Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

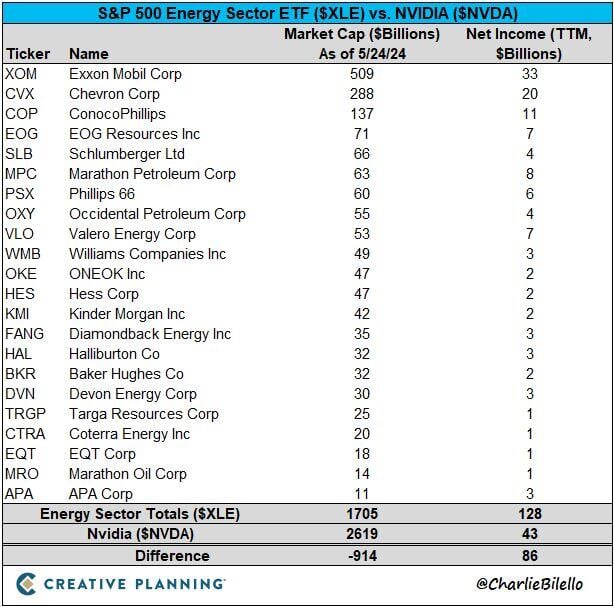

Nvidia vs US energy sector...

At $2.6 trillion, Nvidia's market cap is now over $900 billion higher than all of the companies in the S&P 500 Energy sector ... combined. The net income of the Energy sector is $128 billion vs. $43 billion for Nvidia. $NVDA $XLE Source: Charlie Bilello

Deckers Outdoor acquired the Hoka brand roughly a decade ago.

At the time, Hoka’s annual sales were around $3 million. In the past year, sales topped $1.8 billion. And since the acquisition, Decker’s stock has risen by more than 2,000%... (btw I love these shoes !!!) Source: Jon Erlichman

$RSP (S&P Equal-weight) vs. $SPX (S&P 500) just broke key support level

Source: Ian McMillan

Hedge funds build largest long Gold position in more than 4 years

Source: Barchart

BREAKING 🚨: Argentina

Argentina's Peso has plummeted to an an all-time low against the U.S. Dollar on the Black Market (which is where Argentinians go to convert to USD) Source: FT, Barchart

Starwood Capital limits investor redemptions by up to 80% in its 10 Billion Property Fund...

Source: FT, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks