Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

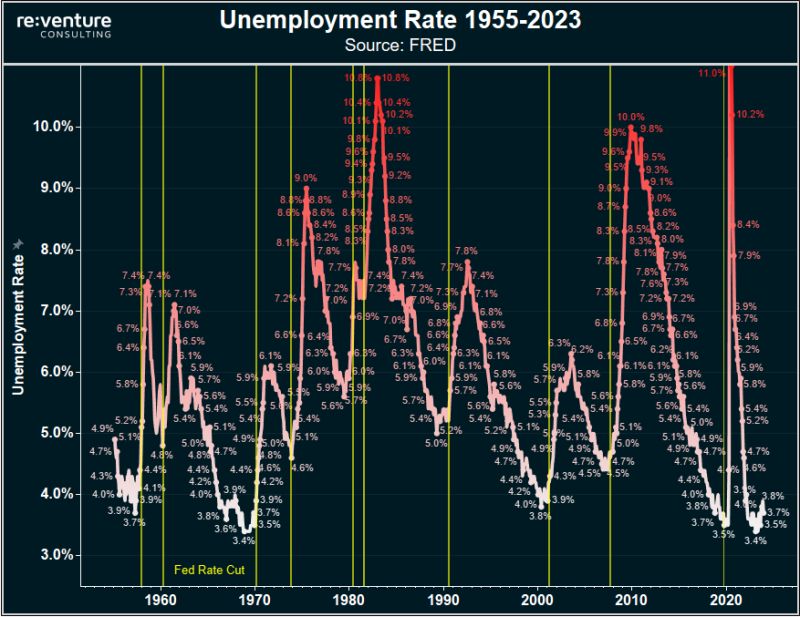

Unemployment rate in America from 1955-2023

Interesting how the unemployment rate tends to spike right after the Fed cuts rates. Suggesting that Fed policy easing is usually a negative signal for the economy. Not a positive one. Source: FRED, re:venture

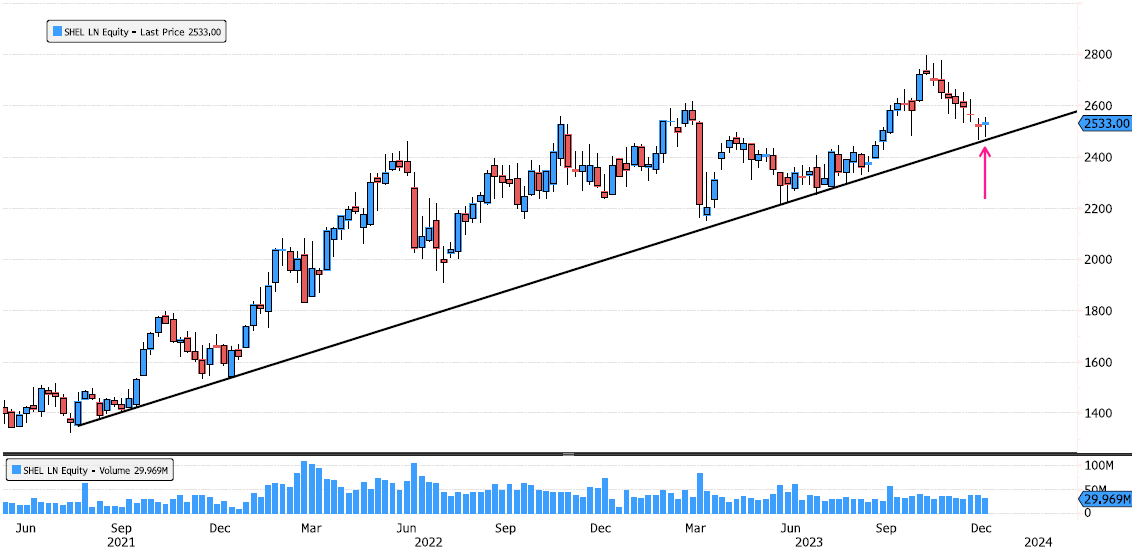

Shell on uptrend support

Shell consolidated 12% since October highs. Bullish trend remains strong. Stock is back on July 2021 uptrend. Is it time for a rebound ? Source : Bloomberg

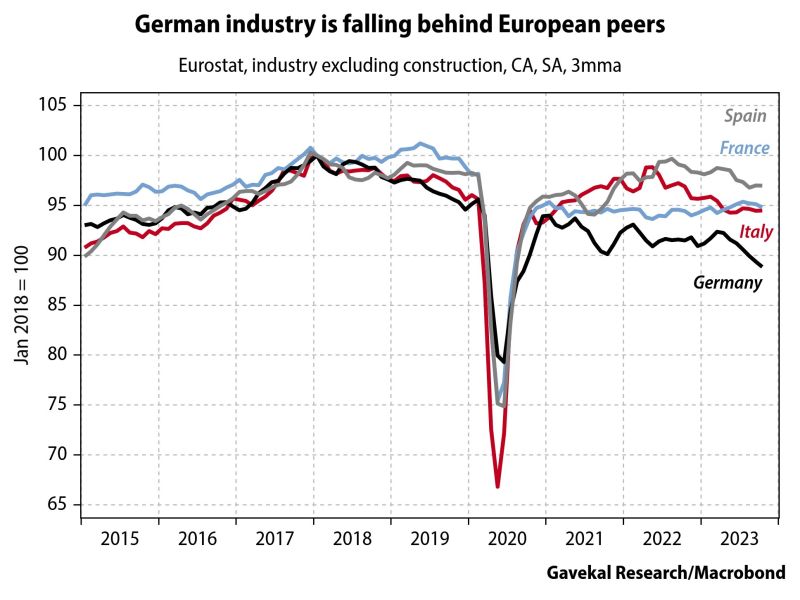

Times are tough for European industry, which is having to adapt to climate-friendly regulations, higher energy costs and increased competition from Chinese producers

German industry has seen production fall by -2.3% this year; worst of the four biggest eurozone economies. Source: Gavekal

The European Central Bank held interest rates steady for the second meeting in a row, as it revised its growth forecasts lower and announced plans to shrink its balance sheet

ECB's Lagarde: We did not discuss rate cuts at all BUT markets price in 5.3 cuts for 2024. “The Governing Council’s future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary,” it said in a statement. Source: Bloomberg, CNBC

What a journey for Ireland...

Ireland has experienced unprecedented growth in prosperity in recent years. GDP per capita is now almost $100k, which is more than twice as much as in Germany and three times as much as in Italy. The small country with a population of 5 million has benefited from the large investments made by tech giants, who have settled here b/c of the low tax regime. No other country in Europe has a meaningful budget surplus, can set up 2 sovereign wealth funds, (Future Ireland Fund (FIF) and a smaller Infrastructure, Nature and Climate Fund (INCF) and has a war chest of €2.5bn before 3 important elections. Source: Bloomberg, HolgerZ

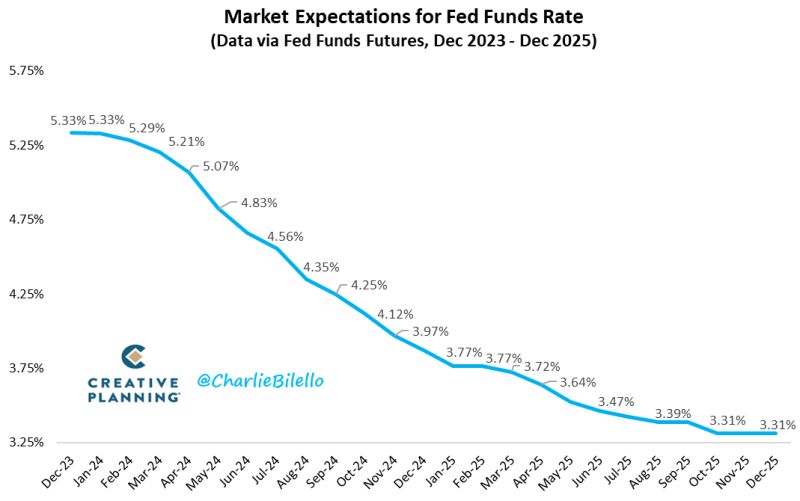

The Fed is still behind the curve...

The market is now pricing in a Fed Funds Rate of 3.8% by the end of 2024, expecting significantly more easing than the Fed's projection of a move down to 4.6%. Source: Charloe Bilello

Investing with intelligence

Our latest research, commentary and market outlooks