Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

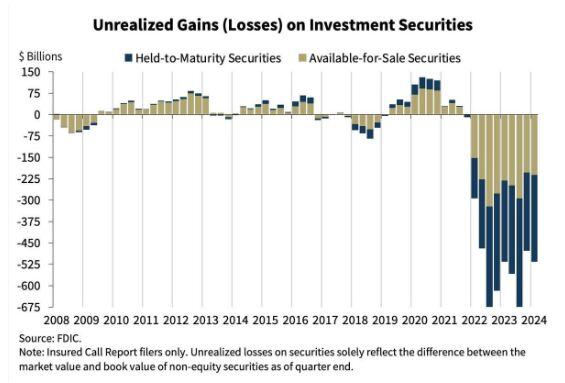

BREAKING 🚨: U.S. Banks

Unrealized losses in the U.S. Banking System increased to $517 billion in Q1 Source: Barchart, BofA

Nvidia has added the size of LVMH in market cap since last week...

Source: Quartr

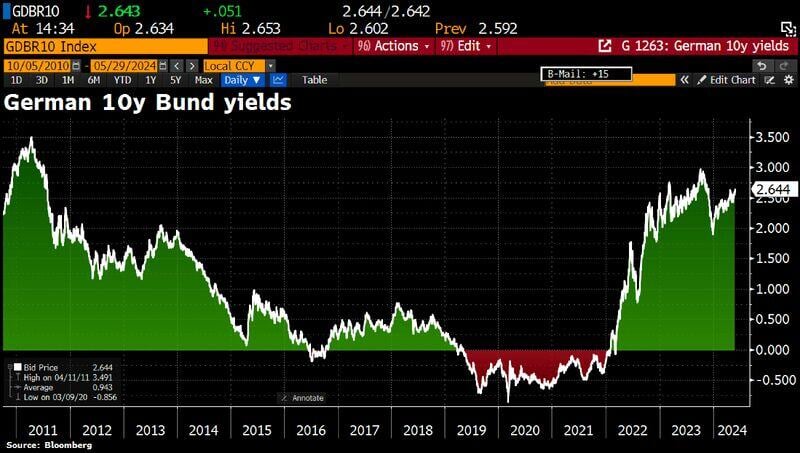

German 10y yields jump to 2.64%, highest since Nov, following a somewhat hotter inflation report.

German Harmonized CPI rose to 2.8% in May YoY from 2.4% in Apr, above the 2.7% median estimate in a BBG poll of economists. German national CPI rose to 2.4% from 2.2% as expected. Source: Bloomberg, HolgerZ

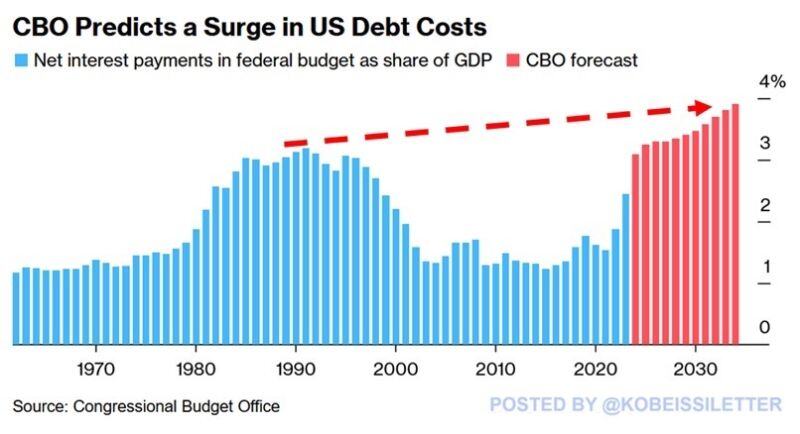

Shocking stat of the day: US net interest payments as a share of GDP are set to reach 3.9% by 2034, the highest in history.

This exceeds the all-time record percentage seen in the 1990s as well as World War II levels. Net interest is expected to account for 75% of the budget deficit increase over the next decade, according to the CBO. All as interest expense has already DOUBLED in just 3 years and now costs the US ~$2 billion per day. The worst part? This project assumes no recession hits within the next 10 years. What happens if we enter a recession? Source: The Kobeissi Letter

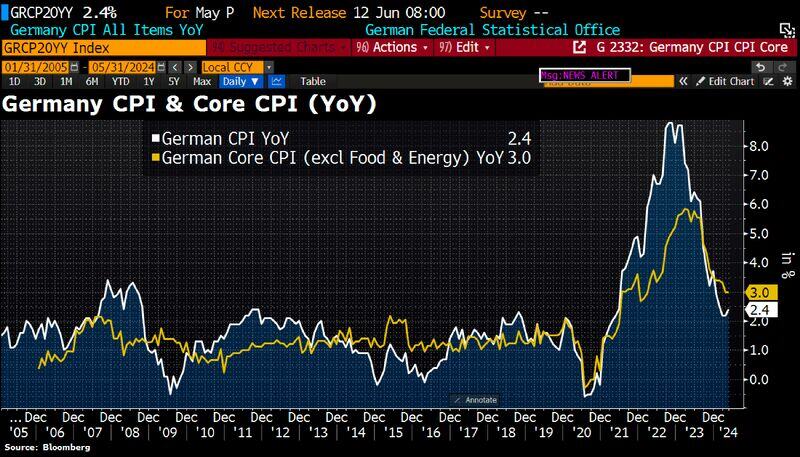

Germany's inflation rose to 2.4% in May from 2.2% in April while Core CPI remains unchanged at 3%.

Uptick was driven by base effects related to the introduction of a cheap public-transportation ticket (so-called 49€ ticket), which pushed prices down 12 months ago. But also food price inflation quickened (for a 2nd month). Source: HolgerZ, Bloomberg

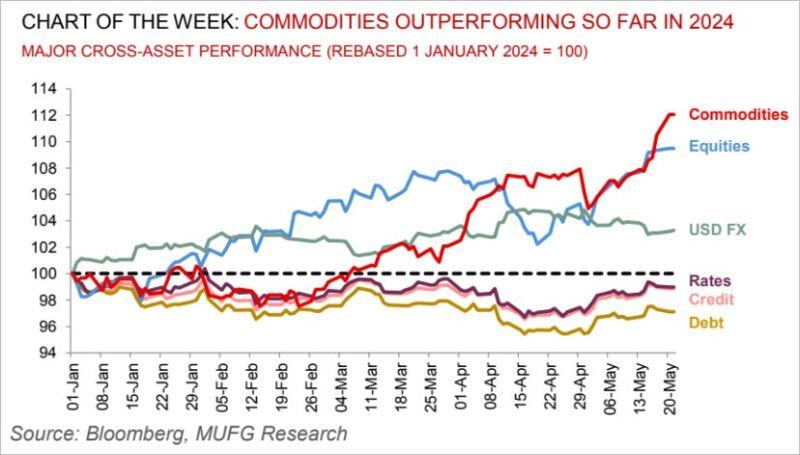

Commodities, the silent bull market that almost nobody cares about...

Source: Ronnie Stoeferle, MUFG

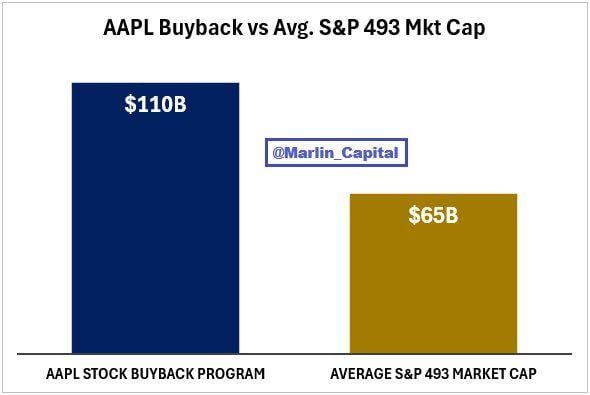

1 of the craziest stats in the market right now 👇

$AAPL announced a $110B stock buyback program in Q1. If you strip out the Mag 7 from the index, the average market cap for the S&P 493 is just $65B. $AAPL buyback program is 169% larger than the average S&P 493 company. Source: David Marlin

The most powerful person in the world is the storyteller. —Steve Jobs

Source: Vala Afshar

Investing with intelligence

Our latest research, commentary and market outlooks