Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

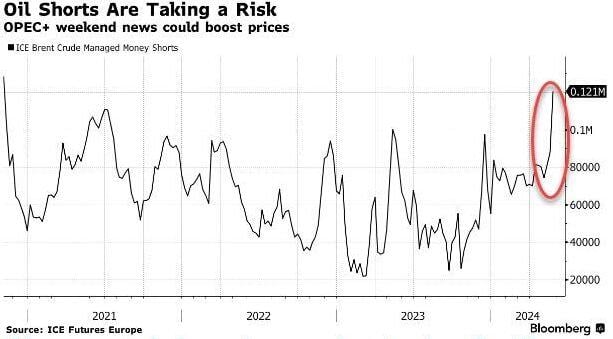

Speculators have built the largest Brent Oil short position since 2020

Source: Barchart, Bloomberg

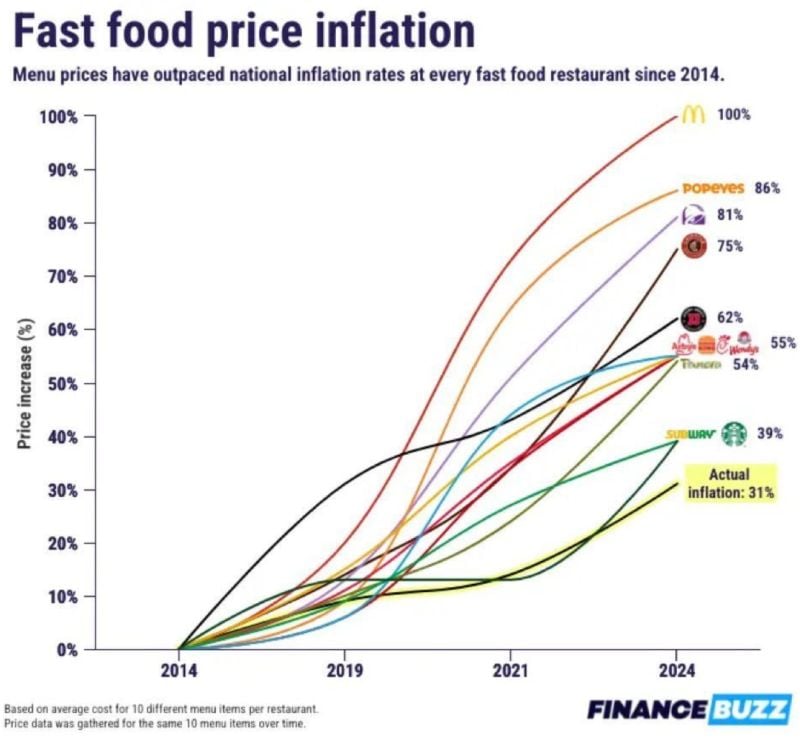

Foodflation! Prices at McDonald's $MCD have doubled over the last decade.

Source: Barchart

The Orange Juice crisis is upon us 🚨 What will be the next fruit to get sent? Mango, Pineapple, Kiwi?

Source: Barchart, FT

If you exclude $NVDA from the Mag 7, it would be trailing the S&P 500 YTD.

Source: Koyfin

Bullish sentiment on US equities is through the roof:

In May, 48.2% of Americans anticipated stock prices to increase over the next 12 months, according to the Conference Board Consumer Confidence Survey. This is the 3rd highest reading in history, only below the January 2018 and March 2024 surveys. Over just 2 years, this share has nearly doubled as stocks recovered from the 2022 bear market. Meanwhile, the S&P 500 has rallied a massive 48% since the October 2022 low. Stock market sentiment is incredibly strong. Source: Bloomberg, The Kobeissi Letter

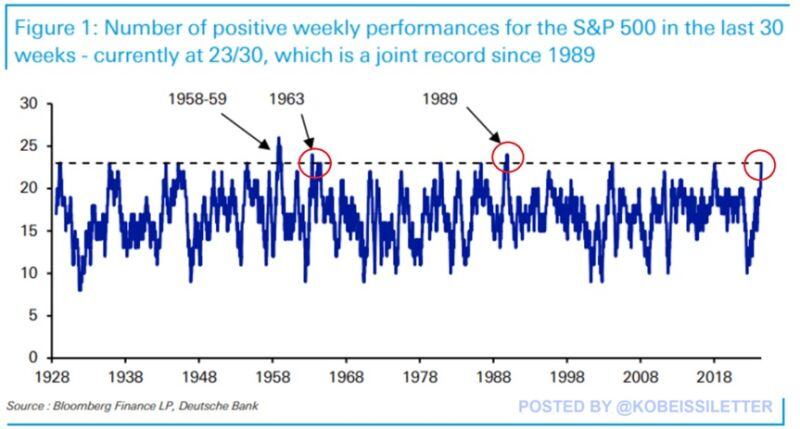

The S&P 500 just posted its best weekly streak in 35 years.

The index has increased in 23 of the last 30 weeks, a joint record since 1989, according to Deutsche Bank. It could thus be that some consolidation is due... Source chart: DB, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks