Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

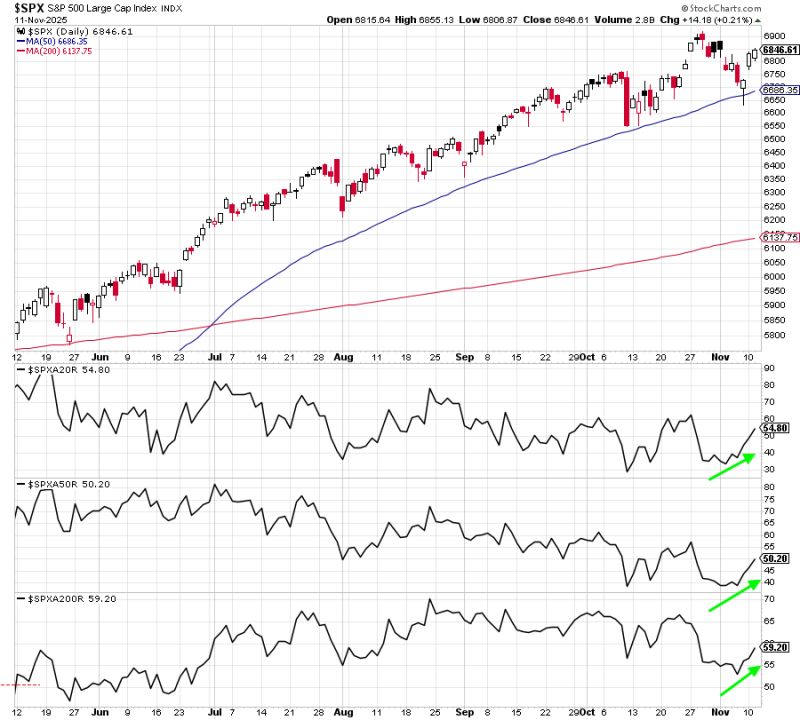

Under the surface, stocks continue to improve.

We keep hearing the opposite from Mr. Hindenburg, but fortunately we have the data to show what is really happening. Number of stocks above their 20-, 50-, and 200-day MAs are all moving higher the past week. Source: Ryan Detrick

What a chart... aluminum...

While most of the critical minerals talk in the US is about rare earths, something far more important is happening: US aluminum all-in costs have surged to a record as traders/smelters demand huge physical premia on top of LME prices due to Trump’s tariffs. Source: Javier Blas on X , Bloomberg

Bitcoin sentiment is as bad as it was at the 2022 low.

Source: Glassnode, Joe Consorti

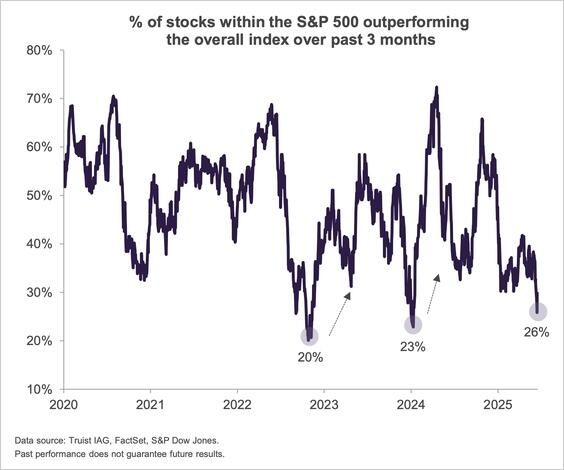

Only 26% of S&P 500 stocks have outperformed the $SPX over the last 3 months, one of the worst market breadth readings since 2020

Source: Goldman

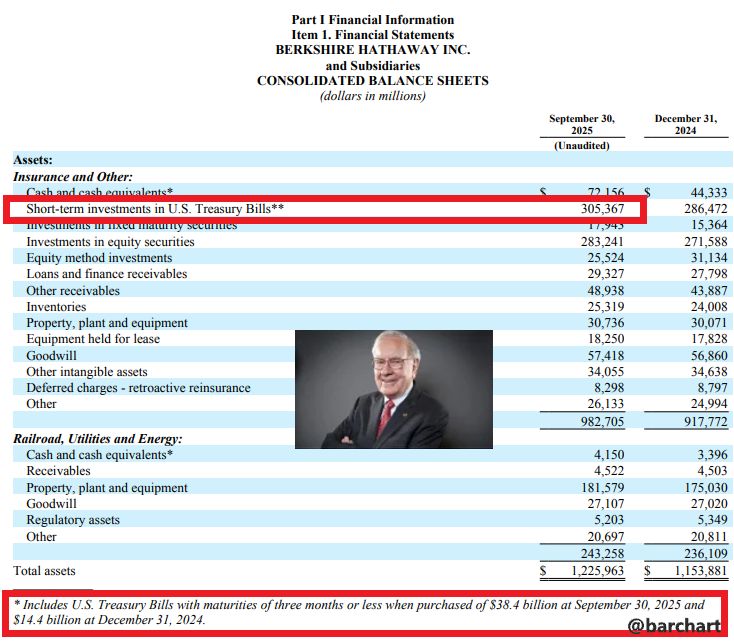

Warren Buffett now owns a staggering 5.6% of the entire U.S. Treasury Bill Market 🚨🚨🚨

Source: Barchart

🚀 Morgan Stanley: “The AI Memory Super Cycle Has Arrived — and It’s Unlike Anything We’ve Seen Before.”

Morgan Stanley says the new AI-driven memory super cycle will far surpass any past cycle — in scale, speed, and earnings power. 💡 Here’s what’s different this time: Led by AI data centers and cloud giants, not consumer devices. Price sensitivity is gone. Memory is now a strategic must-have, not a cost item. HBM (High Bandwidth Memory) demand is exploding, squeezing traditional DRAM supply. 📈 The numbers are jaw-dropping: Q4 server DRAM contract prices up ~70% (vs. 30% expected). DDR5 spot prices +336% since September. NAND up 20–30% — and still rising amid severe shortages. Enterprise SSD demand expected to surge 50%+ YoY by 2026. 🏭 Suppliers in control: SK hynix and Samsung now hold unprecedented pricing power. Morgan Stanley remains Overweight on both, expecting record profits and new share price highs. 🔥 The key insight: “This isn’t a typical memory cycle. It’s a structural shift — driven by AI inference workloads and hyperscaler demand. Earnings, not valuations, will define the peak.” 💰 Even after massive price hikes, memory is still below its last cycle peak ($1/Gb vs. $1.25 in 2018). Morgan Stanley sees further upside as AI capex accelerates. 📊 Bottom line: This AI memory super cycle is longer, stronger, and more profitable than any before. Morgan Stanley expects 2026–27 earnings 30–50% above market consensus for SK hynix and Samsung. “We’re in uncharted territory — this is not just a cycle. It’s a paradigm shift.”

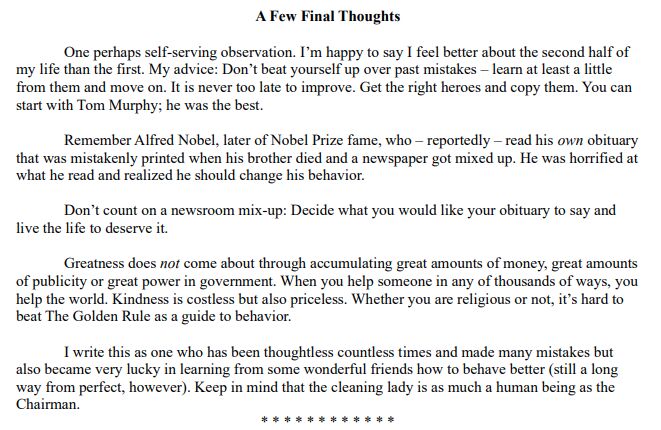

Buffett's few final thoughts in his final letter-

Source: Jeff Park @dgt10011

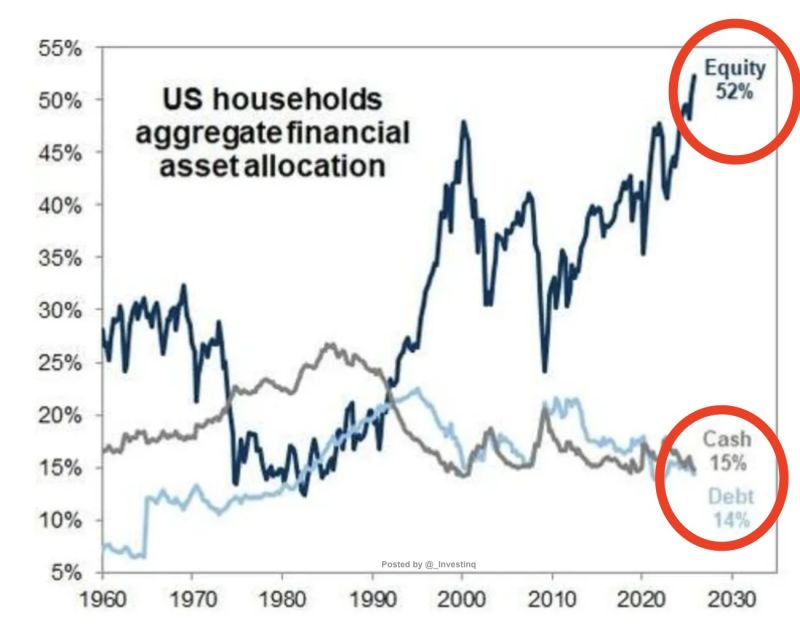

This is Historic: Retail investors own the risk.

Households are holding a record 52% in equities, up from 25% after 2008. That’s above every cycle before it. Source: Goldman Sachs, zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks