Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

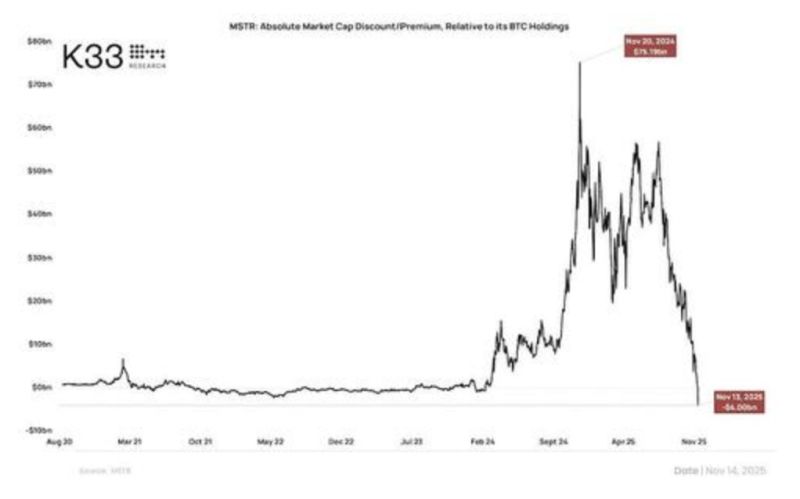

Is Michael Saylor's Strategy under attack?

Its mNAV is now negative - i.e the company's market cap is less than its BTC holdings.. Source: zerohedge

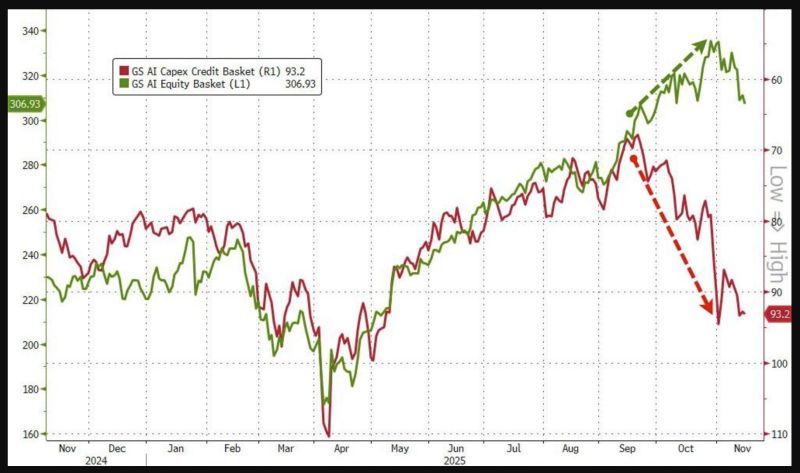

Credit spreads of the hyperscalers (red line - inverted) continue to widen out...and start to put donward pressure on AI equity basket (green line)

Source: Zerohedge

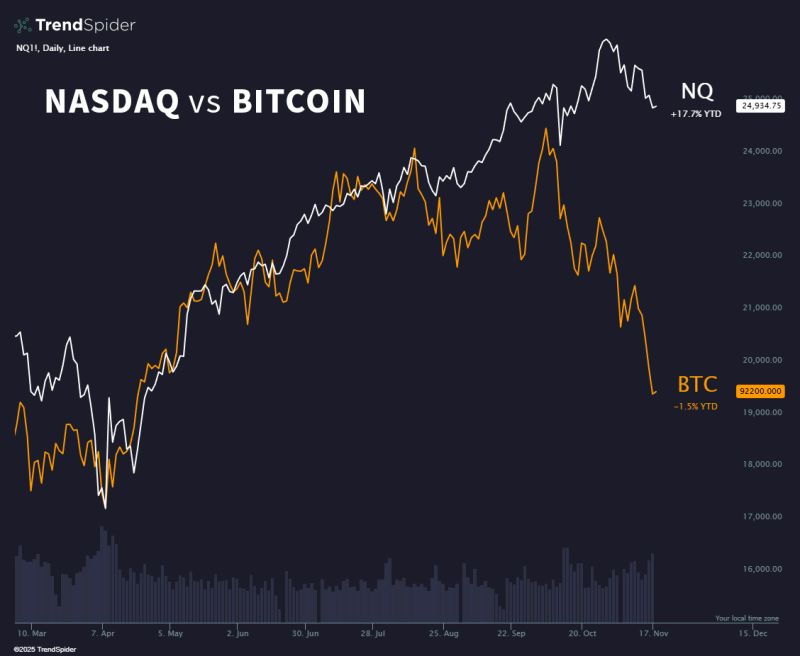

The spread between tech and Bitcoin is stretched to historic extremes.

Either $BTC reclaims ground, or $NQ has unfinished business on the downside. Source: Trend Spider

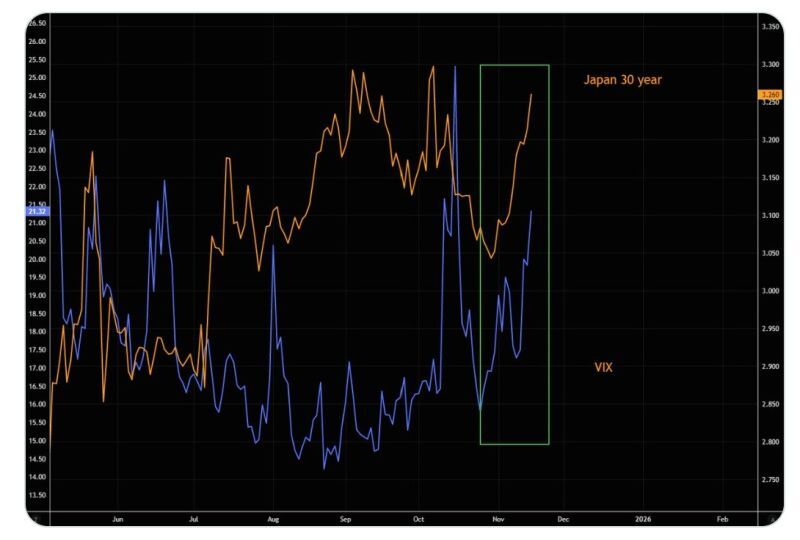

Why You Always Watch Japanese Rates.

Source: The Market Ear @themarketear

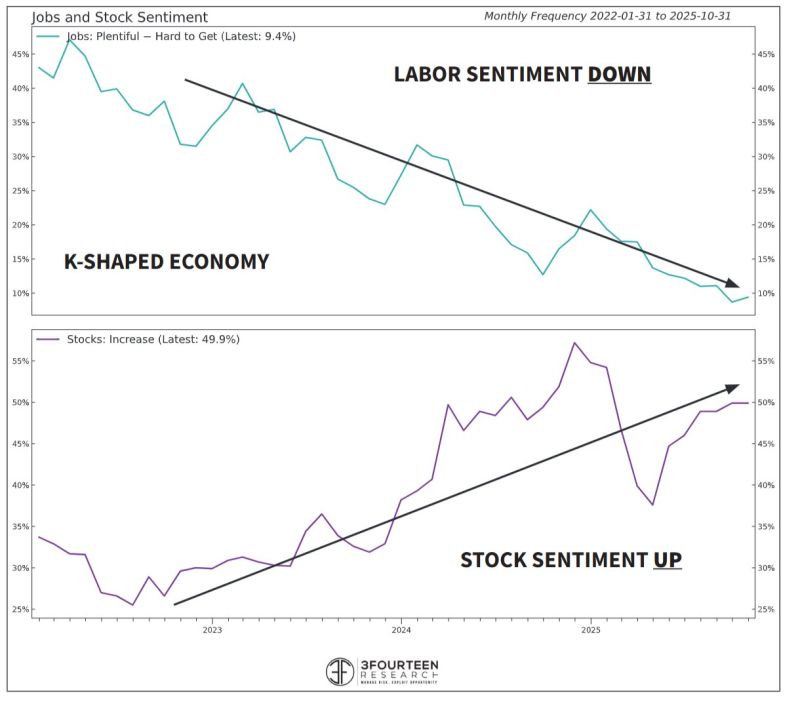

WALLER: Supports a December cut...citing "a weak labor market and mon pol that is hurting low and middle-income consumers."

Waller has been a Fed leader and, whether his view of a Dec cut prevails, the Fed will eventually be forced to respond to the lower-K. Source: 3fourteenresearch

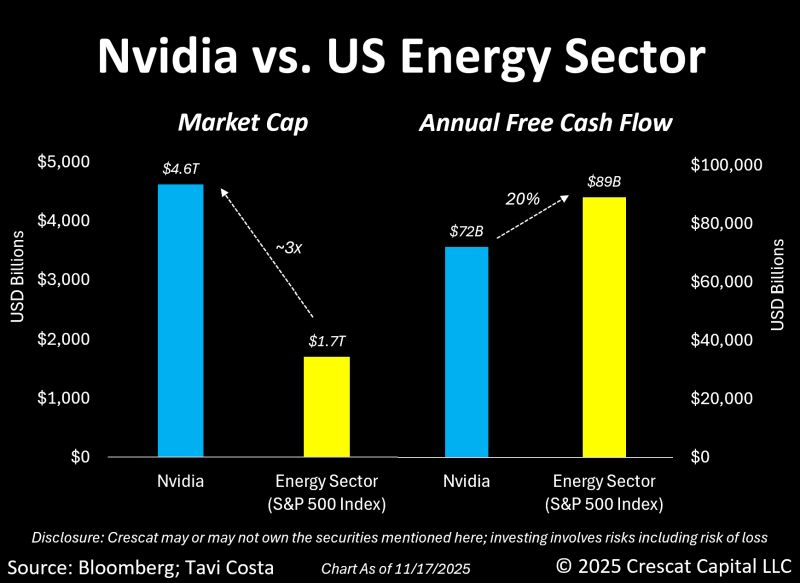

As highlighted by Tavi Costa, Nvidia is now valued at nearly three times the entire energy sector.

Almost three times. And no, it doesn’t generate more profit than energy companies in the S&P 500. In fact, the combined free cash flow of this sector over the last year is about 20% higher than Nvidia’s. Tech innovation is incredible, but let’s not forget that something still has to power it. Source: Tavi Costa, Bloomberg

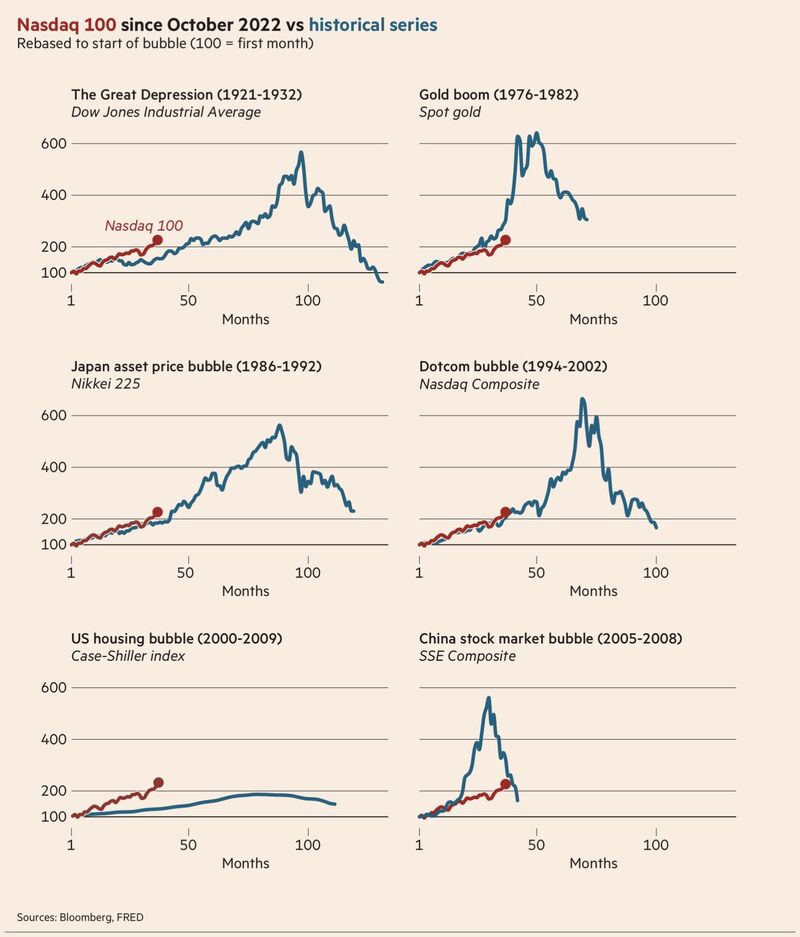

”The AI Bubble” in perspective.

What if the doomsayers are right but they have been, and they continue, miss the last +30% of the ”bubble” for their told-you-so moment? This is indeed what already happened most of this year. Source: Emre Akcakmak, Bloomberg, FT

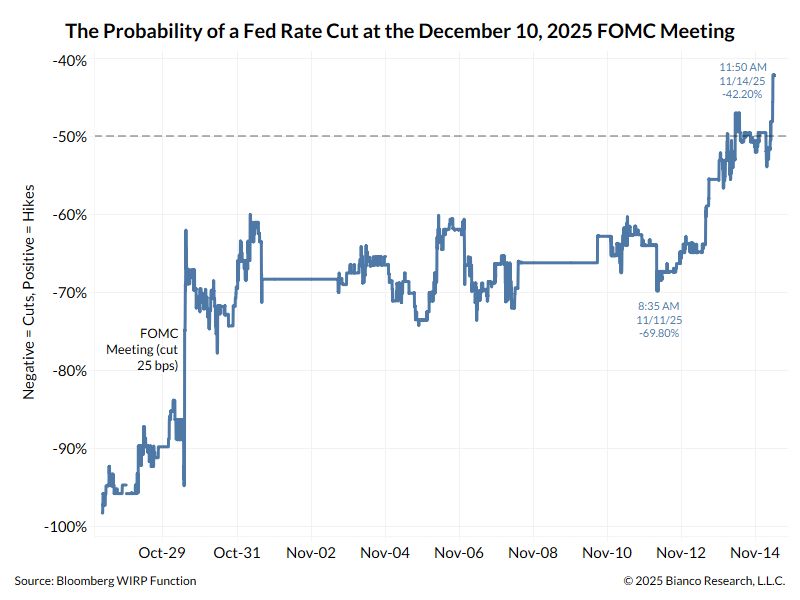

According to Jim Bianco, significant change is now underway at the Fed.

Last week, the probability of a Fed rate cut at the December 10th meeting went from 70% on Monday to 42% on Friday. However: - There were no major government data releases, as the Government was still closed until Wednesday - The Federal Reserve chairman did not speak this past week. So what drove this shift in the outlook for policy? Here's an explanation by Jim Bianco: * 4 Fed voters are arguing for another rate cut (with Miran arguing for at least a 50 bps cut). * 5 voters are arguing for holding rates steady * 3 voters are either neutral or unclear (so far) on how they will vote. This includes Chair Powell. For 40 years, Fed policy was effectively set by one person, the chair. The monetary policy vote was typically 12-0 or 11-1. The Fed justified this unified front by saying it reduced market uncertainty, thereby making it more effective. Now this is changing, and so is the market’s view of the Fed. With higher-than-normal uncertainty, the market is pricing a 50/50 chance of a cut. Normally, these odds are much closer to 0% or 100% when a meeting is less than a month away. What Changed? We would argue Trump’s constant bashing of the Fed/Powell and Fed Governor Miran’s vocal arguments for a 50 bps cut appear to be breaking the 40-year stranglehold the Fed chair has had over committee voting. No longer are the 12 FOMC voters going to fall in line with the chair’s desires. They are quickly considering themselves truly independent voters and will vote as they see fit. Maybe Fed Governor Stephen Miran is leading the way. If he can ignore the Fed groupthink and act completely independently, publish blog posts explaining his rationale, and do numerous interviews to explain his opinion, then why can’t everyone else? The result is 12 truly independent voters. This is how every other major central bank and the Supreme Court operate. If this is truly happening, it marks the end of the Fed’s unanimous voting.

Investing with intelligence

Our latest research, commentary and market outlooks