Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

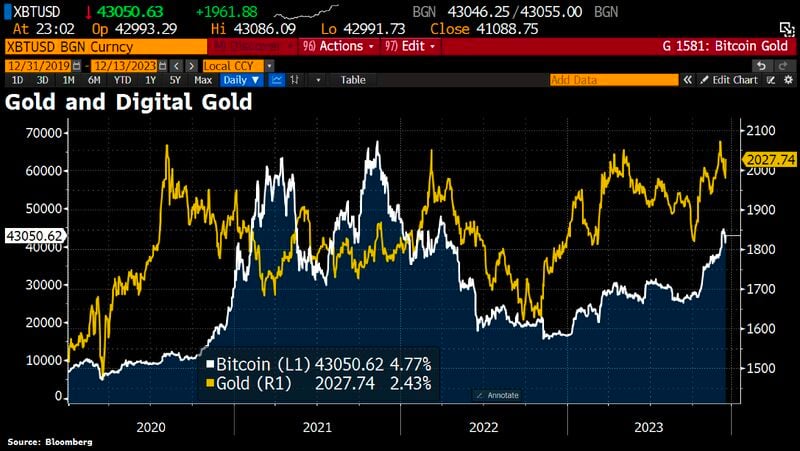

David Marcus, Former President of PayPal & Co-founder and CEO of Lightspark, on FASB officially adopting Fair Value Accounting for bitcoin:

“You may think this is a small accounting change that doesn’t mean much. It’s actually a big deal. This removes a large obstacle standing in the way of corporations holding Bitcoin on their balance sheet. 2024 will be a landmark year for BTC.” Source: Swan Media

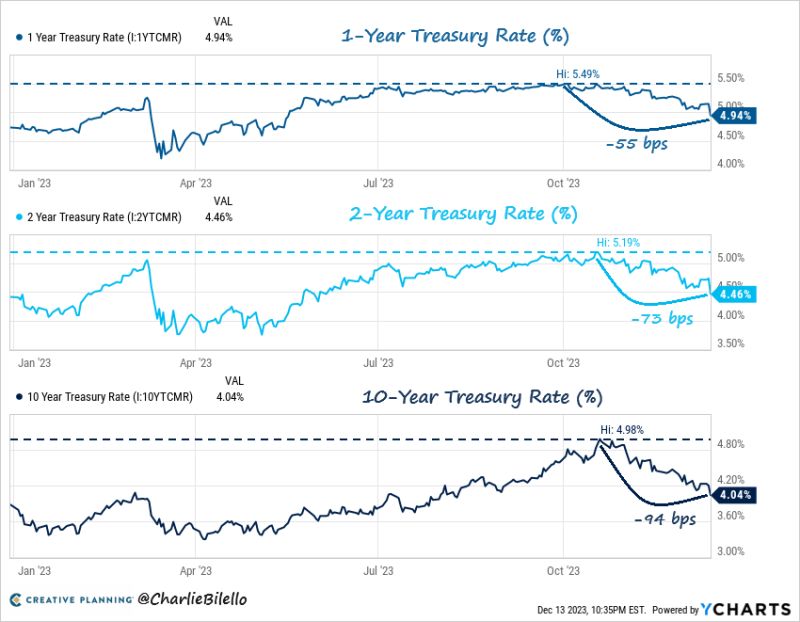

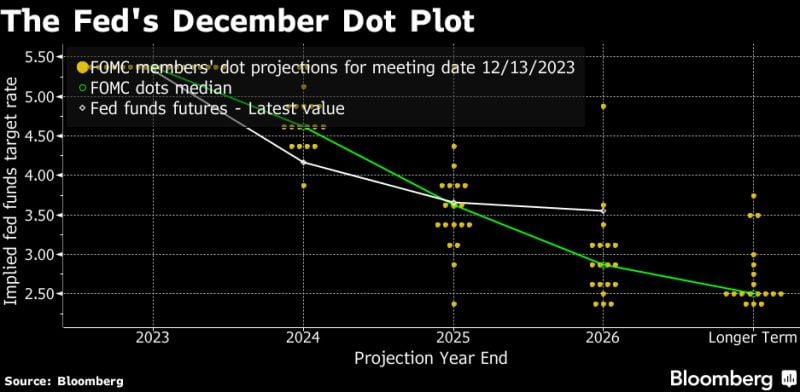

Big move down in Treasury yields yesterday after the FED projected 75 bps of rate cuts in 2024...

1-Year: 4.94%, down 55 bps from Oct high. 2-Year: 4.46%, down 73 bps from Oct high. 10-Year: 4.04%, down 94 bps from Oct high. Source: Charlie Biello

Uranium 16-Year High 🚨: Uranium has now surged past $85 per pound for the first time since January 2008

Source: Barchart

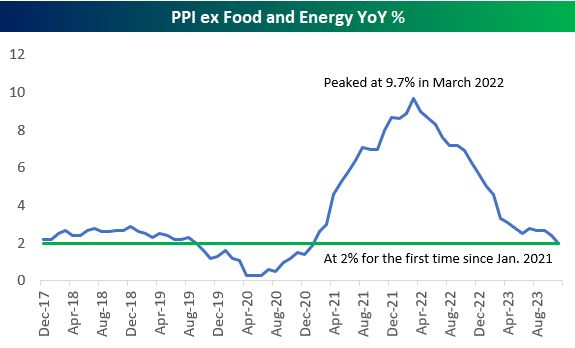

Up the mountain and back down in the valley

Here's a look at the year-over-year percentage change of PPI (producer prices) ex food & energy over the last five years. Core PPI is back down to 2% for the first time since January 2021 after topping out at 9.7% in March 2022. Source: Bespoke

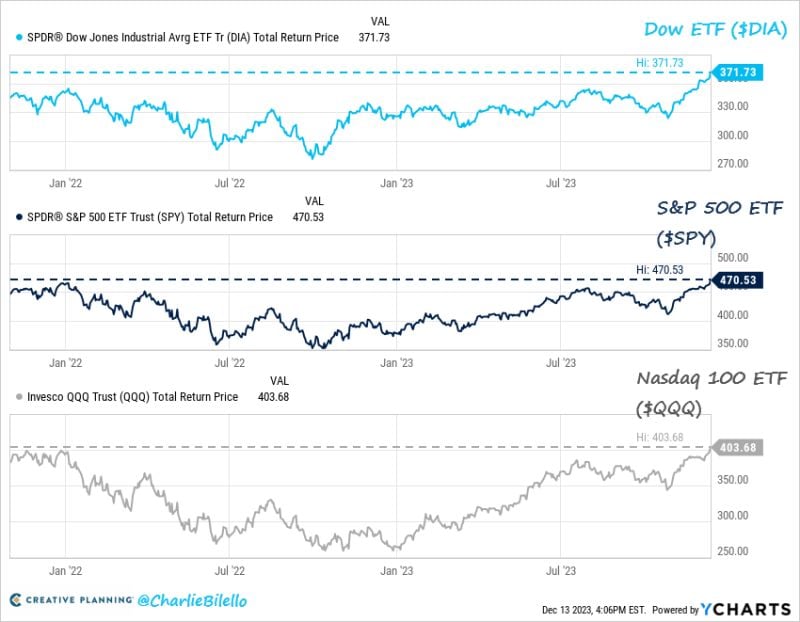

The Fed is finally giving up...

Fed holds rates steady but indicates three cuts coming in 2024. Indeed, the Dot Plot is adjusted down significantly more dovishly than expected, narrowing the gap to the market's expectation significantly... The US 10 year is down 20bp to 4%, the Dow surges by 300 points!

BREAKING: US House votes to authorize an impeachment inquiry into President Biden.

This escalates a probe that has been open for months. The House voted 221 to 212 to open the inquiry. Biden family finances and businesses are in focus. Another historic development in 2023. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks