Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Another 10.00am EST liquidation on Bitcoin dumped $3,200 from $89.8k to $86.6k and liquidated $203 million worth of longs.

All this happened in last 60 minutes with no major negative news. Another example of 10 am manipulation which has been happening over the last few weeks many times when the US market opens. Source: Bull Theory

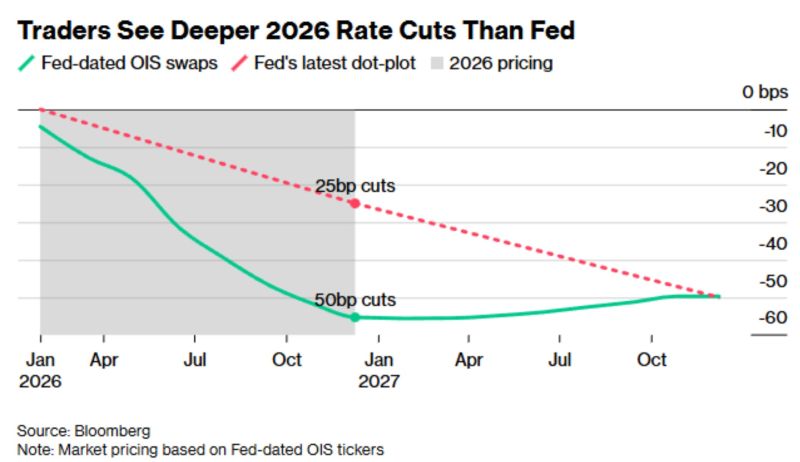

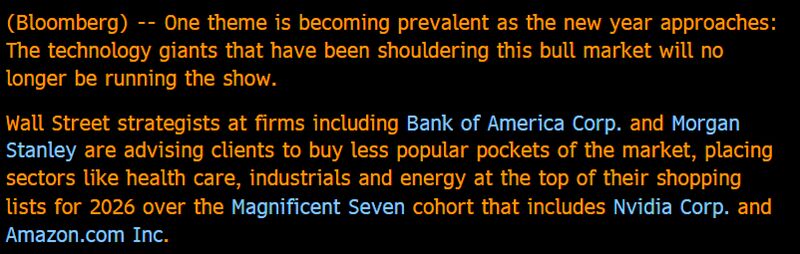

As rightly said by Eric Balchunas many strategists are calling for rotation out of Mag 7 next year..

But let's be honest they said same thing this year and Mag 7 beat market YTD and crushed it since Liberation Day. Will 2026 be different? Source: Bloomberg

In case you missed it...Tech may finish the year with a lower Forward P/E than it began the year...

Tech bubble? Are you sure? Source: Seth Golden @SethCL Factset

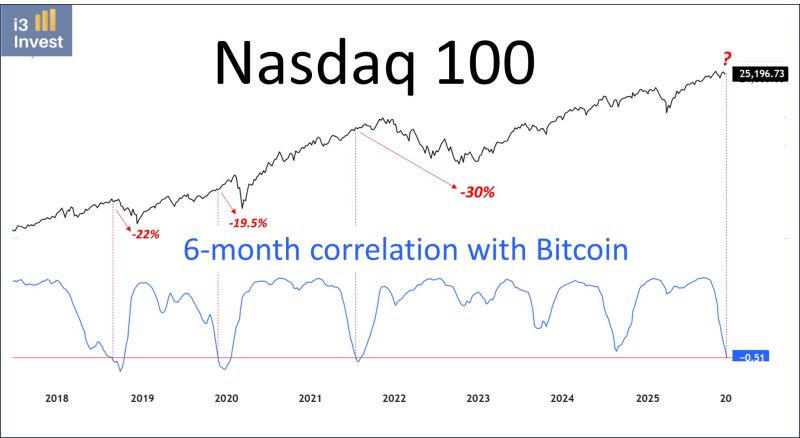

Interesting chart by Guilherme Tavares i3 invest ➡️ when the correlation between BTC and the Nasdaq 100 gets too low (below -0.5), the Nasdaq 100 usually experiences a much deeper drawdown.

It is not necessarily a timing indicator or a “sell everything” signal. But it shows that BTC is more sensitive to liquidity and tends to lead.

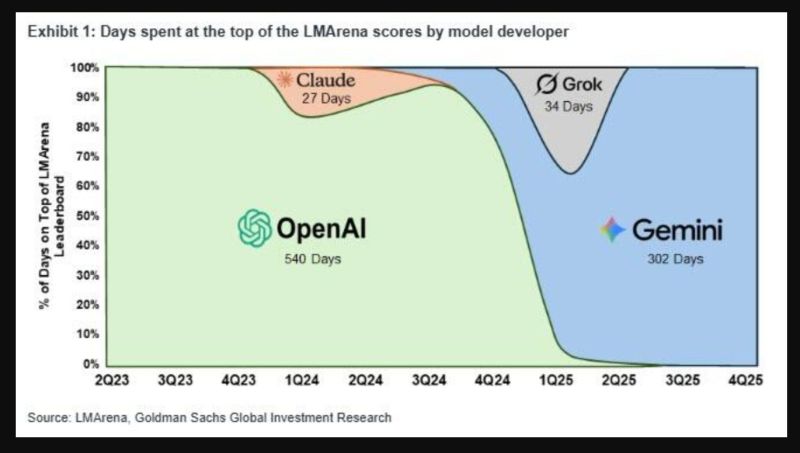

The 'AI Revolution' is still only 2 1/2 years old (if you date it to the release of ChatGTP)

We have experienced swings on which models are gaining the most attention as Goldman's Jim Schneider illustrates the chart below... Source: zerohedge

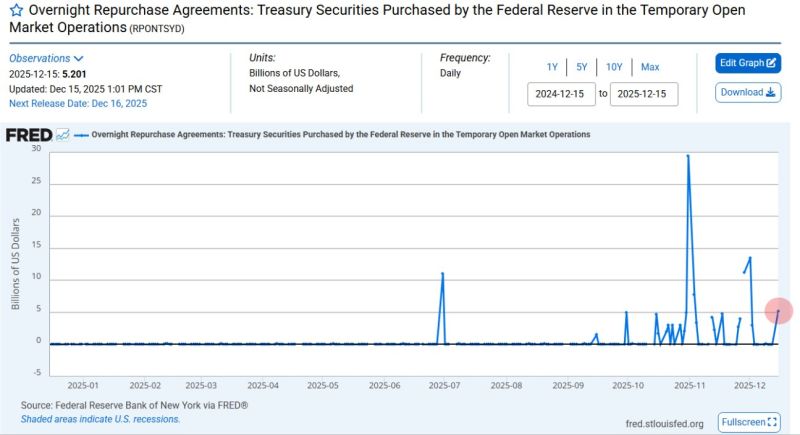

Federal Reserve just pumped $5.2 Billion into the U.S. Banking System through overnight repos

This is the 6th largest liquidity injection since Covid and surpasses even the peak of the Dot Com Bubble 👀 Source: Barchart @Barchart

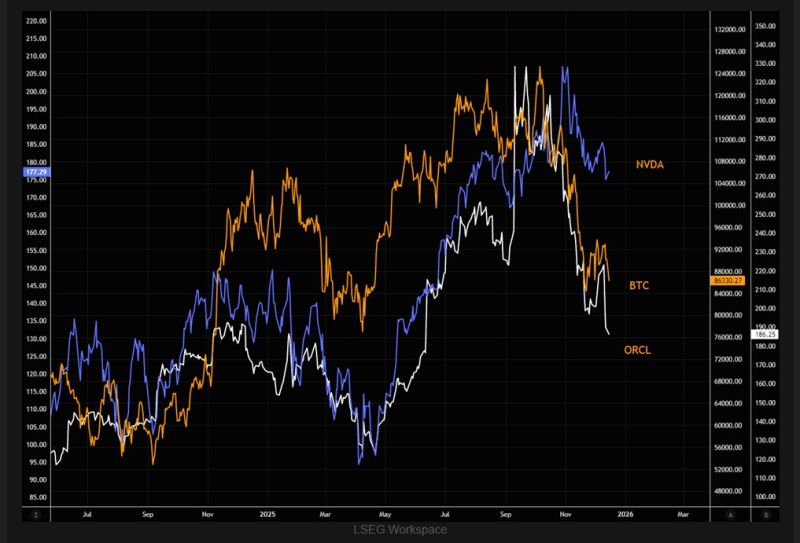

Same same? Are we just seeing "psychology on steroids" being washed out?

All these ex hot assets have moved in close tandem for a long time. Chart below shows Bitcoin $BTC, Nvidia $NVDA and Orcale $ORCL. Source: LSEG, The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks