Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

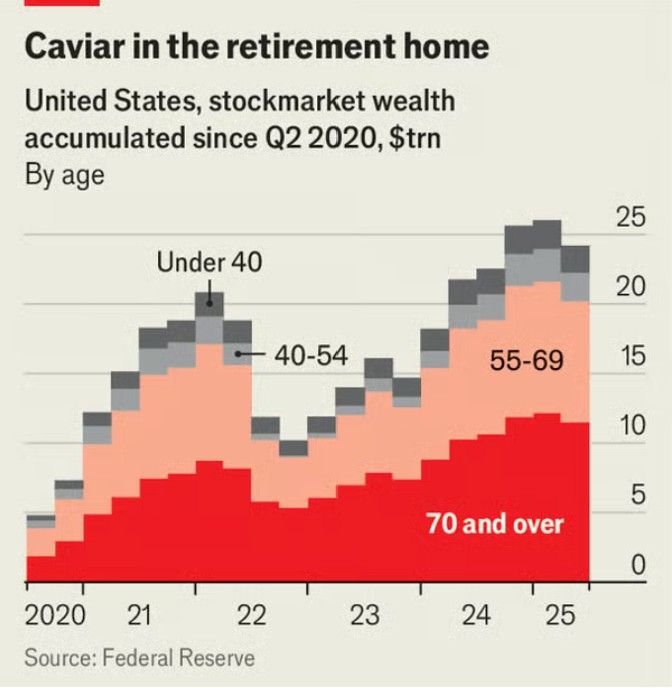

From @TheEconomist thru Mo El Erian on X:

"America’s surging stockmarket has been driven, most of all, by old investors.... Americans aged 70 and above now own 39% of all stocks and mutual funds (which mostly invest in equities), almost twice as much as was common from 1989 to 2009. The trend reflects a shift in outlook. Elderly Americans’ risk tolerance has shot up."

A very interesting article by the FT >>>

Key takeaways: ➡️ 1. Jensen Huang’s Warning Isn’t Just Self-Interest Although Nvidia benefits from greater global AI investment, Huang’s claim that China may win the AI race has substantive grounding. The argument isn’t only about chips—it’s increasingly about energy. ➡️ 2. AI Progress Is Becoming Limited by Electricity, Not Chips Training frontier models consumes massive electricity. A single GPT-4–scale model can use ~463,000 MWh/year — more than 35,000 U.S. homes. As AI workloads expand, data centre electricity consumption could more than double by 2030. By 2040, data centres may consume 1,800 TWh annually, enough to power 150 million U.S. homes. Conclusion: The bottleneck is shifting from access to high-end chips to access to cheap, abundant power. ➡️ 3. China Has a Structural Energy Advantage China is rapidly expanding renewable energy capacity: Added 356 GW of new renewable energy last year (solar + wind). Solar alone grew 277 GW, far exceeding additions in the U.S. Massive government-backed projects linking industrial policy and grid expansion: Solar in Inner Mongolia Hydropower in Sichuan High-voltage lines to coastal tech hubs Local governments also subsidize electricity for Chinese tech giants (Alibaba, Tencent, ByteDance), lowering the effective cost of AI training, even with less advanced chips like Huawei’s Ascend 910B. ➡️ 4. The U.S. Faces Growing Power Constraints U.S. wholesale electricity prices near data-centre clusters are up as much as 267% over five years. Investment in large wind and solar projects is declining due to policy and regulatory uncertainty. The White House has ended subsidies for wind and solar, slowing capacity growth. Outcome: The U.S. is adding compute demand faster than energy supply. ➡️ 5. Chip Superiority Alone May Not Decide the Winner Nvidia’s H100 and Blackwell chips still outperform Chinese alternatives. But the historical “chip supremacy” model may matter less as: Chip performance grows only single digits yearly. China’s energy capacity grows double digits yearly. More cheap power → more compute hours → more model training → faster innovation. ➡️ 6. AI Dominance Will Belong to Those With Cheap Energy The article frames AI as part of a much older pattern: Britain dominated through cheap coal. The U.S. dominated through oil and hydroelectric power. Now, AI dominance will go to those who can run the most computation, not just build the best chips. ‼️ Final takeaway: The future of AI power belongs to countries that can provide abundant, inexpensive electricity — and right now, China is building that capacity faster than anyone else

While we might not get any data on CPI this week, it is worth highlighting that alternative data seems to indicate a meaningful deceleration of CPI amid big drop in rents

(Note: over 33% of the inflation calculation is based on rental cost estimates). According to CoStar, there was -0.31% rent "growth" in October, his was the biggest drop in over 15 years. What is behind this sudden drop in rents? The plunge in immigration into the US, and the resultant drop in demand for rental properties. Reventure CEO Nick Gerli points out in the following thread, "the weakness in the rental market right now is alarming. It suggests there's much more deflationary pressure in housing/economy than people understand." And, as the Fed's Stephen Miran echoes now, "2026 will be a year where CPI drops" even more. But the disinflationary trend is not just visible in rents. OpenBrand, which tracks prices daily from online marketplaces, retail websites, and brick-and-mortar store listings, said price growth slowed across all groups but communications devices. Source: zerohedge

Anthropic commits $50B to build custom AI data centers across multiple US locations including Texas and New York.

Partnership with UK-based Fluidstack Ltd will bring sites online throughout 2026, creating 800 permanent jobs and 2,400 construction jobs. First major data center build Anthropic is developing directly rather than through cloud partners like Amazon or Google. Source: Shanu Mathew @ShanuMathew93

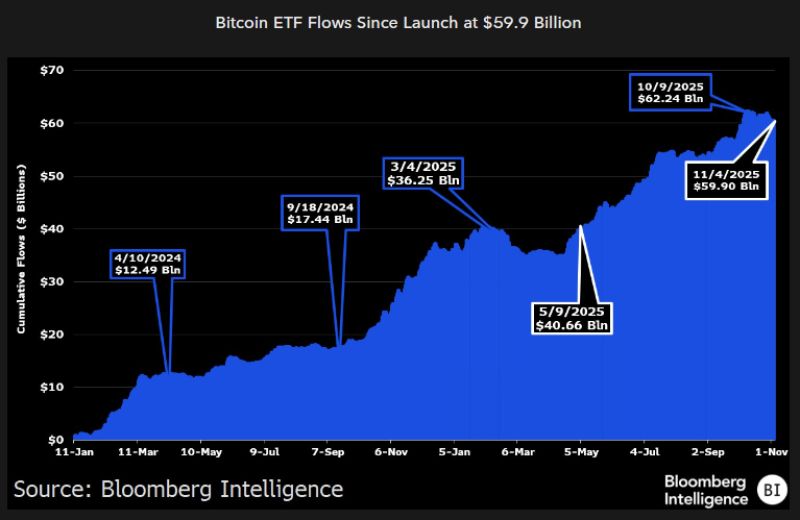

Bitcoin's 50-day moving average is a few days from crossing below the 200-day moving average.

Each cross marked a local bottom: • September '23 • September '24 • April '25 If BTC is still in a bull market, the local bottom is forming. Holding $100,000 remains crucial. Source: Joe Consorti, Bloomberg

About $2.7b has come out of the bitcoin ETFs in the past month

New chart from @JSeyff puts it into context, and shows the two steps forward one step back pattern, it represents just 1.5% of total assets = 98.5% of aum hanging tough. Source: Eric Balchunas, Bloomberg Intelligence

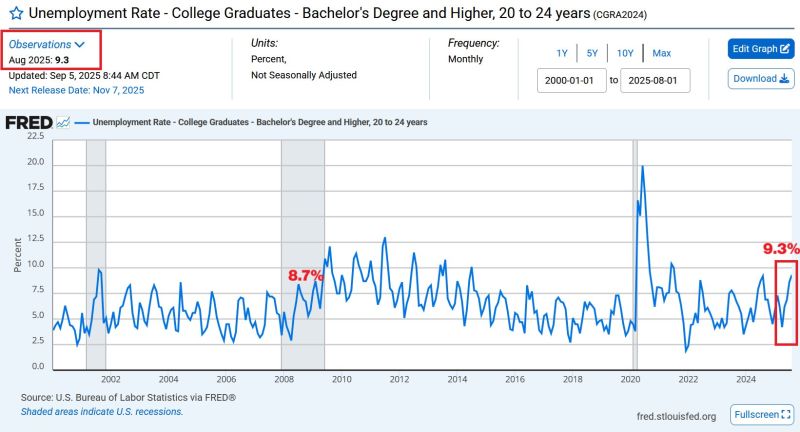

⚠️US college graduates' unemployment is now higher than during the Great Financial Crisis:

The unemployment rate for college graduates with a Bachelor's degree or higher hit 9.3%, the highest since 2021. This almost matches the 2001 recession peak of 9.5%. Source: Global Markets Investor @GlobalMktObserv

Auto loan delinquencies hit record for riskiest borrowers.

The share of subprime borrowers at least 60 days past due on their auto loans rising to 6.65% in October. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks