Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

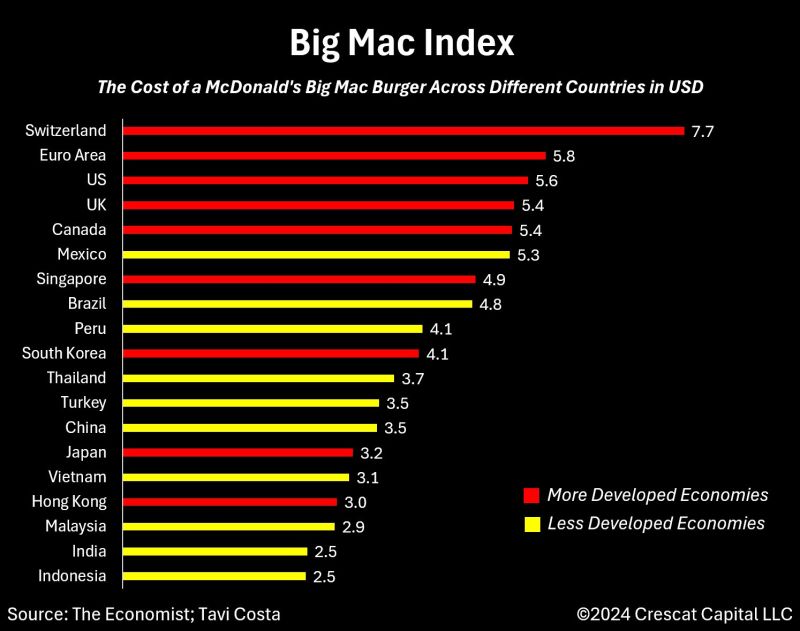

At 8.17 U.S. dollars, Switzerland has the most expensive Big Macs in the world, according to the January 2024 Big Mac index.

Concurrently the cost of a Big Mac was 5.69 dollars in the U.S., and 5.87 U.S. dollars in the Euro area. What is the Big Mac index? The Big Mac index, published by The Economist, is a novel way of measuring whether the market exchange rates for different countries’ currencies are overvalued or undervalued. It does this by measuring each currency against a common standard – the Big Mac hamburger sold by McDonald’s restaurants all over the world. Twice a year the Economist converts the average national price of a Big Mac into U.S. dollars using the exchange rate at that point in time. As a Big Mac is a completely standardized product across the world, the argument goes that it should have the same relative cost in every country. Differences in the cost of a Big Mac expressed as U.S. dollars therefore reflect differences in the purchasing power of each currency. Source: Tavi Costa, Crescat Capital, Statista, The Economist

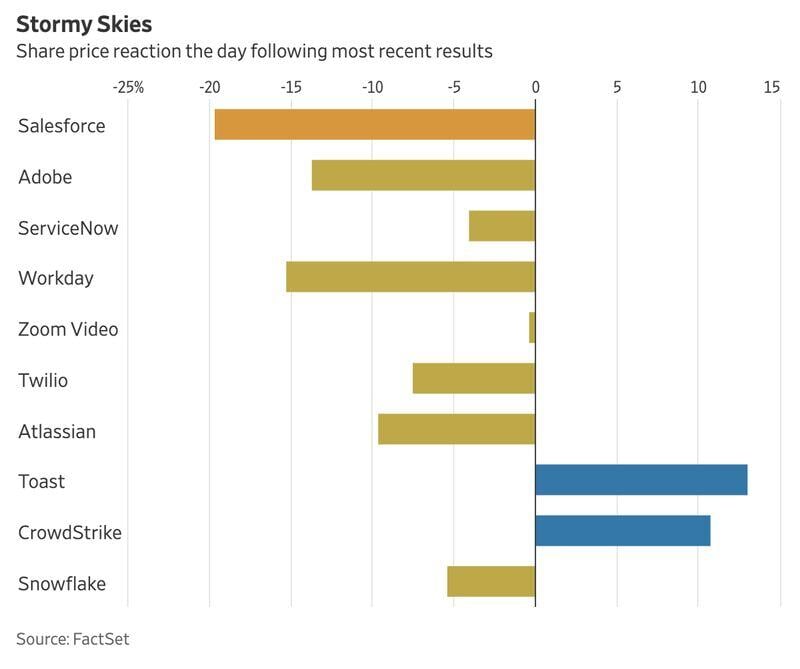

The current earnings season has largely been a rough one for cloud software providers.

Source: Win Smart, Factset

Investing with intelligence

Our latest research, commentary and market outlooks