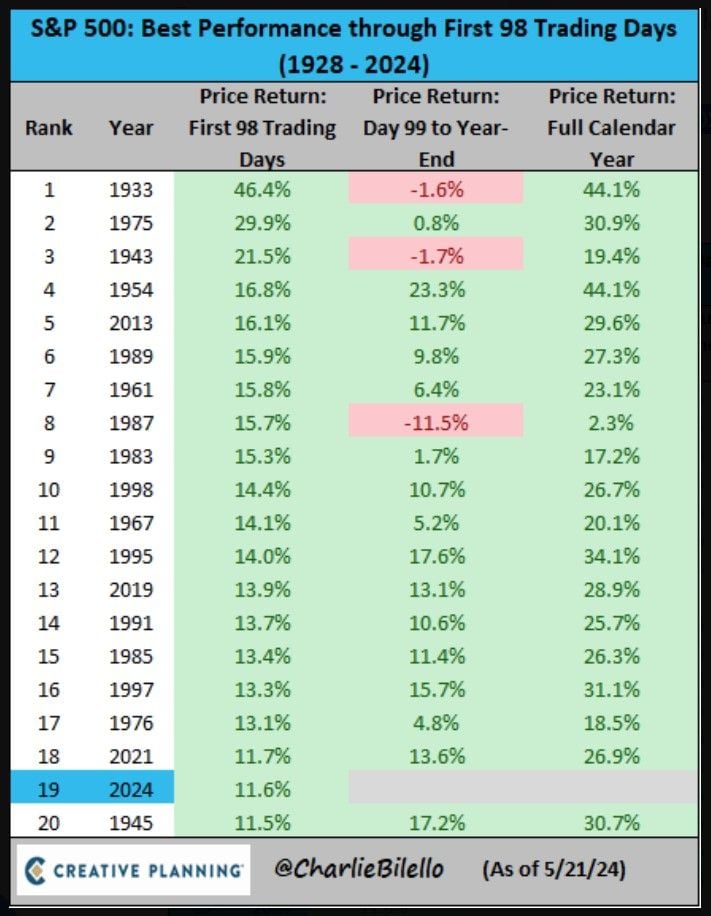

S&P 500 is up 11.6% in the first 98 trading days of 2024, the 19th best start to a year going back to 1928.

$SPX Source: Charlie Bilello

On this day in 2002: Netflix went public.

$2,000 invested in the IPO would be worth $1 million today. Source: Jon Erlichman

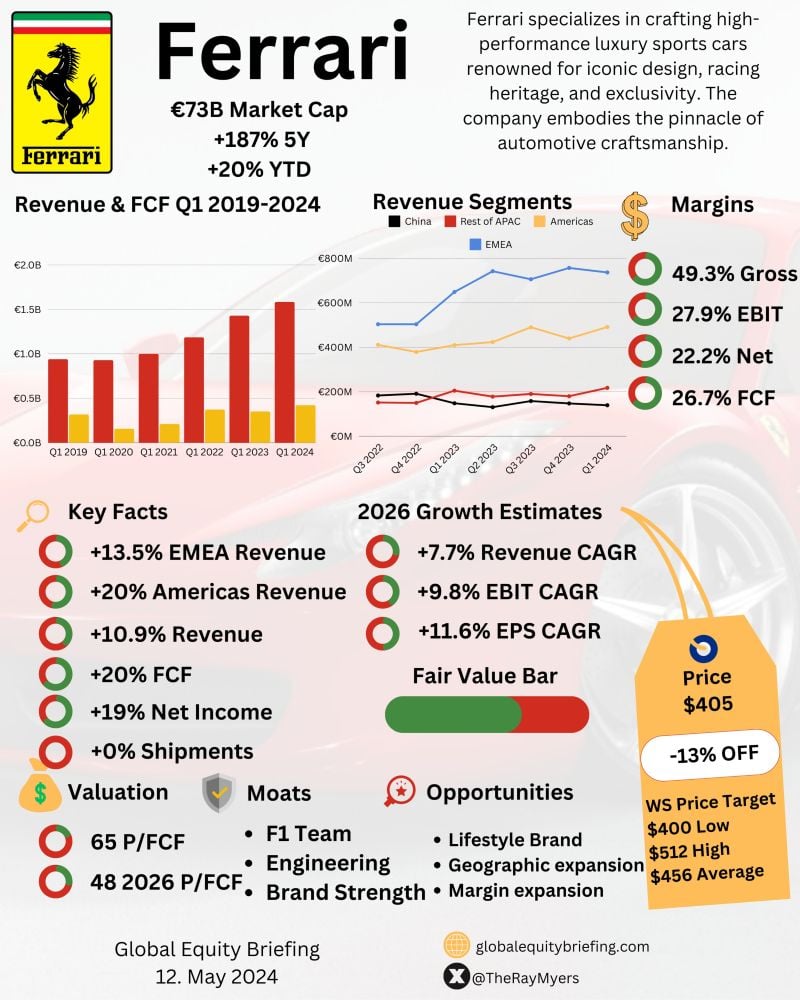

Some great one pager on stocks by The Ray Myers!

📉 $RACE -6% Since earnings 🎯Ferrari Q1 One Pager🧐 by @TheRayMyers 🚨Ferrari pricing power in play🚨 0% Shipment Growth +20% Americas Revenue +13.5% EMEA Revenue +10.9% Total Revenue +19% Net Income +20% FCF €1.58B Revenue €352M Net Income €423M FCF Here is the Ferrari Bull Case in4⃣sentences! 🛍️Lifestyle brand attracts new younger fans, amplifying brand power and customer loyalty! 💰Exclusivity allows for higher prices thus enhancing profitability! 🗺️Geographic expansion to India and the rest of APAC supports a slow volume growth! 🚗Strong brand power will support growth for decades! Would you rather have a Ferrari or $RACE stock? NB: This is NOT an investemnt recommendation

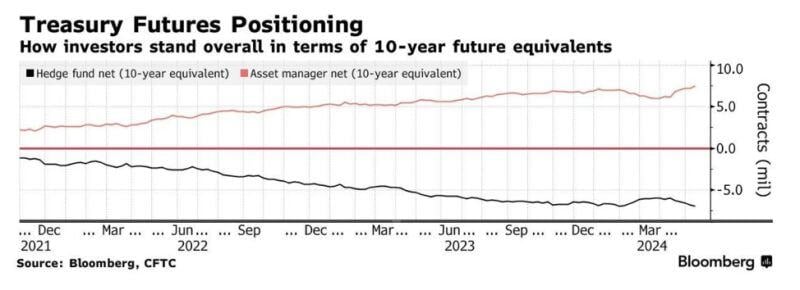

Hedge Funds have now built the largest 10-year Treasury short position in history while Asset Managers have built the largest long position.

Source: Barchart, Bloomberg

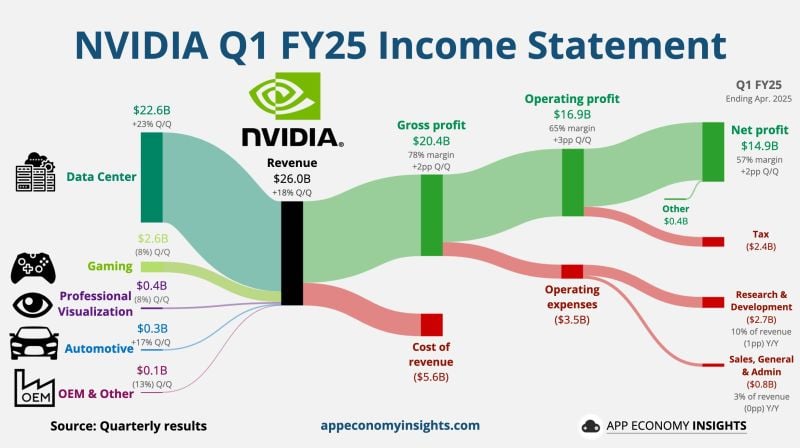

Nvidia stock, $NVDA, surged toward $1,000/share ($2.5 trillion market cap) in after-hours trading after reporting earnings and 10:1 stock split.

The company posted record quarterly revenue of $26 billion on EPS of $6.12, both above expectations. Here are the details: • Revenue +18% Q/Q to $26.0B ($1.5B beat). This marks a 260% jump in year-over-year revenue for the 3rd largest company in the world. • Gross margin 78% (+2pp Q/Q). • Operating margin 65% (+3pp Q/Q). • Net Income hit another record high at $14.88 billion in Q1. That's a 628% increase over last year's Net Income of $2.04 billion • Non-GAAP EPS $6.12 ($0.54 beat). • Dividend raised by 150%. Q2 FY25 guidance: • Revenue ~$28.0B ($1.2B beat). By some estimates, Nvidia controls a whopping 95% of the AI chip market right now. The rise of AI has added trillions in market cap over the last 2 years. Nvidia has made itself the leader of the AI revolution.

Investing with intelligence

Our latest research, commentary and market outlooks