Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

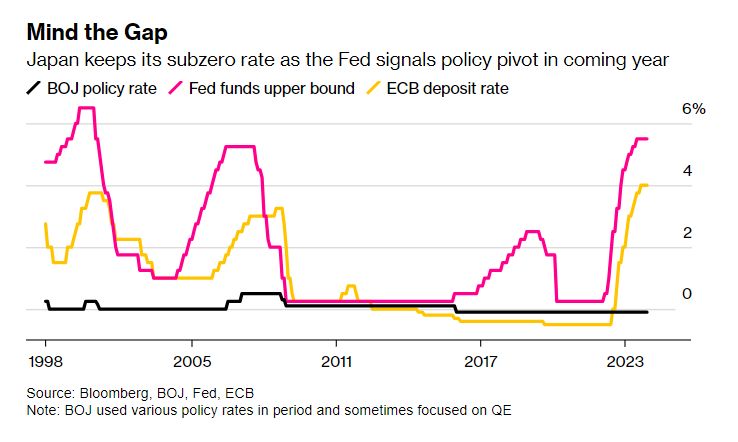

Japan | BOJ Avoids Rate Hike Signal as It Stands Pat, Driving Yen Lower – Bloomberg

As expected, no change from the BoJ this morning on rates or the YCC. The vote was 9-0, in favor of no change. There wasn’t even a hint of change to the policy statement. No change in language around wages and inflation. The Japanese Yen weakened considerably on the initial press release. Nikkei 225 is up +1.5% Source: Ayesha Tariq, Bloomberg

BREAKING: Chinese Equities

Chinese Stocks continue to nosedive and have fallen to their lowest prices in 5 years. Source: Barchart

Global supply chain under threat after Iran-backed Houthi militants on ships in the Red Sea

We live in a world where geopolitical risks are playing a much higher role than during last decade. Current conflict in the Middle East is threatening global trade and suppy chain. These attacks by have already rocked global trade. And there could be more disruptions and price increases to come for shipments of goods and fuel. Several major shipping lines and oil transporters have suspended their services through the Red Sea as more than a dozen vessels have come under attack since the start of the Israel-Hamas war in early October.

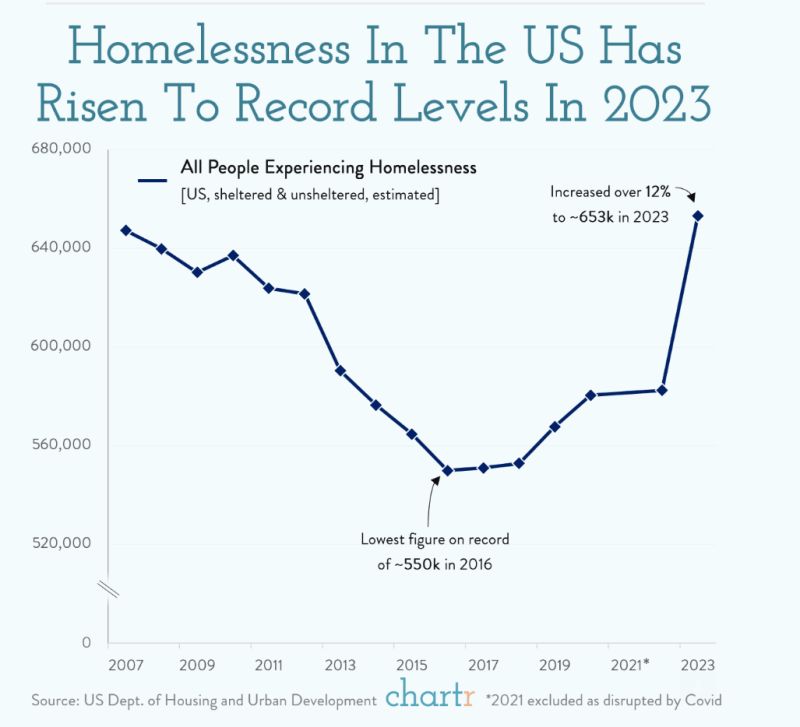

Homelessness in the US has grown to the highest level since the Department of Housing and Urban Development (HUD) started tracking the figure back in 2007

With a record 653,104 people experiencing homelessness at the latest annual count. The number of people experiencing unsheltered homelessness — those living on sidewalks or in abandoned buildings, bus stations, etc. — was up around 47k from last year, while the figure for people staying in emergency shelters, transitional housing programs, or safe havens grew 23k in the same period. Source: Chartr

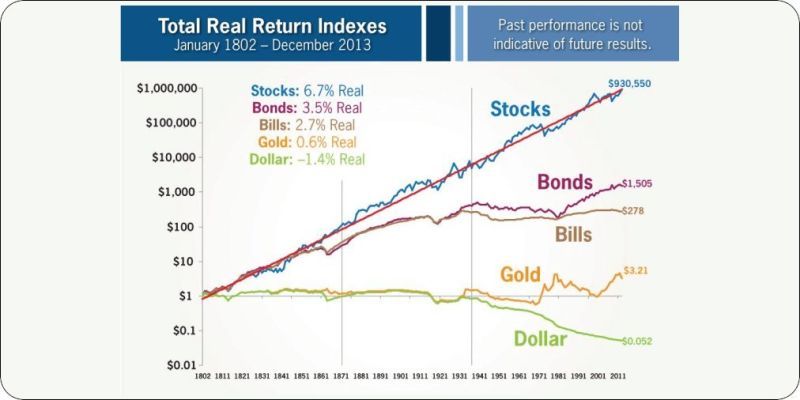

“The reports of my death are greatly exaggerated.” Mark Twain, 1897

Source: Lawrence McDonald, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks