Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

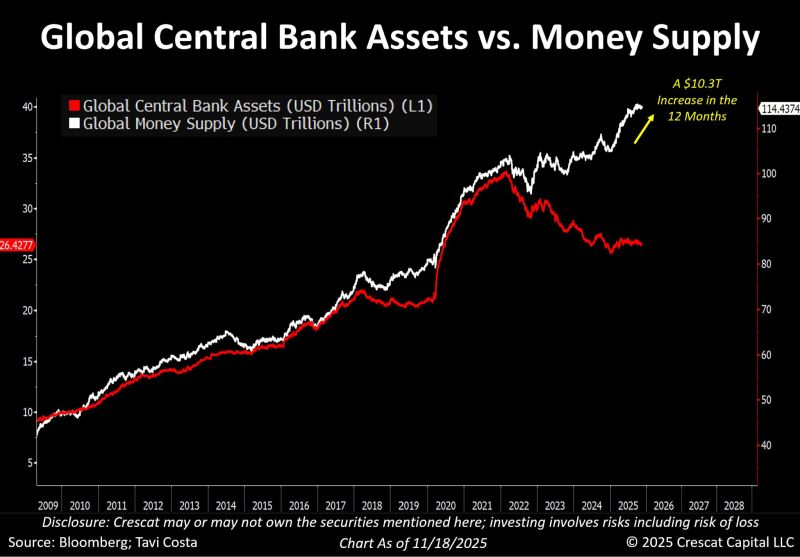

Very interesting to see money supply expanding this aggressively even as global central bank balance sheets have been contracting.

What will happen once central banks inevitably need to expand their balance sheets again? Source: Tavi Costa, Bloomberg

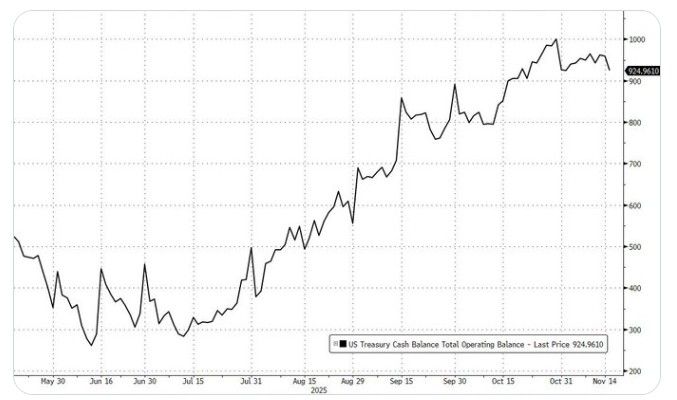

First notable slide in TGA (Treasury General Account):

Treasury cash is down $34BN to $925BN from $959BN Source: www.zerohedge.com, Bloomberg

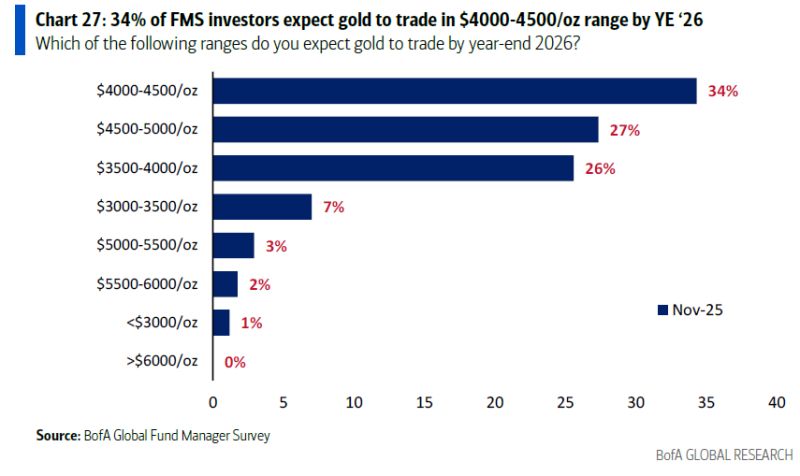

Only 5% of Fund Managers expect gold to trade above $5,000 by the end of 2026, none over $6,000

Source: BofA

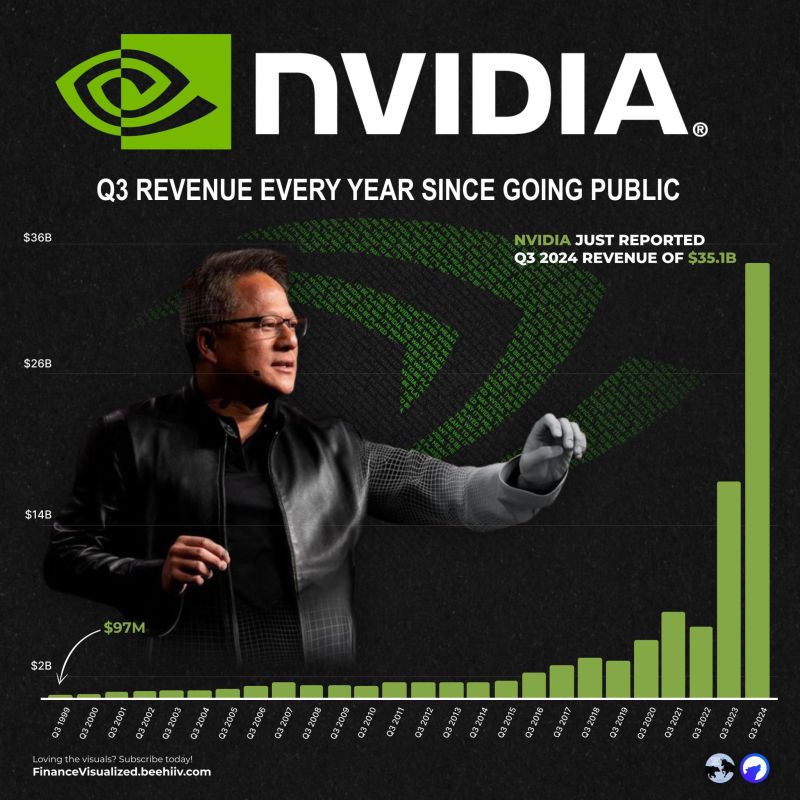

This chart will get soon updated

Wall ST is expecting Nvidia $NVDA to report revenue of $54.9 Billion tomorrow up from $35.1B in the same quarter last year Source: Wolf, https://lnkd.in/enK2fikS

⚠️Retail investors are ALL-IN on US equities:

Individual investors' equity allocation hit 70.5%, near the highest since the 2000 Dot-Com Bubble burst. This is also in line with the 2021 meme stock frenzy peak. Their cash allocation remains historically low at 14.7%. Source: Global Markets Investors

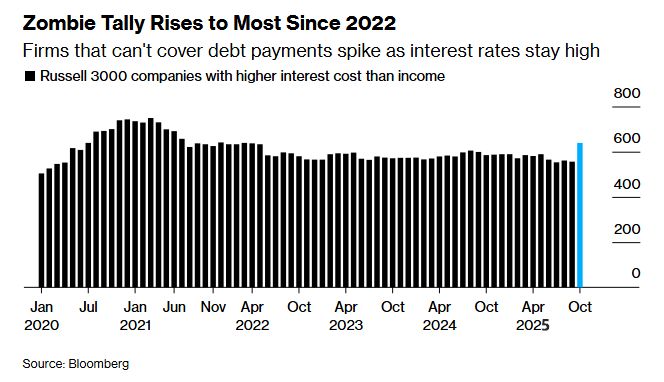

Zombie Companies (businesses unable to cover their debt payments) have reached the highest level in almost 4 years 🚨🚨🚨

Source: Bloomberg

We actually got some US macro data yesterday.

Better than expected survey data for the New York Manufacturing sector along with a jump in construction spending (handily beating the expectations of a small decline), both prompted a further decline in rate-cut odds for December (down to less than 40%)... Source: www.zerohedge.com, Bloomberg

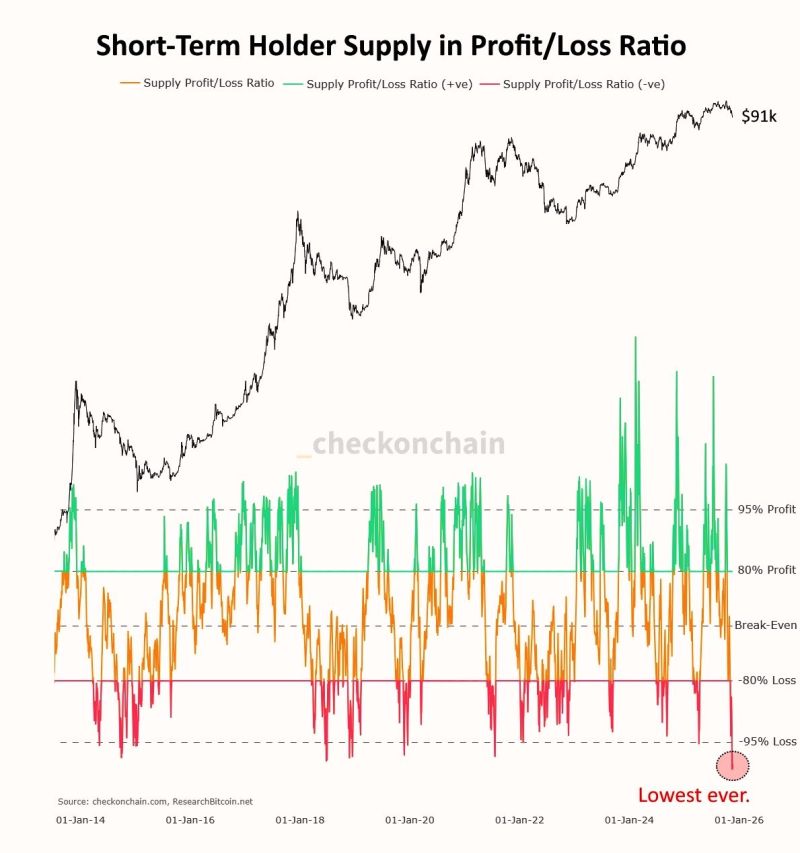

The short-term holder supply in profit/loss ratio is the lowest it’s ever been in the history of bitcoin.

Indeed, 95% of bitcoin $BTC held by short-term holders, those who bought less than 155 days ago, is underwater. Even with two 30% drawdowns this cycle, the speed and severity of the current drawdown have made it much more severe. Source: Joe Consorti, Frank @FrankAFetter

Investing with intelligence

Our latest research, commentary and market outlooks