Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🦔 HSBC built a model to figure out if OpenAI can actually pay for all the compute it's contracted. The short answer is no. Actually not even close.

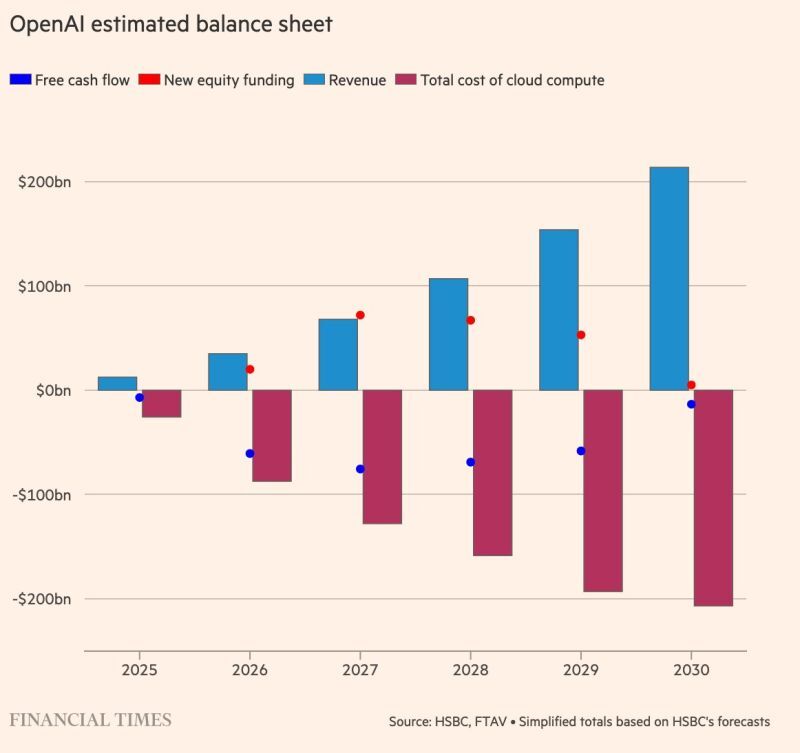

The Commitments: $250B in cloud compute from Microsoft $38B from Amazon 36 gigawatts of contracted capacity All tied to a total deal value up to $1.8 trillion HSBC’s estimate: OpenAI will owe ~$620B per year in data-center rent once everything ramps… and only a third of that capacity is online by 2030. 🔢 The Math (and the Problem) By 2030: Cumulative rental costs: $792B (→ $1.4T by 2033) Projected free cash flow: $282B Cash from Nvidia/AMD: $26B Undrawn debt: $24B Liquidity: $17.5B Even after stacking every possible dollar, there’s still a $207B hole — plus the $10B safety buffer HSBC thinks they need. 💥 And here's where it gets tricky 👇 HSBC’s model already assumes everything goes right: 3B OpenAI users by 2030 (44% of all adults outside China) Paid conversion rising from 5% → 10% 2% share of global digital ads $386B in annual enterprise AI revenue Even under that fantasy scenario, OpenAI still can’t pay the bills. HSBC’s suggested “solution”? OpenAI may need to walk away from its data-center commitments and hope Microsoft/Amazon “show flexibility.” Translation: The economics don’t work — unless everyone politely pretends the contracts aren’t real. And yet this is the company anchoring a $500B Stargate project and driving hundreds of billions in AI infrastructure spending. If this is what the best case looks like… imagine the base case. My take: be very careful with AI plays which are asset-heavy. They might disappoint in terms of shareholders' returns in the years to come. Do you remember the Telecom bubble? The long-term winners have been the asset-light companies. The asset heavy companies never recover. Source: Hedgie on X, FT

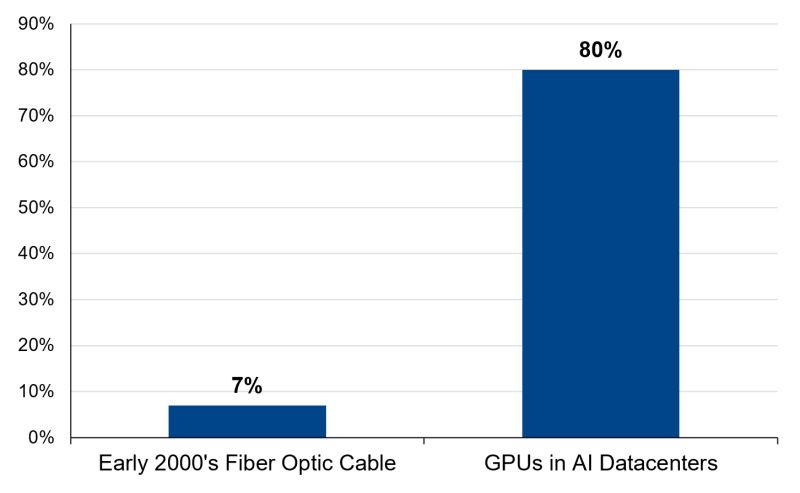

Interesting view by Shay Boloor @StockSavvyShay about why the AI cycle is nothing like the dot-com era.

"Early-2000s fiber ran at roughly 7% utilization because the industry built far ahead of demand that never showed up. The physical layer scaled faster than the software. Today is the inverse. $NVDA clusters inside $MSFT, $AMZN, $GOOGL and $META are running ~80% utilization because every model lab is capacity-constrained. The software layer is scaling far faster than the physical. One cycle had excess supply and no demand. This one has excess demand and not nearly enough supply. That’s the entire difference". ➡️ True. At least for now. But are we sure that capacity utilization will remain as high when hyperscalers would have spent trillions of dollars in additional capacity? What if demand does not pick up as much as supply??? The 7% utilization rate of fiber optics is the one which applied to the end of the cycle, once all fiber optics got built. When the telecom companies started to over-invest, they never assumed that capu would be that low at the end...

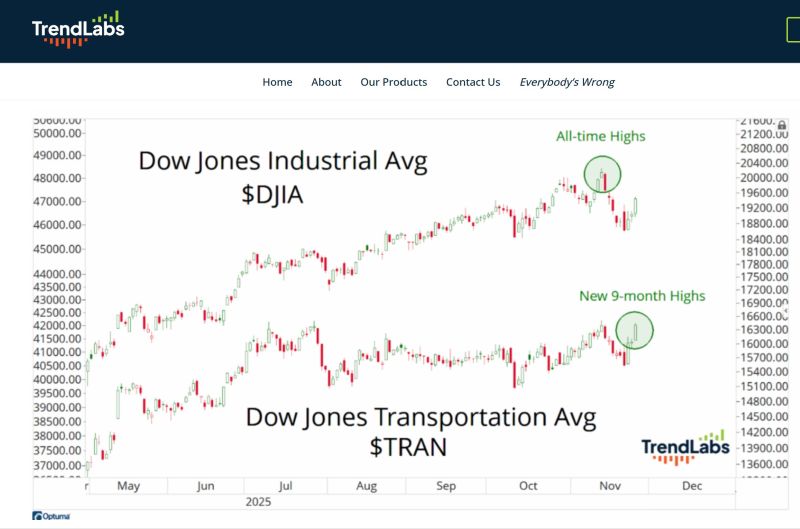

Dow Theory says this is a bull market

Most people watch the Dow Jones Industrial Average (DJIA) and think they understand the market. But smart investors know: The trend isn’t real until the Transportation Index agrees. Here’s why ⬇️ 🔍 The Logic (100+ years old… still undefeated) If manufacturers (Industrial Average) are doing well, they should be shipping more goods. If more goods are being shipped, transportation companies (Transportation Average) should also be trending up. Production ↑ → Shipping ↑ → Healthy trend confirmed If Industrials rise but Transports fall? 🚨 Something’s off. Demand may be weakening. 🧠 How Dow Theory Uses This ✔️ Bull trend confirmed Both DJIA and DJTA make higher highs + higher lows. ✔️ Bear trend confirmed Both make lower lows + lower highs. ❌ No confirmation One goes up, the other flat/down → The trend is suspect. Momentum may be false or weakening. Source chart: J-C Parets

💥 Meta is building a $27 BILLION data center in Louisiana…

👉 But none of it shows up on Meta’s balance sheet. How? Meta shifted the entire project into a joint venture: 🔹 Meta owns 20% 🔹 Blue Owl Capital owns 80% 🔹 A holding company (Beignet Investor) issued $27.3B in bonds, mostly bought by Pimco 🔹 Meta will rent the data center starting in 2029 And here’s the kicker: the lease is structured to qualify as an operating lease, not a finance lease — letting Meta avoid listing the giant asset and the massive debt. But peel back the layers and things get messy: 🔥 Meta runs the data center 🔥 Meta carries the risk of cost overruns 🔥 Meta guarantees the full value of the bonds if they don’t renew 🔥 Yet Meta insists it doesn’t “control” the venture enough to count it on the books Even the Wall Street Journal called it “artificial accounting.” 🧩 It’s part of a bigger trend: Tech giants want unlimited AI infrastructure… 🚫 …but they don’t want the debt that comes with it. Morgan Stanley estimates the industry could need $800B in off-balance-sheet financing by 2028. Meta may not be borrowing on paper — but economically, this is debt with extra steps. What do you think: smart financial engineering or a red flag in disguise? Source: Hedgie

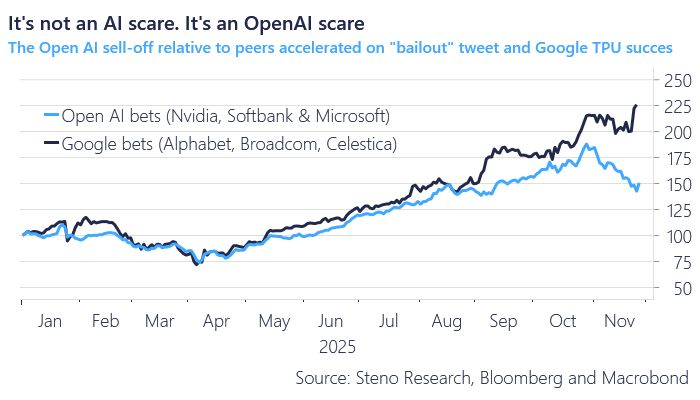

A great post and chart by @AndreasSteno on X: It's not an AI scare. It's an OpenAI scare.

The "Google bets" basket (Alphabet, Broadcom and Celestica) just hit a new ATH while the "Open AI" basket (Nvidia, Softbank & Microsoft) has been hut hard since the end of October. Source: Steno Research, Macrobond, Bloomberg

The Great Orange Juice collapse continues as price fall to the lowest level since 2021 📉

Bottomless Mimosas on tap for Thanksgiving 🥳🥂

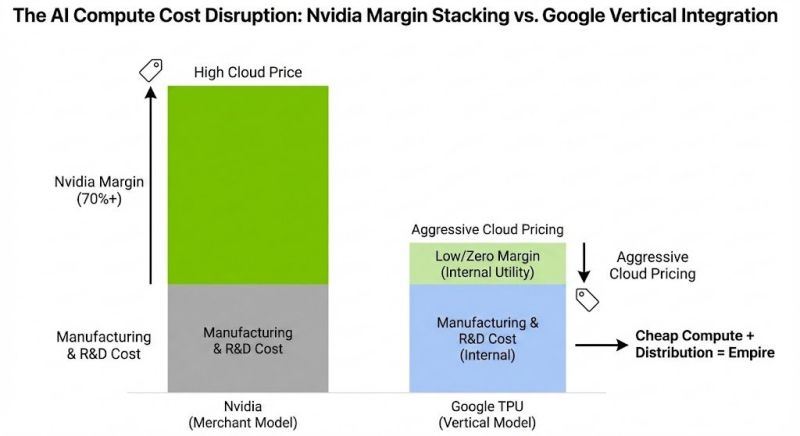

Here are the key takeaways from a great post by Kris Patel on X: 🔥 $GOOGL vs. $NVDA — The Market is mispricing the AI War.

Everyone’s arguing about who has the fastest chip. But that’s not the real disruption. Google isn’t trying to beat Nvidia on speed. Google is trying to beat Nvidia on economics. Here’s the overlooked truth: 1️⃣ The “Nvidia Tax” Nvidia sells to hyperscalers with 70%+ margins. AWS, Azure, and everyone else pay it, and pass it on to you. 2️⃣ Google plays a different game They’re the only hyperscaler that doesn’t need to profit from selling chips. They build TPUs at cost and control the entire stack: Chip → Interconnect → Data Center → Cloud. No margin stacking. No tax. 3️⃣ Training ≠ Inference Training = Ferrari (Nvidia dominates). Inference = Semi-truck (cheap, reliable, scaled). As AI matures, ~90% of spend shifts to inference. And here’s the bombshell: 👉 If Google drives cost-per-token toward zero with TPUs + aggressive cloud pricing… Raw speed stops mattering. Economics wins. Nvidia is selling generators. Google is building the electric grid. Cheap compute + massive distribution = 🏰 Empire. Source: Kris Patel

Nvidia responds to news of Meta using Google's TPUs, sending $NVDA stock -6% lower:

Nvidia says they are "delighted by Google's success" and they "continue to supply Google." They also say, "Nvidia is a generation ahead of the industry" and "offers greater performance, versatility, and fungibility." The AI wars are heating up. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks