Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

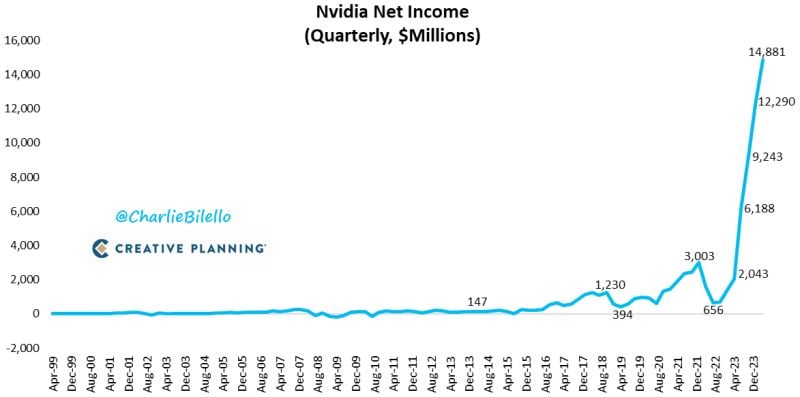

Nvidia's Net Income hit another record high at $14.88 billion in Q1.

That's a 628% increase over last year's Net Income of $2.04 billion. $NVDA Source: Charlie Bilello

Solar stocks are rallying, with a boost from China.

China's Solar Industry Group calls on members to crack down on low-price competition to stop a price war. Invesco Solar ETF (TAN) jumped almost 9%. Source: HolgerZ, Bloomberg

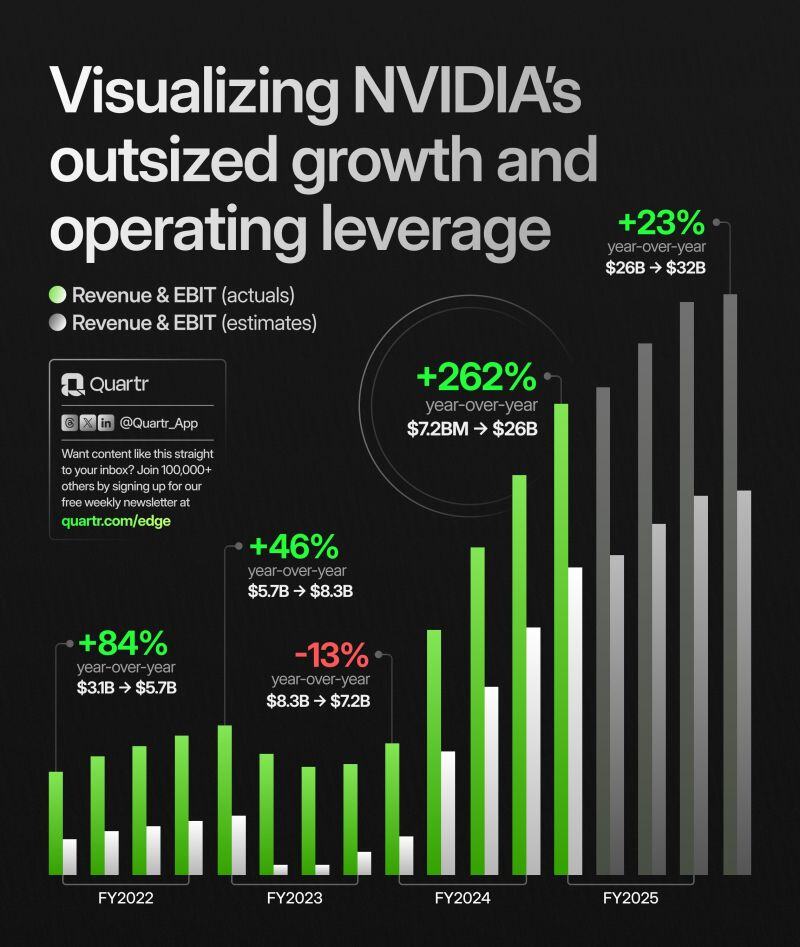

Visualizing Nvidia's outsized growth and operating leverage by Quartr:

$NVDA Q1 2025 Revenue +262% *Data Center +427% *Gaming +18% *Professional Vis. +45% *Automotive +11% EBIT +690% *marg. 65% (30) EPS +629% Source: Quartr

A $2.4 TRILLION STOCK TOMORROW?

BREAKING: Nvidia stock, $NVDA, surges toward $1,000/share after reporting earnings and 10:1 stock split. The company posted record quarterly revenue of $26 billion on EPS of $6.12, both above expectations. This marks a 260% jump in year-over-year revenue for the 3rd largest company in the world. $NVDA is set to open tomorrow with a record market cap above $2.4 TRILLION. Nvidia continues to crush expectations. Source: The Kobeissi Letter

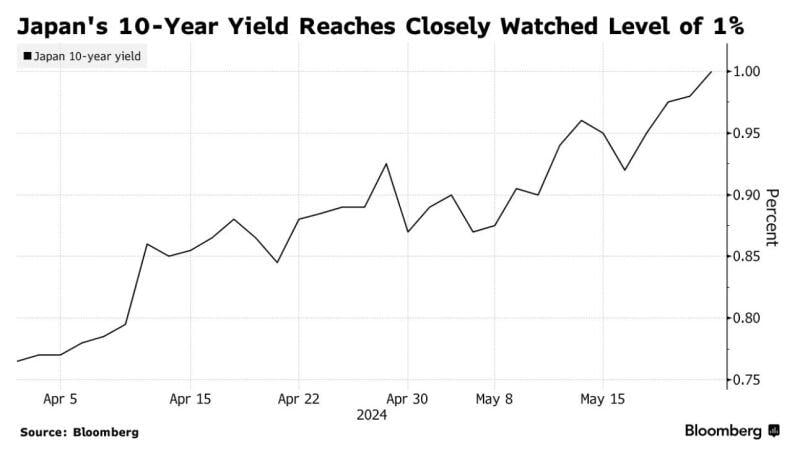

Japan's 10-Year Bond Yield hits 1% for the first time in more than a decade

Source: Barchart

BREAKING: TANGIBLE SIGN OF US CONSUMER WEAKNESS?

Target stock, $TGT, falls 8% after reporting weaker than expected earnings with a 3% revenue decline due to consumer weakness. Target's CEO said the decline reflects “continued soft trends in discretionary categories.” The company's store traffic fell by 1.9% less quarter and the average amount spent by customer also fell 1.9%. Consumers bought fewer everyday items like groceries along with fewer discretionary goods. Another sign that consumers are struggling. Source: The Kobeissi Letter

The implications of an aging population for investment strategies

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks