Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

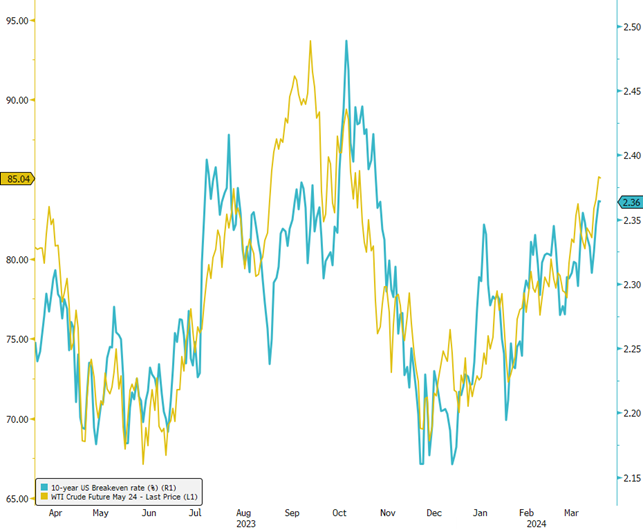

BREAKING: Oil prices have officially broken above $85.00 for the first time since October 2023.

Since the December 2023 low, oil prices are up over 25% as geopolitical tensions have escalated. This comes as PPI, CPI and PCE inflation all posted year-over-year increases in February. Demand forecasts are being raised and supply disruption risks continue to rise. Higher oil prices are simply just the new normal in the post-pandemic world. Is the fight against inflation really over? Source: The Kobeissi Letter

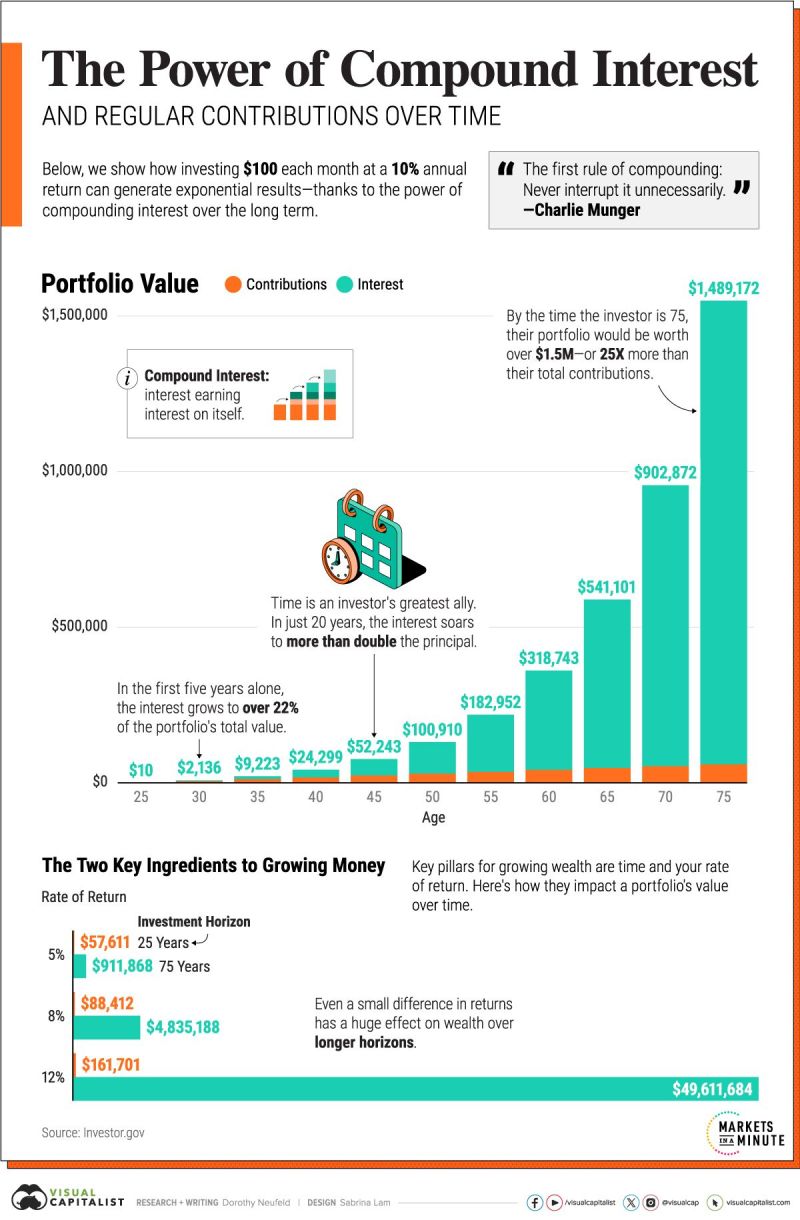

How Small Investments Make a Big Impact Over Time 💸

Source: The Visual Capitalist

Impact of Higher Oil Prices on US Breakeven Rates 🛢️

📈 In recent months, the surge in oil prices has played a pivotal role in the noticeable increase in US Long Term breakeven rates, with a significant rise of 20 bps since the end of December. This trend underscores the nuanced dynamics that influence US Treasury nominal rates, which are comprised of the sum of real yields and inflation expectations (as captured by breakeven rates), alongside the impact of the term premium on longer maturities. Traditionally, long-term US breakeven rates have closely mirrored the Federal Reserve's inflation target of 2%, maintaining a 25-year average of 2.05%. This long-term alignment has served as a benchmark for inflation expectations and a guide for monetary policy. However, the aftermath of the pandemic has ushered in an era of elevated breakeven rates, with the 10-year US Breakeven rate averaging 2.33% since September 2020. This elevation signals market anticipations of persistently higher inflation over the next decade, influenced by factors such as deglobalization trends, sustained supply chain challenges, and increased commodity prices, notably oil. The correlation between rising oil prices and the uptick in US Long Term breakeven rates is stark, highlighting how energy costs can act as a bellwether for inflation expectations. The accompanying chart illustrates this relationship, with oil prices' sharp rebound since December propelling breakeven rates upwards, suggesting a potential for continued increases. This resurgence in oil prices coincides with a broader recovery in global economic activity, posing significant considerations for the Federal Reserve's approach to monetary policy. The crucial question now is whether the Fed will adjust its easing policy plan in response to these inflationary signals. Source: Bloomberg

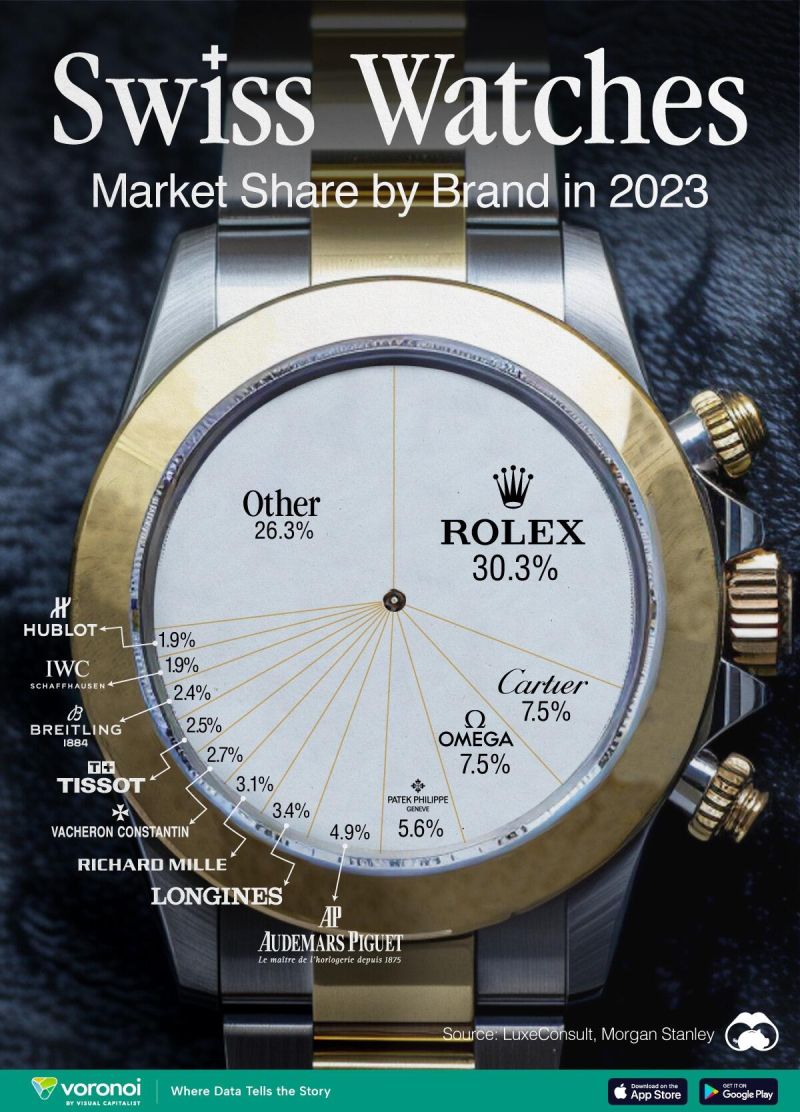

Sales of Rolex watches are believed to have surpassed 10 billion Swiss francs ($11.2 billion) for the first time in 2023

Significantly outpacing rivals like Cartier CHF 3.1 billion ($3.5 billion) and Omega CHF 2.6 billion ($2.9 billion). Additionally, Rolex has strengthened its dominant position in the market, capturing a remarkable 30.3% retail market share. Source: Visual Capitalist, www.zerohedge.com

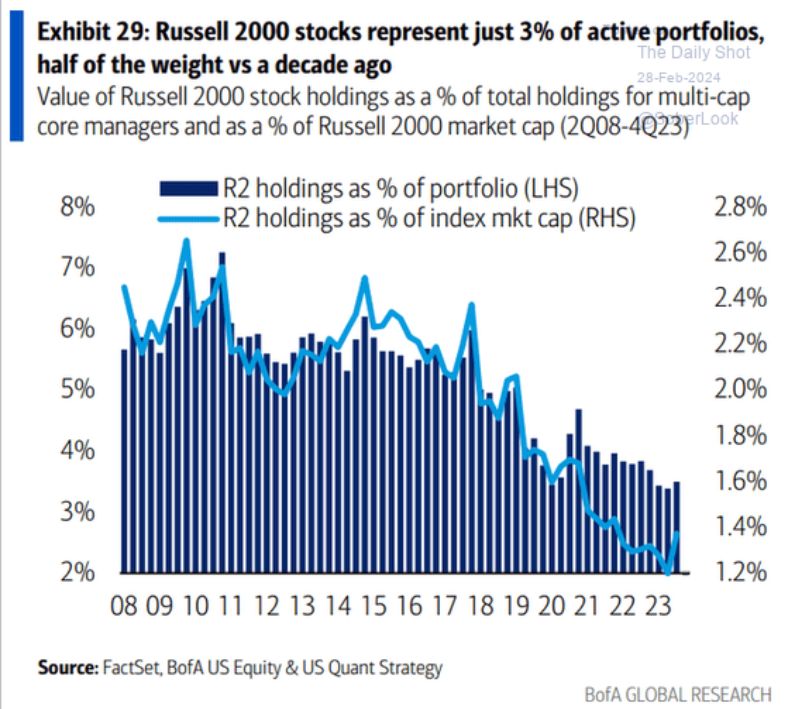

No one holds Russell 2000 (small-caps) stocks any more...

Source: Bob Elliott, BofA, Factset

What are the biggest shorts?

Microstrategy $MSTR is one of the biggest shorts in the entire US market. Nvidia $NVDA is currently leading the pack. Source: Bloomberg

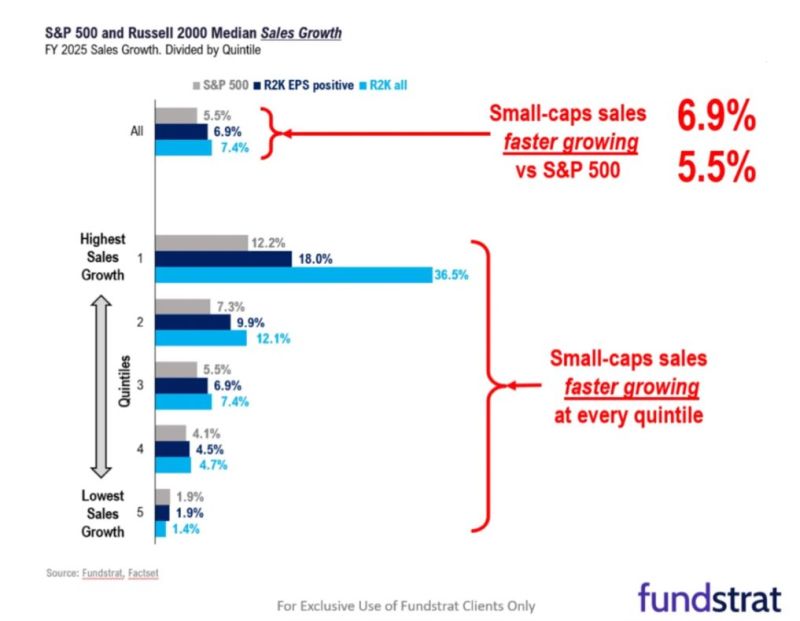

A contrarian idea on us small caps?

=> FUNDSTRAT: “.. Our top idea for 2024 is small-caps, where we see at least 50% upside .. Russell 2000 companies are set to grow .. faster than the $SPX .. Valuations are far more attractive .. when CEO confidence recovers, we also see the low valuations as setting the stage for synergistic M&A ..” Source: Carl Quintanilla, Fund strat

BREAKING: The Nasdaq Composite index is officially up 30% from its October 2023 low.

That's a 30% gain in 5 months or an average of 6% per month since October. To put this in perspective, the median ANNUAL return for the S&P 500 is 10%. This means that the Nasdaq has TRIPLED the median sp500 return in just 5 months. The top 10% of stocks in the S&P 500 also now reflect 75% of the index. Tech stocks have never been more powerful. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks