Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

$GOOGL versus $ORACL: what is the message from the market?

Here's a potential explanation by Mac10: "As a proxy for OpenAI stock which is private, we have OpenAI vendor Oracle as proof of the failure of the OpenAI economic model. Oracle is down -35% from the high in clear repudiation of the Ponzi financing model. Meanwhile Google is having its best seven months in company history which shows the superiority of the self-financed model. It's clear that market is saying that Google will "win" the AI arms race, meaning survive this endurance contest". Maybe a bit extreme. But can we say at least that Mr Market has his doubts about the belief there are economies of scale to AI which is why the market is rejecting the OpenAI vendor financing approach and goes "all-in" the self-financing model of Alphabet??? Source: Mac10

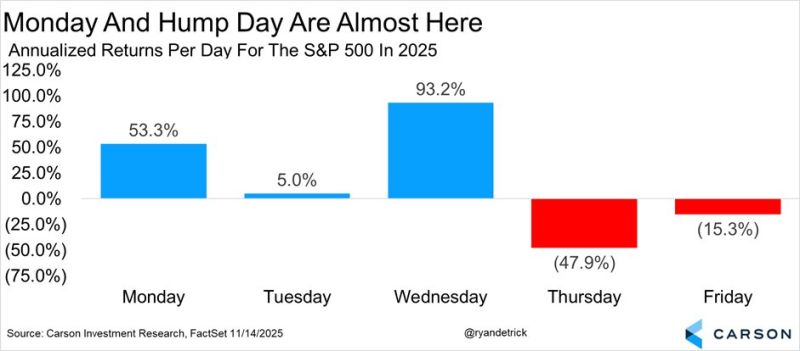

When you see the amount of freak-outs we've been seeing on Friday AM lately = tends to end with a higher Monday.

Can it happen again today? If so, that'll be 11 higher Mondays in a row. Source: Ryan Detrick, Carson

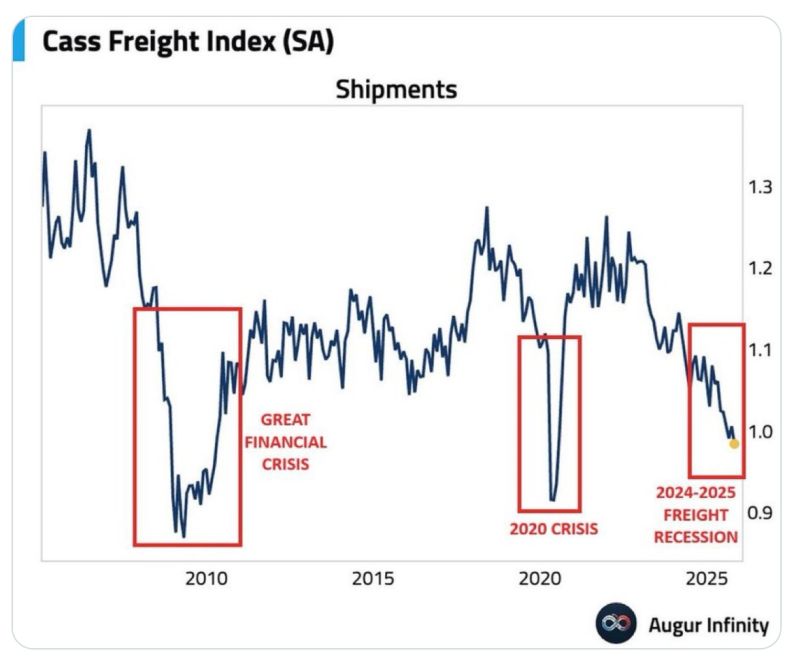

🚨 The Cass Freight Index just fell to 2009 crisis levels — should we worry?

Freight doesn’t care about narratives, headlines, or vibes. If shipments collapse, the real economy is hurting. Period. We’re now 3 years into a freight recession, and the index is still down 7%+ YoY. That means the actual movement of goods — the stuff that reflects real production and real demand — has stalled out. Here’s what’s driving the downturn: Consumer spending shifted from goods → services after the pandemic Retailers are still clearing the bloated inventories from 2021–2022 Manufacturing has been contracting for 8 straight months Tariff uncertainty is freezing new orders Trucking added too much capacity during the pandemic, and now rates are too low for carriers to survive A recovery will come… but only after: - Excess trucking capacity clears - Inventories normalize - Manufacturing turns back up The big takeaway: The freight collapse is telling us the goods recession is real — even if the stock market looks unstoppable. Source: Election wizard on X, StockMarket.news, AUgur Infinity

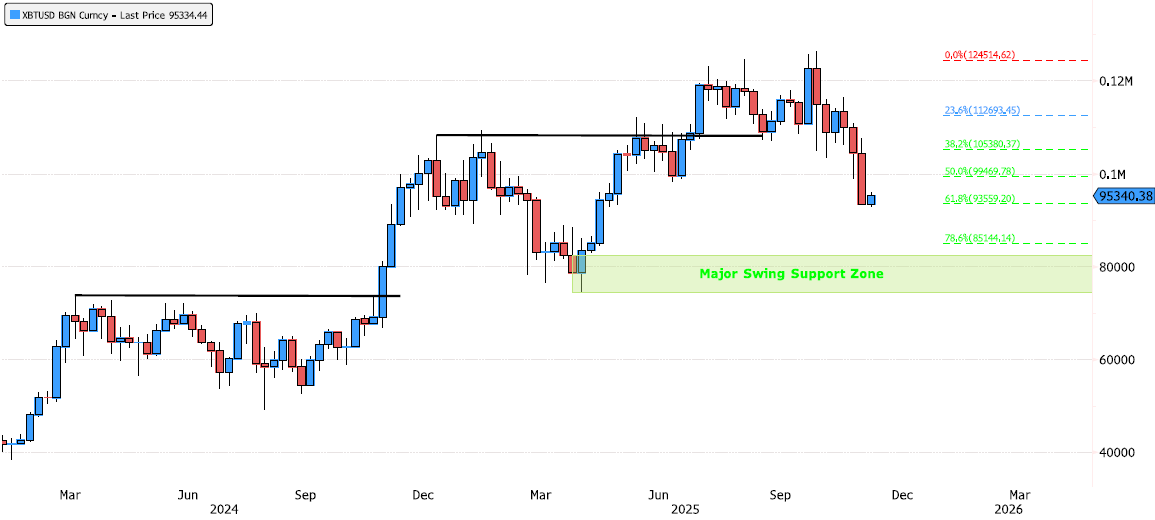

Bitcoin – Next Support Levels

Bitcoin has consolidated 26% since the October highs! Now trading in the discount zone (below the 50% Fibonacci retracement). 👉 Key levels to watch: Imbalance zone: 86'450 – 92'850 Major swing support: 74'424 – 82'531 ⚠️ Critical level that must hold: 74'424 Now it’s all about looking at price action in these key areas. Source: Bloomberg

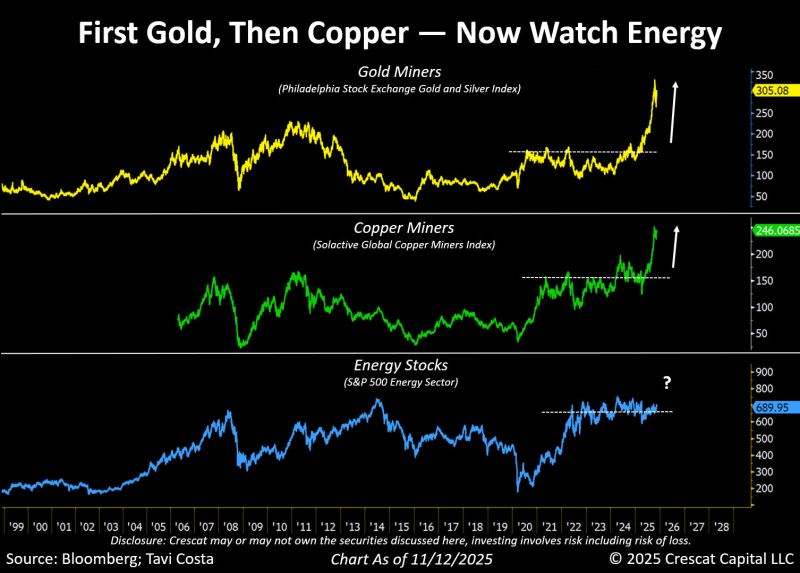

Gold stocks broke out of a major consolidation.

Copper miners followed with almost the same pattern. Are energy equities next? Source: Tavi Costa

Mom, can you come pick me up?

I'm scared. Source: Trend Spider

🔥 OpenAI’s “Go Big or Go Bust” Strategy Just Went Public — and the numbers are insane.

According to leaked financials, OpenAI is preparing to lose $74B in 2028 alone — yes, one year — before expecting to swing to real profitability by 2030. What about this year? $13B in revenue $9B in cash burn A burn rate of ~70% of revenue ‼️ And it only gets wilder: OpenAI expects three-quarters of its 2028 revenue to be wiped out by operating losses. Meanwhile, competitor Anthropic expects to break even in 2028. OpenAI expects to burn $115B cumulatively through 2029. OpenAI’s commitments: Up to $1.4T over 8 years for compute deals Nearly $100B on backup data-center capacity Aiming for $200B in revenue by 2030 (a 15x jump from today) 💡 The read-through: This is the biggest strategic divergence in AI right now: Anthropic = disciplined scaling OpenAI = moonshot economics OpenAI is effectively saying: “We’ll lose tens of billions now to own the entire future later.” But there’s a catch: 95% of businesses still get zero real value from AI today. And OpenAI is funding its hyperscale buildout not from revenue (like AWS did), but from debt, investors, and chip-supplier deals — while losing money on every ChatGPT interaction. This ends one of two ways: 🚀 The most valuable company in history 💥 Or a case study in overestimating demand There’s no middle lane when you’re burning cash faster than any startup in history... Source: hedgie on X

Bitcoin's weekly RSI is at its most oversold level since the April bottom, the end of last summer's 'chopsolidation', and the end of the last bear market.

Source: Joe Consorti @JoeConsorti

Investing with intelligence

Our latest research, commentary and market outlooks