Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

⚠️BREAKING:

*FED'S POWELL: IT IS NOT LIKELY WE WILL HIKE FURTHER *POWELL: POLICYMAKERS ARE THINKING AND TALKING ABOUT WHEN IT WILL BE APPROPRIATE TO CUT RATES Source: www.investing.com

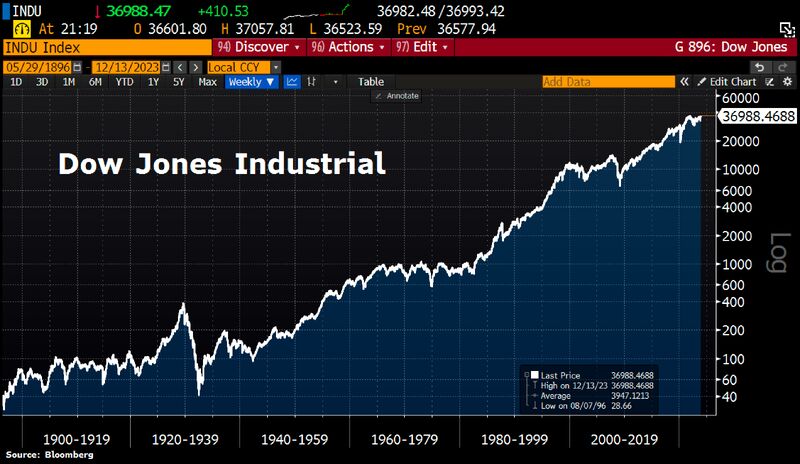

BREAKING: an ATH for the Dow > 37k !

The Dow Jones rose to its highest level ever following latest Fed meeting—which left rates unchanged & predicted 3 possible cuts in the coming year—as cheer continues to flood equities markets at year’s end. Breaking its prior ATH of nearly 37,000 set in January 2022 Dow rose >37k. Source: Bloomberg

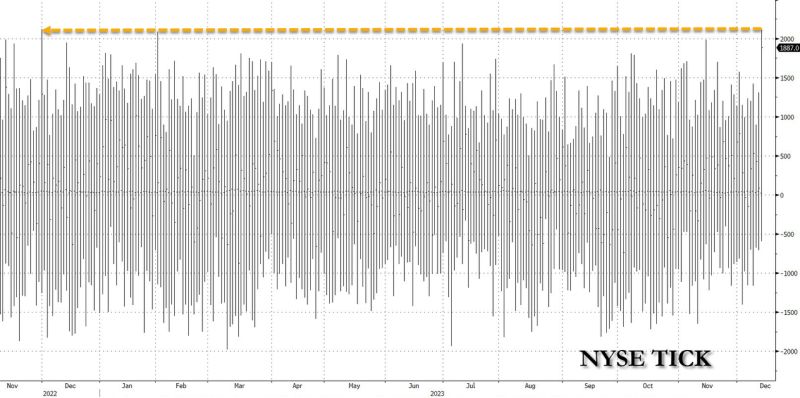

The Fed just triggered the biggest stock-buying program since Nov 2022...

Source: Bloomberg, www.zerohedge.com

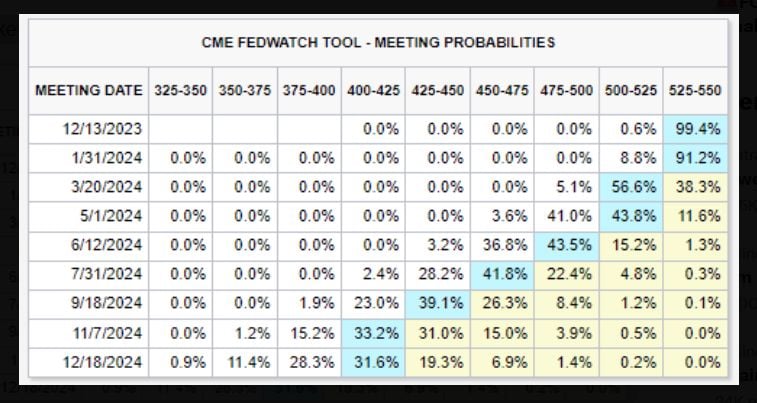

Interest rate futures shift to showing a ~57% chance of rate CUTS beginning in March 2024

Markets also see a growing 9% chance of rate cuts beginning as soon as next month. Futures are projecting a total of FIVE rate cuts in 2024. There's a 28% chance of 6 cuts and an 11% chance of 7 cuts in 2024. Meanwhile, the Fed just said they see just 3 rate cuts in 2024. So markets are still "fighting" the Fed. But the Fed is starting to adjust... Source: The Kobeissi Letter

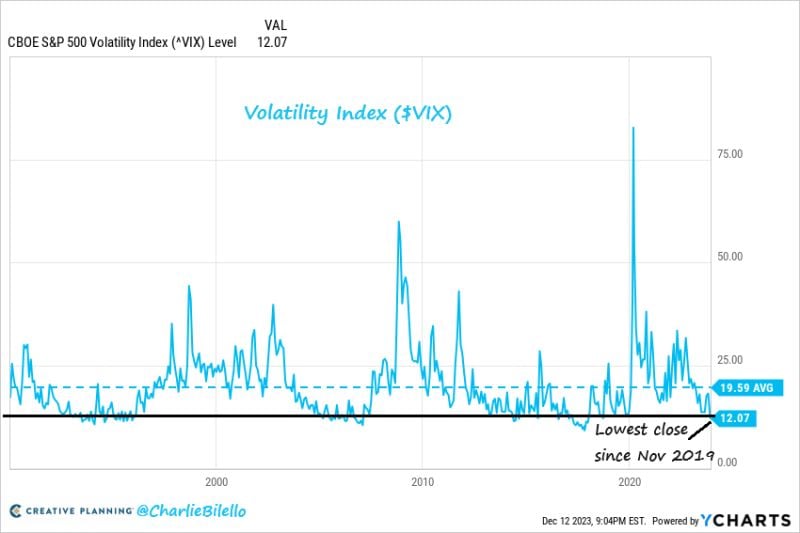

The $VIX currently stands at 12.07, its lowest close since November 2019

Soruce: Charlie Bilello

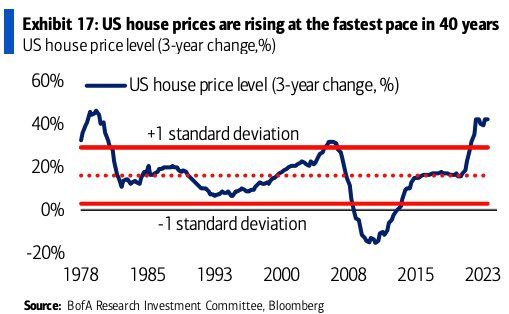

After 2 years of the most aggressive FED rate hike cycle since the 1980s, the price of US houses (3 years change) is rising at the fastest pace in 40 years...

that sounds a bit counterintuitive at first glance as most surveys show that the housing affordability is at record low Source: BofA

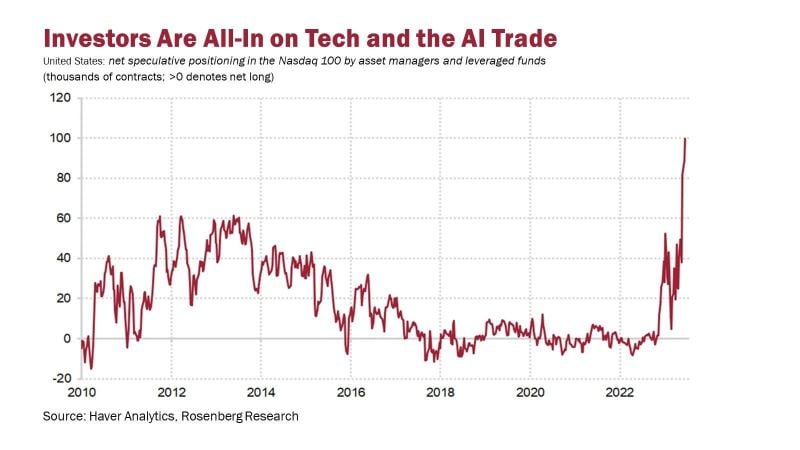

The tech and AI trade is very crowded. The net long positioning on the Nasdaq 100 by asset managers and leveraged funds is at a record high

Source: Haver Analytics, Rosenberg Research

Investing with intelligence

Our latest research, commentary and market outlooks