Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

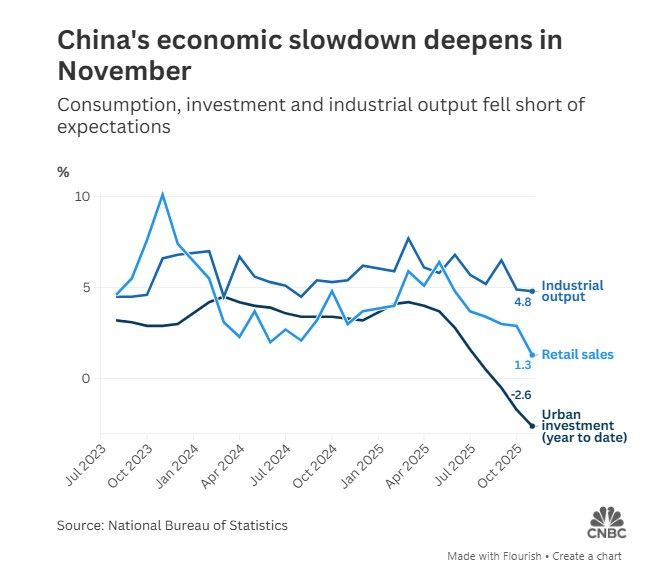

📢 China's Economic Slowdown Deepens in November 📉

China's economic performance in November fell short of expectations across key metrics, signaling a deepening slowdown as authorities grapple with weak demand, property sector decline, and supply-side constraints. Key data points: 🔴 Retail Sales: Rose 1.3% year-on-year (YoY), sharply missing the 2.8% forecast and slowing significantly from 2.9% in October. 🔴 Industrial Production: Climbed 4.8% YoY, missing the 5.0% forecast and marking its weakest growth since August 2024. 🔴 Fixed-Asset Investment (YTD): Contracted 2.6% over the January-November period (worse than the 2.3% forecast). This contraction deepened from the prior period (1.7% drop) and represents the sharpest slump since the 2020 pandemic outbreak. Source: CNBC

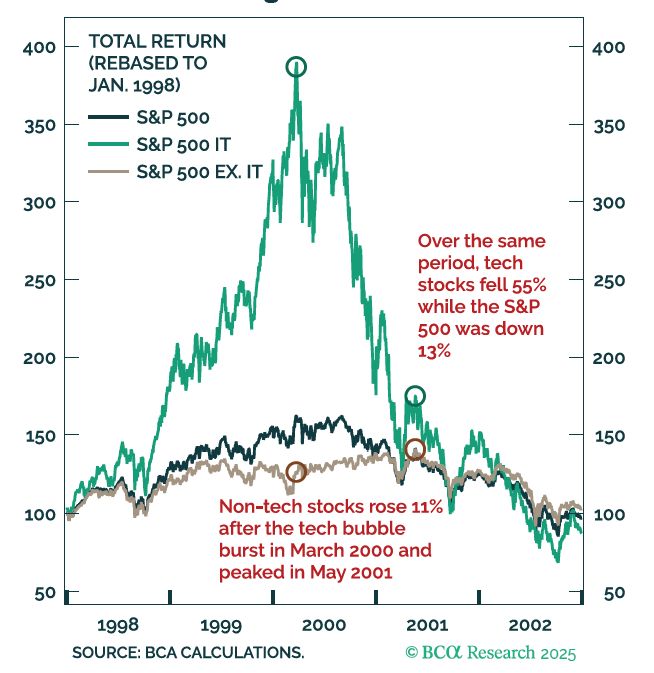

🗓️ A Look Back at the Dot-Com Bubble's Aftermath

For those unfamiliar with the late-1990s internet bubble that burst in March 2000: the pain was initially confined. As Peter Berezin of BCA Research highlighted, non-technology stocks continued their ascent for a full year before the broader market succumbed to the 2001 recession. Is this history set to repeat, ushering in another "great rotation" in the coming months?

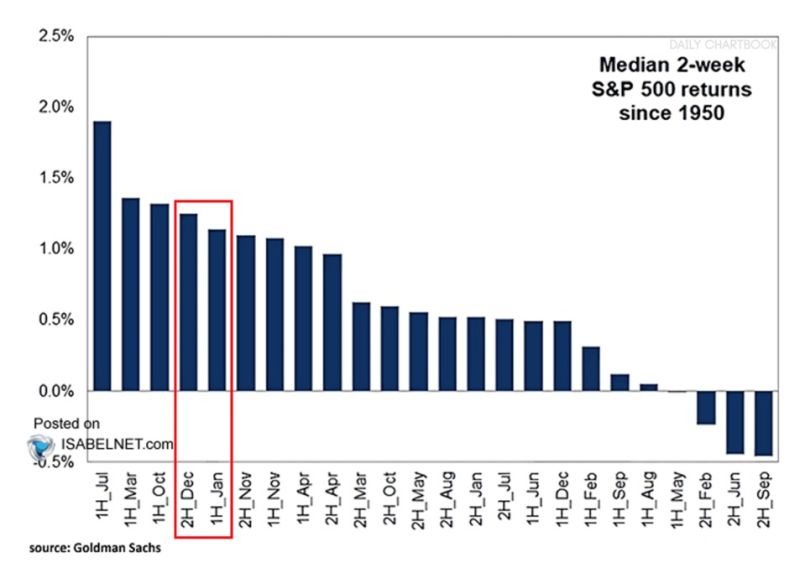

We are running into the 4th and 5th best 2-weeks periods.

And they happen to be back-to-back... Source: Goldman Sachs, isabelnet, RBC

This monetary policy cycle is much less synchronized than it used to be

Source: Mo El-Erian

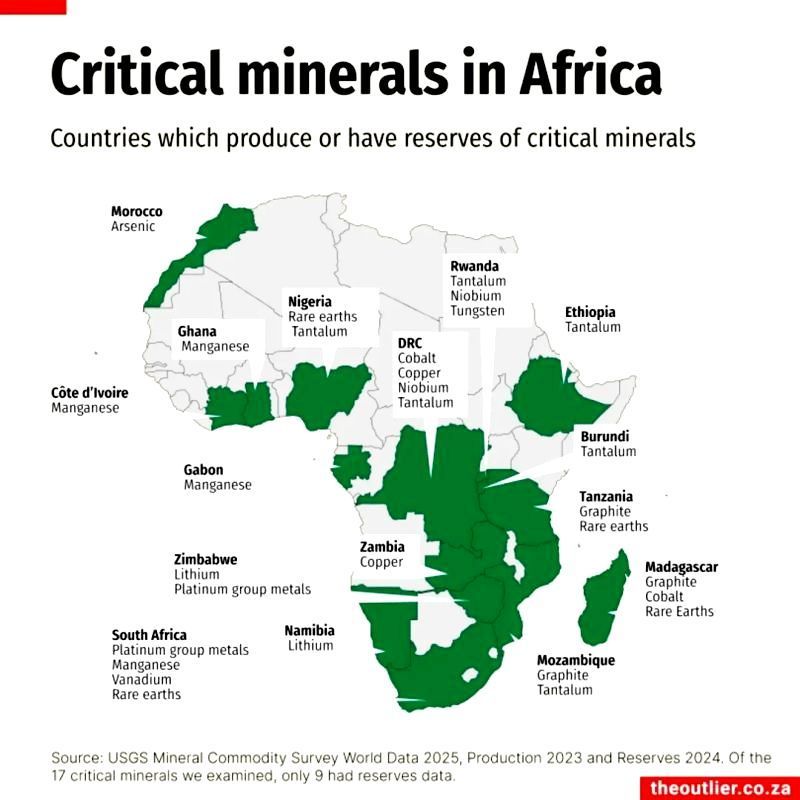

Africa is a critical minerals powerhouse

The Continent holds the keys to Green Tech Map highlights producers/reserves: DRC: Cobalt, Copper, Niobium, Tantalum South Africa: Platinum Group Metals, Manganese, Vanadium, Rare Earths Zambia: Copper Namibia: Lithium Tanzania/Zimbabwe: Graphite, Rare Earths Ghana/Gabon: Manganese Rwanda/Burundi: Tantalum Bottom-line: from EV batteries to renewables Africa is indispensable. And it has much more to offer than minerals. Source: Jack Prandelli, theoutlier.co.za

🤯 The Hidden Engine Powering the US Economy

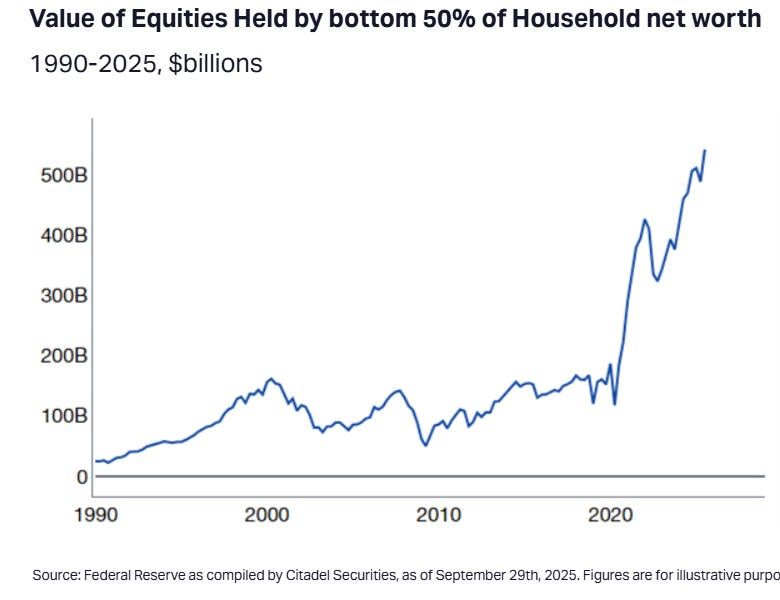

Everyone is talking about interest rates and inflation, but here’s the underappreciated truth: The average US household’s net worth has silently exploded thanks to unbelievable equity returns over the last five years. 📈 That extra few hundred dollars on discretionary spending? It’s mentally offset by a stock portfolio that's sitting significantly higher. The Takeaway: This "wealth effect" isn't just a coincidence, it's likely among the reasons why the long-predicted recession keeps failing to materialize. When people feel richer, they spend! Source: Boring_Business @BoringBiz_

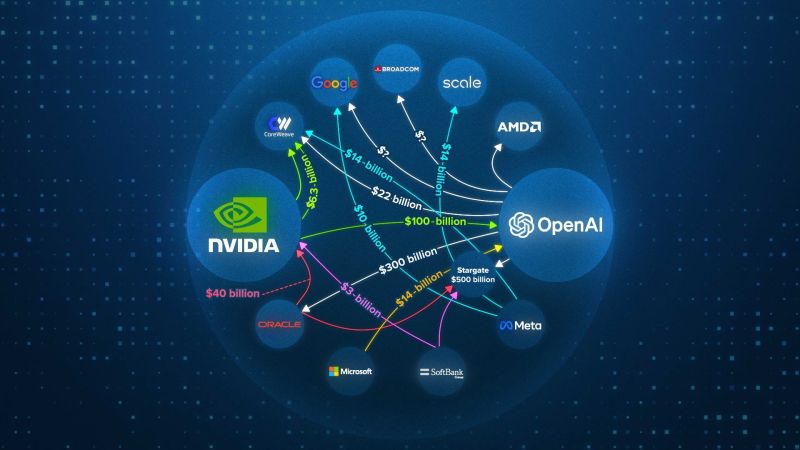

🤯 The Open AI circular financing 🤯

Forget the hype. Look at the numbers. The AI sector will spend $400 BILLION this year. Revenue? A measly $60 BILLION. That $340 BILLION gap? It's filled with circular financing and off-balance sheet debt 💣 🔴 The CoreWeave Trap: Circular Financing 🔄 The Play: CoreWeave uses NVIDIA’s money to buy NVIDIA’s chips, then rents them back to NVIDIA. The Math: They are spending $20 BILLION to make $5 BILLION in revenue. The Debt: They have $14 BILLION in debt due next year and a staggering $34 BILLION in lease payments starting in 2028. 🔴Debt & Leverage 🧊 OpenAI's Burn Rate: They make $10B but need $50B just for their Oracle deals! They're projected to lose $15 BILLION this year. The only one making money? NVIDIA. Everyone else is buying chips on credit, praying for a future payoff. 🙏 🔴SPVx Meta hid a $27 BILLION data center build off their balance sheet using Special Purpose Vehicles (SPVs). 🔴The New CDO? Companies are taking GPU-Backed Loans, posting chips as collateral. What happens when the chip bubble pops? It’s a cascade risk Will we see something similar to the housing collateral crisis, but with sthis time with silicon ??? 📉 🔴Private Credit: The $1.25 TRILLION Blind Spot 🚨 The riskiest part is happening in the shadows: Private Credit. Private Equity firms have already lent $450 BILLION to tech and plan to lend another $800 BILLION in two years. Zero Disclosure. They operate outside of traditional banking scrutiny. Life Insurers (who hold your policies!) have $1 TRILLION tied up in this private credit gamble. If AI loans fail, private credit fails. If private credit fails, banks and insurers are at risk because everyone is connected. To make a long story short, the leverage is building... Source: Hedgie on X

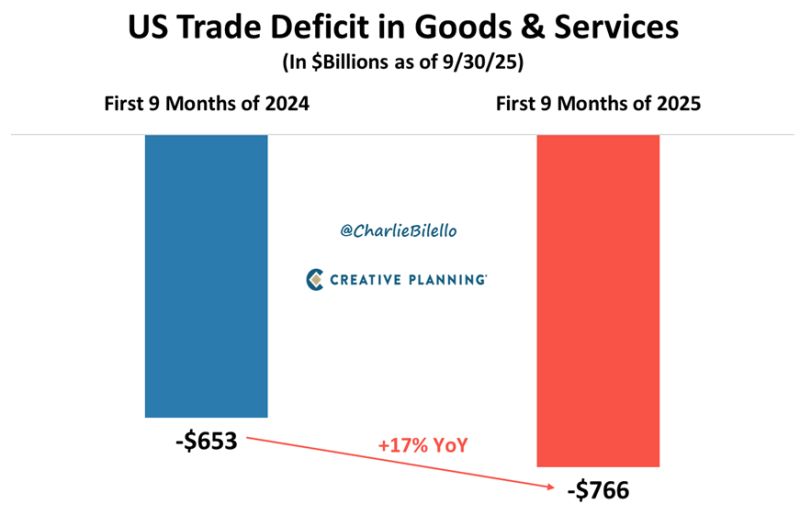

US Trade Deficit in Goods & Services...

First 9 months of 2024: –$653 billion deficit. First 9 months of 2025: –$766 billion deficit. +17% YoY 🚨 Record high. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks