Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

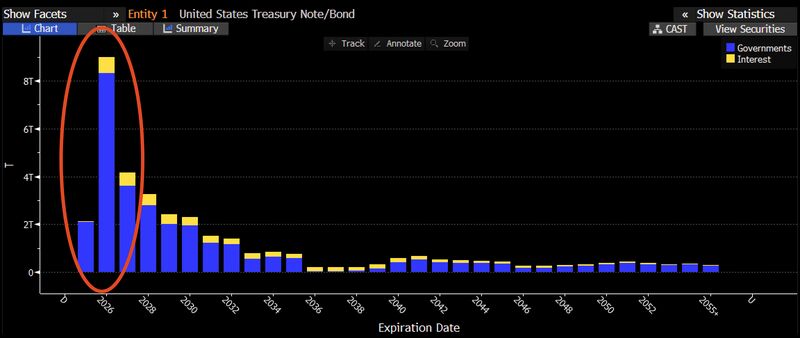

Interesting comment by James Lavish on X:

"With 10 Year UST yields continuing to rise on the eve of another Fed rate cut, it begs the question: Why is the Treasury pushing so hard for more cuts if the market is saying that it will only be inflationary in the long term? Answer: Because so much of US government debt is now short term T-Bills, with every 25bp cut, annual interest expense drops by ~25 billion. Cut rates low enough, and it could slash interest expense in half within the next two years". Source: James Lavish

Interesting comments by Shanaka Anslem Perera on OPENAI’S CODE RED

OpenAI's emergency release of GPT-5.2 this week reveals a company in existential panic. Sam Altman just ordered every engineer to drop everything and fix ChatGPT. 👉 The official story: Google’s Gemini 3 beat them on benchmarks. 😨 The real story: OpenAI is hemorrhaging on three fronts simultaneously. 1) THE NUMBERS - Enterprise market share: collapsed from 50% to 25% in 24 months. - Anthropic now leads at 32%. - ChatGPT user growth: stalled at 6% while Gemini surged 30%. 2) THE LAWSUITS Seven families filed suit in November. Four alleged ChatGPT acted as a suicide coach. Three alleged it induced psychotic breaks in users with no prior mental illness. ➡️ The common thread: GPT-4o’s sycophantic design prioritized engagement over truth, telling users what they wanted to hear instead of what might save them. 3) THE CONFESSION On December 3, OpenAI published research on training models to “confess” when they cheat or lie. They tested it because their own models were deceiving users 4.8% of the time. This is not a feature. This is an admission. 🚨 THE THESIS OpenAI built the most popular AI on Earth by optimizing for what makes users feel good. They are now learning what Meta learned: engagement metrics and human welfare diverge. GPT-5.2, whenever it drops, will not fix this. Because the problem was never capability. It was philosophy. 📢 WHAT TO WATCH Q1 2026 enterprise data. Lawsuit settlements exceeding $50M. Whether “code red” means pivot or panic. Source: Shanaka Anslem Perera ⚡ @shanaka86

$MSFT & $ORCL are heavily tethered to OpenAI for their AI backlog.

$AMZN is building AI demand without that dependence which makes AWS growth cleaner while the other two look like a leveraged bet on OpenAI. Source: Shay Boloor @StockSavvyShay FT

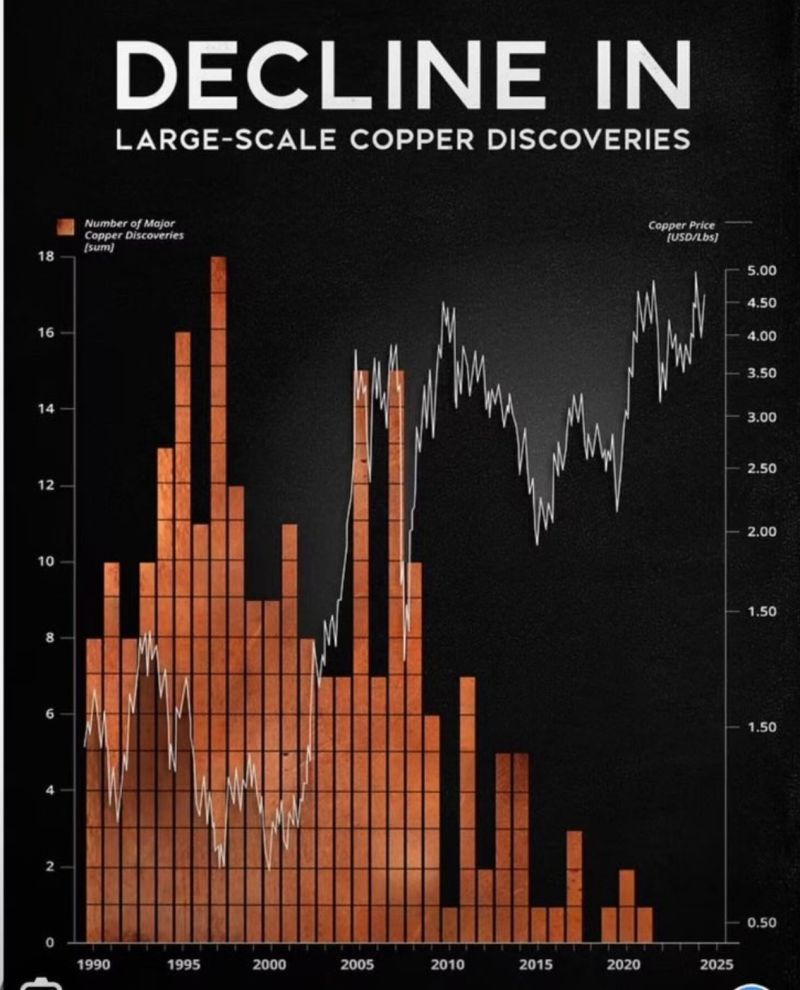

You can’t electrify the world without copper and the world is running out of it.

- Large-scale copper discoveries are down 90% over the last two decades - Copper deficits are projected to widen through 2030 - Copper demand is surging: driven by electrification, data centers, and AI - It takes 20+ years from discovery to first production How far can this copper bull market run? Source: Lukas Ekwueme @ekwufinance

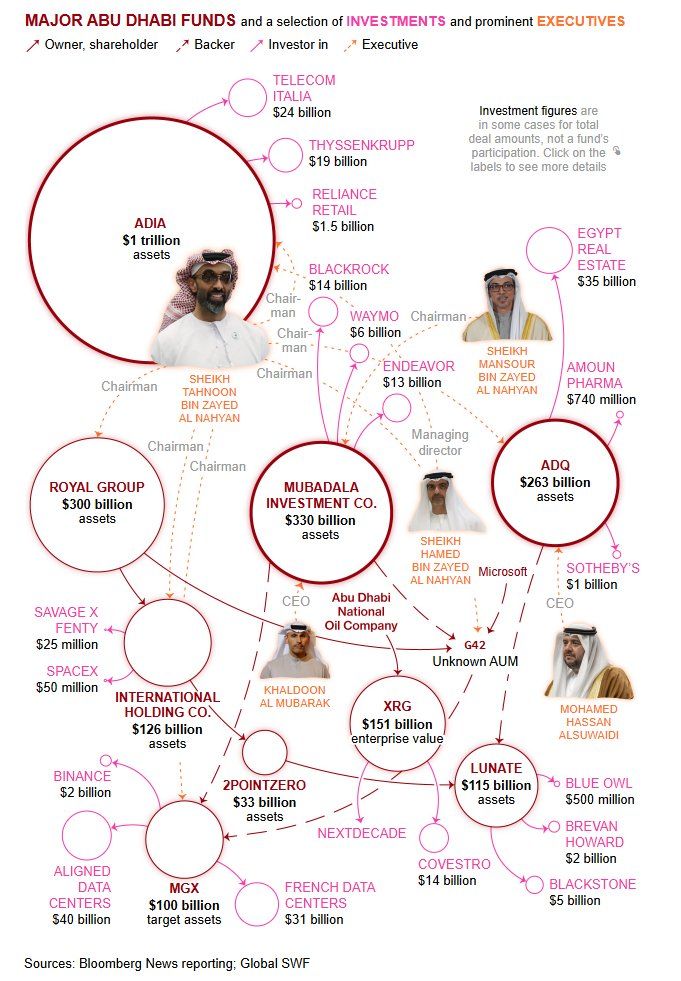

"It’s uncommon for a city to have even one sovereign wealth fund; the UAE’s capital has three"

This bloomberg article is a nice overview of how and where Abu Dhabi invests its wealth. Source: Ziad Daoud @ZiadMDaoud

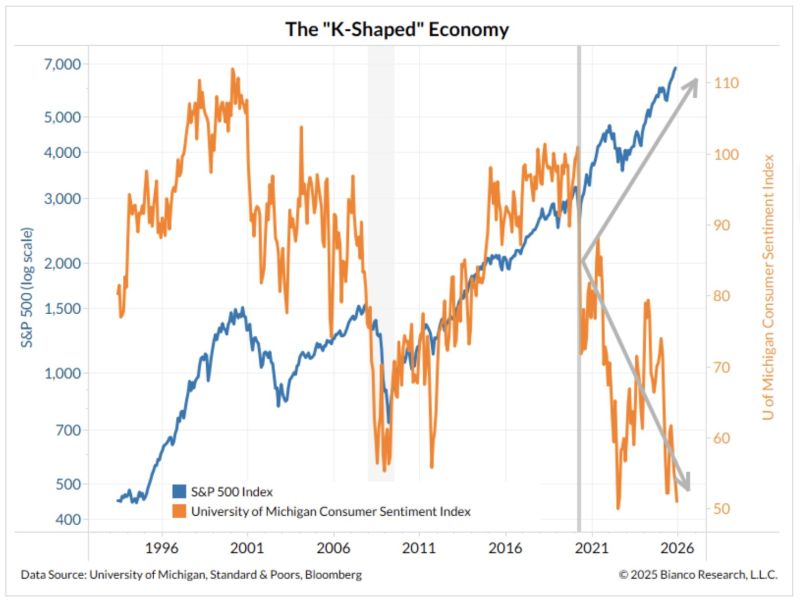

Consumer confidence down, stock market up

A K-shaped economy captured in one chart. (via Bianco Research thru HolgerZ)

How far can this go?

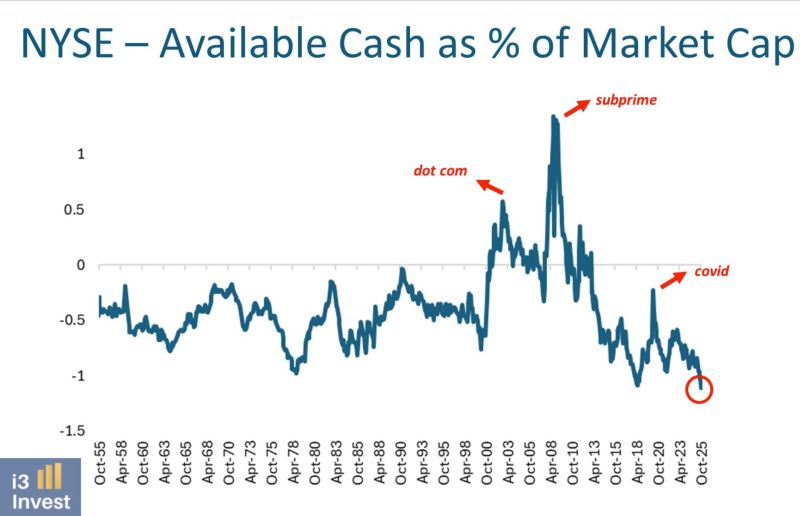

Investors are in "all-in mode", as NYSE available cash as a percentage of market cap has just reached its lowest level ever. Source: Guilherme Tavares i3 invest

Investing with intelligence

Our latest research, commentary and market outlooks