Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Going All-In on US Long-Term Bonds for 2024? 📈

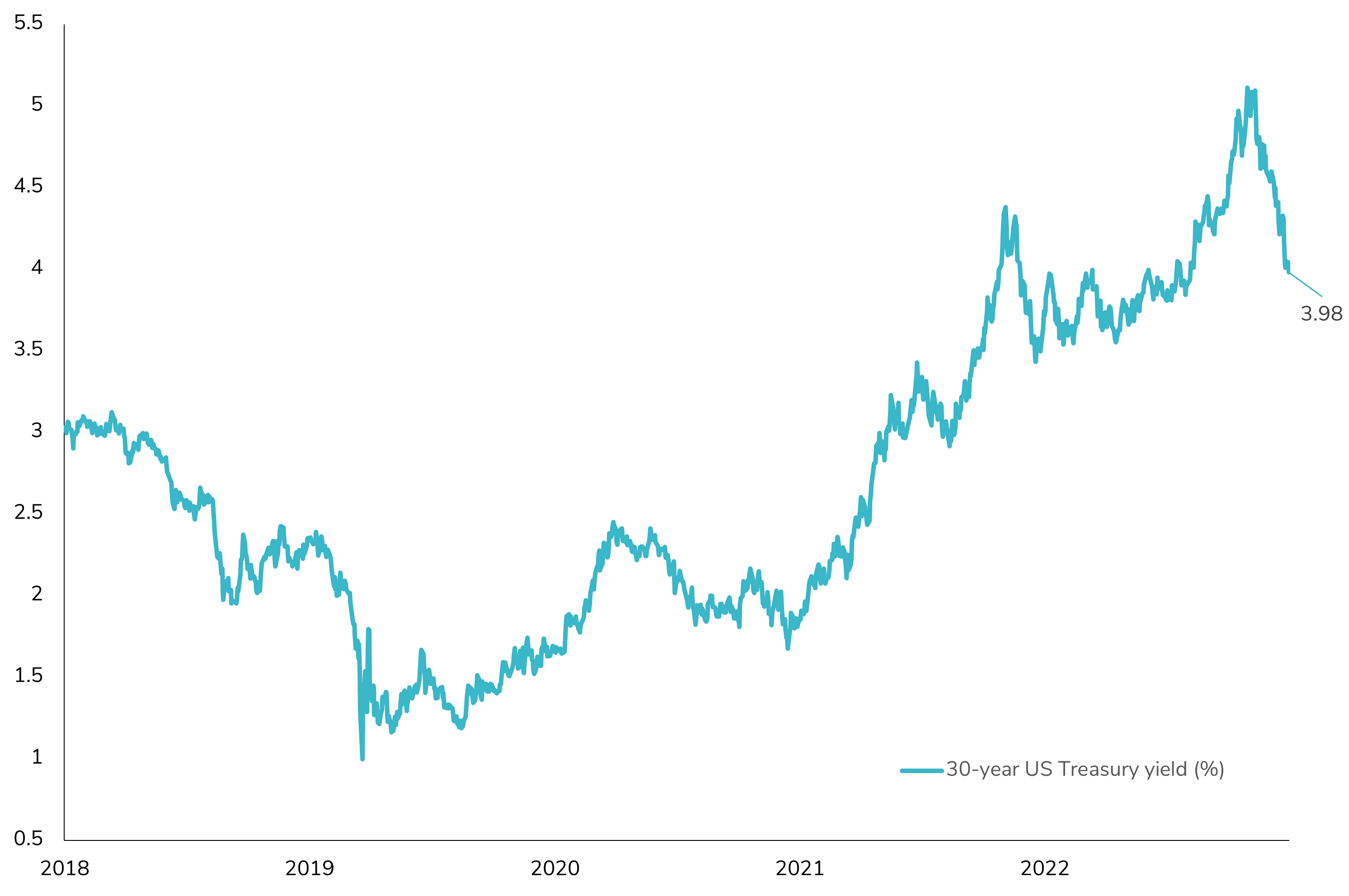

In a recent Bank of America survey, when asked which asset would likely excel if the Fed cuts rates in H1'24, an intriguing 26% (earning the top spot) pointed to the Long 30-Year US Treasury. This raises an important question: Is this a sound strategy given the current economic climate? Notably, the preference for long-term bonds comes amid a significant drop in the 30-year US Treasury yield (>100 bps). However, the landscape is complicated by the anticipated heavy Treasury supply in the first quarter, alongside other factors. These include the uncertain economic repercussions of potential fiscal policies from the 2024 US election results (if Trump or another candidate favoring fiscal stimulus were to win), a negative US term premium, and an unusually persistent inverted yield curve in what appears to be a late economic cycle. Moreover, there's a critical consideration often overlooked: in scenarios of Fed rate cuts, the front-end of the yield curve, when adjusted for duration risk, might actually offer a more favorable position. So, is pouring resources into long-term bonds for 2024 a judicious move right now? Are long-term US bonds really the safe haven they’re perceived to be, or should we approach this strategy with a more critical lens? 🤔📊 #InvestmentStrategy #FixedIncome #FinancialMarkets"

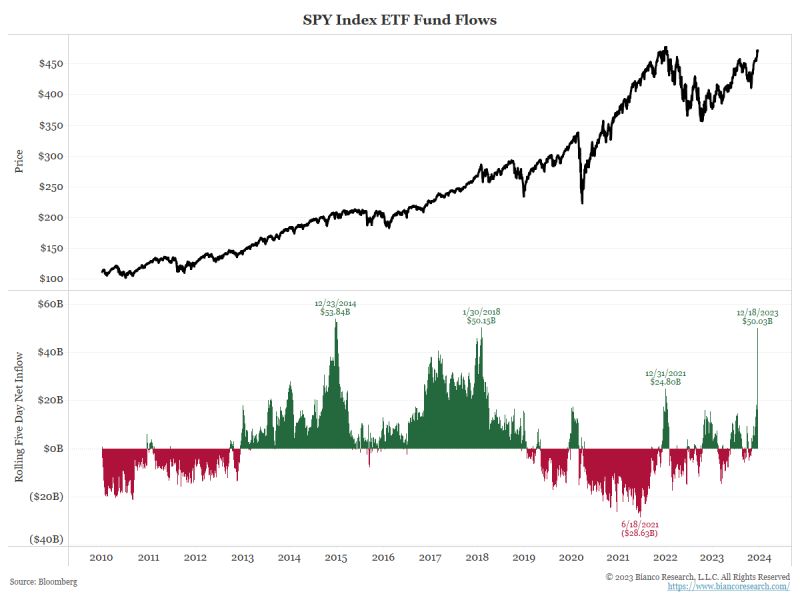

In just 5 days, $SPY has taken in $50B+, more than any other ETF YTD! This is the biggest 5-day take for $SPY since January 2018

This is the biggest 5-day take for $SPY since January 2018. FYI - the following week Jan 30, 2018, was vol-maggeon, (the $VIX went from 12 to 50 in 3 days and the $SPX plunged 10+% in 9 days) Source: Jim Bianco

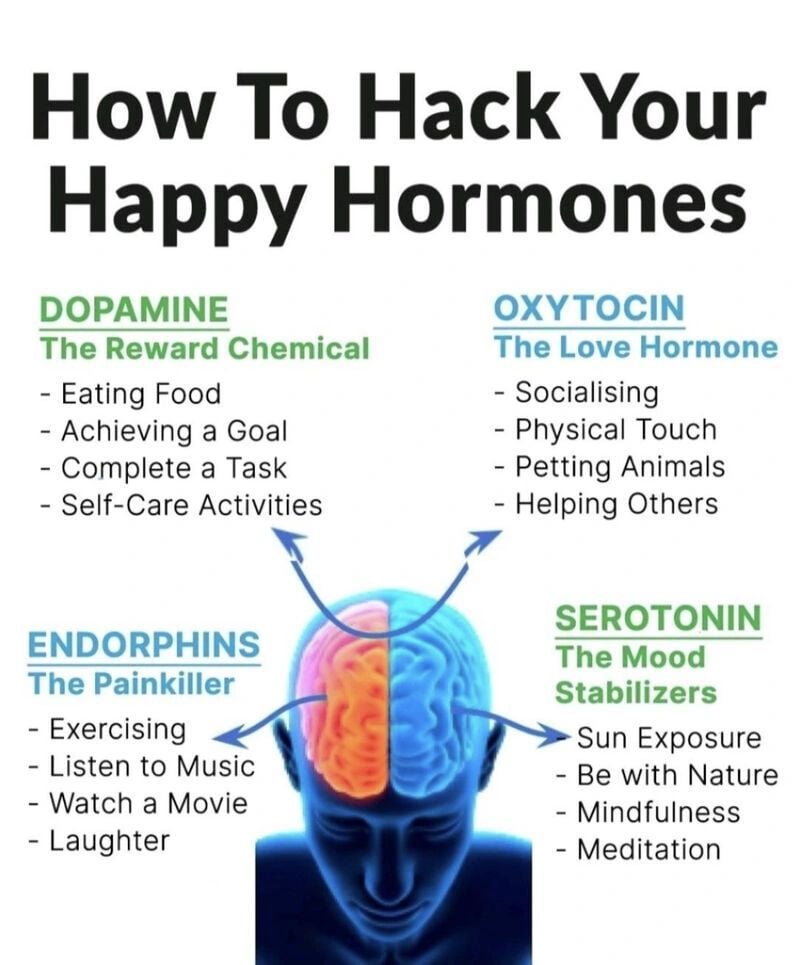

✨🎉Serotonin, Dopamine, Endorphins, and Oxytocin: The Neurotransmitters of Well-being

Source: SEEMA YADAVSEEMA YADAV

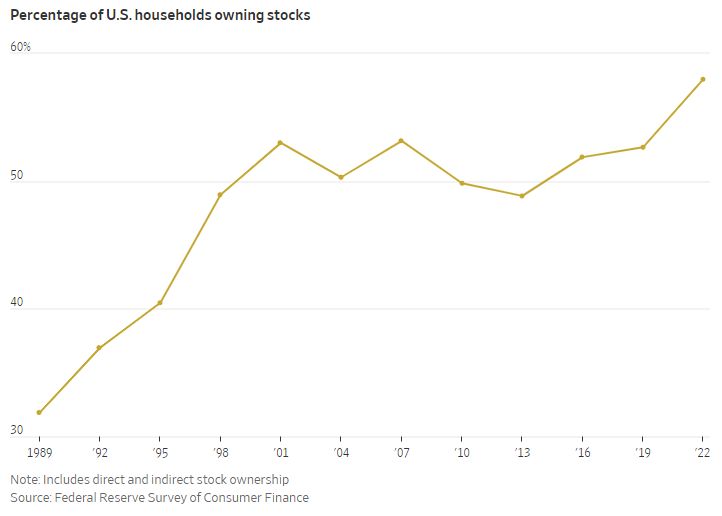

58% of US households own stocks, the highest percentage on record

Source: Charlie Bilello

The gap between the Magnificent 7 and the S&P 493 (remaining 493 companies) is now 63%

This year, the Magnificent7 is up a massive 75% while the remaining 493 companies are up just 12%. Combined, the S&P 500 is up ~25%, more than doubling the S&P 493's total return. In other words, the Magnificent 7 is up 3 TIMES as much as the S&P 500 and ~6 TIMES as much as the S&P 493. Just 7 weeks ago, the S&P 493 was DOWN 2% this year. Source: The Kobeissi Letter

The stock market spent 2022 steadily declining and 2023 steadily gaining, to generally wind up about where it started

Source: Peter Mallouk

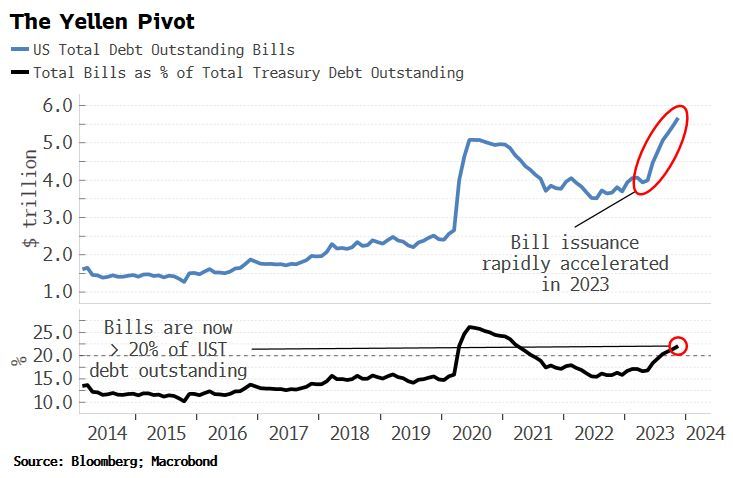

Simon White posted an excellent chart showing the potential short-term gain / long-term pain of the dual Yellen / Powell pivot

Phase 1: The Yellen Pivot. Early 2023, she decided skewing the Treasury's issuance towards bills. This bought time for risk assets, allowing Fed reserves to rise despite QT Phase 2: The Powell Pivot last week -> His dovish turn should buy more time for risk assets next year. He is literally trying to limit the growing amount of liquidity sucked from the government's ballooning interest-rate bill While this leads to short-term gain, there is a huge risk of long-term pain as these dovish operations have significantly increased long-term inflation risks and the prospect of even higher yields in the near-future. Source: Bloomberg, Macrobond

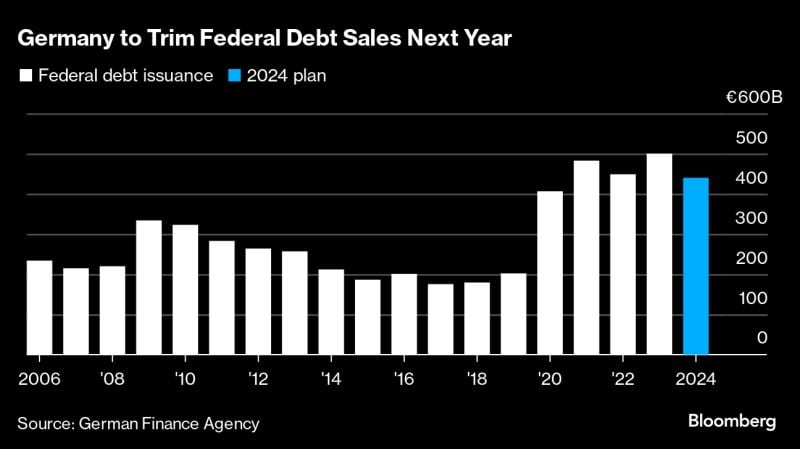

German federal government is set to trim federal debt sales next year following the German top court's 'debt brake' ruling. Berlin plans to issue ~€440bn in debt

That compares with a record volume of ~€500bn in 2023 Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks