Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

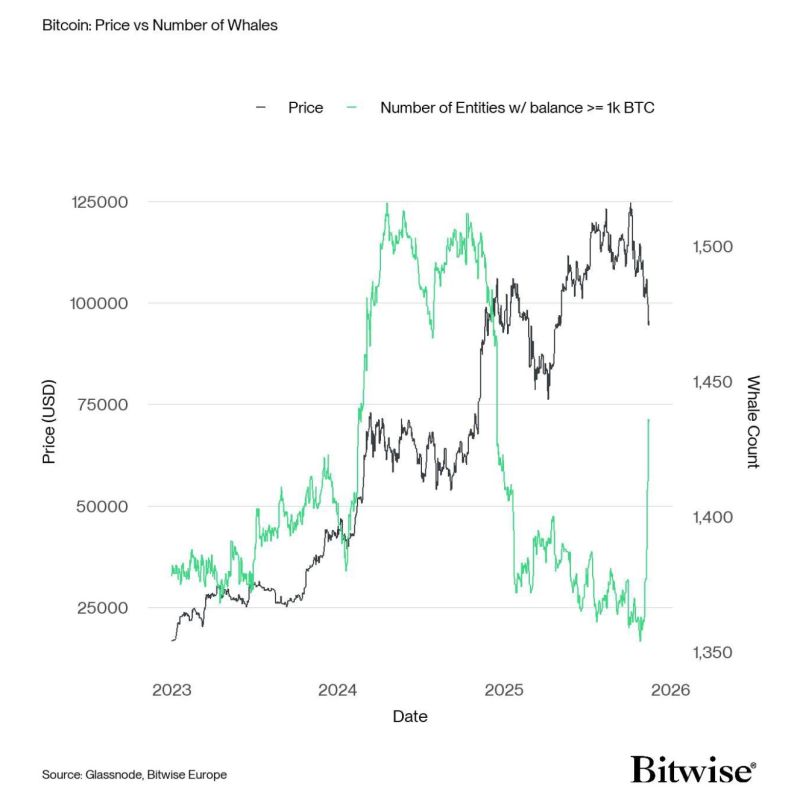

A great chart by Bitwise - 𝐓𝐡𝐢𝐬 𝐢𝐬 𝐰𝐡𝐨 𝐲𝐨𝐮’𝐫𝐞 𝐬𝐞𝐥𝐥𝐢𝐧𝐠 𝐲𝐨𝐮𝐫 𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐭𝐨

While retail panic-sold the dip, something very different was happening under the surface. The number of Bitcoin wallets holding 1,000+ BTC just went vertical. That’s ~$91 million per wallet. Translation? Short-term hands are handing their coins straight into the pockets of deep-pocketed, long-duration buyers. And yes — they know exactly what they’re doing. Markets have been jittery: • Rate-cut uncertainty 📉 • Overheated AI equity spending 🤖 • The classic “crypto cycle fear” 😬 Sentiment gauges? Extreme fear. Long-term capital? Completely unfazed. Case in point: Abu Dhabi’s sovereign wealth fund reportedly tripled its BTC exposure last quarter — now sitting near $500M. These aren’t tourists. They’re the ones who buy when everyone else hesitates. So if you’re selling your Bitcoin today… You might want to take a closer look at who’s on the other side of your trade. Now zoom out 👇 Global liquidity is sitting at record highs — and still expanding. Over 80% of major economies are easing or injecting capital again. Crypto regulation is finally becoming clearer. Historically, when: ✅ Liquidity rises + ✅ Policy clarity improves → Risk assets rally. → Crypto rallies the most. Will it happen again this time? Source: Bitwise, Tommy Rogulj @tommyrogulj

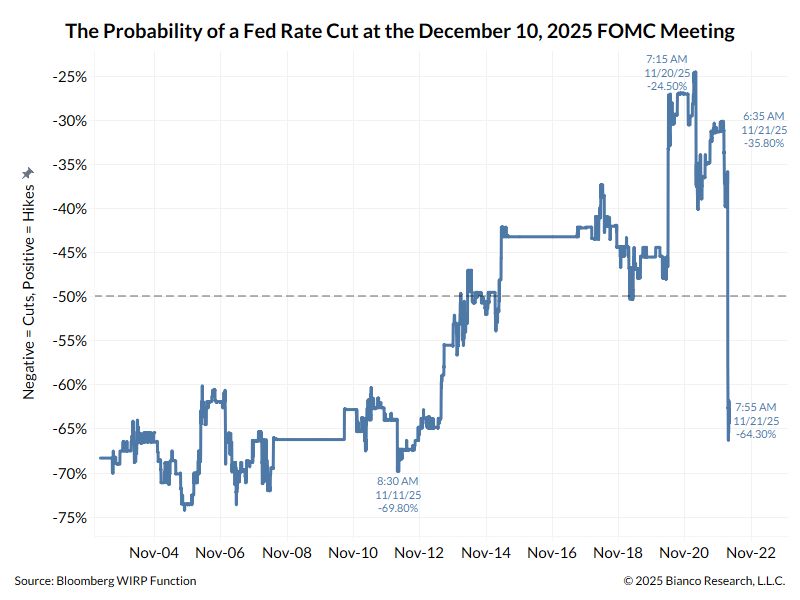

Fed Williams's speech this morning dramatically changed the outlook for the December 10 FOMC meeting.

As highlighted by Jim Bianco, the current tally looks like this: * 5 Voters have strongly signaled they do not want to cut rates next month (Barr, Musalem, Schmid, Goolsbee, Collins) * 5 Voters signaled they want to cut rates (Miran, Waller, Bowman, Williams, Cook) * 2 Voters are unknown (Powell and Jefferson) If the Fed is truly becoming independent, then it should be a 7-5 vote ... either way. Time will tell...

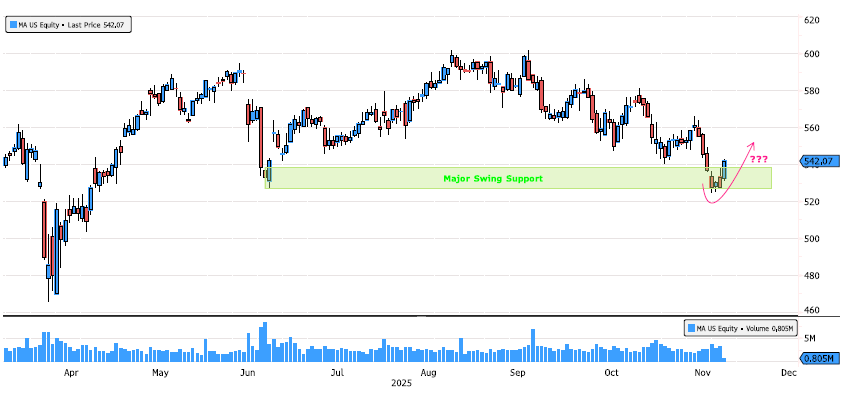

Mastercard rebounding on Swing Support

After a 12% consolidation since the August high, Mastercard is now showing constructive price action on a major swing support zone at 527–538. This area has acted as a strong demand zone in the past — daily and weekly closes will be key to confirm whether buyers are stepping back in with conviction. Source: Bloomberg

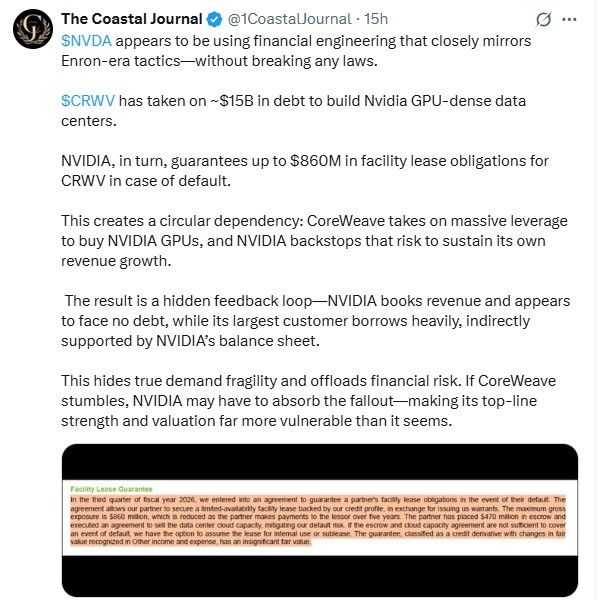

We are seeing a lot of threads on X talking about Nvidia using financial engineering to boost results.

See one example below from The Coastal Journal.

24 years ago, Nvidia replaced Enron in the S&P 500...

Similar to last year anniversary, it seems that some investors see this as an ominous sign...

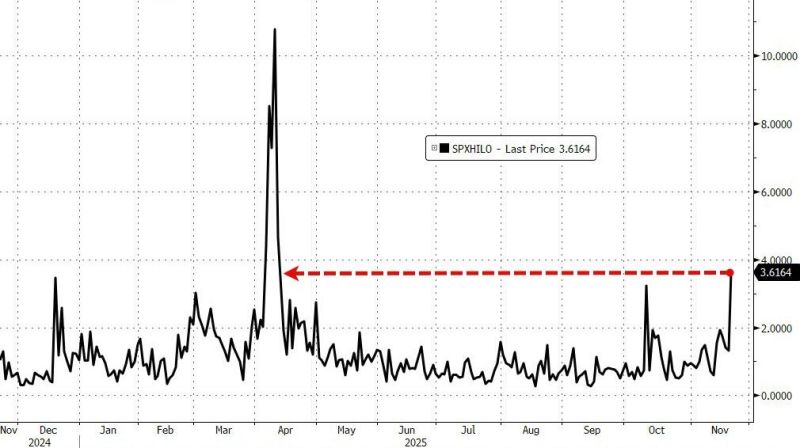

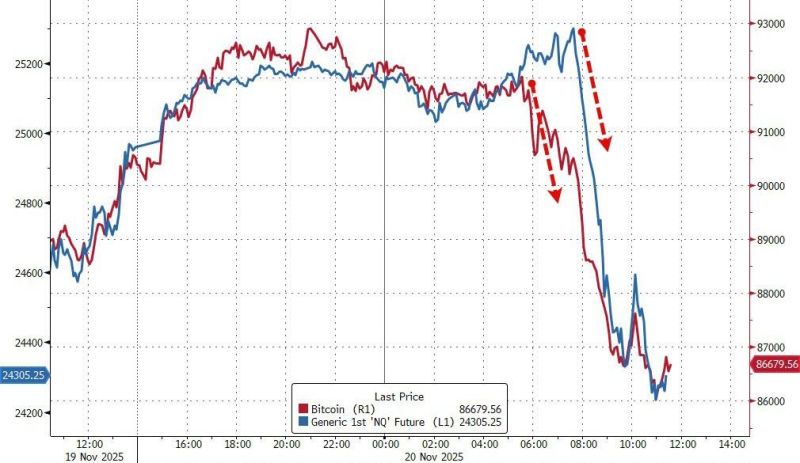

WHAT JUST HAPPENED ON WALL STREET? 🤯

Today the S&P 500 opened up +1.4%… and finished deep in the RED (-1.5%). That move has happened only twice in modern history: Apr 7, 2020 — Post-COVID crash volatility Apr 8, 2025 — Post-Liberation Day shock Today just became the third. So what actually drove the reversal? Goldman’s trading desk points to a perfect storm: 🔥 1) NVDA -7% fade Yes, they beat. Yes, they raised. But the “clear all” bull case didn’t show up. ⚠️ 2) Private credit risk can’t be brushed aside Fed’s Cook literally flagged “potential asset valuation vulnerabilities.” 📉 3) September NFP = fine… but not decisive December rate-cut odds barely nudged higher (now ~35%). 💥 4) Crypto cracked below the $90K psychological line 📊 5) CTA supply hit the gas Positioning was crowded long… and we just crossed short-term triggers. Medium-term supply looms at 6456. 🐻 6) Shorts are waking back up 🌏 7) Weak global price action SK Hynix, SoftBank… not helping. 💧 8) Liquidity? Nearly nonexistent Top-of-book S&P liquidity ~$5mm vs ~$11mm YTD average. 📈 9) ETF-driven market ETFs were 41% of the tape today (YTD avg: 28%). When passive flows dominate, macro > fundamentals. Here’s the kicker: NVDA’s results were good. Objectively good. But as Goldman’s John Flood put it: 👉 “When really good news isn’t rewarded, that’s usually a bad sign.” So the real question: Is the market pricing in a Fed policy mistake? (No December cut → forced tightening → equity stress?) Or is this the market’s way of dragging the hawks back to the dovish table? Either way… Volatility is back. And the macro tape is driving the bus. 📡 Stay tuned. Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks