Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Antifragile: Things that gain from disorder

Source: Investment Books (Dhaval)

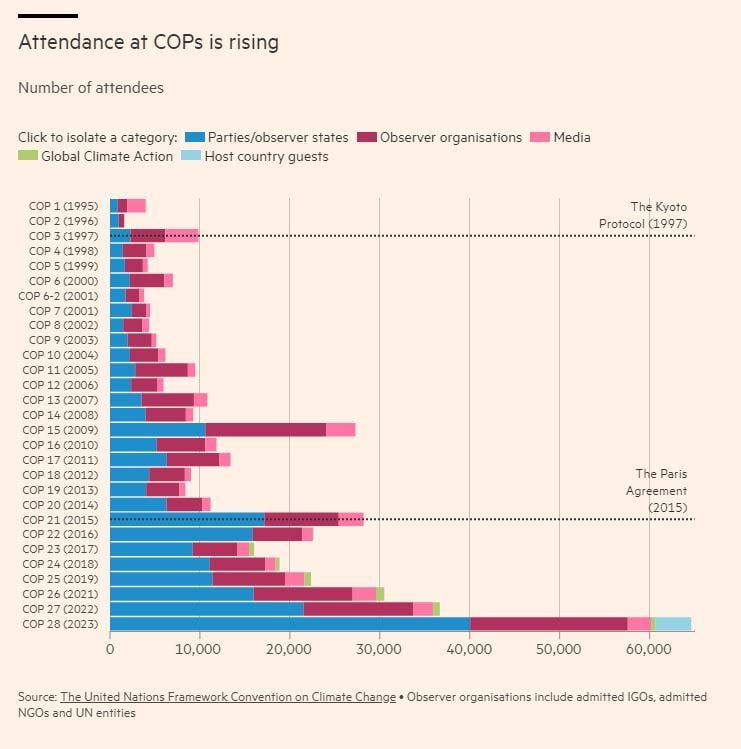

The number of core participants at OP28 in Dubai topped a record 65,000, an increase of 80 per cent on the flagship UN climate summit’s event last year in Sharm el-Sheikh, Egypt

Source: FT

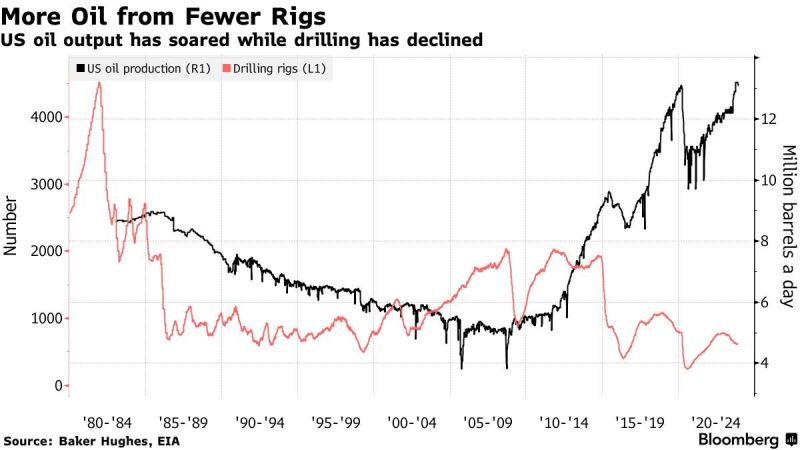

The US added the equivalent of a new Venezuela in oil supply during Q4, with less rigs producing more oil as technological efficiency ramps up

This supply growth has exceeded expectations and furled OPEC's attempt to put a floor under prices, at least for now. Source: Markets & Mayhem, Bloomberg

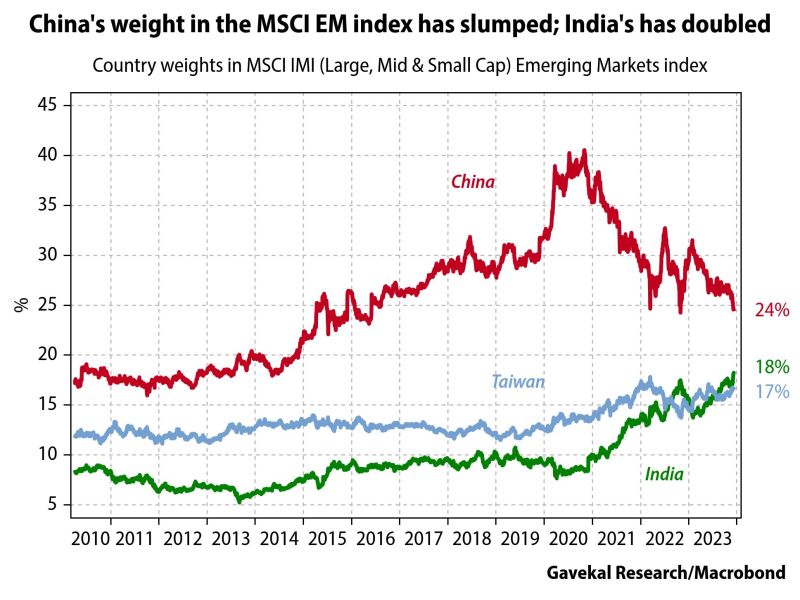

Chinese stocks made up 24.7% of the MSCI Emerging Markets index by capitalization, down from 40% three years ago

Meanwhile, India's weight has doubled... Source: Gavekal

Nestle back on major level

Nestle (NESN VX) has consolidated 25% since July 2022. It's now on 2009 majort support level. Keep an eye at this key level. Source : Bloomberg

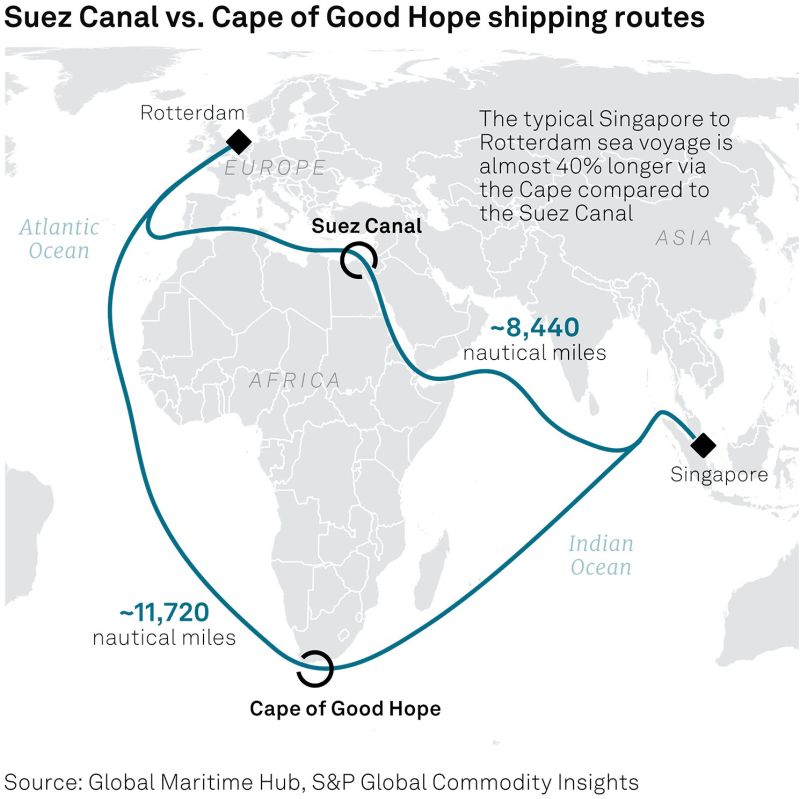

The supply chain / 3inflation risk ahead of 2024. Red Sea is now largely closed to traffic

That's 8.8 million bpd of daily oil transit, and nearly 380 million tons of daily cargo transit. Global traffic now will be rerouted around Cape of Good Hope, adding 40% to voyage distance (and even more to cost) Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks