Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

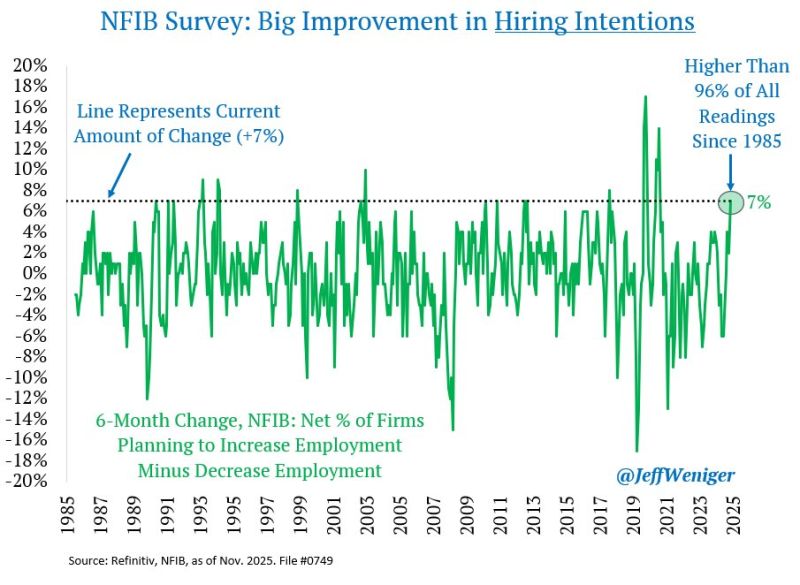

Here's a chart that shows the US labor market is improving - and not deteriorating.

The NFIB Small Business Optimism survey saw a rise in the number of firms who plan to increase employment versus decrease employment. Over the last 6 months, the rate-of-change exceeds 96% of all periods since 1985. Source: Jeff Weniger

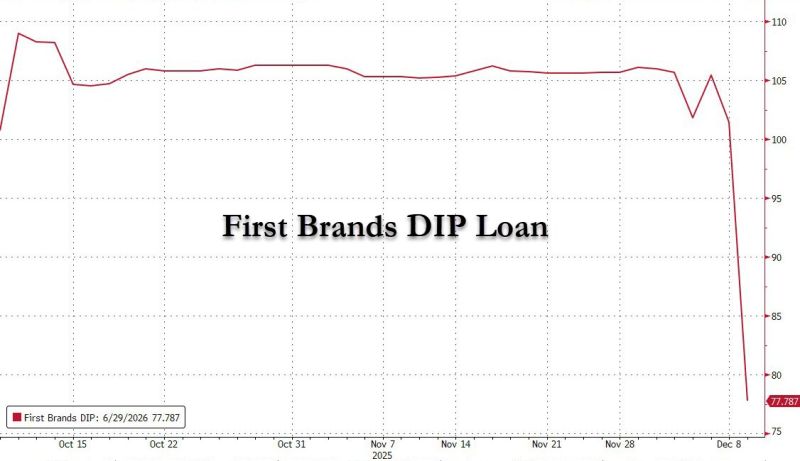

It looks like those who did zero homework on the First Brands term loans did exactly zero homework on the First Brands DIP loans.

A DIP (Debtor in Possession) loan is a form of financing that is provided to companies facing financial distress and who are in need of bankruptcy relief. In other words, the main purpose of DIP financing is to help fund an organization out of bankruptcy. Source: www.zerohedge.com, Bloomberg

🚨 In case you missed it...

JPMorgan cracked nearly 5% yesterday after the bank told investors that it will spend billions of dollars more in expenses ...

Oracle 5Y CDS graph looks exciting $ORCL until you run the math and realize that it is only pricing in 1.93% probability of default per year.

And a 9% 5 year cumulative probability of default... Historically, ORCL CDS traded around 20–40 bps, so 117 bps represents a material repricing of risk, but not a distressed profile. Source: Special Situations 🌐 Research Newsletter (Jay) @SpecialSitsNews

"Low hire, low fire... low quitting"

In the US, number of quits plunges to 5 years low, as hiring slide accelerates Source: zerohedge

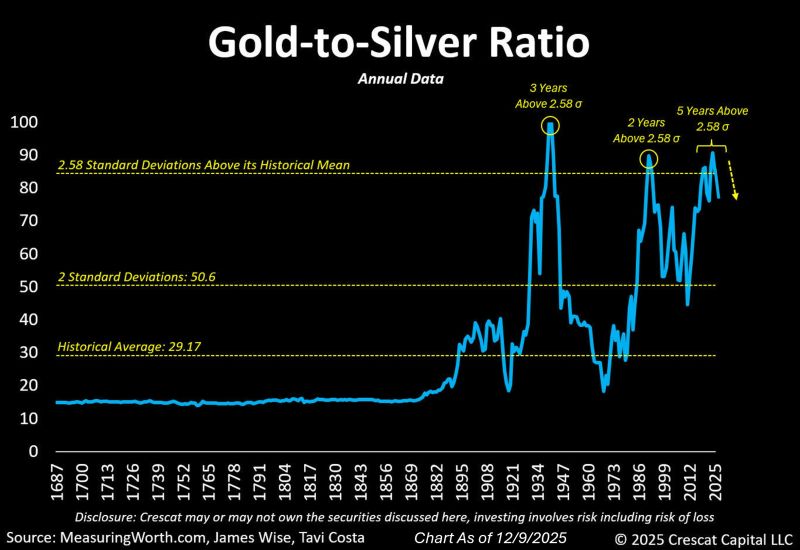

The gold-to-silver ratio is starting to move abruptly, as it often does after reaching extremely elevated levels.

Source: Tavi Costa

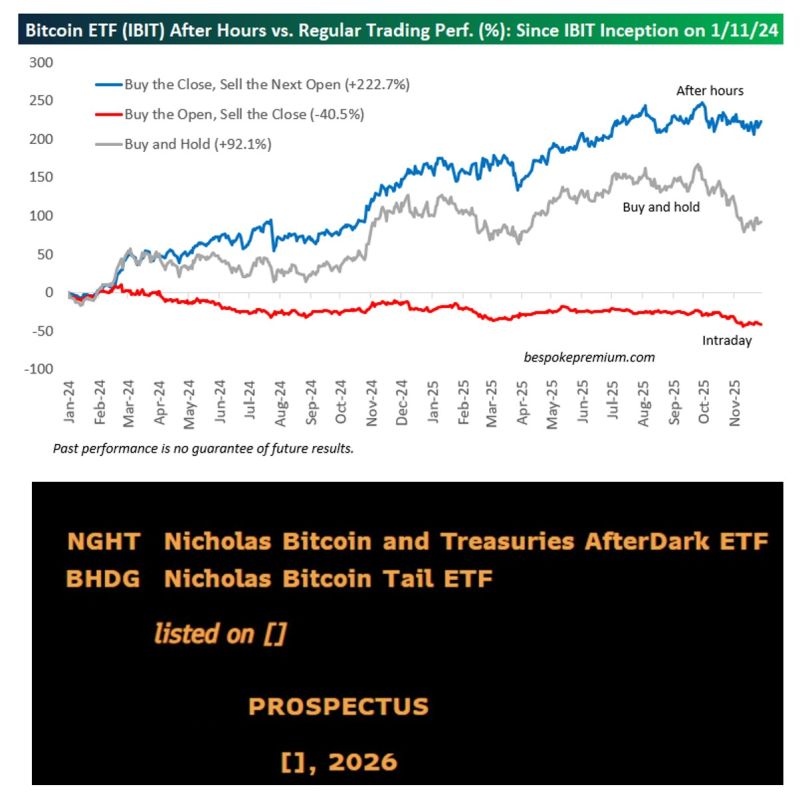

Sounds like a very interesting strategy...

Bespoke shows how you can outperform $IBIT with a simple strategy: buy the (NYSE) close, sell the (NYSE) opening... Since the iShares Bitcoin ETF $IBIT began trading, had you only owned it after hours (buy the close, sell the next open), it's up 222%. Had you only owned intraday (buy the open, sell the close), it's down 40.5%. (Past performance is no guarantee of future results.) Results have been so impressive that Nicholas just file for an ETF that replicates this strategy: NICHOLAS BITCOIN AND TREASURIES AFTER DARK ETF (NGHT) will only hold bitcoin at night, buying it when the US market closes and selling it when it opens. Source: Bespoke, Eric Balchunas, Bloomberg

In case you missed it...

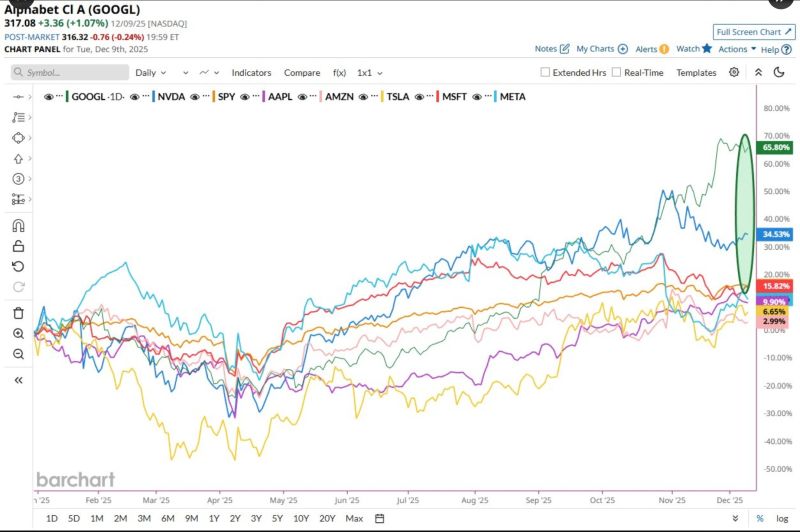

Alphabet $GOOGL and Nvidia $NVDA are now the only 2 Magnificent 7 stocks that are outperforming the S&P 500 this year Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks