Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The main takeaways from the Federal Reserve’s updated forecasts:

- Economic growth was revised up (1.9% for 2025 and 2.1% for 2026 when adjusted for the effects of the shutdown, per Chair Powell) but still looks low overall given other indicators. - “Somewhat elevated” inflation is persisting, which Chair Powell attributes to tariffs, with upside risk in the short term. - Weakening labor market with an unclear balance between demand and supply side influences. - Expected decoupling of growth from employment. - Relatively upbeat on productivity but not willing to attribute this to any large extent to AI. Side note: Yes it sounds weird that the Fed is cutting rates while upgrading economic growth forecasts. But their target is mainly the weakening job market. Source: El Erian

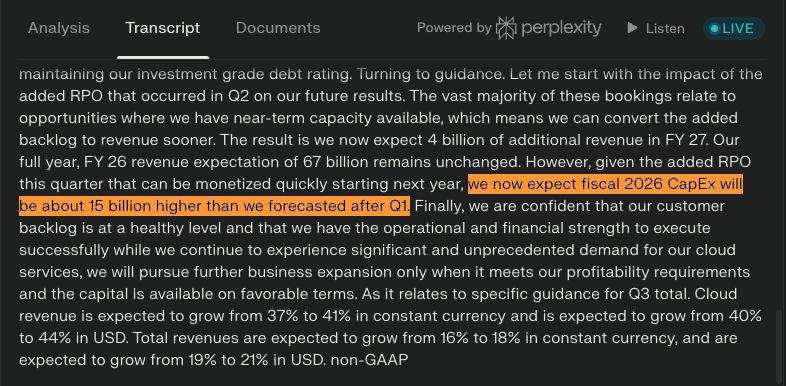

ORACLE $ORCL: We now expect fiscal 2026 CapEx will be about 15 billion higher than we forecasted after Q1.

Source: Wall St Engine @wallstengine

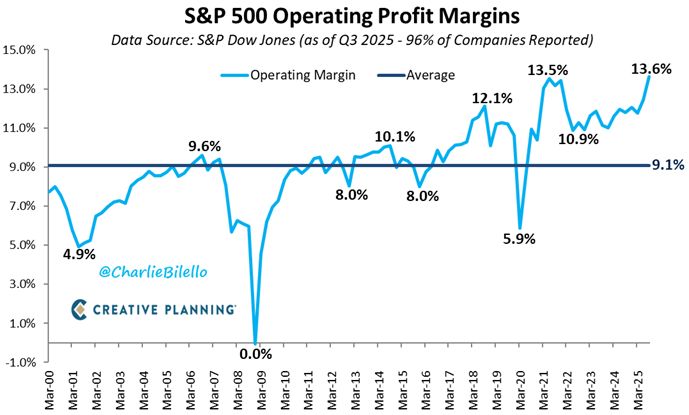

S&P 500 profit margins rose to 13.6% in the 3rd quarter, their highest level in history.

Source: Charlie Bilello

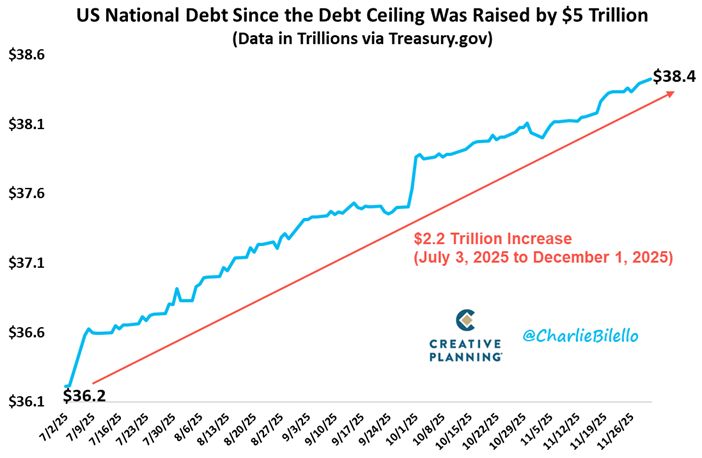

The US National Debt has now increased by $2.2 trillion since the Debt Ceiling was raised back in July.

Source: Charlie Bilello

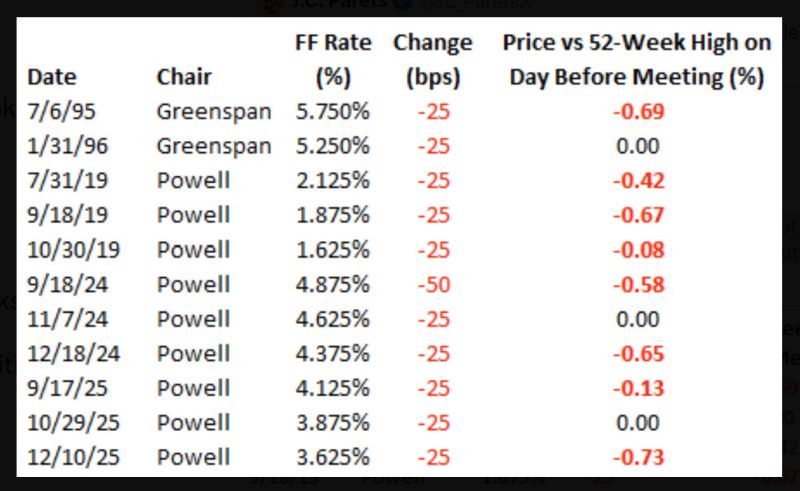

Powell the Provider.

Today was the 11th time since 1994 that the Federal Reserve cut rates when the S&P 500 was within 1% of a 52-week high. Nine of those cuts have occurred under Powell. Source: Bespoke @bespokeinvest

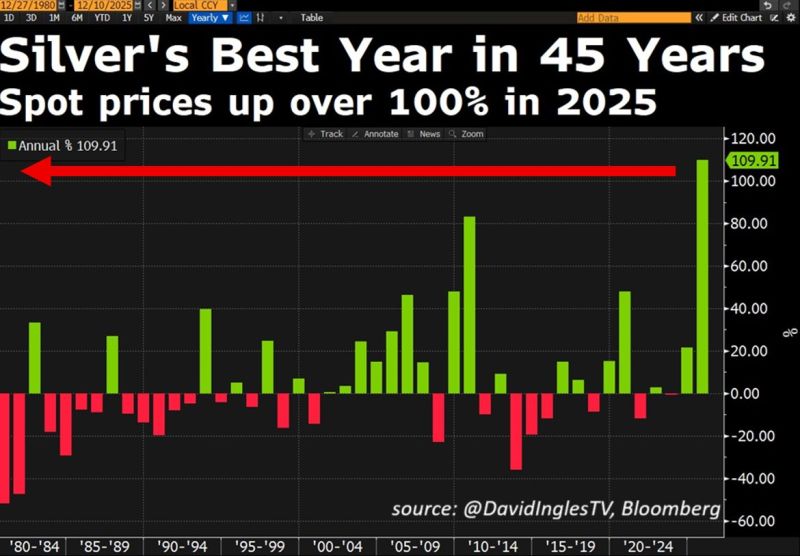

🚨 SILVER SHOCKWAVE: WHY THE GREY METAL IS EXPLODING TO RECORD HIGHS! 🚀💰

Silver is trading above $61 for the first time in history, tracking a colossal +110% gain in 2025—the second-best year on record! 💥 THE 8 FORCES DRIVING THIS PARABOLIC MOVE: CHINA SUPPLY COLLAPSE: SHFE inventories are at a 9-year LOW! Massive exports are draining the world's key bullion hubs. LONDON LIQUIDITY CRISIS: Even with record inflows, market liquidity is strained, and borrowing costs are stubbornly ELEVATED. TRUMP TARIFF SCARE: Traders pulled huge quantities into the US on anticipation of potential tariffs, tightening the London market even more. INDIA'S APPETITE: Accelerating demand from one of the world's largest consumers is intensifying the squeeze. RETAIL RUSH: ETF inflows are heading for their 10th positive month, and call options on the largest silver ETF are SPIKING. The crowd is piling in! FED RATE CUT BETS: Falling borrowing costs make non-yielding assets like silver IRRESISTIBLE compared to cash and bonds. SOLAR BOOM: Rising industrial demand, especially from photovoltaic installations (peak season!), is consuming physical metal at an alarming rate. CHINA TAX SHIFT: Tax changes on gold pushed investors directly into silver's welcoming arms. Meanwhile, the Gold-to-Silver Ratio is plummeting to 2021 lows. Source: Global Markets Investor, David Ingles, Bloomberg

Alphabet $GOOGL Waymo weekly rides now at 450k:

• Jul 2024 ➝ 50k • Oct 2024 ➝ 100k • Dec 2024 ➝ 150k • Feb 2025 ➝ 200k • May '25 ➝ 250k • Dec 2025 ➝ 450k The latest figure appears to have been leaked from an investor-letter cited (Tiger Global) by media.

Investing with intelligence

Our latest research, commentary and market outlooks