Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The “HODL” meme started a decade ago today when a user misspelled the word “holding”

On that day, bitcoin $BTC opened at $678 and "closed" at $522 (i.e last price of the day), so quite a volatile session. If the hodler kept his/her coins, the current unrealized gain is 7,783%. In other words, a $10,000 position at that date is worth today a whopping $788,352. Source: Documenting Bitcoin

What a headline...

Hafize Gaye Erkan, the new head of Turkey’s central bank, said rampant inflation has priced her out of Istanbul’s property market, leaving the former finance executive with no choice but to move back in with her parents. “We haven’t found a home in Istanbul. It’s terribly expensive. We’ve moved in with my parents,” 44-year-old Hafize Gaye Erkan, who took up her post in June after two decades in the United States, told reporters. Source: Wall Street Silver

Long-Dated Treasuries have officially entered a bull market after $TLT surged higher by more than 20% from the 16-year low it hit on October 23

Source: Barchart

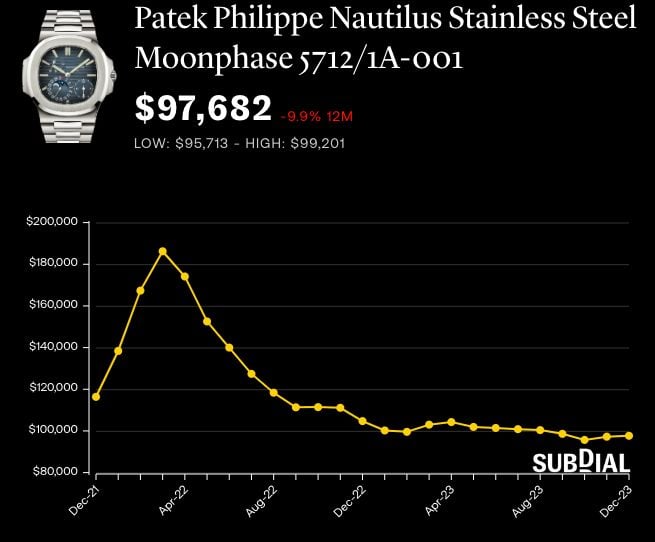

Bottom? Will the Turmoil In Used Rolex and Patek Market End After Fed's Pivot?

Extract from a zerohedge article: The secondary market for pre-owned Rolex and Patek Philippe watches has been spiraling down since peaking in early 2022, mainly because the Federal Reserve ended helicopter-dropping trillions of dollars in stimulus checks and was forced to begin the most aggressive interest rate hiking cycle in a generation to curb inflation. Now, the Fed's bizarre, unexpected pivot this week has spurred hope that a bottom nears for the luxury watch market. Bloomberg spoke with Christy Davis, a co-founder of Subdial, a UK-based secondary watch market dealer and trading platform, who believes the turmoil in the secondary luxury watch market is ending. "As we look toward 2024, the potential for a soft landing of stable and eventually declining rates is reason for optimism in the watch market," Davis said. Source: www.zerohedge.com

Markets are full risk-on since November 9th

The Nasdaq 100 and the S&P 500 have underperformed the equal weighted indices. They got beat up pretty badly by the Russell 2000 and have been left in the dust by Regional Banks and $ARKK (Ark Invest Innovation ETF). Source: Peter Tchir of Academy Securities

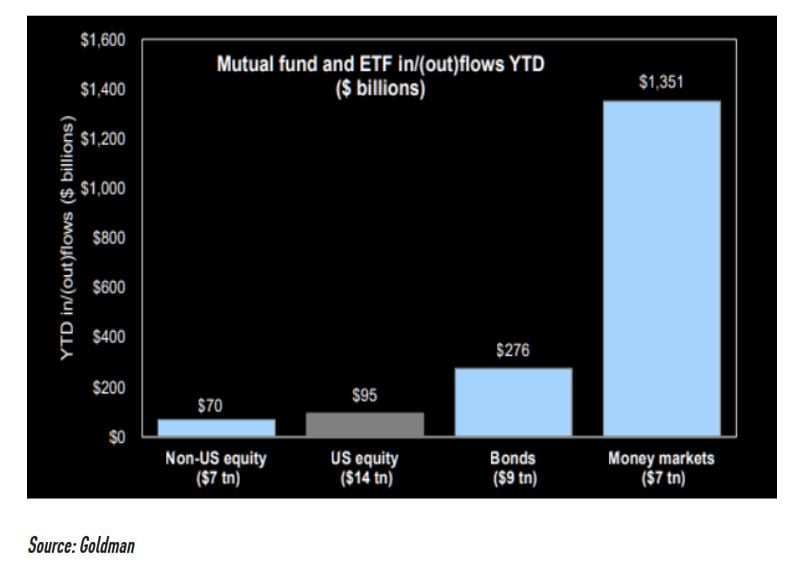

There is significant dry powder on the side line...

In 2023, we saw very limited US equity inflows vs. $1.4 trillion in money market inflows. If the gap starts to close for real now and gains momentum in 2024 it is needless to say a very good support for equities. Source: Goldman

Investing with intelligence

Our latest research, commentary and market outlooks