Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

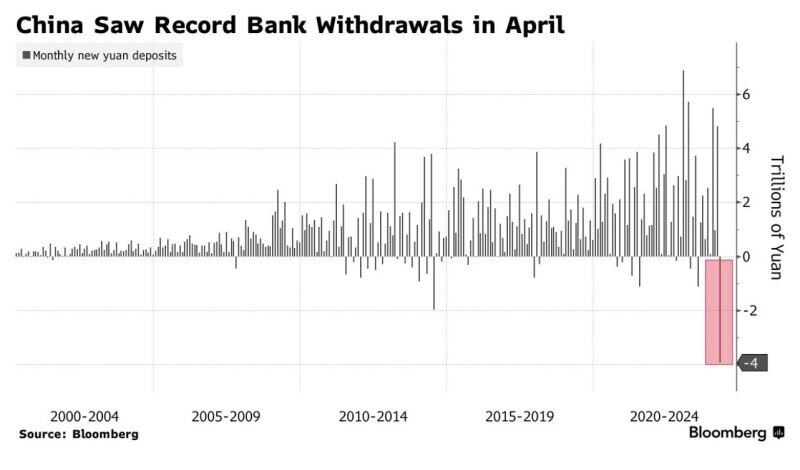

BREAKING 🚨: China

China sees largest bank withdrawals in history last month of just under 4 trillion yuan Source: Bloomberg, Barchart

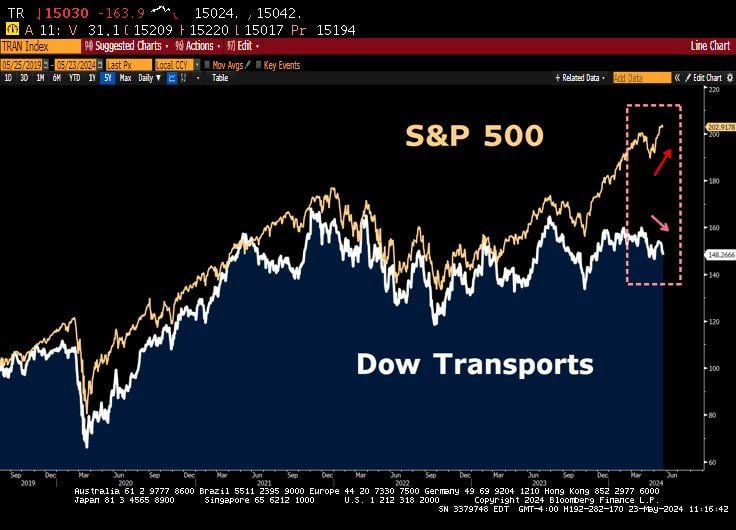

Divergence between DJ Transports and S&P500 is something to watch.

The former is seen as a reliable indicator of domestic activity Source: Lawrence McDonald, Bloomberg

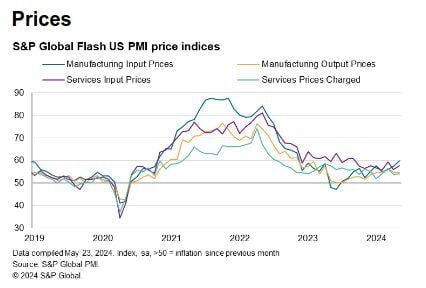

Wall Street pull-back yesterday is mainly explained by the PMI data.

And not because they show that the US economy remians resilient. The biggest concern was the prices print as it shows that more cost increases are coming for companies and consumers alike: - Input prices continued to rise sharply in May, the rate of inflation accelerating to register the second-largest monthly increase seen over the past eight months. - Manufacturers reported an especially steep increase, suffering the largest cost rise for one-and-a-half years amid reports of higher supplier prices for a wide variety of inputs, including metals, chemicals, plastics, and timber- based products, as well as higher energy and labor costs. - Service sector costs also rose at an increased rate, reflecting higher staffing costs in particular. - Companies again sought to pass higher costs onto customers in the form of higher selling prices, the rate of increase of which accelerated slightly compared to April. One good news though: although still elevated by pre-pandemic standards, the rate of inflation across both goods and services remained below the average recorded over the past year. Source: S&P Global, Markets & Mayhem

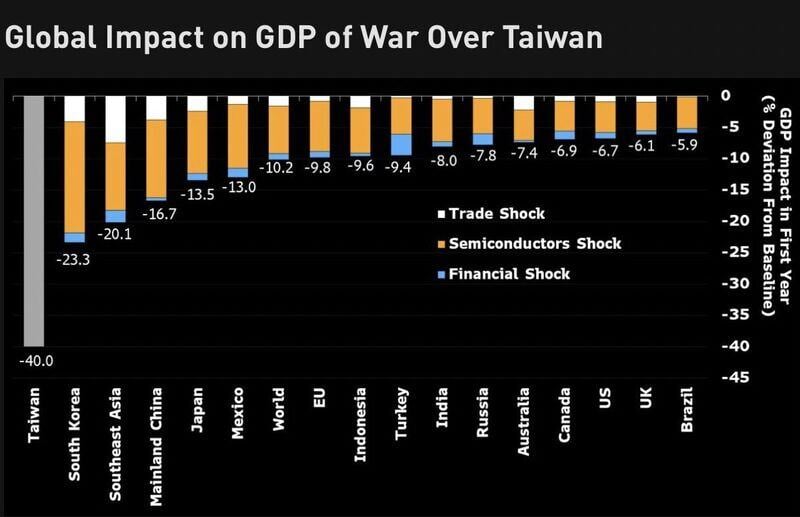

A scary chart... the global impact on GDP of a war in Taiwan...

Source: Bloomberg, Michel A.Arouet

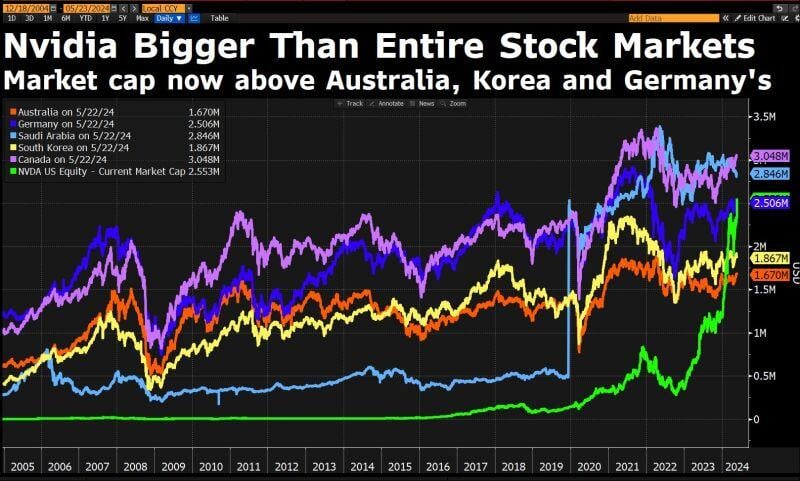

Nvidia is bigger than entire German stock market, the entire Australian market or the entire Korean market.

Canada and Saudi are within reach. Source: Bloomberg

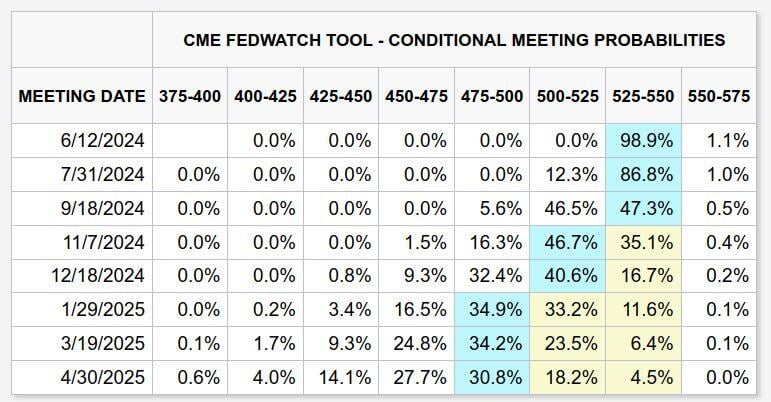

After the hotter than expected Flash PMI prints yesterday, the market is pricing in one cut for this year to occur in November or December, and another in early 2025.

Source: Markets & Mayhem

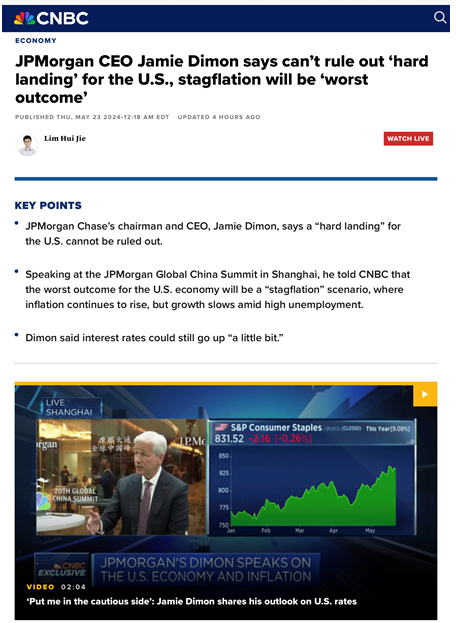

Jamie Dimon does not rule out a hard landing for the US economy

Source: CNBC

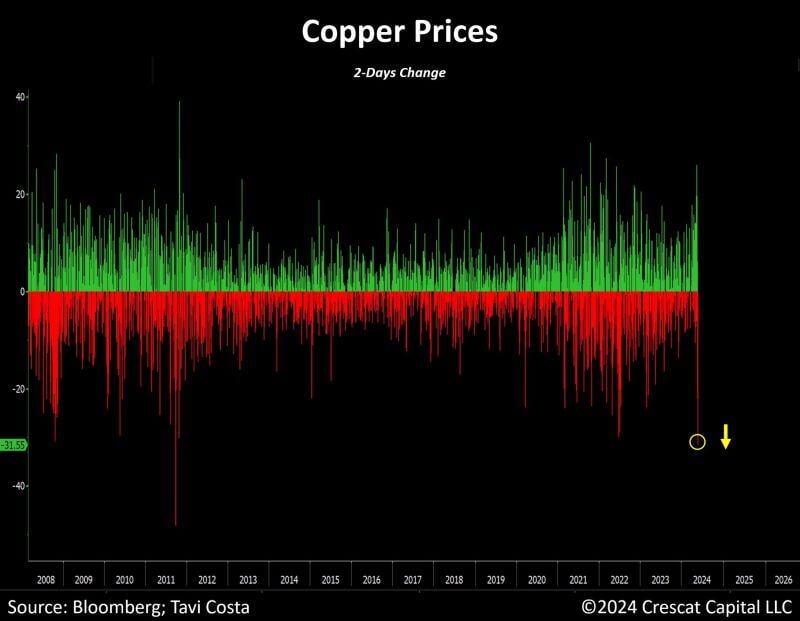

Copper just had its worst 2-day decline in 13 years.

A much-needed shake out to reset the sentiment. Source: Bloomberg, Tavi Costa, Crescat Capital

Investing with intelligence

Our latest research, commentary and market outlooks