Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

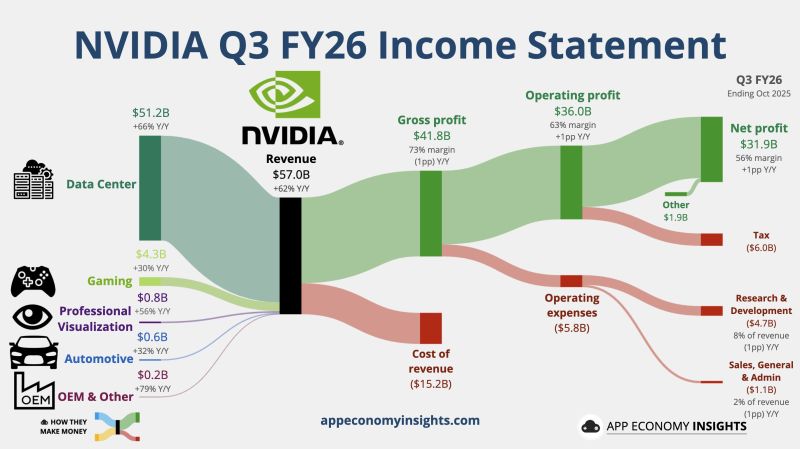

Nvidia $NVDA said sales to just its number one largest customer represented 22% of its total $57 Billion of revenue during Q3

That means someone spent $12.5 Billion with Nvidia during the quarter 🤯 61% of Nvidia $NVDA Q3 revenue came from just 4 customers: $12.54B – Customer A (22%) $8.55B – Customer B (15%) $7.41B – Customer C (13%) $6.27B – Customer D (11%) So who are A, B, C, D in your view ??? Source: Wall St Engine on X, Evan on X

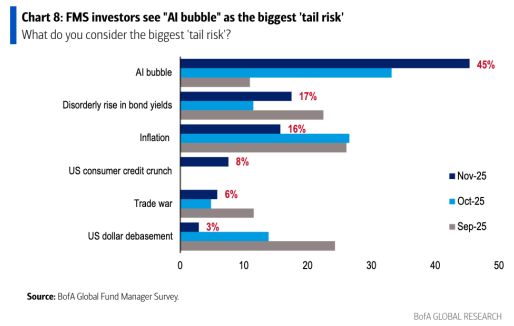

45% of fund managers surveyed by Bank of America in November said an "AI bubble" was the biggest tail risk for markets, spiking from just 11% in September.

Over half of these investors said they think AI stocks are already in a bubble. Source: BofA

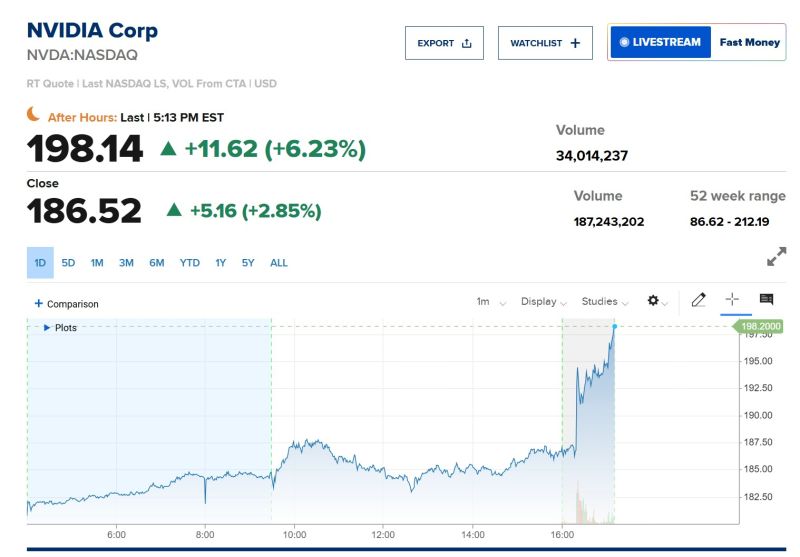

Nvidia $NVDA saves humanity again with blowout earnings... 🚀

Q3 REV: $57.01B vs $55.19B exp. Q3 EPS: $1.30 vs $1.25 exp Q4 REV: $63.7B TO $66.3B vs $62B exp “Blackwell sales are off the charts, and cloud GPUs are sold out.” — Jensen Huang, Q3 FY26 earnings release (Nov 19, 2025) $NVDA is up +6% after-hours... The market is saved

$NVDA NVIDIA Q3 FY26 (October quarter).

• Revenue +62% Y/Y to $57B ($1.9B beat). • Operating margin 63% (+1pp Y/Y). • Non-GAAP EPS $1.30 ($0.04 beat). Q4 FY26 guidance: • Revenue $65B ($3.2B beat). Source: App Economy Insights @EconomyApp

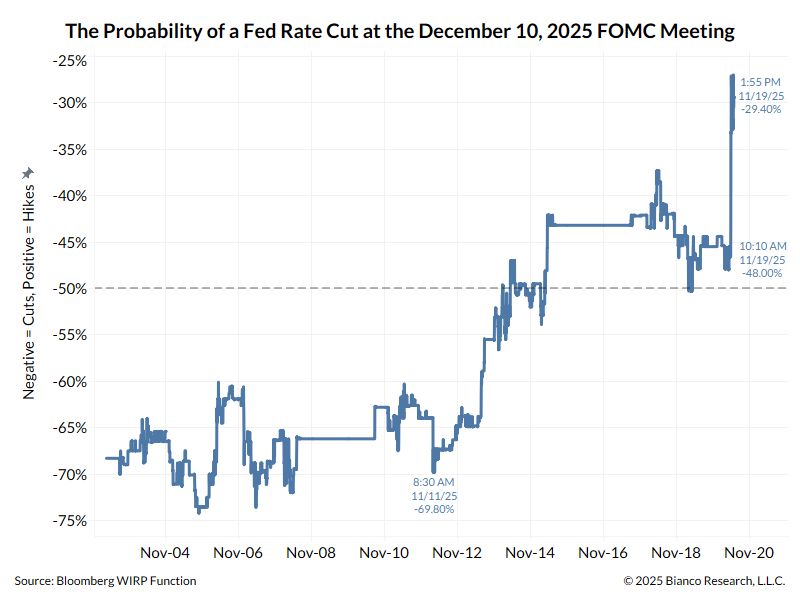

Reaction to the release of the FOMC minutes: the probability of a rate cut is down to less than 30%...

➡️ Many participants stated that it would be appropriate to hold interest rates steady for the rest of the year, in line with their expectations. 📌 Most participants supported the October rate cut, while some said they would not support any changes. 📌Almost all participants stated that ending the balance sheet reduction program on December 1st would be appropriate. 📌Many participants said a December cut would be appropriate. 📌Many participants noted the possibility of a disorderly decline in stock prices, particularly if expectations regarding artificial intelligence were suddenly reassessed. 📌Most participants preferred the Fed's portfolio to match the composition of its outstanding Treasury bonds. 📌Some participants preferred a larger proportion of Treasury bonds, stating that it provided more flexibility. 📌Many participants believed the December rate cut was inappropriate. The Fed's economic outlook, released at its October meeting, suggests that real GDP growth through 2028 will be slightly stronger than the September forecast Source: Bianco Research, @EcoPulseStreet

🔥 3 Bullish Signals from NVIDIA’s Earnings Call Last Night — and why the AI trade is far from over.

Most CEOs play it safe on earnings calls. Jensen Huang did the opposite. Here are the 3 comments everyone in tech, AI, and markets should pay attention to: 🚀 1. “No AI Bubble” — Just Three Structural Shifts 1️⃣ The migration from CPU ➝ accelerated computing 2️⃣ Generative AI hitting a tipping point across every workload 3️⃣ The rise of agentic AI All three require massive infrastructure builds. And the kicker? Inference demand is exploding — and is set to become a major revenue engine for NVIDIA. 💰 2. “Funding Is NOT the Problem” Worried customers are running out of capital? NVIDIA is not. Hyperscalers are already monetizing AI, sovereign buying is ramping, and agentic AI opens entirely new revenue pools. Translation: the money is there, and it's accelerating. 🧠 3. “The Ecosystem Is the Moat” This one flew under the radar but is HUGE. The CFO pointed out: A100 GPUs from SIX years ago are still fully utilized — thanks to the Kuda software stack. It means: Longer useful life for GPUs Better ROI on datacenter capex A deeper, stickier NVIDIA ecosystem Plus, NVIDIA is expanding partnerships across enterprise platforms and top AI developers. 📈 Bottom Line This was a monster print: ✔ Strong results ✔ Confident guidance ✔ Constructive multi-year outlook After-hours? NVIDIA popped ~5%, and AI-related names rallied across the board. 📊 Valuation Check (Yes, Really) NVIDIA’s stock has actually de-rated lately — earnings kept growing, the share price didn’t. And now with Q4 guidance out, investors will pivot to 2026–2027. Here’s the jaw-dropper: ➡️ Using 2027 FactSet consensus, NVIDIA trades at 21× P/E. Twenty. One. Times. Earnings. For the company powering the entire AI revolution. 🔮 The Broader Message The AI trade is alive. Healthy. And nowhere near done.

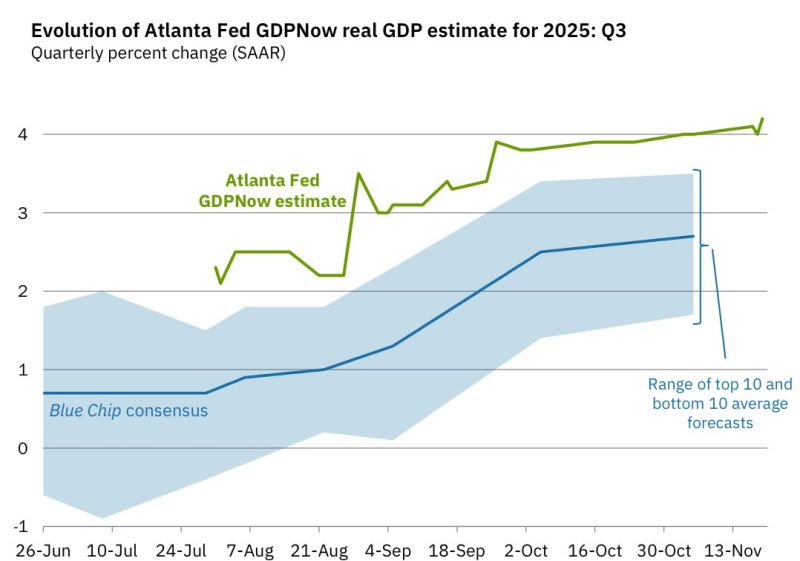

🔥 In Case You Missed It… Here's the latest update by Atlanta Fed GDPNow forecast?

👉 US Q3 real GDP: +4.2% Yes, you read that right. The US economy isn’t just growing — it’s running HOT. 🚀 And Here’s the Wild Part… Policy is about to get even more supportive: ✔ QT likely ending ✔ Rate cuts expected next year (or maybe in December but that looks less and less likely...) ✔ Fiscal stimulus coming (think: checks, tax cuts, more spending) ✔ Looser financial regulation to expand bank lending This is the opposite of tightening. This is fuel on an already burning fire.

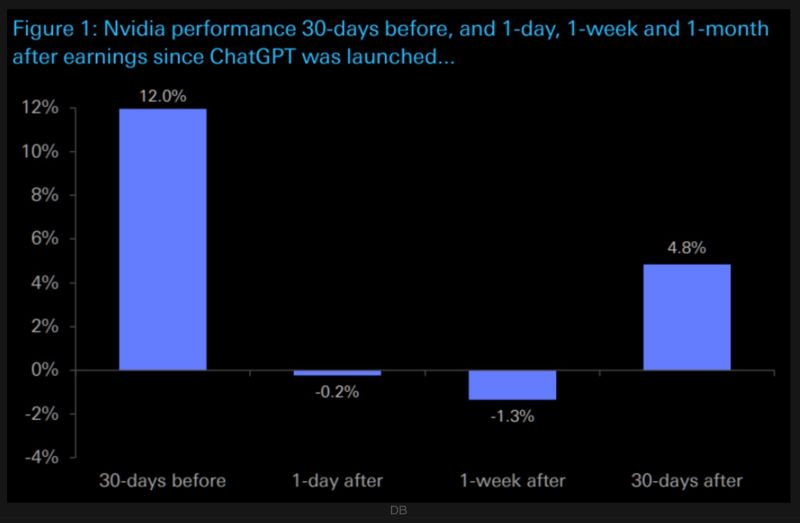

➡️ Over the past eleven releases since ChatGPT launched, NVDA’s massive 10x rally hasn’t come from earnings-day pops:

Day-after and week-after moves have typically lagged, while the month before earnings has usually been the strong stretch. ➡️This quarter breaks that pattern, NVDA is flat heading into results, with recent earnings cycles showing weaker immediate reactions and stronger rallies later in the quarter. Source: The Market Ear, DB

Investing with intelligence

Our latest research, commentary and market outlooks