Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

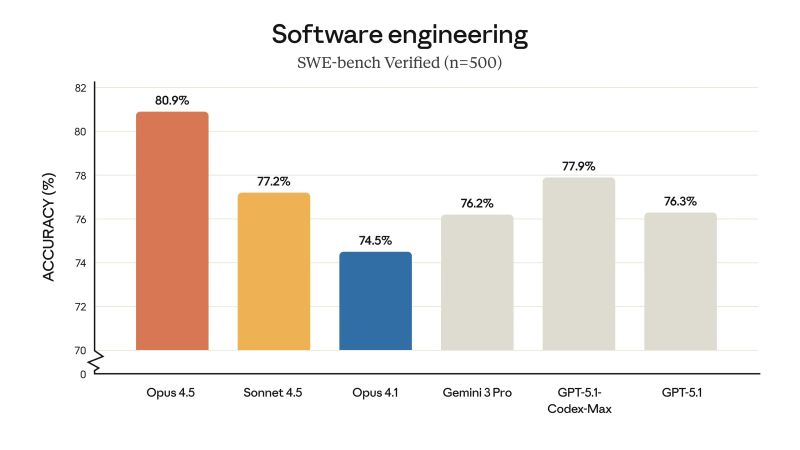

Anthropic unveils Claude Opus 4.5, its most intelligent model to date, co says

It’s meaningfully better at everyday tasks like working with slides and spreadsheets. The new AI tops coding benchmark, leading in key tests like SWE-bench Verified at 80.9%, Terminal-bench 2.0 at 59.3%, and OSWorld at 66.3%, beating models from Google and OpenAI in coding, agent tasks, and computer use. It features a 200K token context window, uses far fewer tokens for the same work, and costs much less at $5 per million input tokens. Developers can now access it through APIs, apps, and platforms like Amazon Bedrock and GitHub Copilot, with engineers noting its strength on complex bugs. Source: CNBC-TV18

In case you missed it...

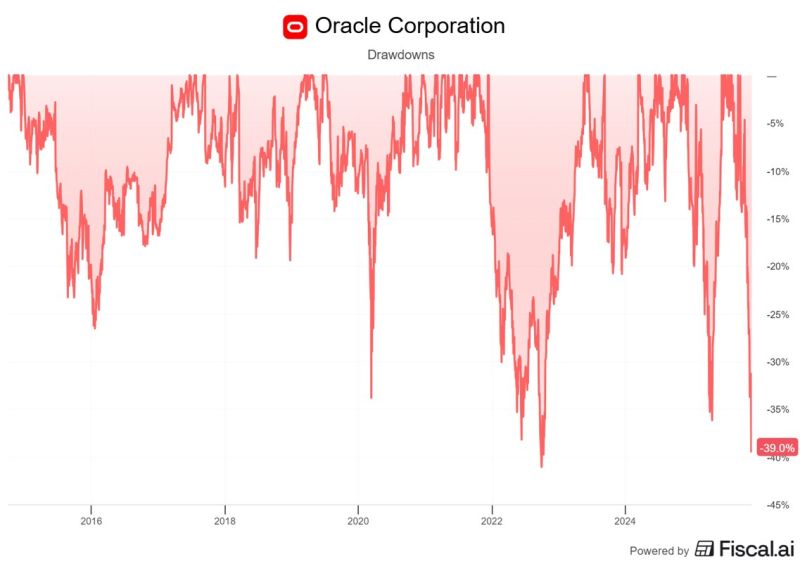

Oracle $ORCL is now approaching its largest drawdown in a decade Source: Shay Boloor @StockSavvyShay

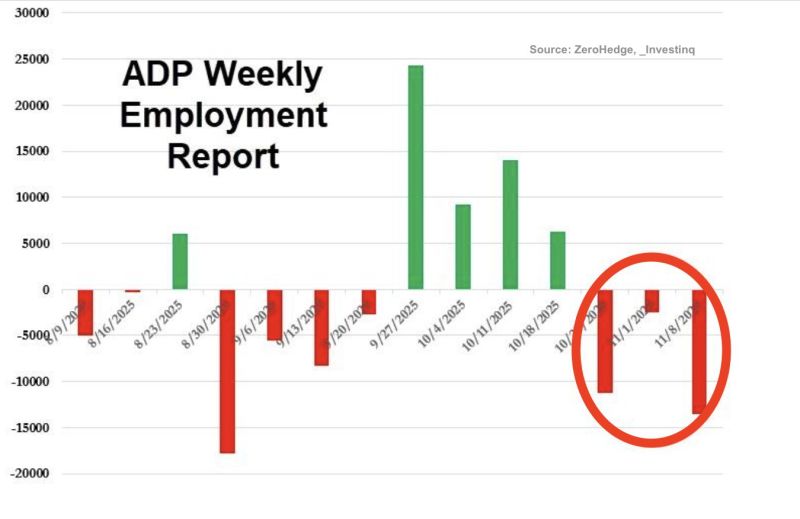

The latest ADP numbers are out and show that over the four weeks ending November 8, 2025, US private employers shed an average of 13,500 jobs per week.

📉 Inflation Isn’t the Story Anymore The Fed’s dual mandate is price stability + maximum employment — and the employment side is flashing red for the first time in years. 💡 And the Market Is Catching On Just 1–2 weeks ago, a December rate cut was basically dismissed. Markets were pricing in 30–42% odds. Then NY Fed President John Williams spoke on Friday — and he all but signaled, in classic Fed-speak, “We need to cut.” He pointed to rising downside risks in employment and fading risks in inflation. 🔍 Fast forward to this yesterday’s data: prediction markets now show an 85% chance of a December rate cut. Source: StockMarket.news

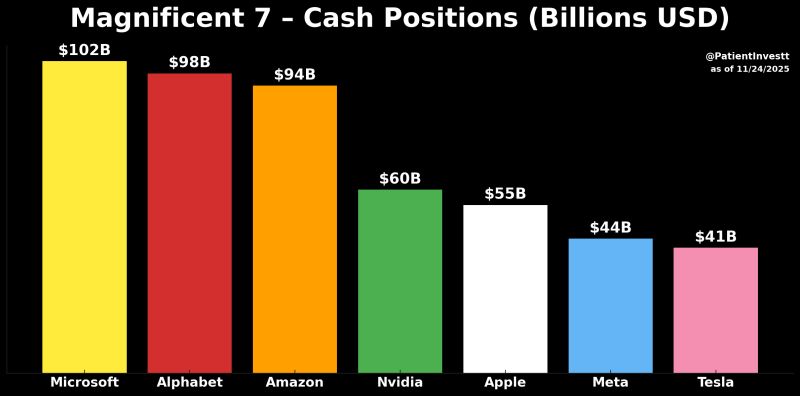

Magnificent 7s Cash Position💰:

$MSFT: $102 Billion $GOOGL: $98 Billion $AMZN: $94 Billion $NVDA: $56 Billion $AAPL: $55 Billion $META: $44 Billion $TSLA: $41 Billion Patient Investor @patientinvestt

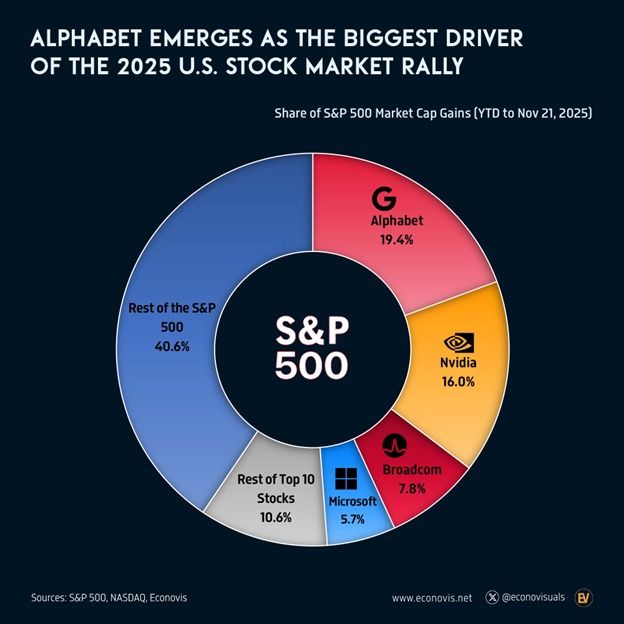

🚀 Big Tech Is Carrying the Entire Stock Market — Literally

Alphabet ($GOOGL) has been the single biggest driver of the S&P 500 this year… accounting for 19.4% of the index’s entire YTD gain. That’s what happens when you add $1.3 trillion in market cap in 11 months. Right behind it? Nvidia ($NVDA): +16.0% contribution (+$1.05T) Broadcom ($AVGO): +$520B Microsoft ($MSFT): +$380B Together with the rest of the mega-cap giants, the top 10 stocks now make up 59.4% of the S&P 500’s total gain this year. Which means the other 490 companies combined contributed just 40.6%. Source: The Kobeissi Letter, econovisuals

Late November gonna late November?

Stocks bottomed on November 20 and have staged a pretty impressive three day rally. Exactly in line with normal seasonality... Source: Ryan Detrick, Carson

Gold loves rising Japanese rates.

This remains a massive driver of the shiny metal, despite few talking about it on a daily basis. Source: The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks