Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Exciting Developments for Dassault Systemes

In January, Dassault Systemes broke its long-term downtrend—a very positive sign. Since then, the market has consolidated by more than 25%. Recently, we're seeing signs of demand, confirmed by stronger-than-average volume in the short-term trend. Keep an eye on it. Source : Bloomberg

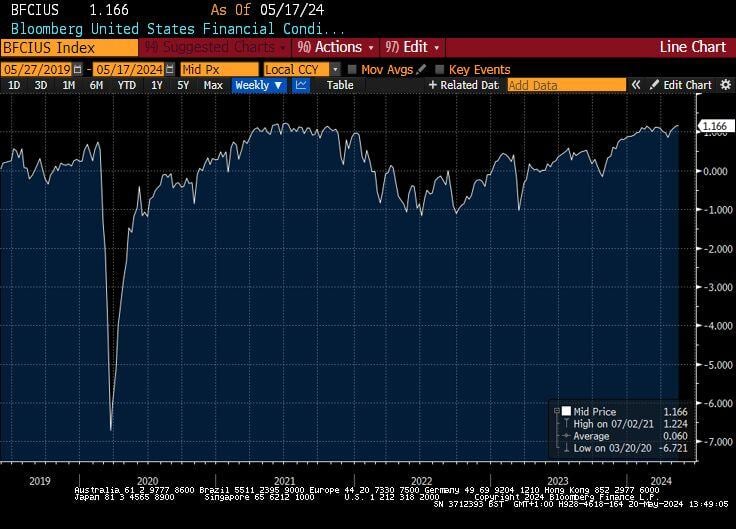

While the FED monetary policy is seen as restrictive, the Bloomberg US Financial Conditions Index is at record highs.

Risk premia in stocks and credit are near all-time tights as commodities are breaking higher. Source: Bloomberg

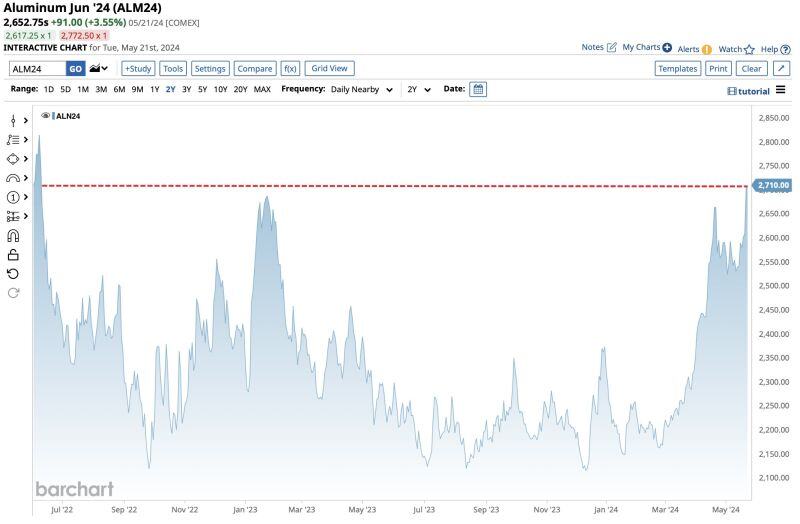

Aluminum appears to be the next metal getting sent as price surges to highest level since June 2022

Source: barchart

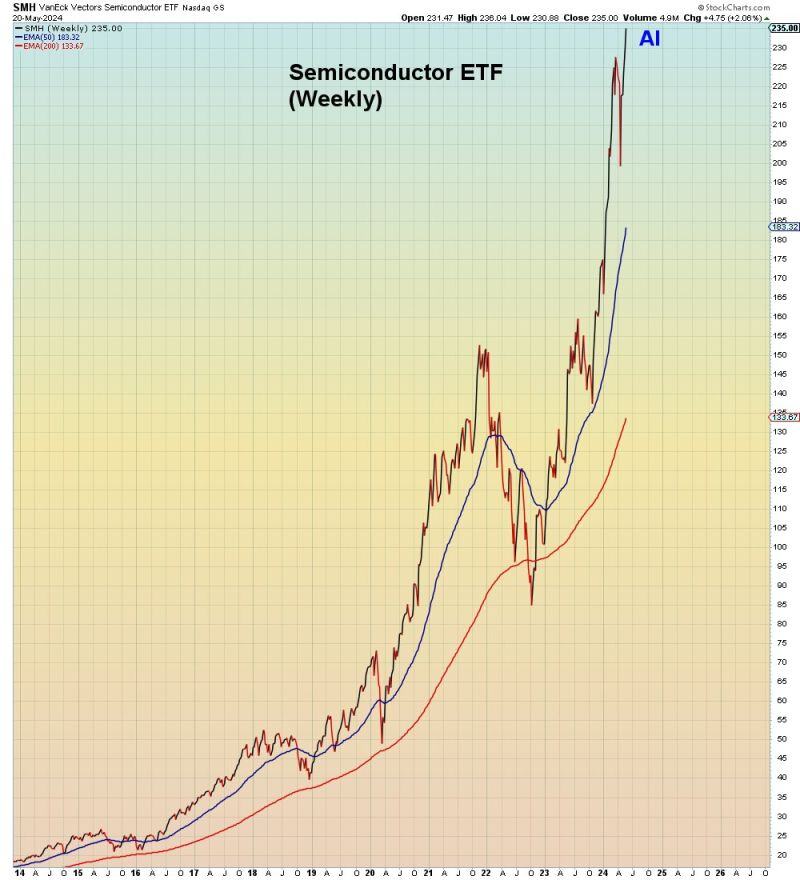

Is this sustainable? Nvidia results tonight might give us a clue...

Source: Mac10

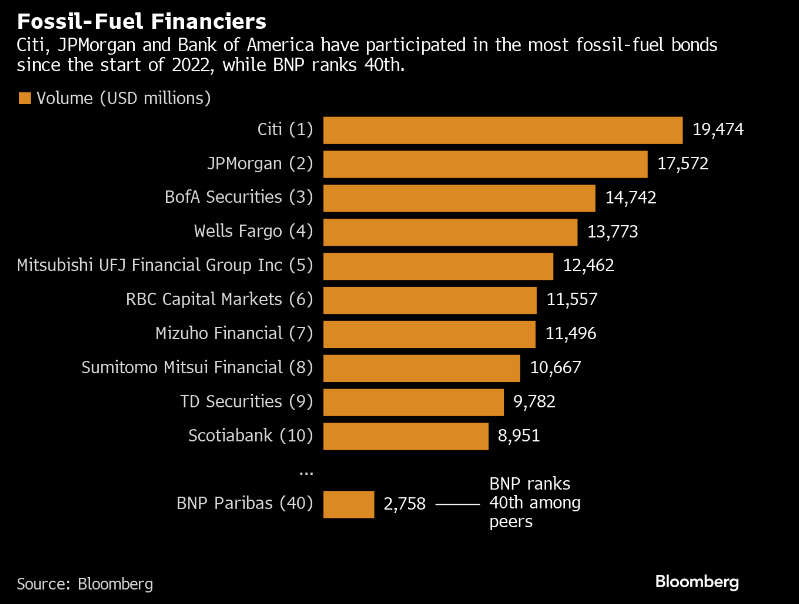

Credit Agricole’s bond desk is targeted by climate activists

The French bank is under pressure to reveal the carbon footprint of its bond business. A group of investment managers with $777 billion in combined assets is using the bank’s AGM to demand that it start disclosing the greenhouse gas emissions tied to its capital markets operations.

Source: Bloomberg

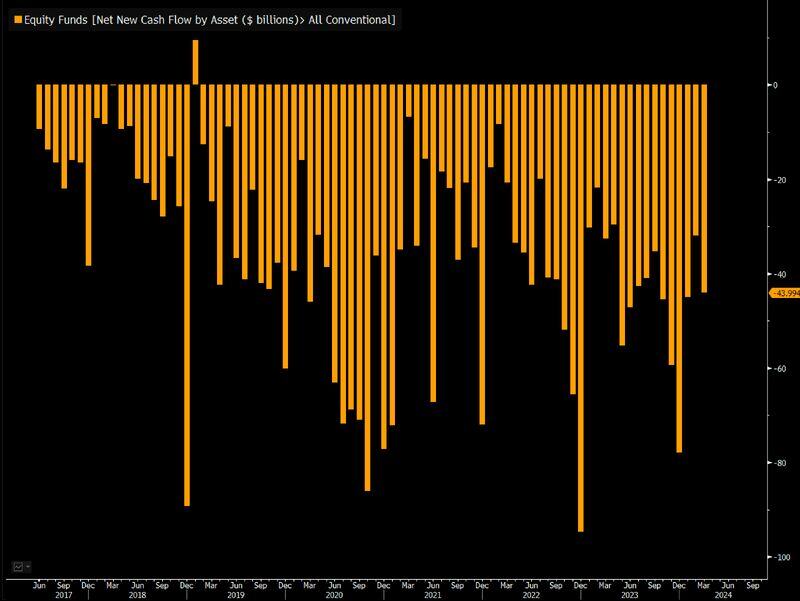

A POSITIVE contrarian signal >>>

EQUITY mutual funds are working on their 82nd straight month of OUTFLOWS. Source: Bloomberg, Eric Balchunas

China may well be the world leader for de-risking trade ties

• Chinese firms have been developing ties with emerging markets over past ten years • This reduces China's reliance on unfriendly markets (🇺🇸🇪🇺), shielding Beijing from geopolitical tensions Source: FT, Agathe Demarais

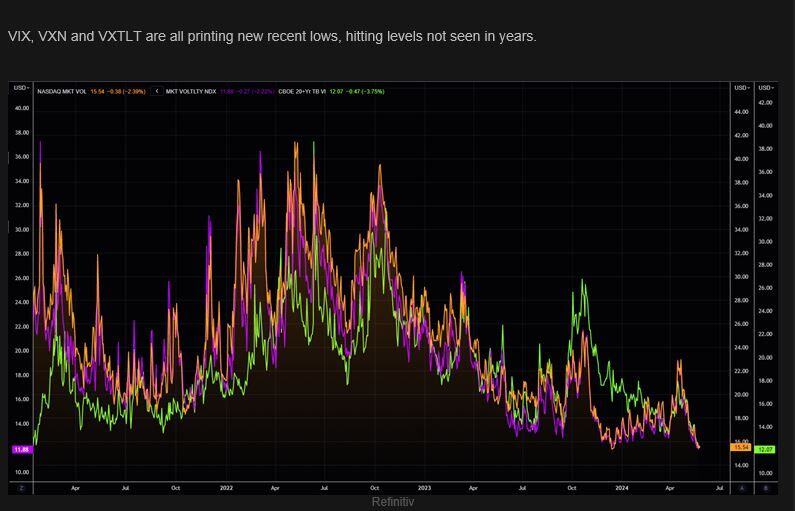

The death of volatility? VIX, VXN and VXTLT are all printing new recent lows, hitting levels not seen in years.

Source: Bloomberg, The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks