Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

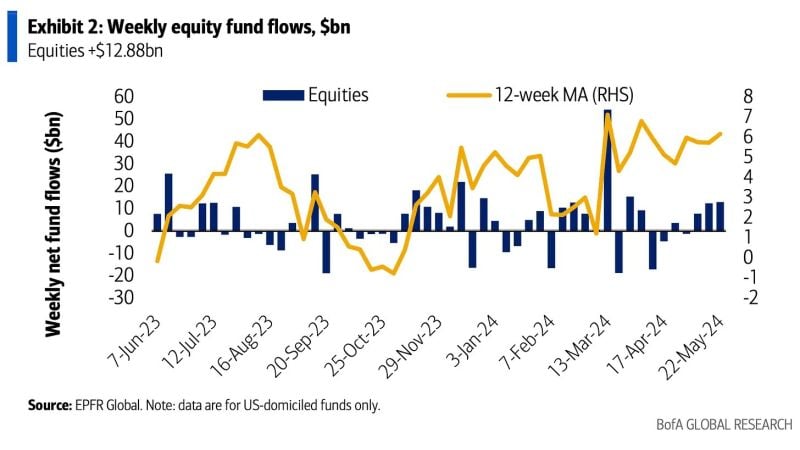

Inflows to equities accelerated to +$12.88bn (largest in 2 months) this week.

via BofA

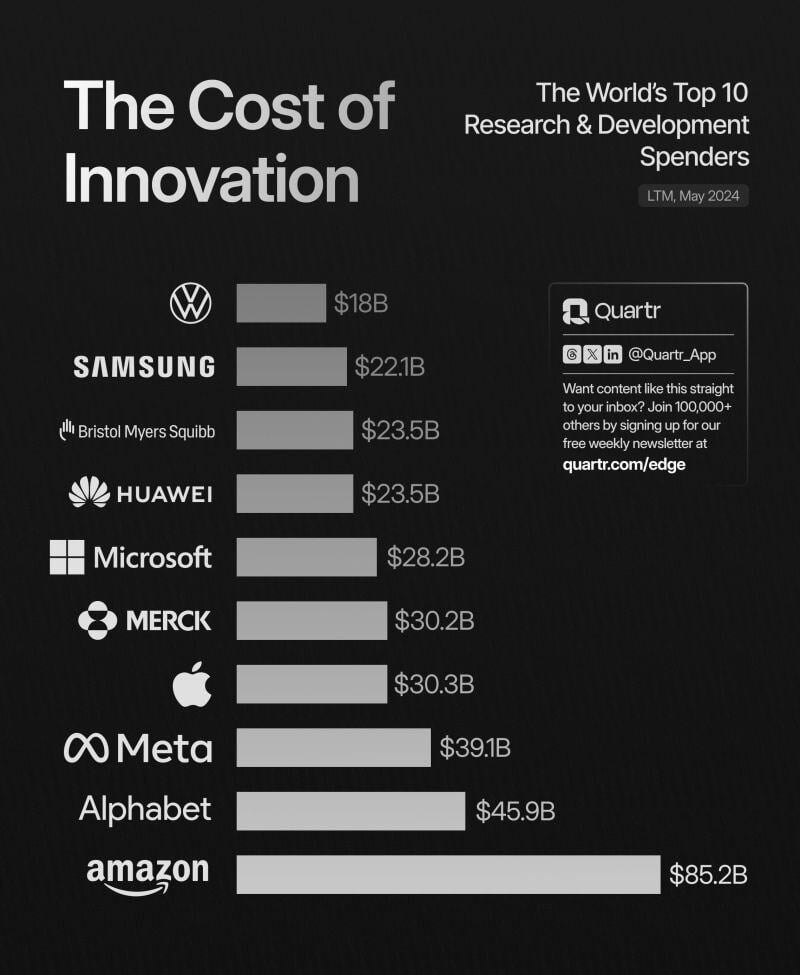

The world's top 10 R&D spenders by Quartr

Did you know that $AMZN has spent more on R&D over the last twelve months than $GOOGL and $AAPL combined?

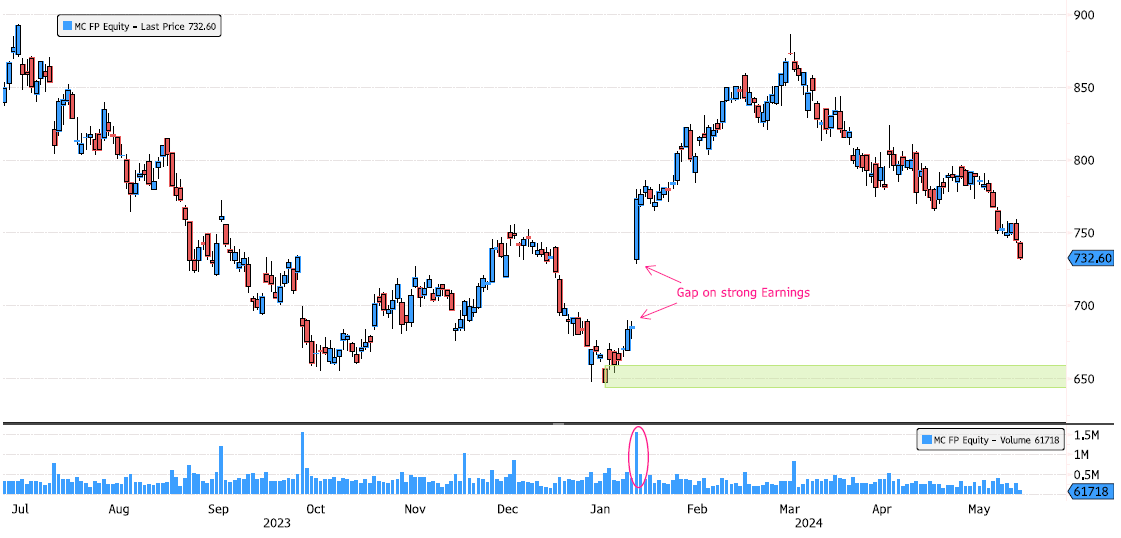

LVMH Approaching an Interesting Zone

LVMH (MC FP) has consolidated 17% since the March highs. It's now filling in the January earnings gap zone between 690-730. It has also reached the 61.8% Fibonacci retracement level and is in the discount zone for prop traders. The major long-term support swing low is at 644. Keep an eye on this stock over the next few days. Source : Bloomberg

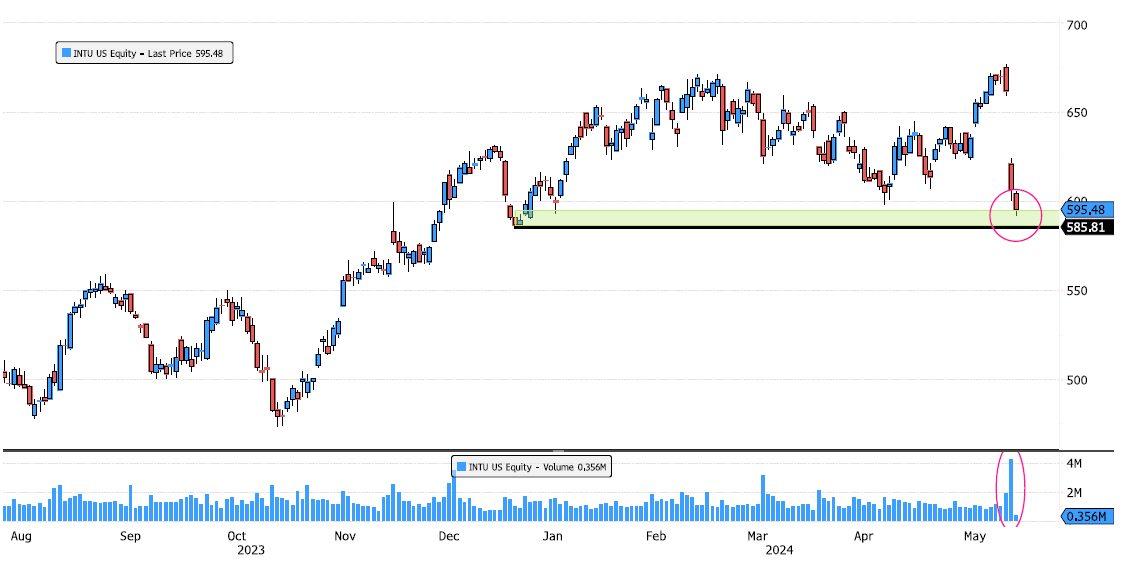

Intuit Reaching Strong Support

Intuit (INTU US) has been under significant pressure since the earnings release last Thursday, dropping by 12%. The stock is now approaching the last swing low support on the long-term trend (weekly chart). Keep an eye on this crucial support zone between 585-595. Source: Bloomberg

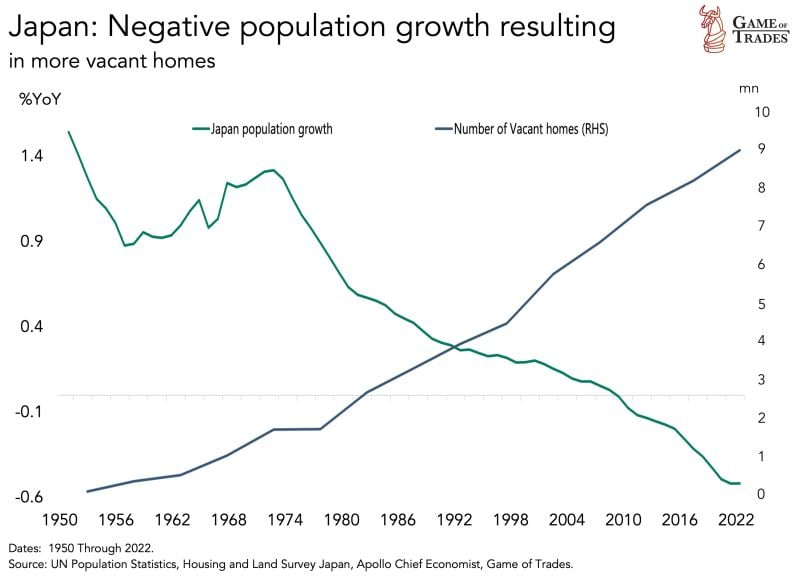

Japan’s population has now been contracting for almost 15 years

At the same time, number of vacant homes there has risen significantly Now reaching the 9 million mark At this rate, Japan’s demography poses long-term sustainability risks for their economy Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks