Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

waouuu... this could be a major medical breakthrough...

Source: Mario Nawfal

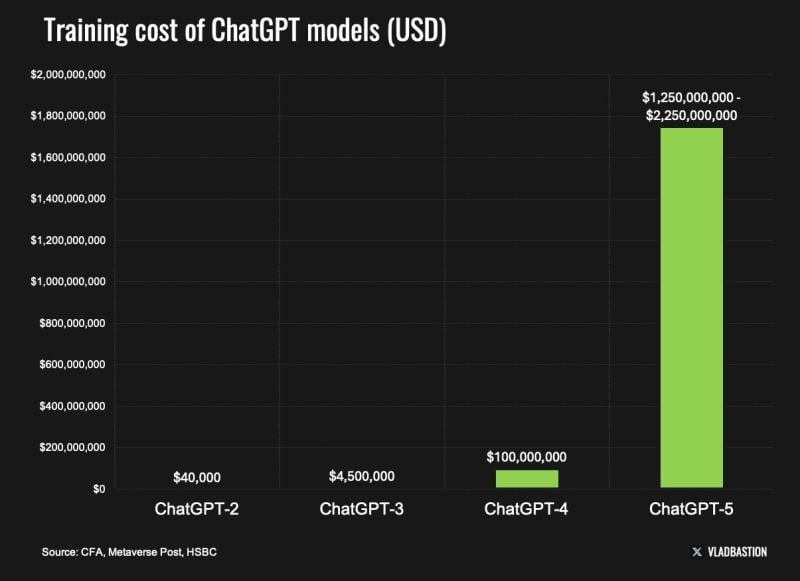

The cost of training the ChatGPT-5 model could range from $1.7 to $2.5 billion, according to HSBC.

This is 17.5 times more expensive than ChatGPT-4 and nearly 400 times more expensive than ChatGPT-3. Only a few can afford such a race in expenses, so the leadership in AI technologies will remain with the current market technology leaders. Source: Vlad Bastion Research, HSBC

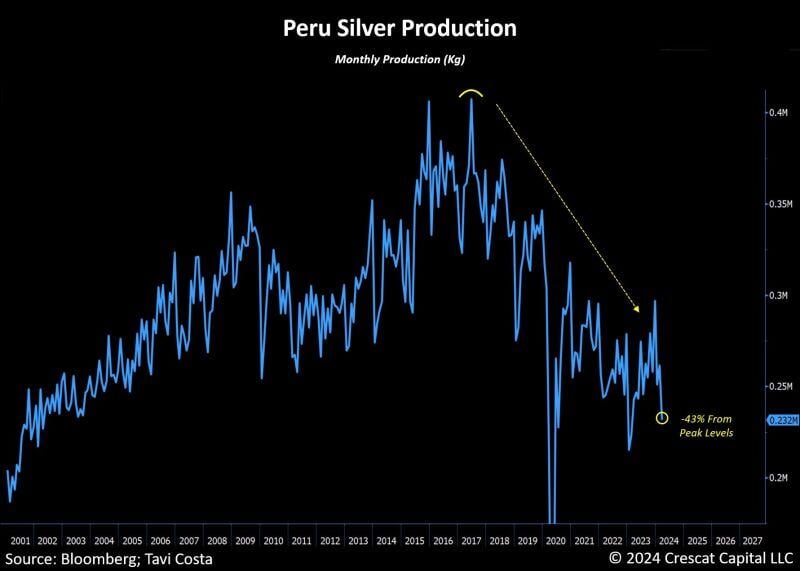

As highlighted by Tavi Costa ->

Silver production in Peru continues to fall severely, now down 43% from peak levels. Together with China, Peru is projected to be the second-largest producer of silver globally. Limited new supply paired with structurally higher demand is the perfect recipe for major price surges in any commodity. Source: Tavi Costa, Crescat Capital, Bloomberg

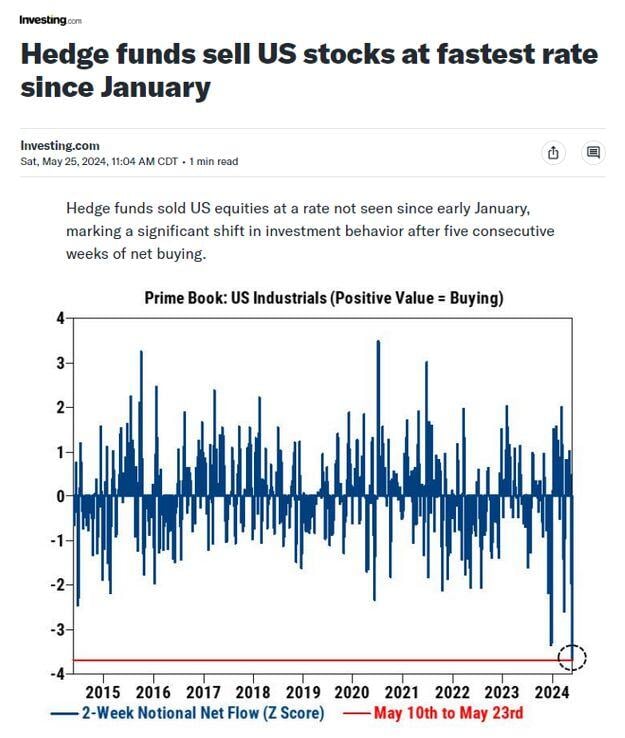

Hedge Funds dumped stocks at the fastest rate since January and, in particular, sold Industrials at the fastest pace in a decade.

Source: Goldman Sachs thru Barchart

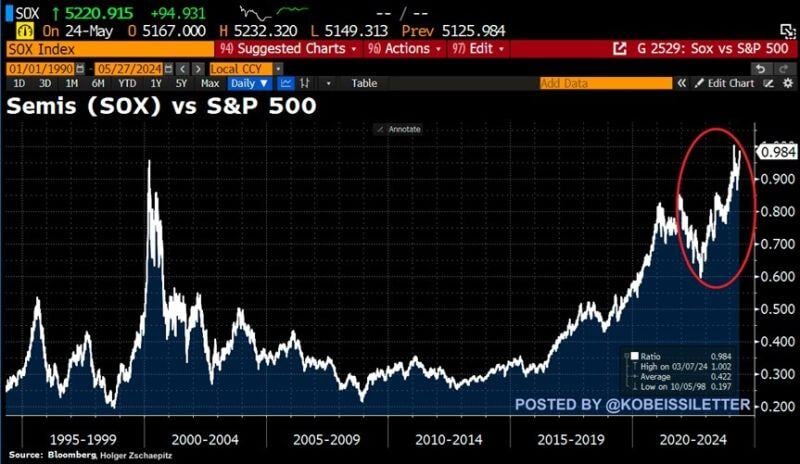

The Semiconductor Index, $SOX, relative to the S&P 500 has once again exceeded Dot-com bubble levels.

The Semis vs S&P 500 ratio has roughly doubled in just 2 years. This comes after a massive semiconductor sector rally of 85% compared to a 35% gain in the S&P 500. The rally has been led by NVIDIA, $NVDA, which has seen a 560% surge during this time. Meanwhile, the top 10% of stocks in the US now reflect ~75% of the entire market, the most since The Great Depression of 1929-1939. Source: The Kobeissi Letter, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks