Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

McDonald’s Back on Long-Term Swing Low

McDonald’s (MCD US) has consolidated 17% since the January highs. It's now testing a strong support zone between 245-250. Keep an eye on this level. Source: Bloomberg

Chinese BYD launches plug-in hybrids with a 2100 km driving range

Source: WSJ

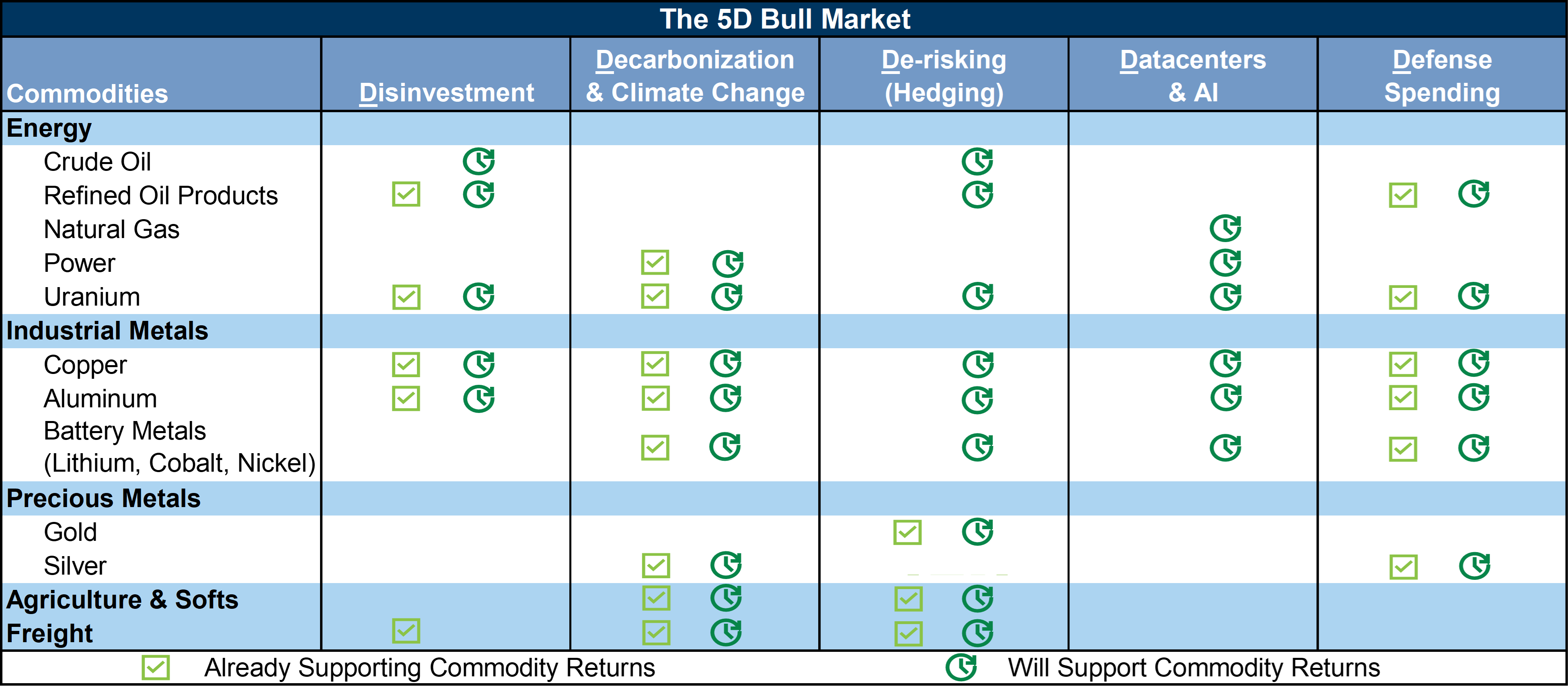

The 5D commodity bull market according to Goldman Sachs

Source: Goldman Sachs Global Investment Research

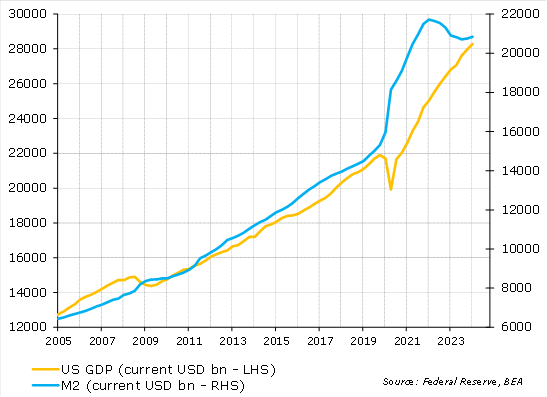

The US money supply is back in line with the size of the economy, after the excesses of the pandemic period

Time for the Fed to take its foot off the brake pedal regarding liquidity Source: US Federal Reserve, BEA

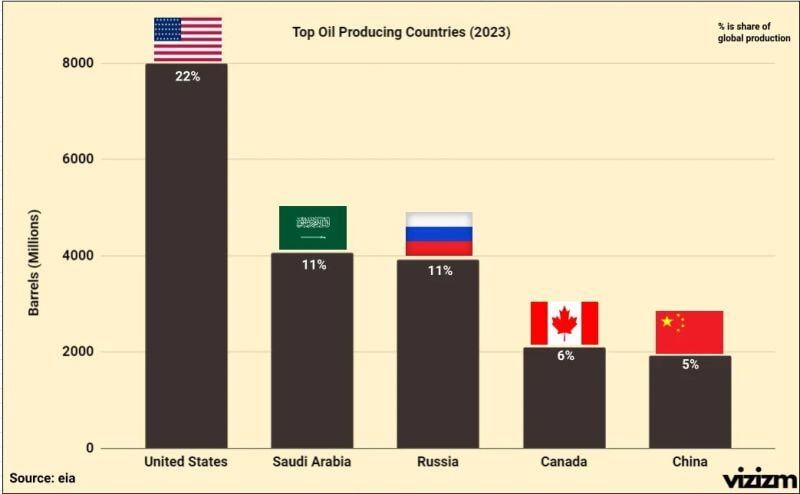

The US is the largest oil producer in the world, by quite a lot...

Source: Markets & Mayhem, Vivizm

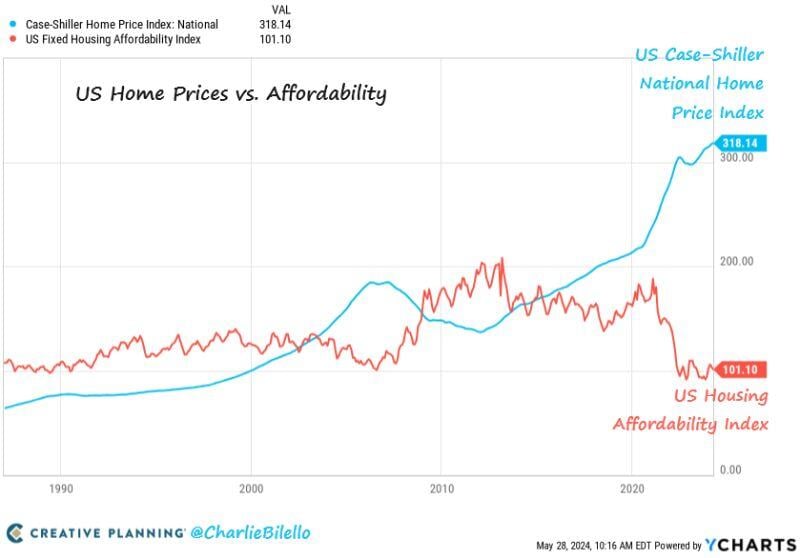

US Home Prices hit another all-time high in March, rising 6% over the last year. Affordability remains near record lows.

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks