Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

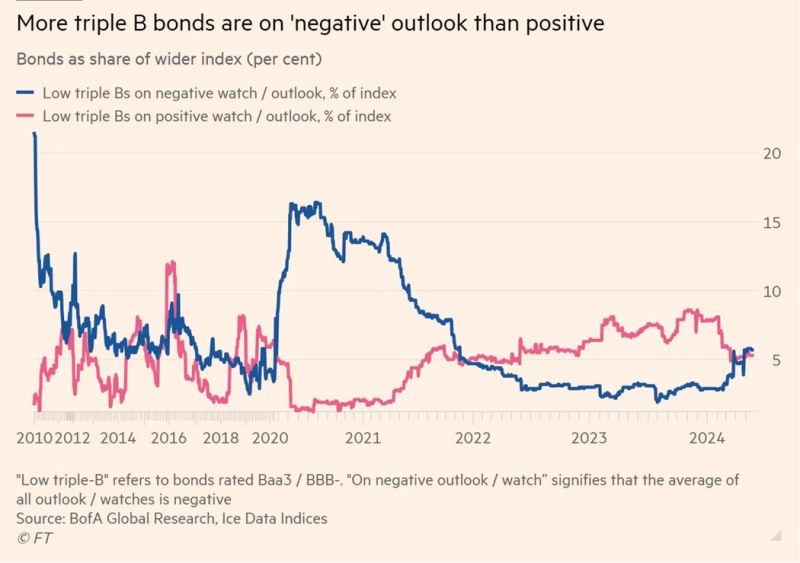

More US high-grade borrowers at risk of downgrade as economy slows

A rising share of the $8.9tn high-grade US corporate bond market is at risk of being slashed to junk status, with rating agencies’ expectations of downgrades exceeding upgrades for the first time since the end of 2021. The proportion of the lowest-quality investment-grade bonds that rating agencies have on so-called “negative watch” or “negative outlook” — meaning their ratings are more likely to be downgraded — stood at 5.7 per cent this week, according to analysis by BofA Securities, including names such as Paramount Global and Charter Communications. That is almost double the level of 2.9 per cent at the start of this year. In contrast, the percentage of these bonds on “positive watch” — meaning they are more likely to be upgraded — stood at 5.3 per cent, down from 7.9 per cent in early January Full FT article >>> Source: FT, C.Barraud

The importance of using the right media to reach your target audience

Source: Mom's Village Asia

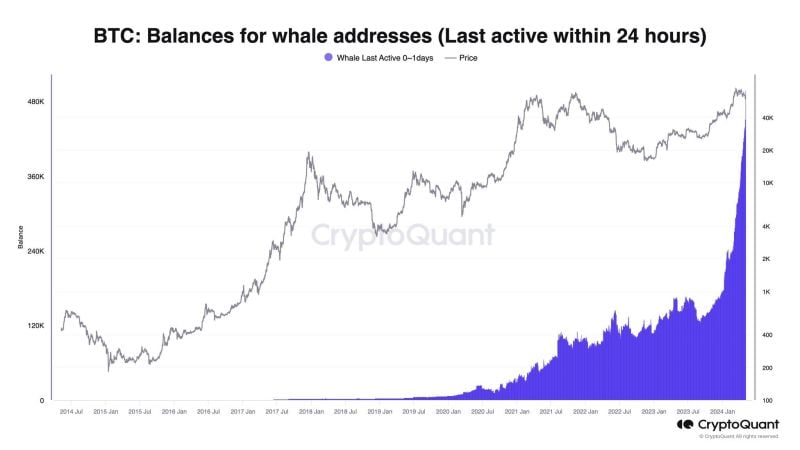

Friendly reminder that markets are always wrong about future Fed funds rate.

Source: Michel A.Arouet

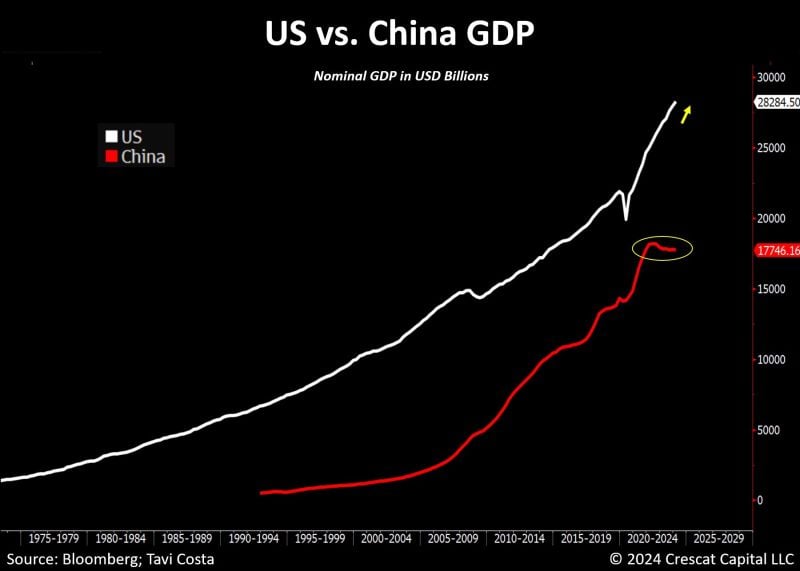

As highlighted by Tavi Costa, this is one of the reasons China is enhancing teh quality of its international reserves and accumulating gold:

China’s macro imbalances are increasing pressure on its monetary system to devalue. Source: Bloomberg, Tavi Costa, Crescat Capital

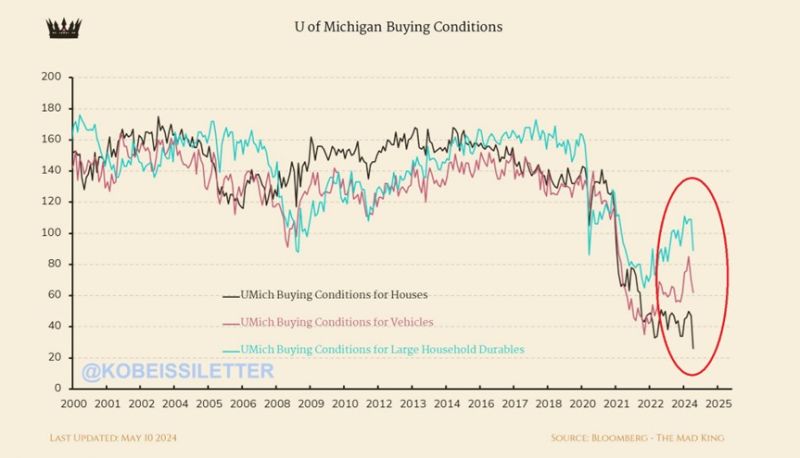

Homebuyer conditions for US consumers plummeted to their lowest level in history this month.

The index of buying conditions for houses fell to ~30 points which is below the previous low of ~40 points in the early 1980s. In just 4 years, conditions for buying a house have dropped by 110 points, a massive 73% decline. Meanwhile, buying conditions for vehicles and large household durables are down for 3 straight months. Source: The Kobeissi Letter

S&P 500 $SPX hasn't declined by 2% or more for 317 consecutive trading days, the longest streak since a 351-day stretch that lasted from Sep 2016 through Feb 2018.

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks